As Ethereum’s restaking ecosystem rapidly expands, understanding the nuances of EigenLayer slashing risks has become essential for both seasoned validators and newcomers. With Ethereum (ETH) currently trading at $4,538.51, the economic stakes are higher than ever. Restaking on EigenLayer allows validators to secure additional decentralized services and earn layered rewards, but it also introduces a complex web of penalties that can result in substantial losses if not properly managed.

How Slashing Works in EigenLayer Restaking

Slashing serves as a critical deterrent against malicious or negligent behavior by validators. In the context of EigenLayer, slashing is not just a technical detail – it’s the backbone of protocol security and trust. When a validator misbehaves or fails to meet protocol requirements, a portion (or all) of their restaked ETH can be confiscated. This penalty system aligns incentives across the network, ensuring that only those who act honestly can continue to participate.

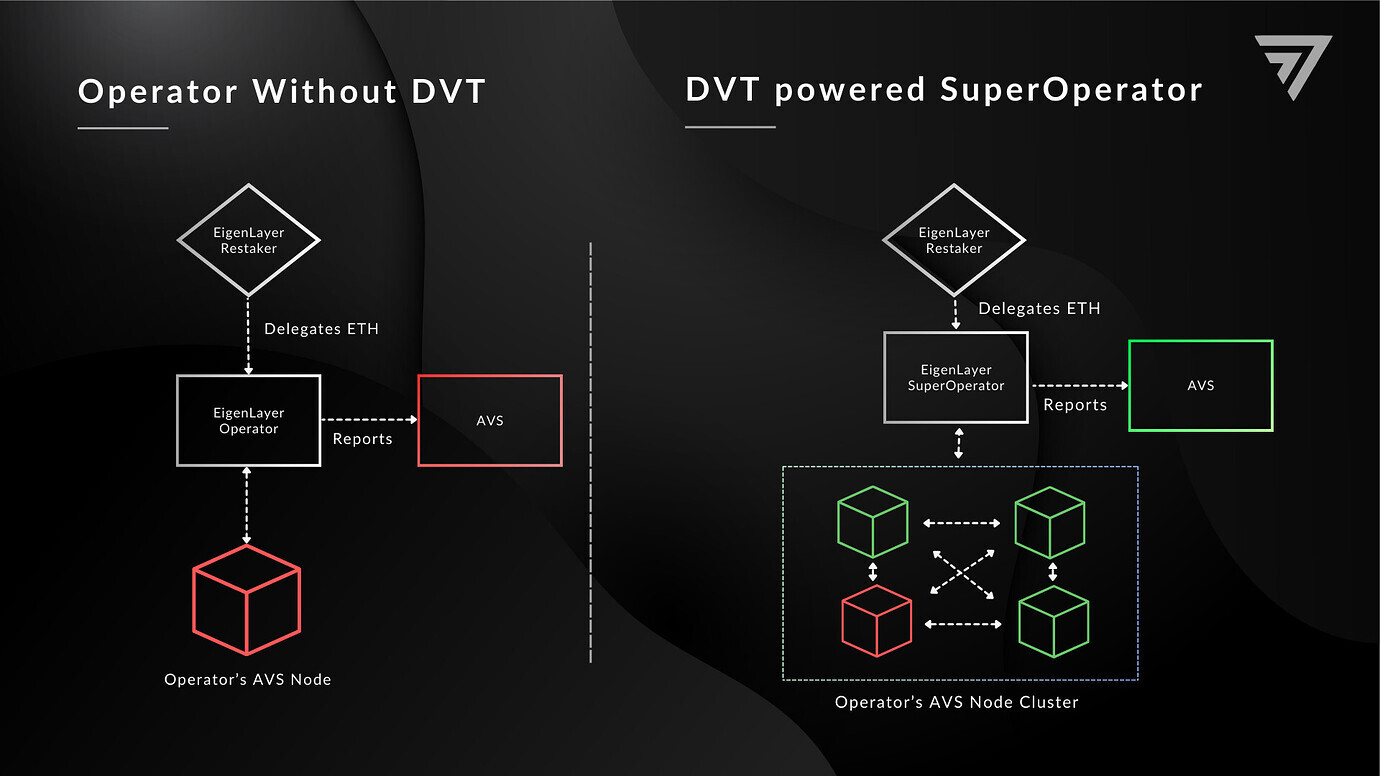

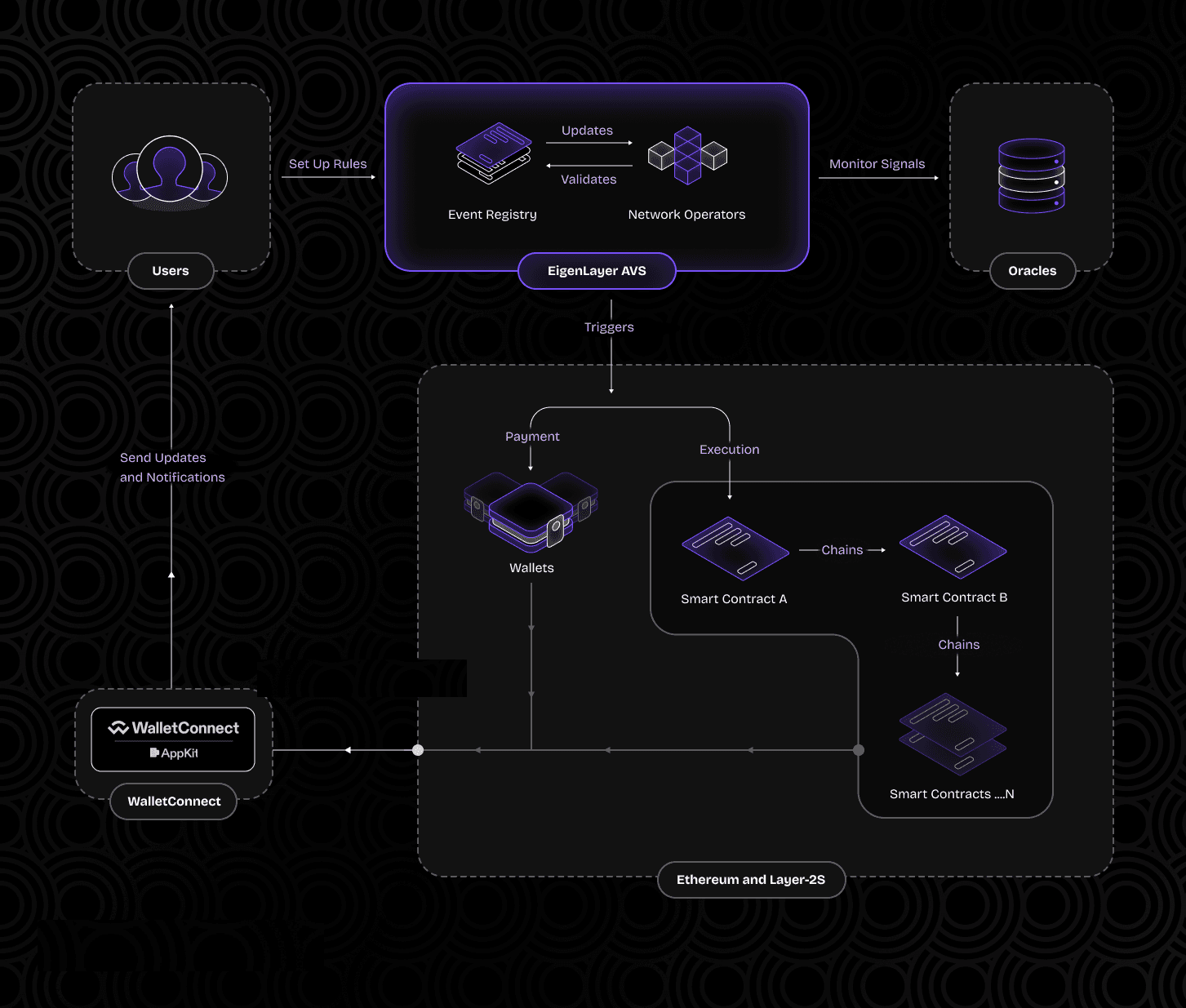

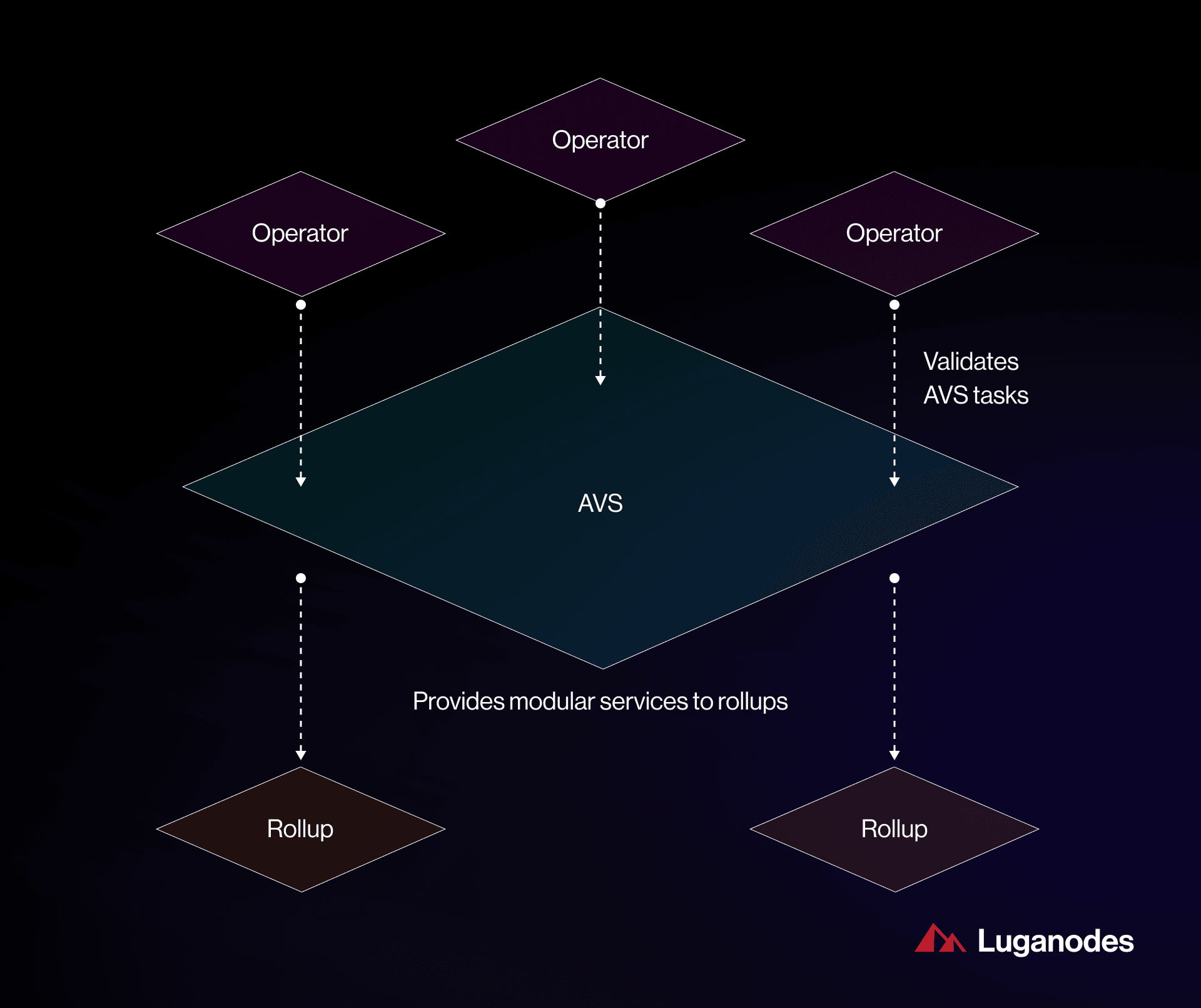

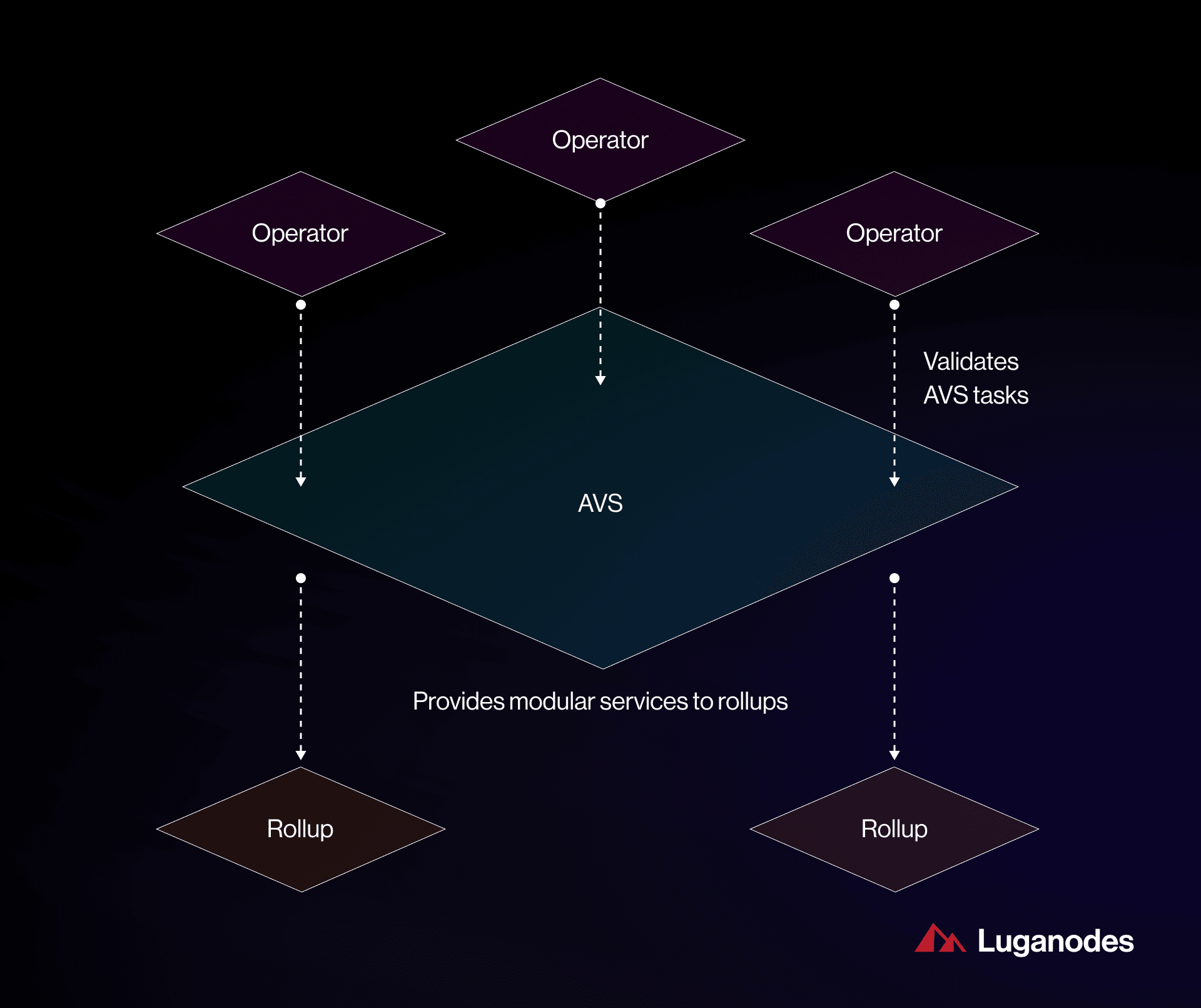

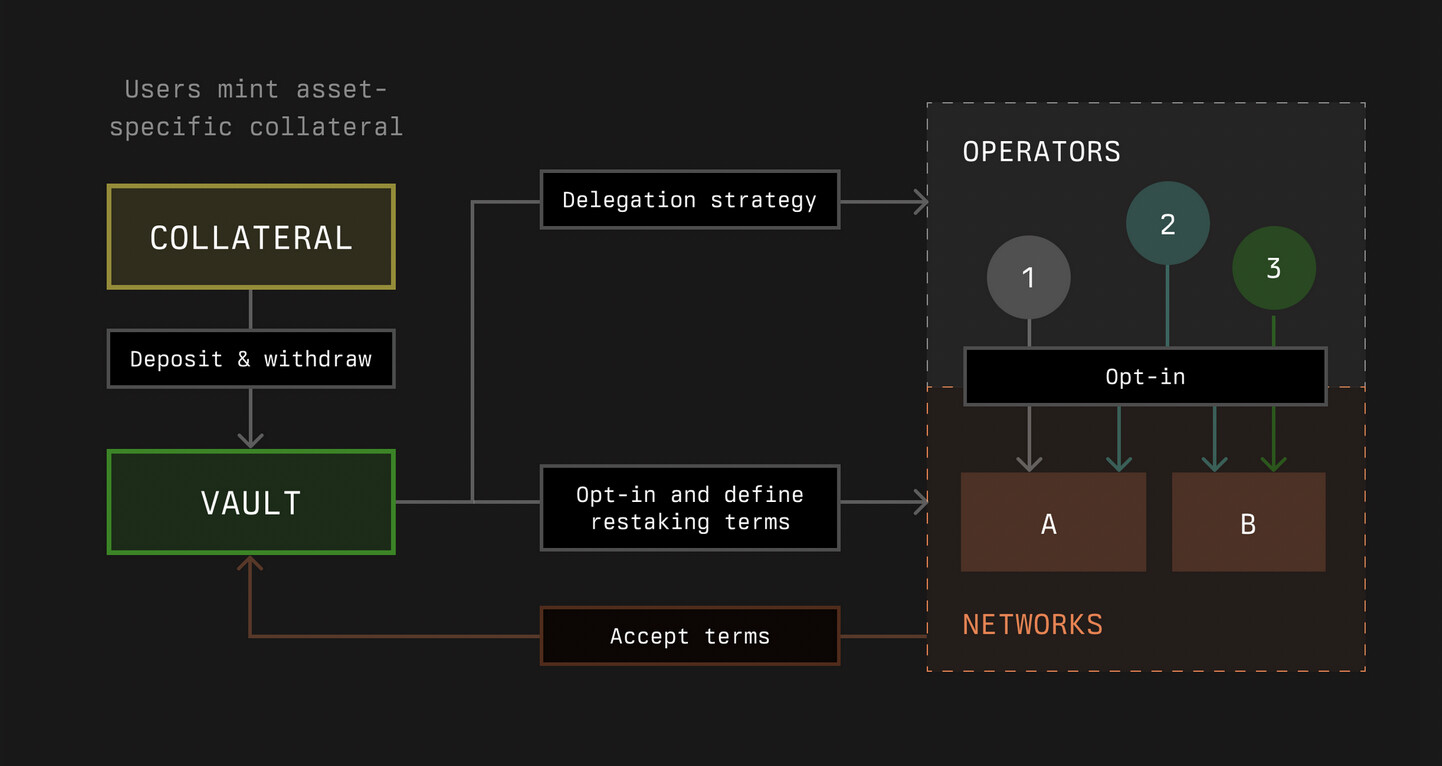

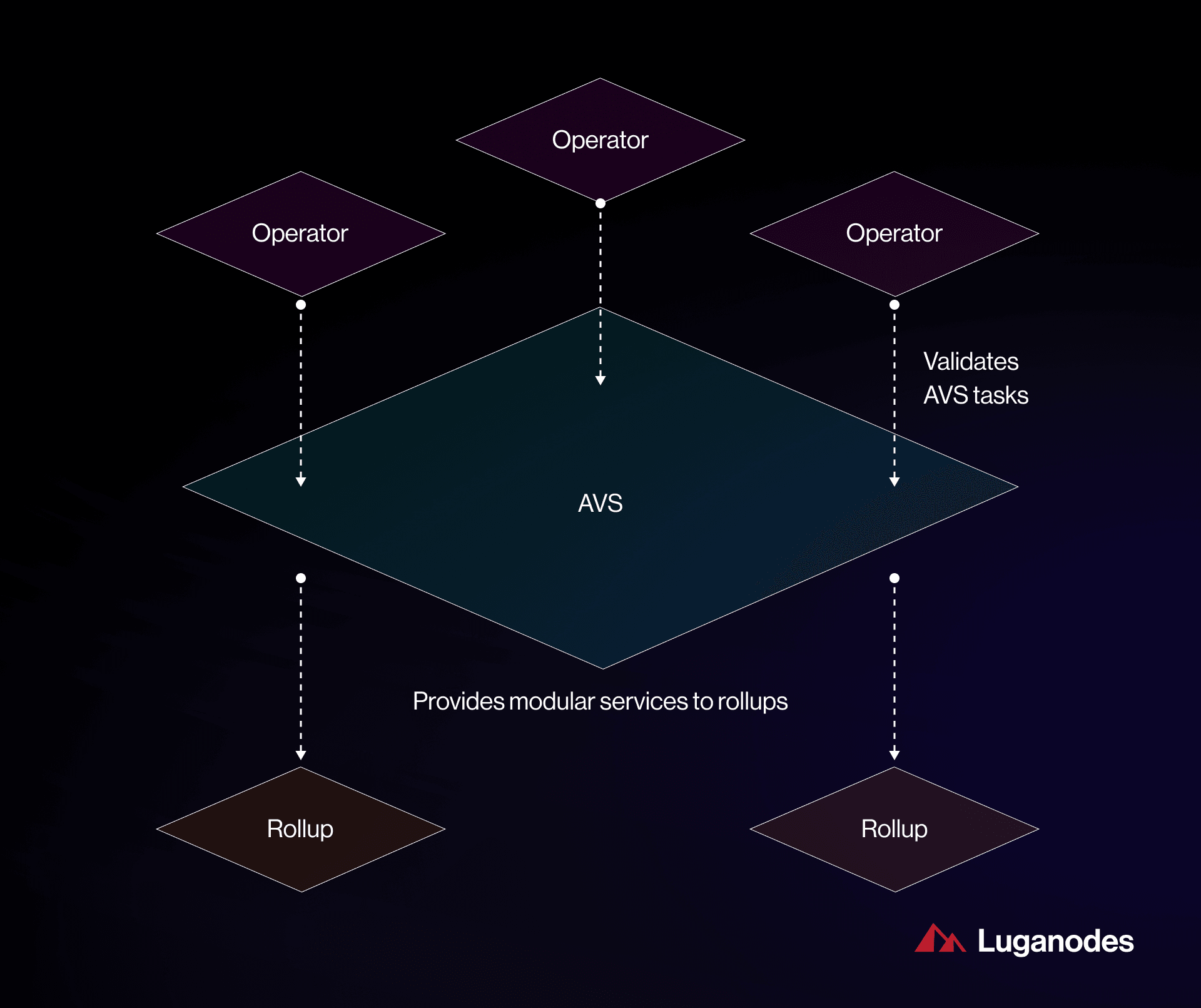

The mechanics of slashing within EigenLayer are notably more intricate than on Ethereum’s base layer. Since restaked ETH may secure multiple Actively Validated Services (AVSs), a single infraction could trigger cascading penalties across several protocols. This risk is amplified by programmable slashing frameworks, giving AVS developers granular control over how and when to enforce penalties (source).

Key Slashing Risks Unique to EigenLayer Restaking

-

Dual Slashing Exposure: Validators are at risk of being slashed by both Ethereum and EigenLayer for consensus violations or malicious behavior, potentially compounding asset losses beyond standard staking penalties.

-

Smart Contract Vulnerabilities: Participation in EigenLayer requires interacting with complex smart contracts. Any bugs or exploits in these contracts can result in loss of restaked ETH, as highlighted in recent security audits and bug bounty programs.

-

Rehypothecation and Cascading Slashing: Restaked ETH can secure multiple protocols through EigenLayer. If one protocol fails or is compromised, it may trigger cascading slashing events across all connected protocols, amplifying potential losses.

-

Centralization Risks: The concentration of restaked ETH among large validators or liquid staking providers can increase systemic risk, making coordinated attacks or large-scale failures more likely within the EigenLayer ecosystem.

-

Liquidity Constraints: EigenLayer restaking may involve withdrawal delays and service fees, which can restrict participants’ ability to quickly access or move their funds, especially during periods of network stress or slashing events.

-

Regulatory Uncertainty: The innovative nature of restaking protocols like EigenLayer may attract regulatory scrutiny, potentially leading to legal challenges or restrictions that could impact user funds or protocol operations.

Restaking Penalties: What Validators Need to Know

The dual-layered nature of EigenLayer means that validators face potential penalties from both the Ethereum consensus layer and from any AVS they support through restaking. This dual exposure creates scenarios where misconduct – whether accidental or intentional – can lead to significant asset loss.

Key penalty triggers include:

- Double signing or equivocation: Signing multiple conflicting messages can result in immediate slashing.

- Liveness failures: Extended downtime or failure to participate in consensus may also incur penalties.

- Breach of AVS-specific rules: Each AVS can implement its own programmable slashing logic, compounding risk for participants (source).

This heightened risk profile is why some experts caution that “the slashing risk for EigenLayer ETH Restaking may be higher than that for normal ETH staking” (source). In other words, while potential rewards increase with restaking, so too does the probability and impact of punitive actions.

Cascading Risks: Rehypothecation and Smart Contract Vulnerabilities

A unique challenge with EigenLayer’s model is rehypothecation – using the same staked ETH as collateral for multiple services simultaneously. If one protocol experiences a failure or attack, it could trigger widespread slashing events that ripple through all interconnected AVSs and their operators. Such systemic risk is new territory for most Ethereum validators.

Additionally, interacting with EigenLayer’s smart contracts introduces another layer of vulnerability. Flaws in contract code or exploits could result in loss of staked assets outside traditional consensus failures. To mitigate these threats, EigenLayer has implemented measures such as regular security audits and a $2 million bug bounty program (source). However, even with these safeguards in place, participants must remain vigilant.

Beyond technical and operational diligence, validators must also weigh broader market and regulatory factors. With Ethereum’s price at $4,538.51, each slashing event now carries amplified financial consequences. The increasing adoption of liquid staking and the rise of large validator pools have led to concerns about centralization, which could heighten the risk of coordinated attacks or large-scale failures within the restaking ecosystem.

Mitigating Slashing Risks: What Can Validators Do?

EigenLayer has introduced several mechanisms to help mitigate these risks. Slashing Veto Committees, composed of independent actors, can review and veto unintended or erroneous slashing events before they are finalized. This layer of governance is designed to prevent catastrophic losses due to bugs or misconfigurations in AVS-specific slashing logic.

Community-driven multisig governance further enhances protocol resilience by enabling emergency upgrades and rapid response to threats, while regular third-party audits and an active bug bounty program incentivize transparency and ongoing security improvements (source). Still, no system is infallible; operators are urged to stay current with protocol updates and AVS requirements.

Given these dynamics, prudent validators should:

- Diversify across AVSs: Avoid overexposure to a single protocol or service.

- Monitor smart contract upgrades: Stay informed on changes that may affect slashing conditions.

- Engage with community governance: Participate in multisig votes and veto committees when possible.

- Review AVS-specific rules: Understand unique penalty triggers for each service you secure.

Looking Forward: The Evolving Landscape of Restaking Safety

The restaking paradigm is still maturing, with new security tools and risk management frameworks emerging alongside protocol innovation. As programmable slashing becomes more sophisticated, both the technical complexity and the potential for unforeseen edge cases increase (source). Validators who treat restaking as a passive investment may be caught off guard by nuanced penalty conditions or delayed detection of cascading failures.

Ultimately, success in this environment comes down to a blend of vigilance, community engagement, and an appetite for ongoing learning. As institutional capital continues entering the space – drawn by higher yields but wary of elevated risks – robust education around EigenLayer slashing risks will be crucial for sustainable growth.

Best Practices for Safe EigenLayer Restaking

-

Understand Slashing Risks: Carefully review EigenLayer’s slashing mechanisms, as restaked ETH is subject to penalties from both Ethereum and EigenLayer for protocol violations, potentially resulting in substantial asset loss.

-

Evaluate Smart Contract Security: Only interact with EigenLayer contracts that have undergone independent security audits and are covered by active bug bounty programs, such as EigenLayer’s $2 million initiative.

-

Monitor Rehypothecation Exposure: Be cautious when restaking ETH across multiple protocols, as failures in one can trigger cascading slashing events affecting all associated assets.

-

Assess Validator and AVS Operator Reputation: Choose established validators and AVS operators with a proven track record to minimize risks associated with operator misconduct or negligence.

-

Stay Informed on Protocol Updates: Regularly follow official EigenLayer communications and community channels to remain aware of changes in slashing policies, governance, and security measures.

-

Utilize Slashing Veto Committees: Leverage the protection offered by EigenLayer’s slashing veto committees, which can overturn erroneous or unintended slashing events.

-

Factor in Liquidity and Withdrawal Constraints: Be mindful of potential withdrawal delays and service fees, and plan accordingly to avoid liquidity crunches during periods of high volatility.

-

Consider Regulatory Developments: Monitor evolving regulatory landscapes that may affect restaking, as legal changes could impact your ability to participate or withdraw funds.

The bottom line: while EigenLayer’s architecture unlocks powerful new opportunities for yield generation on Ethereum at $4,538.51, it also demands a higher standard of operational excellence from its participants. Those who invest time into understanding restaking penalties, smart contract vulnerabilities, rehypothecation risks, and evolving governance models will be best positioned to thrive as this innovative sector matures.