Ethereum’s security model has long been anchored by its robust validator network, but the landscape is evolving rapidly. With Ethereum (ETH) currently priced at $4,519.55 and over a quarter of all staked ETH now participating in EigenLayer restaking, the protocol is reshaping how validators contribute to and benefit from the ecosystem. By enabling staked ETH to secure not just Ethereum itself but also a range of Actively Validated Services (AVSs), EigenLayer is fundamentally enhancing both capital efficiency and cryptoeconomic security.

How EigenLayer Restaking Works for Validators

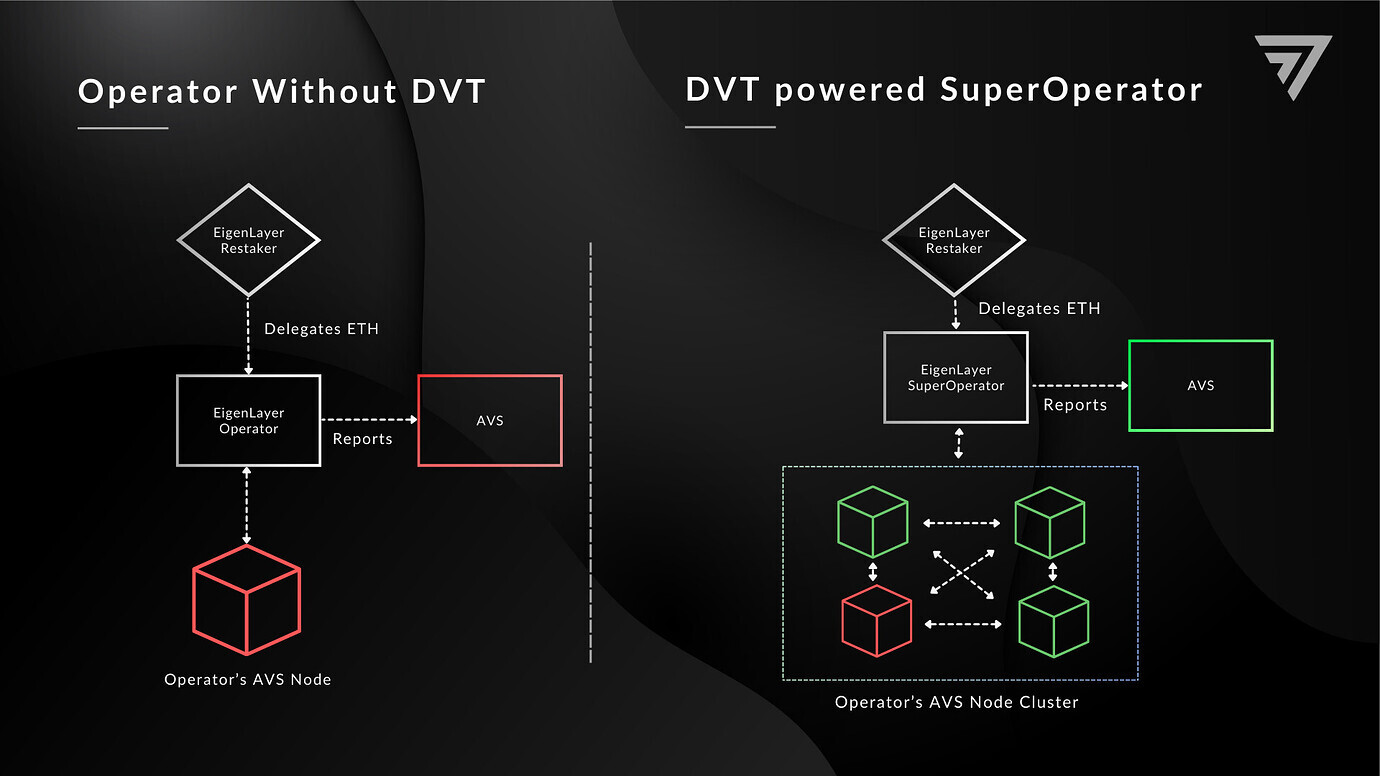

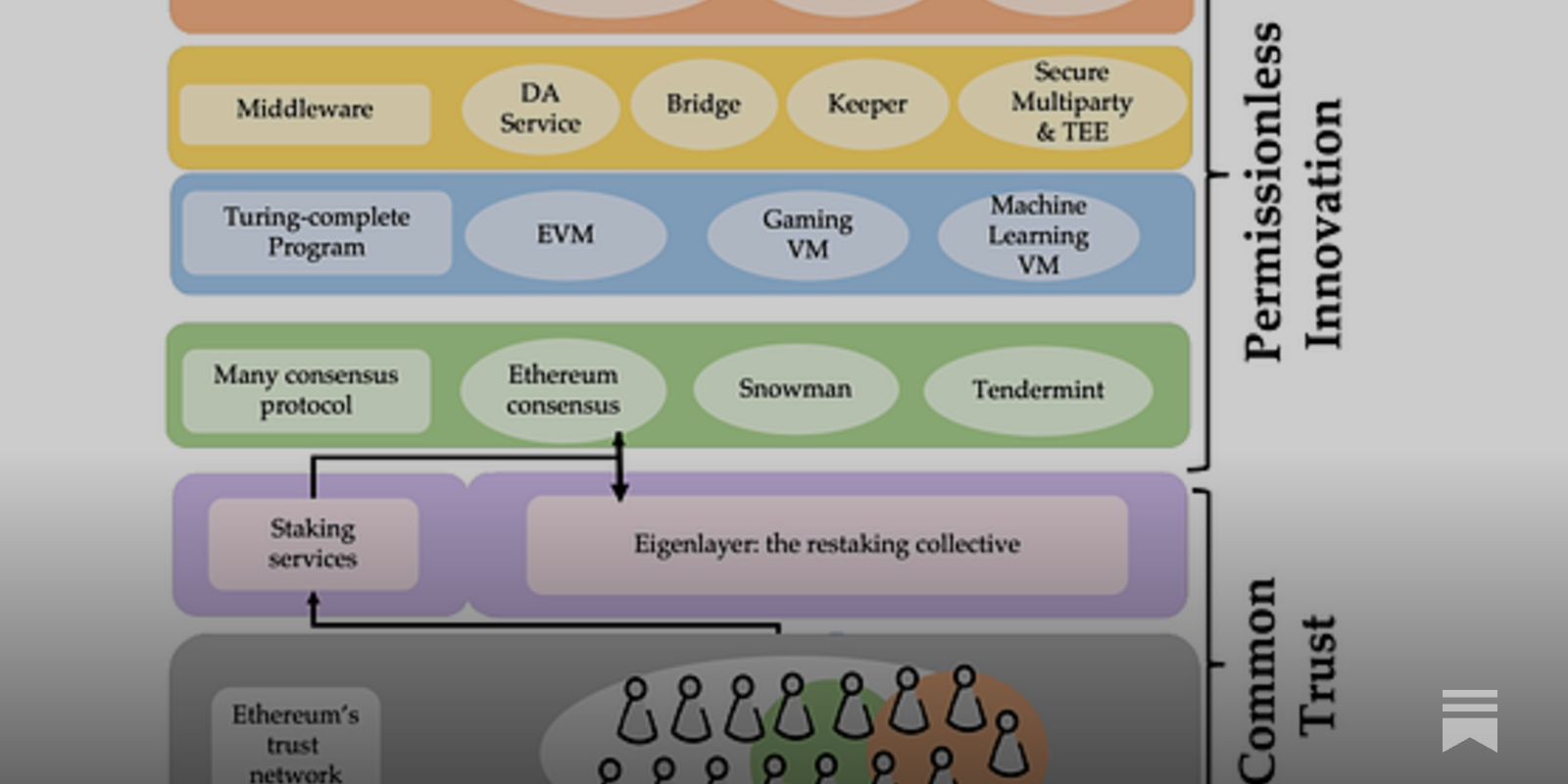

At its core, EigenLayer restaking allows validators to reuse their existing staked ETH as collateral for securing additional protocols beyond Ethereum’s base layer. This is achieved through two primary mechanisms:

- Native Restaking: Validators redirect their withdrawal credentials so that staking rewards flow into EigenLayer smart contracts. This enables their ETH to secure multiple networks simultaneously without additional capital outlay.

- Liquid Restaking: Validators deposit Liquid Staking Tokens (LSTs) such as stETH, rETH, or cbETH into EigenLayer, leveraging these assets as collateral for AVS security roles.

This dual approach not only maximizes the utility of each ETH staked but also democratizes access to restaking rewards and responsibilities across a wider range of participants. According to the official EigenLayer documentation, this mechanism ensures that validators can participate flexibly based on their technical capacity and risk tolerance.

Pooled Security: Reinforcing Trust in DeFi and Beyond

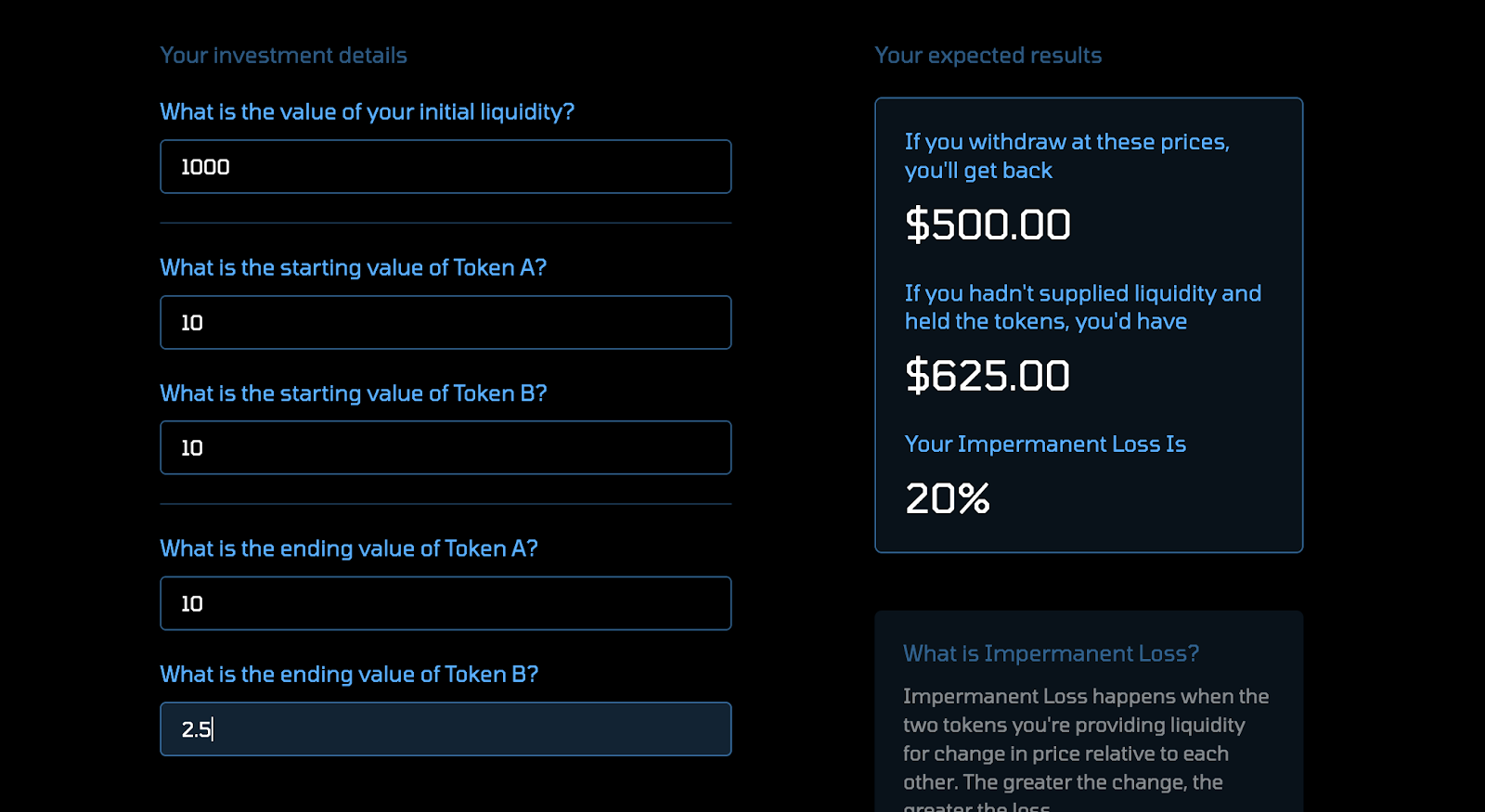

The most significant innovation brought by EigenLayer lies in its pooled security model. By allowing validators to extend their economic trust to AVSs like oracles, cross-chain bridges, and data availability layers, restaking creates a shared risk-reward environment. If a validator acts maliciously or fails operational requirements on any supported AVS, they face slashing penalties that impact all associated protocols, a powerful deterrent against bad behavior.

This shared security framework has already attracted substantial adoption: Reddit’s r/ethstaker community estimates that about 25% of all staked ETH is now committed to EigenLayer-based restaking, an indicator of growing confidence in this model’s integrity (source). The incentive alignment between Ethereum’s base layer and auxiliary services strengthens overall ecosystem resilience against attacks or validator collusion.

The Validator Incentive Equation: Rewards vs. Responsibilities

The economic rationale behind restaking is clear: Validators can earn additional fees from AVSs on top of standard Ethereum staking rewards, without needing more capital. For example, with ETH holding steady at $4,519.55, even modest increases in annualized yield from AVS participation can translate into significant incremental returns for large-scale operators.

Ethereum (ETH) Price Prediction 2026-2031

Professional outlook considering EigenLayer restaking, DeFi evolution, and Ethereum market dynamics (Baseline: $4,519.55 on 2025-09-19)

| Year | Minimum Price (Bearish Scenario) | Average Price | Maximum Price (Bullish Scenario) | Year-over-Year % Change (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $3,950 | $5,200 | $6,500 | +15% | Post-restaking adoption, steady DeFi growth |

| 2027 | $4,200 | $5,700 | $7,800 | +9.6% | Layer 2 scaling, AVS integration, regulatory clarity |

| 2028 | $4,500 | $6,300 | $9,200 | +10.5% | Broader institutional adoption, restaking mainstream |

| 2029 | $4,800 | $7,100 | $11,000 | +12.7% | Global DeFi expansion, new AVS markets |

| 2030 | $5,000 | $8,000 | $13,500 | +12.7% | ETH as DeFi backbone, competition from other L1s |

| 2031 | $5,400 | $9,200 | $16,000 | +15% | Matured staking ecosystem, increased cross-chain security |

Price Prediction Summary

Ethereum’s price outlook for 2026-2031 is positive, underpinned by continued innovation in restaking (EigenLayer), DeFi security, and validator incentives. While minimum price projections reflect potential bear markets or regulatory headwinds, average and maximum prices suggest strong growth driven by network effects, new use cases, and increased institutional participation. The bullish scenario assumes successful scaling, broad AVS adoption, and Ethereum maintaining its leadership in smart contract platforms. Risks include competition from emerging L1s, unforeseen technical vulnerabilities, and evolving global regulation.

Key Factors Affecting Ethereum Price

- Adoption and security benefits of EigenLayer restaking

- Growth and stability of DeFi and AVS sectors

- Ethereum network upgrades (scalability, fees, energy efficiency)

- Regulatory clarity and institutional participation

- Competition from alternative smart contract platforms

- Macro-economic trends impacting crypto markets

- Validator incentives and slashing risks in restaking

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

However, these enhanced rewards come with new operational challenges. Each AVS may impose unique uptime requirements or slashing conditions; failure to comply could result in penalties across multiple platforms simultaneously (EigenLayer FAQ). As such, validators must carefully assess their technical capabilities before opting into multiple service commitments, a dynamic that continues to shape best practices within the staking community.

The Capital Efficiency Paradigm Shift

By enabling one unit of staked ETH to secure several protocols concurrently, EigenLayer dramatically boosts network-wide capital efficiency. This innovation allows DeFi projects and infrastructure providers to access high-grade security without duplicating economic resources, a critical advantage as competition intensifies among Layer-1s and middleware solutions (more info here). For validators who have historically viewed staking as a zero-sum game between reward maximization and risk minimization, restaking offers an unprecedented opportunity for portfolio optimization within the Ethereum ecosystem.

As the restaking paradigm gains traction, it’s important to recognize the broader implications for both validator operations and Ethereum’s overall security posture. The EigenLayer model not only incentivizes validators with higher yields but also compels a new level of professionalism and risk management. With the price of Ethereum firmly at $4,519.55, the economic stakes for validators have never been higher, especially as slashing risks now span multiple protocols.

Mitigating Risks: Operational Best Practices for Validators

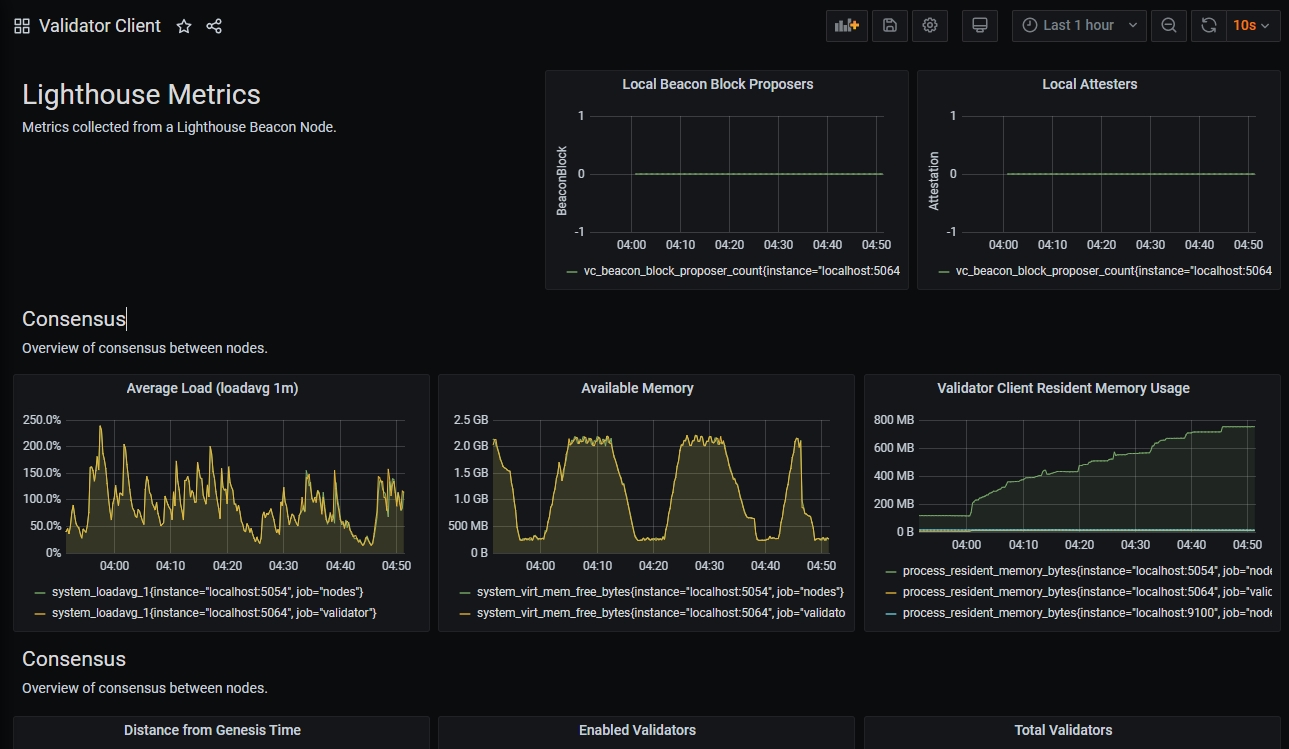

Participation in EigenLayer restaking demands robust technical infrastructure and a proactive approach to validator performance. Validators must monitor their node uptime, maintain redundancy, and stay updated on each AVS’s unique rules to avoid unintentional penalties. Failure on one service can cascade into losses across all secured networks due to EigenLayer’s pooled slashing mechanism, a design that powerfully aligns incentives but punishes negligence.

Best Practices for Validators Restaking with EigenLayer

-

Understand Slashing Risks Across Platforms: Malicious or negligent behavior can trigger slashing penalties not only on Ethereum but also across all Actively Validated Services (AVSs) secured via EigenLayer. Carefully review EigenLayer’s slashing documentation before restaking.

-

Maintain High Uptime and Performance: AVSs often require strict uptime and performance standards. Ensure your validator infrastructure is robust and monitored 24/7 to avoid missed rewards or penalties.

-

Choose AVSs and LSTs Carefully: Only restake to reputable AVSs and use well-established Liquid Staking Tokens (LSTs) like stETH, rETH, or cbETH to minimize exposure to smart contract or protocol risks.

-

Regularly Monitor Protocol Updates: Stay informed about changes in EigenLayer, Ethereum, and the AVSs you support, as protocol upgrades can impact validator requirements and risk profiles. Follow official channels and documentation, such as EigenLayer’s official guides.

-

Assess Capital Efficiency and Reward Structures: Evaluate the additional rewards offered by AVSs against the operational complexity and risks. With Ethereum (ETH) currently priced at $4,519.55, maximizing capital efficiency is crucial for competitive staking returns.

-

Implement Robust Security Practices: Use hardware security modules (HSMs), multi-signature wallets, and regular audits to safeguard validator keys and infrastructure against attacks or mismanagement.

For operators considering entry, careful evaluation of AVS requirements and ongoing monitoring are essential. Many professional staking providers now offer managed services tailored for EigenLayer participation, reflecting both demand and the complexity involved.

Ecosystem Impact: A More Secure and Efficient DeFi Landscape

The influence of EigenLayer extends beyond individual validator economics. By enabling capital-efficient security sharing, it lowers barriers for new DeFi protocols seeking robust trust guarantees, potentially accelerating ecosystem growth. In turn, this may attract more ETH holders to stake or restake as opportunities for yield and network impact multiply.

It’s worth noting that this innovation is not without debate. Some observers have raised concerns about systemic risk if too much value is concentrated in a single restaking protocol (see discussion). However, recent case studies, such as how EigenLayer prevented a critical validator hazard during Ethereum’s Electra upgrade, demonstrate adaptive governance mechanisms at work within the protocol.

Looking Ahead: The Future of Validator Incentives and Security Models

The rapid adoption of EigenLayer restaking is already reshaping validator incentives across Ethereum. As more AVSs launch and competition intensifies among staking providers, we can expect continued evolution in both technical standards and economic models. For now, with a quarter of all staked ETH participating in restaking, and $4,519.55 as the current ETH benchmark, the alignment between validator rewards and ecosystem resilience is stronger than ever.

“Restaking isn’t just about earning more; it’s about building a more secure foundation for decentralized finance. ”

For those seeking to maximize returns while contributing to Ethereum security, understanding the nuances of EigenLayer protocols will be critical in 2025 and beyond. As always, prudent risk assessment must accompany any pursuit of higher yields, especially when network-wide integrity is on the line.