As Ethereum cements its status as the backbone of decentralized finance, the challenge for new protocols remains unchanged: how to bootstrap robust security without incurring unsustainable costs. EigenLayer restaking is rapidly emerging as a transformative solution, enabling new projects to tap into Ethereum’s established validator set and dramatically lower their initial capital requirements. With Ethereum (ETH) currently trading at $4,477.39, restaking has become a focal point for both developers and investors seeking efficient security models in a competitive ecosystem.

Restaking: Turning Staked ETH into a Security Engine

At its core, EigenLayer allows Ethereum validators to “restake” their already-committed ETH, extending its utility to secure multiple protocols beyond Ethereum’s base layer. Instead of building isolated validator networks from scratch, new protocols can now inherit the trust and economic weight of the existing Ethereum validator set. This model introduces an immediate boost in security credibility while sidestepping the traditional need for high native token emissions or bespoke incentives.

According to Unchained Crypto, EigenLayer’s approach lets protocols buy pooled security from a marketplace of validators, creating a dynamic where security becomes a liquid commodity. By leveraging this shared security architecture, protocols no longer face the binary choice between rapid deployment and robust protection, they can achieve both.

Quantifying Bootstrapping Cost Reduction with EigenLayer

The implications for cost reduction are significant. Traditionally, launching a new protocol on Ethereum required incentivizing validators with large allocations of native tokens, often resulting in inflationary pressures and unsustainable economics. With EigenLayer restaking, these capital requirements shrink dramatically:

- No need to establish independent validator sets: Protocols can piggyback on Ethereum’s $4,477.39-per-ETH security layer.

- Lower upfront token emissions: Security is rented rather than bought outright with newly minted tokens.

- Simplified onboarding for developers: Teams can focus resources on core product innovation instead of complex network infrastructure.

This shift is especially valuable in today’s market, where capital efficiency is paramount and competition among L2s and DeFi protocols is intensifying. As highlighted by Medium’s primer on EigenLayer, restaking not only reduces financial barriers but also accelerates time-to-market, a critical edge for early-stage projects.

Accelerated Innovation Through Shared Security

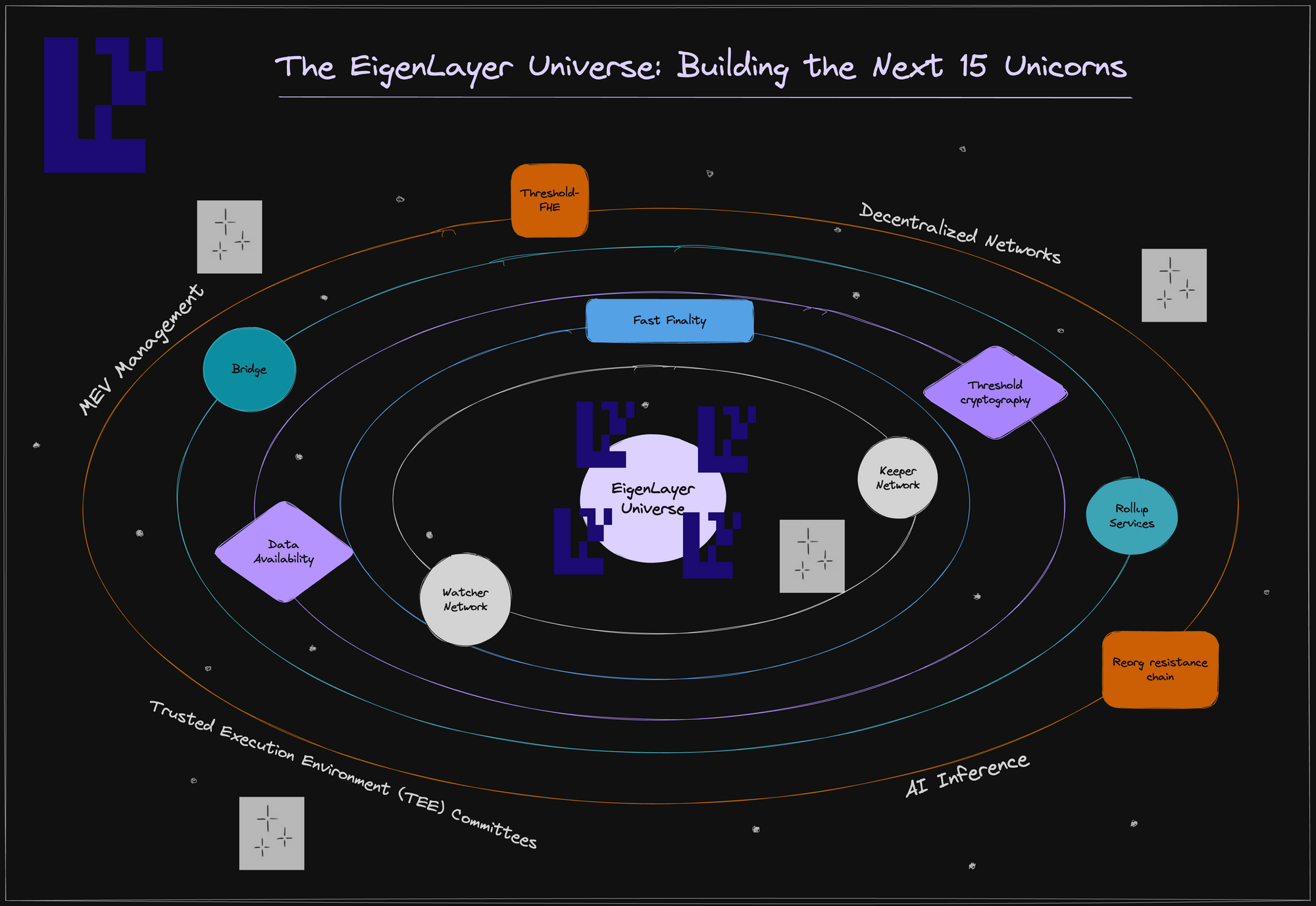

The ripple effects of AVS (Actively Validated Services) security sharing go beyond cost savings. With foundational security handled by Ethereum validators via EigenLayer, teams are freed from the burden of bootstrapping trust from scratch. This enables:

- Rapid experimentation: Developers can iterate quickly without worrying about immediate network vulnerabilities.

- Easier composability: Protocols built atop shared validator pools are inherently more interoperable.

- Smoother user experiences: End-users benefit from enhanced safety without needing to understand complex staking mechanics.

The net effect is an ecosystem where innovation is no longer throttled by prohibitive upfront costs or fragmented trust assumptions, a paradigm shift that could redefine how new DeFi primitives come to market.

Ethereum (ETH) Price Prediction 2026-2031: The Restaking Revolution Era

Forecasts based on EigenLayer adoption, restaking yield innovation, and Ethereum’s evolving ecosystem (2025 baseline: $4,477.39)

| Year | Minimum Price | Average Price | Maximum Price | Year-on-Year % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,900 | $5,150 | $6,800 | +15% | Restaking adoption accelerates, ETH demand rises; possible regulatory headwinds. |

| 2027 | $4,300 | $5,900 | $8,500 | +15% | Layer-2s and EigenLayer-based protocols grow; ETH benefits from increased utility. |

| 2028 | $4,650 | $6,800 | $10,000 | +15% | Mainstream DeFi and restaking reach critical mass; potential for new all-time highs. |

| 2029 | $4,900 | $7,750 | $12,500 | +14% | Competition from other chains intensifies; ETH maintains leadership via security. |

| 2030 | $5,300 | $8,700 | $15,000 | +12% | Ethereum upgrades and restaking innovations drive sustained growth. |

| 2031 | $5,800 | $9,600 | $18,000 | +10% | Restaking becomes DeFi standard; ETH volatility moderates as institutional adoption increases. |

Price Prediction Summary

Ethereum’s ETH is poised for significant growth from 2026 to 2031, driven by EigenLayer’s restaking innovations, increased protocol adoption, and Ethereum’s strong network effects. While short-term volatility and competition may cause fluctuations, the long-term outlook remains bullish, with ETH potentially reaching new all-time highs by 2031 as restaking becomes a core DeFi primitive.

Key Factors Affecting Ethereum Price

- Adoption rate of EigenLayer and restaking models across new and existing protocols.

- Ethereum’s continued dominance as a smart contract platform and network upgrades (e.g., scalability, security).

- Regulatory clarity and global acceptance of staking and restaking mechanisms.

- Competition from alternative Layer-1 and Layer-2 blockchains.

- Macro-economic conditions and institutional investment trends.

- Potential risks related to smart contract vulnerabilities and systemic risks from restaking.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Validator Perspective: Yield Maximization Without Additional Capital

A crucial driver behind EigenLayer’s adoption is its appeal to validators themselves. By restaking their ETH across multiple protocols, validators unlock additional yield streams without injecting more capital, an attractive proposition as staking yields face downward pressure amid increased competition and higher network participation rates. As noted in recent analysis by QuickNode Blog and CoinGecko, this dual-sided incentive structure creates a virtuous cycle: more validators join the pool, further strengthening shared security while making it even easier for new protocols to launch securely at scale.

For validators, the ability to restake ETH and participate in multiple security markets is more than just an incremental yield boost. It represents a fundamental shift in how validator economics are structured. With Ethereum’s price currently at $4,477.39, the opportunity cost of locking up capital is significant. EigenLayer’s model ensures that each staked ETH can work harder, earning rewards from a diversified set of protocols rather than being limited to consensus-layer returns alone.

“Restaking transforms Ethereum validators into multi-protocol security providers, aligning incentives between protocol growth and network robustness. “

This dynamic not only increases validator engagement but also enhances the resilience of the entire ecosystem. As more protocols leverage AVS security sharing, the overall risk profile for both stakers and new projects improves, a win-win scenario that accelerates Ethereum’s evolution as a modular financial infrastructure.

Risks and Considerations: Shared Security Isn’t Risk-Free

While the benefits of EigenLayer restaking are substantial, it’s important to acknowledge potential risks. Shared security introduces correlated risks: if a major protocol leveraging EigenLayer is compromised, it could have downstream effects on validators and other protocols sharing the same trust layer. This underscores the need for robust slashing conditions, careful protocol selection by validators, and ongoing transparency regarding risk exposures.

Protocols must also consider their own unique requirements, some may still opt for independent networks if they require custom consensus mechanisms or wish to maintain complete sovereignty over their validator set. However, for most emerging DeFi applications and L2s aiming to minimize upfront costs, EigenLayer offers a compelling default path.

Top Protocols Leveraging EigenLayer Restaking (with TVL)

-

EigenDA: EigenLayer’s flagship data availability solution currently leads the restaking ecosystem with a TVL exceeding $3.1 billion. EigenDA leverages restaked ETH to provide scalable, decentralized data availability for rollups and modular blockchains.

-

Ethos: A decentralized trust marketplace built on EigenLayer, Ethos utilizes restaked ETH to secure its trustless infrastructure. TVL: approximately $1.2 billion as of September 2025.

-

Omni Network: An interoperability protocol that uses EigenLayer restaking to secure cross-chain messaging and communication. TVL: around $950 million.

-

AltLayer: A rollup-as-a-service platform that leverages EigenLayer’s shared security for launching customizable rollups. TVL: about $680 million.

-

Layer N: A modular blockchain network utilizing EigenLayer restaking to bootstrap validator security. TVL: estimated $430 million.

The Future of Ethereum Protocol Bootstrapping

The rise of EigenLayer restaking signals a maturing Ethereum ecosystem where capital efficiency and modular security are paramount. As more projects adopt this model, we’re likely to see faster innovation cycles, reduced token inflation across new launches, and an increasingly interconnected network of AVSs, each benefiting from Ethereum’s $4,477.39-per-ETH security foundation.

Market data shows growing validator participation as well as increasing total value locked (TVL) within EigenLayer contracts, a trend closely watched by both institutional players and retail investors seeking efficient yield opportunities. For those interested in deeper technical dives or live metrics on AVS adoption rates, resources like EigenCloud provide real-time analytics on restaking activity across the ecosystem.

The bottom line: By dramatically reducing bootstrapping costs while maximizing validator incentives through shared security markets, EigenLayer is poised to become a foundational pillar for next-generation Ethereum protocols, and a catalyst for DeFi’s continued expansion in 2025 and beyond.