Ethereum’s security model has long relied on validators staking ETH to help maintain consensus and defend the network against attacks. With the introduction of EigenLayer restaking, this paradigm is rapidly evolving. Validators now have the ability to extend the utility of their staked ETH beyond Ethereum’s core protocol, participating in the security of emerging decentralized applications and services. This mechanism not only unlocks new earning opportunities, but also reinforces Ethereum’s overall security by pooling validator resources across a broader ecosystem.

What Is EigenLayer Restaking?

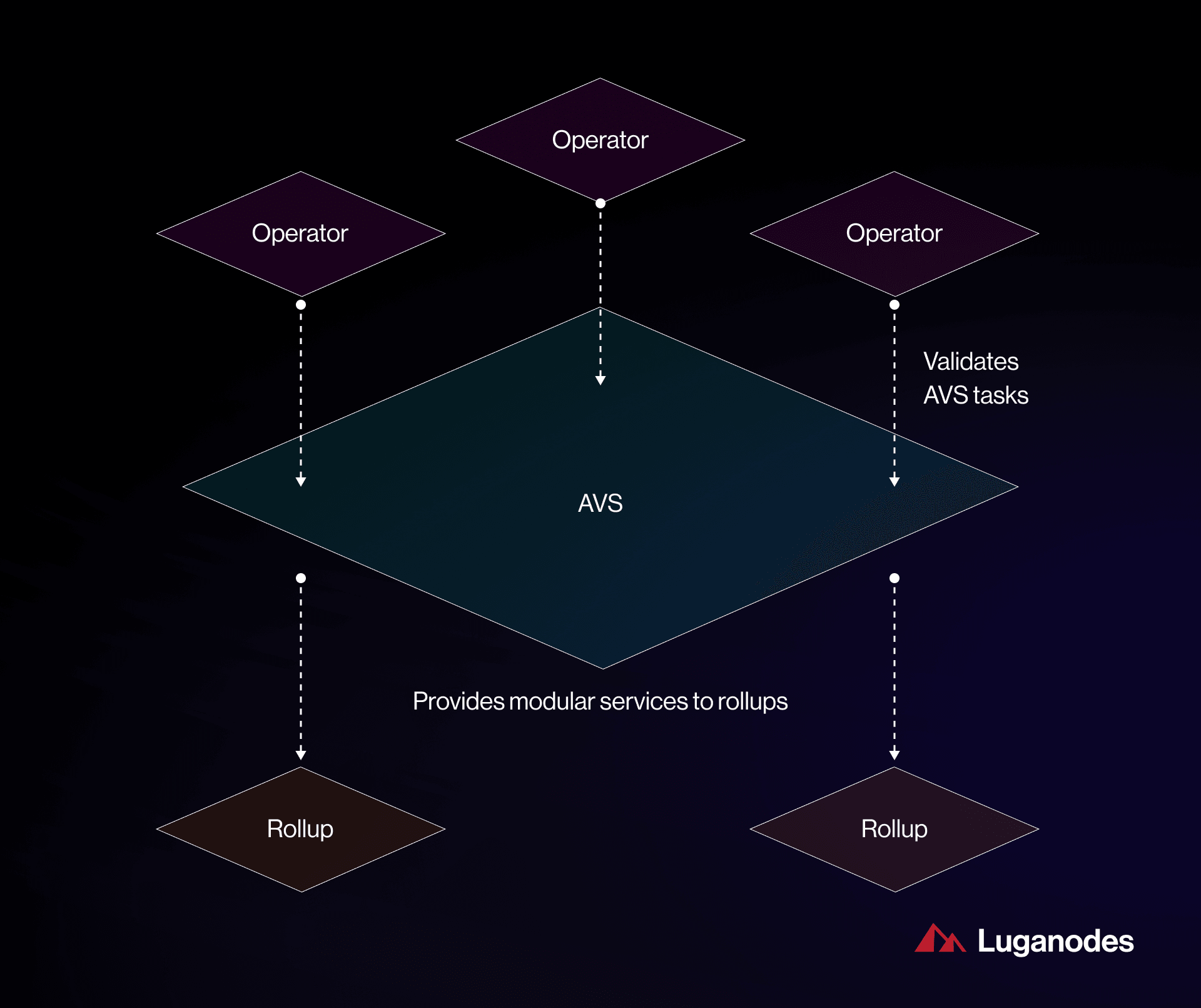

At its core, EigenLayer is a decentralized restaking protocol built on Ethereum. It allows validators to “restake” their already-staked ETH, using it to secure additional protocols known as Actively Validated Services (AVSs). Rather than requiring new capital, validators can leverage their existing stake, maximizing capital efficiency and earning extra yield by validating AVSs.

As of this writing, Ethereum is trading at $3,849.07, highlighting the significant value already secured by validators. By restaking through EigenLayer, these assets can now support not only Ethereum itself, but also a growing suite of modular services and protocols. This approach is transforming the economics of validation and the security landscape for the entire Ethereum ecosystem.

How Restaking Enhances Validator Security and Network Resilience

Security in proof-of-stake systems like Ethereum is fundamentally about incentives and penalties. Validators are rewarded for honest participation and risk losing their staked ETH (a process known as “slashing”) if they act maliciously or negligently. With EigenLayer restaking, these dynamics become even more nuanced.

By opting into restaking, validators agree to secure AVSs in addition to Ethereum. This means they are now subject to slashing conditions on both the base layer and any AVS they support. While this increases potential risk, it also aligns validator incentives across multiple protocols, making attacks more costly and less likely. The result is a more robust and resilient security model that benefits both validators and the ecosystem at large.

Capital Efficiency and New Revenue Streams for Validators

One of the most compelling features of EigenLayer restaking is its ability to unlock new revenue streams without requiring additional capital outlay. Validators can earn extra rewards from AVSs while continuing to collect their standard Ethereum staking rewards. This dual-yield opportunity is particularly attractive in today’s market, where ETH’s price remains strong at $3,849.07.

However, with greater rewards come increased responsibilities. Validators must maintain high uptime and performance standards across all protocols they secure. Any failure to do so can result in slashing not only from Ethereum, but from AVSs as well. This makes robust restaking risk management essential for participants seeking to maximize returns while safeguarding their principal.

Ethereum (ETH) Price Prediction 2026-2031

Professional forecast considering EigenLayer restaking, Ethereum ecosystem growth, and evolving market conditions.

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg, YoY) | Key Scenario |

|---|---|---|---|---|---|

| 2026 | $3,100 | $4,300 | $6,200 | +12% | Institutional adoption of restaking, moderate market growth |

| 2027 | $3,400 | $5,100 | $7,800 | +18% | Expansion of AVSs, improved ETH utility, moderate regulation |

| 2028 | $3,800 | $6,200 | $10,000 | +22% | Major DeFi growth, global adoption, bullish cycle |

| 2029 | $4,500 | $7,000 | $12,500 | +13% | Market consolidation, Layer-2 and AVS maturation |

| 2030 | $5,200 | $8,200 | $15,000 | +17% | ETH as multi-protocol security standard, new institutional capital |

| 2031 | $6,000 | $9,400 | $18,000 | +15% | ETH dominance in restaking, robust AVS ecosystem |

Price Prediction Summary

Ethereum is expected to see steady price growth through 2031, driven by the adoption of EigenLayer restaking, new DeFi and AVS opportunities, and increasing institutional participation. The minimum price projections reflect potential bearish scenarios, such as regulatory hurdles or technical setbacks, while maximum prices account for bullish adoption and market expansion. Average prices show a progressive upward trend, with notable jumps during expected crypto bull cycles and ecosystem breakthroughs.

Key Factors Affecting Ethereum Price

- EigenLayer restaking adoption and validator participation

- Growth and success of Actively Validated Services (AVSs)

- Regulatory clarity and global crypto policy evolution

- Ethereum’s competitive positioning vs. other smart contract platforms

- Macroeconomic trends and institutional investment flows

- Scalability and network upgrade milestones (e.g., Danksharding, L2 adoption)

- Potential risks from slashing, security incidents, and market volatility

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Restaking Protocol Guide: How It Works in Practice

Participating in EigenLayer restaking involves a few key steps:

- Deposit or Redirect: Validators can deposit liquid staking tokens or redirect their Ethereum validator withdrawal credentials into EigenLayer smart contracts.

- Select AVSs: Validators choose which AVSs to support, each with its own reward and risk profile.

- Monitor Performance: Ongoing monitoring is crucial to avoid slashing events and optimize yield across all protocols.

This process is designed to be seamless for experienced validators, but those new to restaking should review frequently asked questions about EigenLayer restaking before committing capital.

As more protocols and AVSs launch on Ethereum, the role of restaking is becoming central to the network’s evolution. By leveraging the same staked ETH to secure multiple layers, validators not only increase their earning potential but also help bootstrap security for new projects. This shared security model is a win-win: emerging protocols gain robust protection from day one, while validators diversify their income streams in a dynamic market.

Managing Slashing Risks and Validator Accountability

While the upside of EigenLayer restaking is clear, it’s vital for validators to understand the expanded risk landscape. Slashing penalties are now possible from both Ethereum and any AVSs a validator chooses to support. This means poor performance, downtime, or malicious behavior on any supported protocol can jeopardize the validator’s entire staked position.

To mitigate these risks, validators should:

Key Risk Management Practices for EigenLayer Validators

-

Monitor Slashing Conditions Across All Protocols: Validators must stay updated on the slashing rules for both Ethereum and each supported Actively Validated Service (AVS), as restaking exposes them to multiple penalty regimes.

-

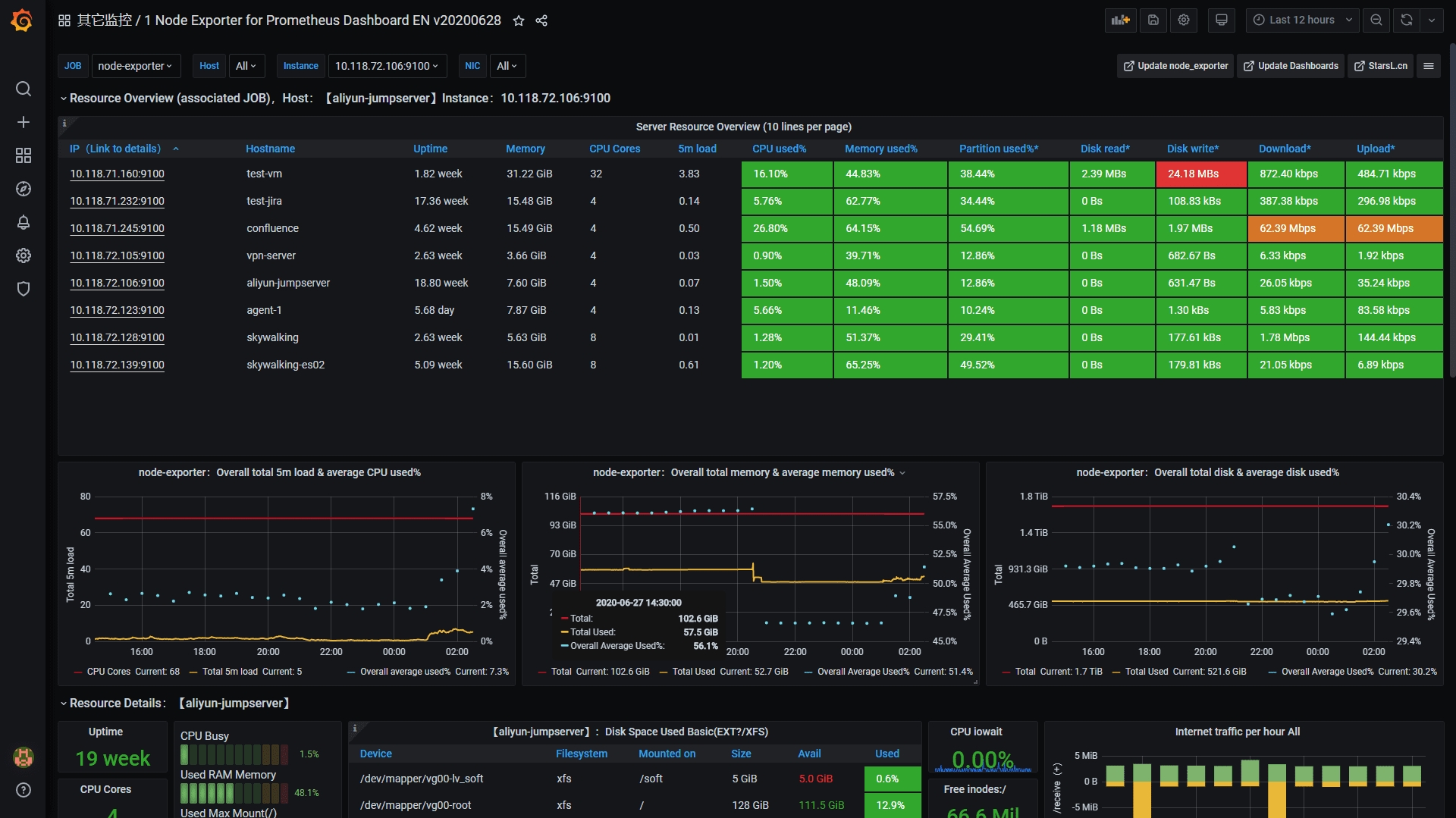

Maintain High Uptime and Performance: Consistent validator uptime and reliable node performance are essential to avoid penalties and maximize rewards from both Ethereum and AVSs.

-

Use Reputable Staking Infrastructure Providers: Leveraging established platforms like Blockdaemon or Kiln can help ensure robust node operation and risk mitigation.

-

Regularly Audit Smart Contract Interactions: Validators should review and audit their interactions with EigenLayer smart contracts and AVSs to detect potential vulnerabilities or misconfigurations.

-

Stay Informed on Protocol Updates and Governance: Active participation in EigenLayer and Ethereum governance forums helps validators respond promptly to changes in protocol rules or security practices.

For many, the additional complexity is offset by the potential for increased rewards. Still, robust operational practices and real-time monitoring are non-negotiable. Validators who treat restaking as a core business function, rather than a passive income stream, will be best positioned to thrive as the ecosystem grows. For a deeper dive into risk management strategies, see our guide on slashing risks in EigenLayer restaking protocols.

Community Perspectives: The Validator Experience

Early adopters of EigenLayer restaking report a mix of excitement and caution. Many appreciate the protocol’s capital efficiency and the opportunity to help secure the next generation of decentralized services. Others highlight the importance of due diligence before selecting AVSs to support, given the varying slashing conditions and technical requirements.

Discussions across the Ethereum validator community frequently focus on best practices, performance tools, and the evolving landscape of AVS offerings. As the protocol matures, expect to see more sophisticated dashboards and automation tools designed to help validators monitor their exposure and optimize for both yield and security.

Looking Ahead: The Future of Validator Security and Rewards

With Ethereum’s price holding steady at $3,849.07, the value proposition for validators has never been more compelling. EigenLayer’s restaking protocol is poised to become a cornerstone of Ethereum’s security model, enabling validators to play a more active role in shaping the future of decentralized finance and infrastructure.

As AVSs proliferate and the restaking ecosystem matures, the interplay between risk, reward, and responsibility will only intensify. Validators who invest in education, risk management, and operational excellence will be well-positioned to capitalize on these changes. For a comprehensive overview of how restaking is transforming validator yields, see our guide on EigenLayer validator yields.

Key Takeaways for Ethereum Validators

- Restaking amplifies both rewards and risks: Validators can earn more, but must be vigilant about performance and slashing conditions.

- Capital efficiency is maximized: The same staked ETH can now secure multiple protocols, supporting both Ethereum and new AVSs.

- Security is a shared responsibility: By participating in restaking, validators collectively strengthen the entire ecosystem.

As the restaking landscape evolves, staying informed is essential. Whether you’re an established validator or just exploring the space, EigenLayer is redefining what it means to secure Ethereum, and offering unprecedented opportunities for those ready to adapt.