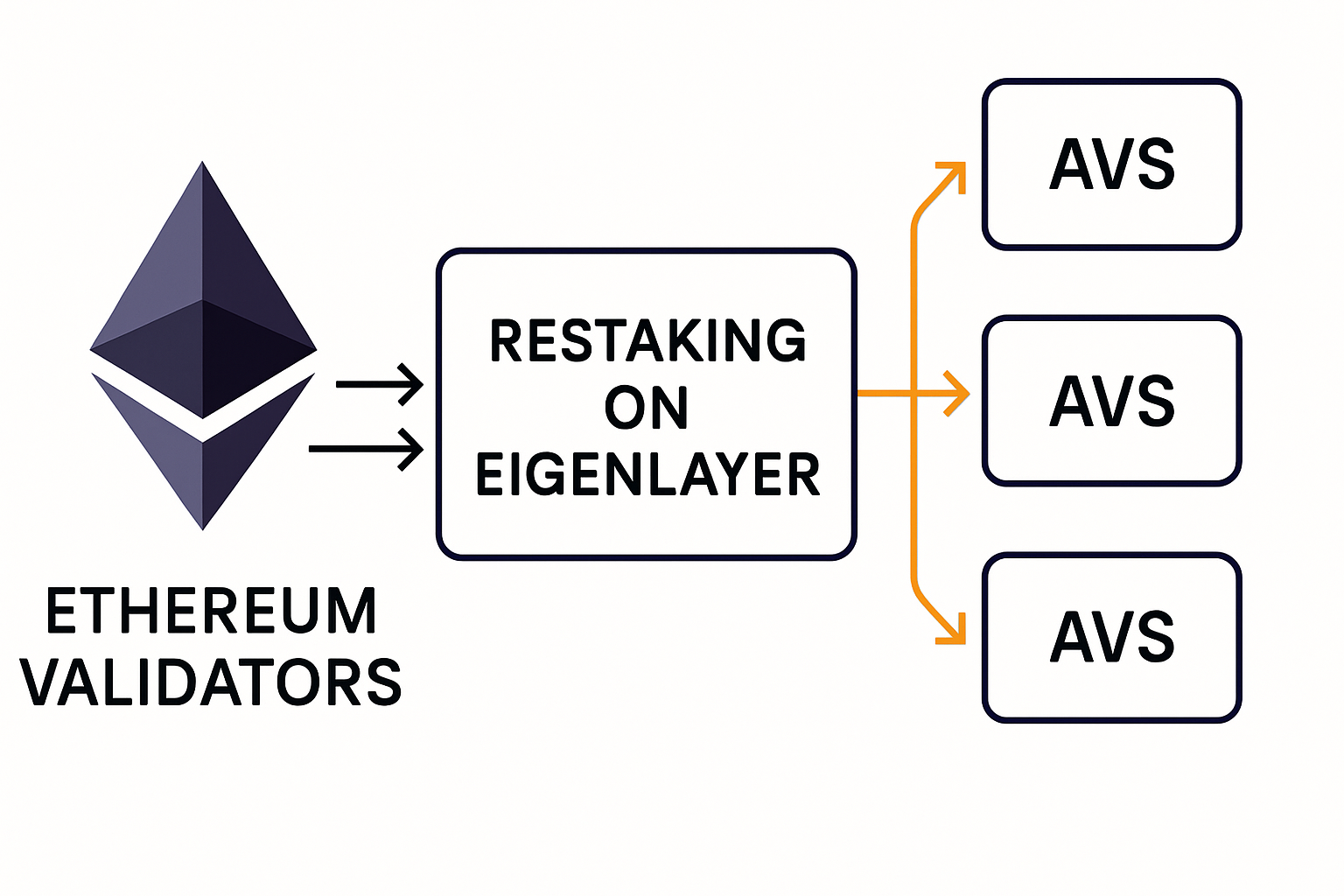

Ethereum’s security model has long been the gold standard in decentralized finance, but as the ecosystem expands, new protocols are seeking ways to tap into this robust foundation. Enter EigenLayer restaking: a mechanism that lets Ethereum validators put their staked ETH to work not just for Ethereum itself, but also for a growing universe of additional protocols called Actively Validated Services (AVSs). This innovation is reshaping the way we think about securing Ethereum staking pools and maximizing yield potential.

What Is EigenLayer Restaking and Why Does It Matter?

At its core, restaking is about capital efficiency and shared security. Instead of locking up ETH solely for Ethereum consensus, validators can now “restake” their assets via EigenLayer smart contracts. This allows them to extend their crypto-economic security guarantees to other protocols, without having to unstake or commit new capital. The result? Multiple services piggyback on the credibility and decentralization of Ethereum’s native staking layer (learn more here).

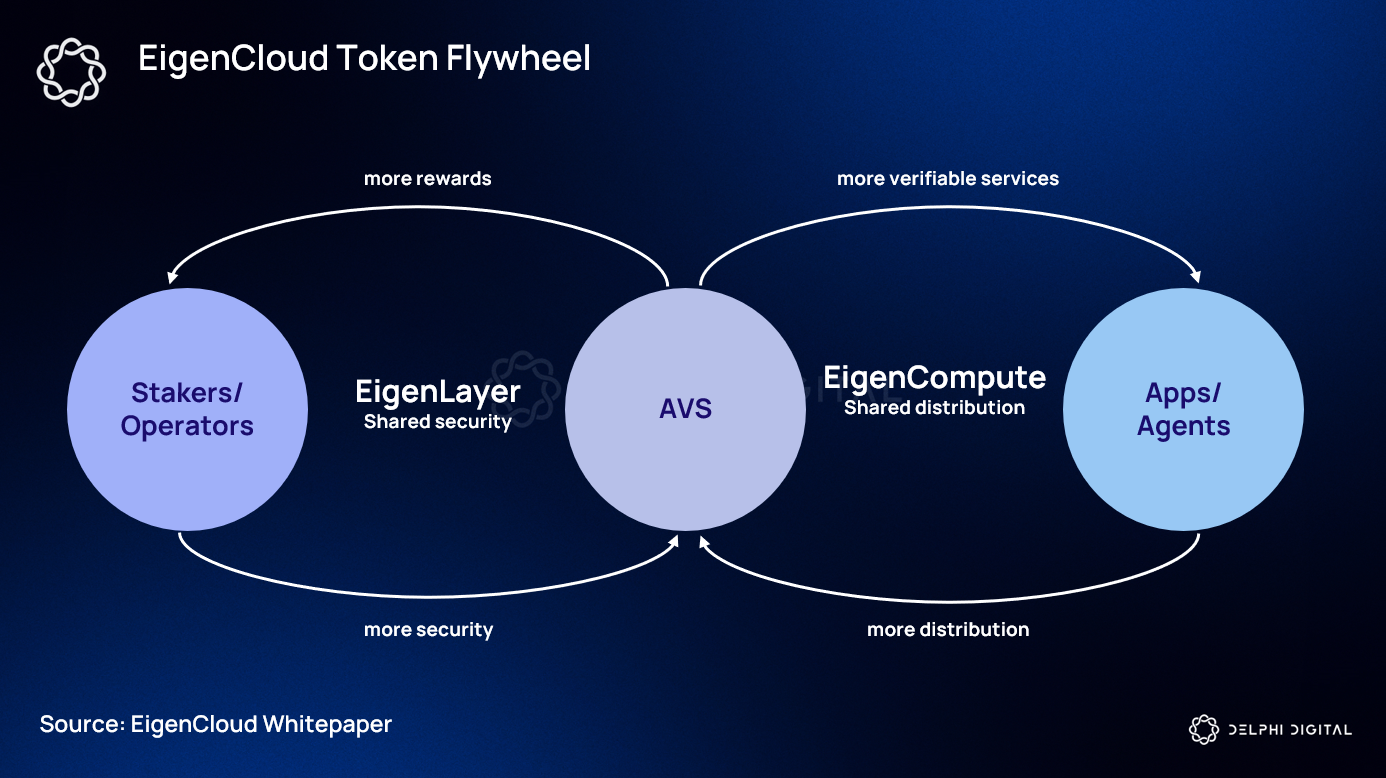

This shared security model has two major effects:

- Amplified Security: By pooling staked ETH across several AVSs, EigenLayer makes it costlier for attackers to compromise any single protocol.

- Increased Rewards: Validators can earn rewards from both the base Ethereum protocol and from each AVS they help secure, making every staked ETH “work harder. “

This isn’t just theoretical. According to Hacken and Consensys research, restaking is already enhancing network robustness while opening doors for new DeFi primitives that need strong security but lack their own validator set.

The Mechanics: How Restaking Enhances Staking Pool Security

The secret sauce lies in EigenLayer’s middleware approach. Validators opt-in by depositing their staked ETH (or liquid staking tokens) into EigenLayer smart contracts. From there, they choose which AVSs to support. Each validator’s reputation, and their staked capital, are now on the line across all supported protocols.

If a validator acts dishonestly or fails in any supported AVS, they risk slashing not only from that service but also from their main Ethereum stake. This creates powerful incentives for honest behavior and careful diligence when selecting which AVSs to secure (see our technical guide). The threat of slashing is no longer isolated; it becomes a network-wide deterrent against malicious activity.

The Benefits for Staking Pools: Security at Scale

For staking pools, whether running their own infrastructure or leveraging liquid staking tokens, the implications are huge:

- Pooled Risk = Pooled Protection: By aggregating staked assets across many validators and protocols, pools create a larger economic barrier against attacks.

- Diversified Yield Streams: Pools can offer participants exposure to multiple reward sources without requiring additional deposits or complex strategies.

- Stronger Community Trust: As pools demonstrate rigorous diligence in choosing reputable AVSs (and transparently communicate risks), user confidence grows alongside returns.

This layered approach means that even as new services launch atop Ethereum, they benefit from instant access to battle-tested security, without needing years or millions in bootstrapping costs (more on this here).

But with greater opportunity comes new responsibility. Validators and staking pools must be vigilant about the AVSs they support, since a vulnerability or exploit in any connected protocol could trigger slashing across all linked stakes. This risk-reward calculus is at the heart of EigenLayer’s design: it’s not just about maximizing yield, but about maintaining systemic integrity for everyone involved.

Top 5 Security Considerations for EigenLayer Restaking

-

Shared Slashing Risk Across Protocols: Restaking on EigenLayer means your staked ETH secures multiple Actively Validated Services (AVSs). If any AVS misbehaves or is compromised, your ETH can be slashed across all protocols, amplifying potential losses.

-

Due Diligence on Supported AVSs: Validators must carefully evaluate the security and reliability of each AVS they choose to support, as vulnerabilities or failures in these external protocols can directly impact staked assets.

-

Smart Contract Security: EigenLayer operates through smart contracts. Any bugs or exploits in these contracts can threaten both staked ETH and rewards, making robust auditing and ongoing monitoring essential.

-

Operational Complexity for Validators: Supporting multiple protocols increases validator responsibilities and technical complexity. This raises the risk of configuration errors or downtime, which can lead to slashing or missed rewards.

-

Centralization Risks: As restaking grows, large staking pools or centralized entities could gain disproportionate influence over multiple AVSs, potentially undermining Ethereum’s decentralization and security.

Transparency and due diligence are now critical differentiators among staking pools. Leading pools are already publishing detailed reports on their AVS selection criteria, technical audits, and real-time monitoring systems. This level of openness helps users make informed decisions and sets a higher bar for industry standards.

The Slashing Dynamic: Aligning Incentives Across Protocols

EigenLayer’s restaking model fundamentally changes how slashing works in the Ethereum ecosystem. In the traditional model, slashing only affects misbehavior within Ethereum consensus itself. With restaking, however, a validator can be penalized for failures in any AVS they opt into, making every decision consequential.

This cross-protocol slashing is a powerful deterrent against malicious activity. Validators must weigh potential extra rewards against the increased risk of loss if an AVS is poorly designed or managed. The upshot? Only well-audited, high-integrity protocols will attract meaningful validator support, raising the security bar for the entire ecosystem.

Best Practices for Pools Entering EigenLayer Restaking

If you’re running a staking pool or considering joining one that supports EigenLayer restaking, here are some key steps to keep your assets, and your community, safe:

- Perform deep technical due diligence on every AVS you consider supporting.

- Monitor protocol upgrades and governance actions, as changes to an AVS could affect risk profiles overnight.

- Educate your delegators about both the upside (extra rewards) and downside (expanded slashing risk) of restaking.

- Leverage third-party audits and real-time monitoring tools to catch issues early.

- Stay informed: follow developments on EigenLayer governance and emerging best practices (see our FAQ).

If you want your ETH to work harder without compromising on safety, EigenLayer restaking could be your next strategic move, but only if you approach it with eyes wide open.

The future of Ethereum staking pool security is collaborative, dynamic, and transparent. By embracing EigenLayer’s restaking protocol with robust diligence practices, pools can unlock new revenue streams while reinforcing trust across DeFi. As more protocols plug into this shared security model, expect both competition, and cooperation, to drive continual improvements in how we secure value on-chain.