As Ethereum trades at $3,038.91 on December 6,2025, down 2.95% in the last 24 hours, restakers face a pivotal moment to leverage the EigenLayer points system for outsized ETH restaking rewards. This mechanism, tied directly to future EIGEN token airdrops, rewards sustained participation across Actively Validated Services (AVSs) like EigenDA. With TVL driving yields around 4.24% in EIGEN, understanding points accrual becomes essential for anyone eyeing Ethereum restaking yields 2025.

EigenLayer’s points system quantifies your commitment by tracking restaked ETH or Liquid Staking Tokens (LSTs) over time. Points serve as a proxy for EIGEN allocations, incentivizing long-term staking amid rising protocol adoption. Stakers earn from multiple streams: native ETH rewards, AVS-specific emissions, and EIGEN stakes, claimable up to three times weekly if exceeding 0.00000001 ETH. Yet profitability hinges on TVL dynamics and AVS performance, underscoring the need for a data-driven approach.

Decoding Points Calculation and Accrual Mechanics

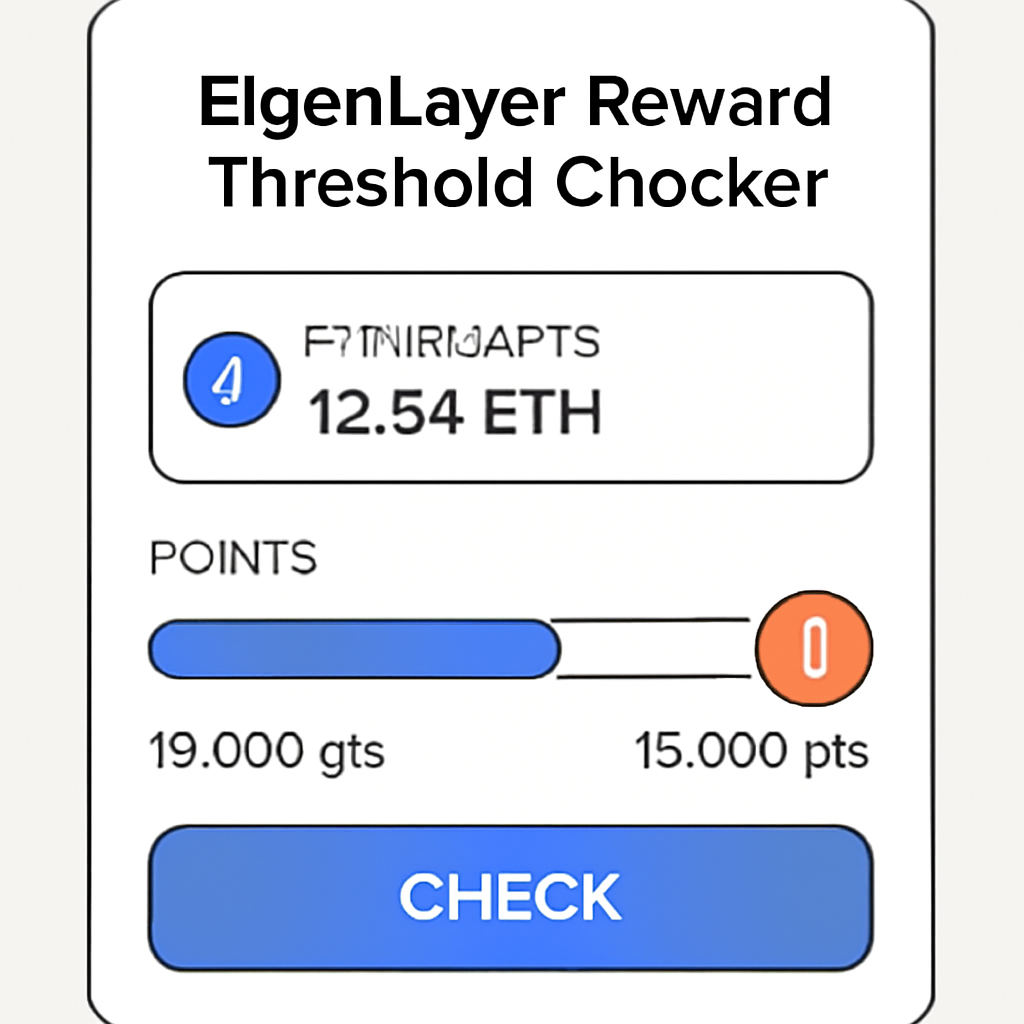

The formula is straightforward yet powerful: points = restaked amount × days × 24 hours. Restaking 1 ETH for 10 days yields 240 points, scaling linearly with exposure. This hourly precision encourages consistent positioning, especially as AVSs like EigenDA demand reliable security. Data from LlamaRisk highlights how extended durations amplify eligibility for programmatic incentives, including 4% of EIGEN reserved for restakers.

In practice, direct ETH deposits or LSTs from protocols like Lido or Rocket Pool qualify equally, but layering EIGEN tokens boosts total rewards. Current yields reflect EigenLayer’s maturity: at 4.24% annualized in EIGEN, restaking outpaces solo Ethereum staking when AVS demand surges. Operators play a crucial role here, as their uptime directly influences point multipliers and slashing avoidance.

Ethereum (ETH) Price Prediction 2026-2031

Forecasts influenced by EigenLayer restaking rewards, EigenDA/AVS adoption, and ETH utility enhancements from 2025 baseline of $3,038.91

| Year | Minimum Price (Bearish) | Average Price (Base) | Maximum Price (Bullish) |

|---|---|---|---|

| 2026 | $2,500 | $4,200 | $6,800 |

| 2027 | $3,200 | $5,800 | $10,000 |

| 2028 | $4,000 | $8,000 | $14,000 |

| 2029 | $5,500 | $11,000 | $19,000 |

| 2030 | $7,200 | $15,000 | $25,000 |

| 2031 | $9,500 | $20,000 | $33,000 |

Price Prediction Summary

Ethereum’s price is projected to grow progressively through 2031, driven by EigenLayer’s restaking ecosystem boosting yields (currently ~4.24%) and demand for restaked ETH/LSTs. Bearish scenarios account for market corrections and regulatory hurdles, while bullish cases reflect mass AVS adoption, EIGEN airdrops, and Ethereum scaling. Average prices imply ~30-40% CAGR from current levels, with potential 10x upside in optimistic outlooks.

Key Factors Affecting Ethereum Price

- EigenLayer TVL expansion and points system for EIGEN token incentives

- Diversification across AVSs like EigenDA enhancing restaking rewards

- Liquid restaking tokens (LRTs) integration with DeFi for compounded yields

- Ethereum protocol upgrades (e.g., scaling, security improvements)

- Institutional adoption of restaking and LSTs

- Regulatory developments supporting DeFi and staking

- Macro cycles, BTC correlation, and competition from other restaking protocols (Symbiotic, Karak)

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

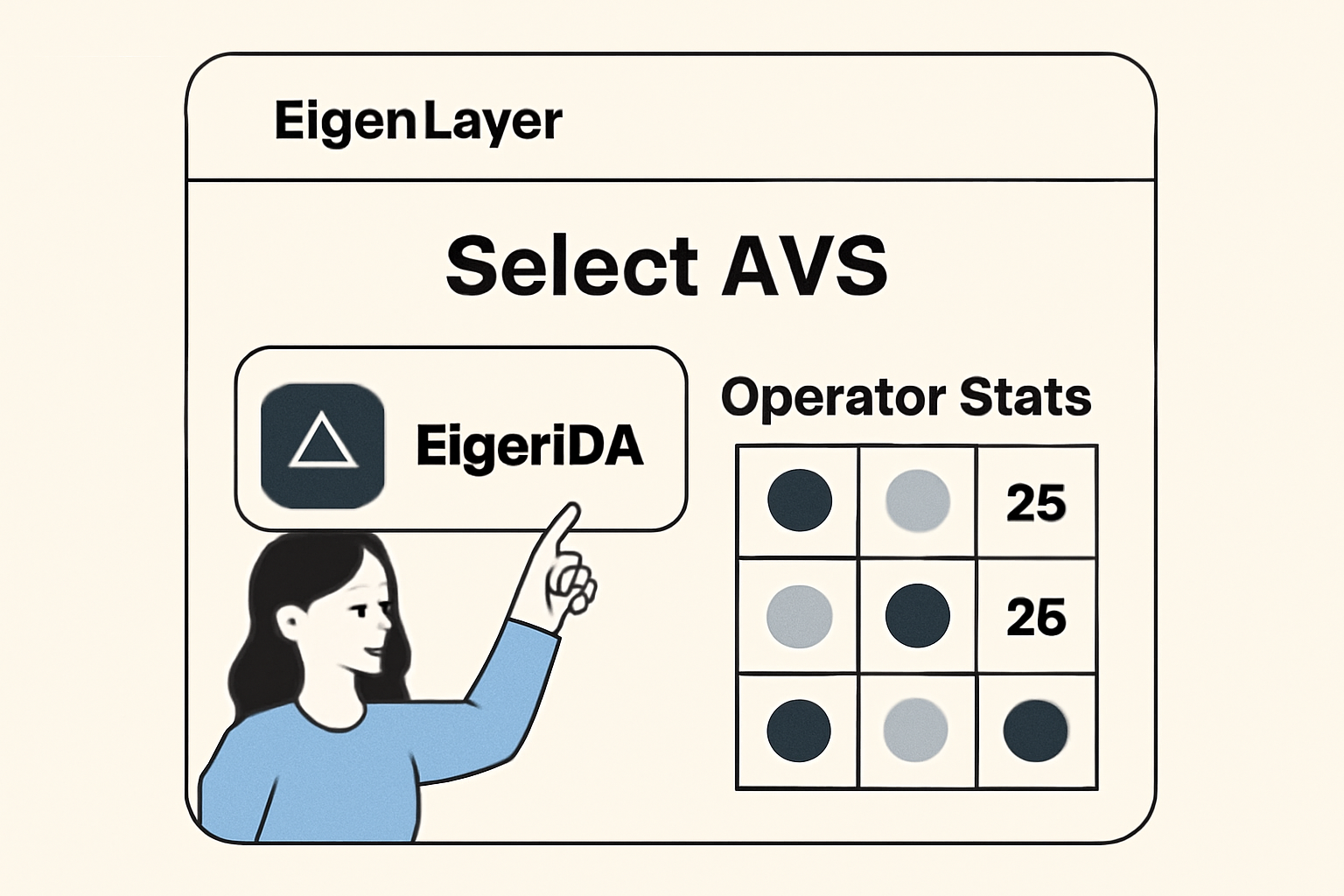

Why EigenDA Stands Out in AVS Diversification

EigenDA, EigenLayer’s data availability solution, exemplifies high-potential AVS restaking. By securing blobspace for rollups, it taps Ethereum’s post-Dencun efficiency gains, drawing substantial TVL. Restakers opting into EigenDA capture premium rewards, as its performance correlates with Layer 2 growth. Diversifying across EigenDA and ARPA Network mitigates single-AVS risks, balancing downtime exposure while chasing elevated points.

Real-world data backs this: top operators show 99.9% uptime, minimizing slashing, a key drag on yields. Check EigenLayer’s operator directory for metrics before delegating. Liquid Restaking Tokens (LRTs) from ether. fi or Kelp DAO supercharge this, enabling DeFi composability without liquidity sacrifice. Deploy LRTs on Pendle for yield farming, compounding EigenLayer points with external APYs.

Timing matters profoundly. Align restaking with incentive epochs; EigenLayer allocates bonuses around major AVS launches. Monitoring Dune Analytics reveals slashing events early, preserving principal at $3,038.91 ETH levels. For beginners, this EigenLayer restaking guide emphasizes starting small: 1-5 ETH tests operator fit before scaling.

Strategic LST and Operator Selection for Peak Rewards

LSTs unlock flexibility, letting you restake staked ETH from Kiln or Figment while retaining liquidity. Protocols pay for validator reuse, layering restaking atop base rewards. Select LSTs with low fees and high EigenLayer compatibility, data shows rETH outperforming in points efficiency.

Operators demand scrutiny: prioritize those with transparent fees under 5% and proven AVS integration. EigenLayer’s slashing framework penalizes downtime harshly, so historical performance trumps promises. By Q4 2025, high-performers yield 1-2% extra annually, per DeFiLlama trackers.

Integrating EIGEN stakes alongside LSTs further elevates returns, as dual-token exposure captures both restaking points and governance emissions. At Ethereum’s current $3,038.91 price, even modest positions compound meaningfully over quarters.

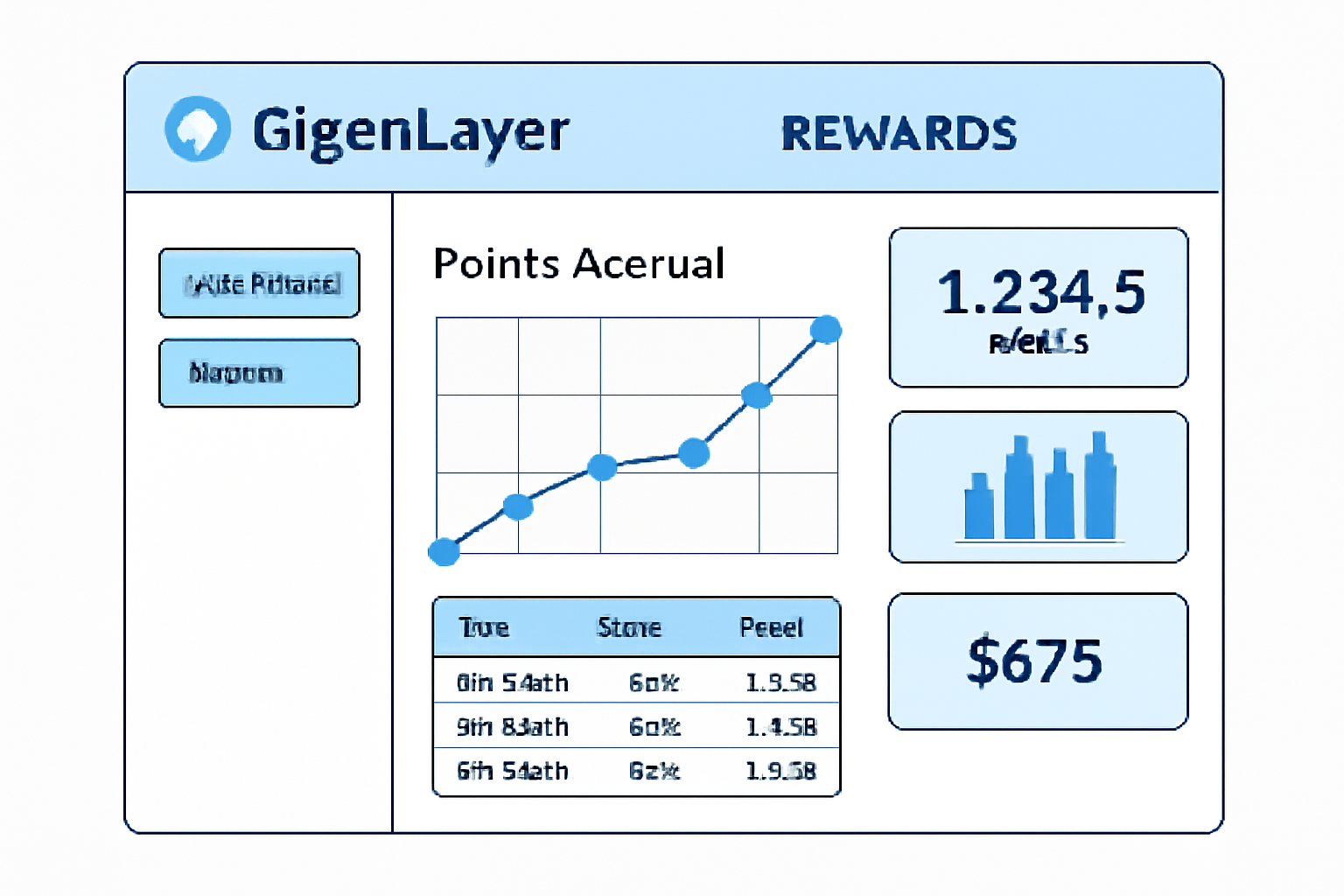

Claiming AVS Rewards: A Streamlined Process

Rewards from AVSs like EigenDA accrue in ETH, LSTs, or EIGEN, distributed up to three times weekly once surpassing the 0.00000001 ETH threshold. Everstake outlines the flow: connect your wallet via EigenLayer’s dashboard, navigate to the ‘Rewards’ tab, and claim per AVS. Automation via operators streamlines this, but manual verification prevents dust losses. Data indicates frequent claimants capture 15-20% more annualized yield through compounding.

Post-claim, reinvest promptly to sustain points momentum. EigenLayer’s design favors active participants, with unclaimed rewards forfeiting after epochs, per protocol rules.

Risk-Adjusted Strategies for 2025 Yields

While points farming promises ETH restaking rewards, slashing looms as the primary threat. EigenDA’s blobspace demands uninterrupted validation; a single outage could erase weeks of accrual. Diversification across five-plus AVSs caps exposure at 20% per service, empirical models from ChainUp affirm. LRTs introduce smart contract vectors, yet ether. fi’s audits yield top DeFiSafety scores.

Comparison of Top AVSs for ETH Restaking on EigenLayer in 2025

| AVS | TVL (USD) | Yield (APR) | Uptime (%) | Slashing Risk |

|---|---|---|---|---|

| EigenDA | $8.2B | 4.5% | 99.99% | Low 🟢 |

| ARPA Network | $1.5B | 4.0% | 99.8% | Medium 🟡 |

| Mantle LSP | $2.1B | 4.3% | 99.95% | Low 🟢 |

| AltLayer | $900M | 4.1% | 99.7% | Low 🟢 |

| Average | – | 4.24% | – | – |

Timing entries around airdrops unlocks multipliers; EigenLayer’s 4% EIGEN carveout rewards early movers in incentive programs. Pendle deployments of LRTs have delivered 8-12% blended APY in backtests, outstripping native staking amid $3,038.91 ETH consolidation.

Operators warrant deepest diligence. High-performers like those in EigenLayer’s directory boast 99.99% uptime, translating to 1.5% yield edges. Cross-reference DeFiLlama for fee transparency; avoid newcomers lacking AVS track records. For EigenDA AVS restaking, prioritize blob-compatible nodes, as rollup demand surges post-Dencun.

Real-time tools transform guesswork into precision. Dune dashboards flag anomalies hours ahead, while DeFiLlama’s risk pages quantify correlations to ETH at $3,038.91. In my view, restakers ignoring these forfeit alpha; data-driven selection has separated outperformers since mainnet.

Looking toward 2025’s close, EigenLayer’s points system cements its lead among restaking primitives. With TVL fueling 4.24% EIGEN yields and AVS maturation, disciplined stakers stand to harvest substantial Ethereum restaking yields 2025. Scale thoughtfully, diversify rigorously, and let compound mechanics work. This EigenLayer restaking guide equips you to navigate it all.

Explore EigenLayer restaking pools step-by-step Secure EigenDA blobspace with ETH restaking