Ethereum’s evolution as a decentralized financial backbone has hinged on the strength and incentives of its validator network. With EigenLayer restaking, Ethereum validators can now amplify both their rewards and the security they provide across the ecosystem. As of today, ETH trades at $4,716.39, reflecting renewed interest in staking innovations that maximize yield and network resilience.

Restaking: Unlocking New Yield Streams for Validators

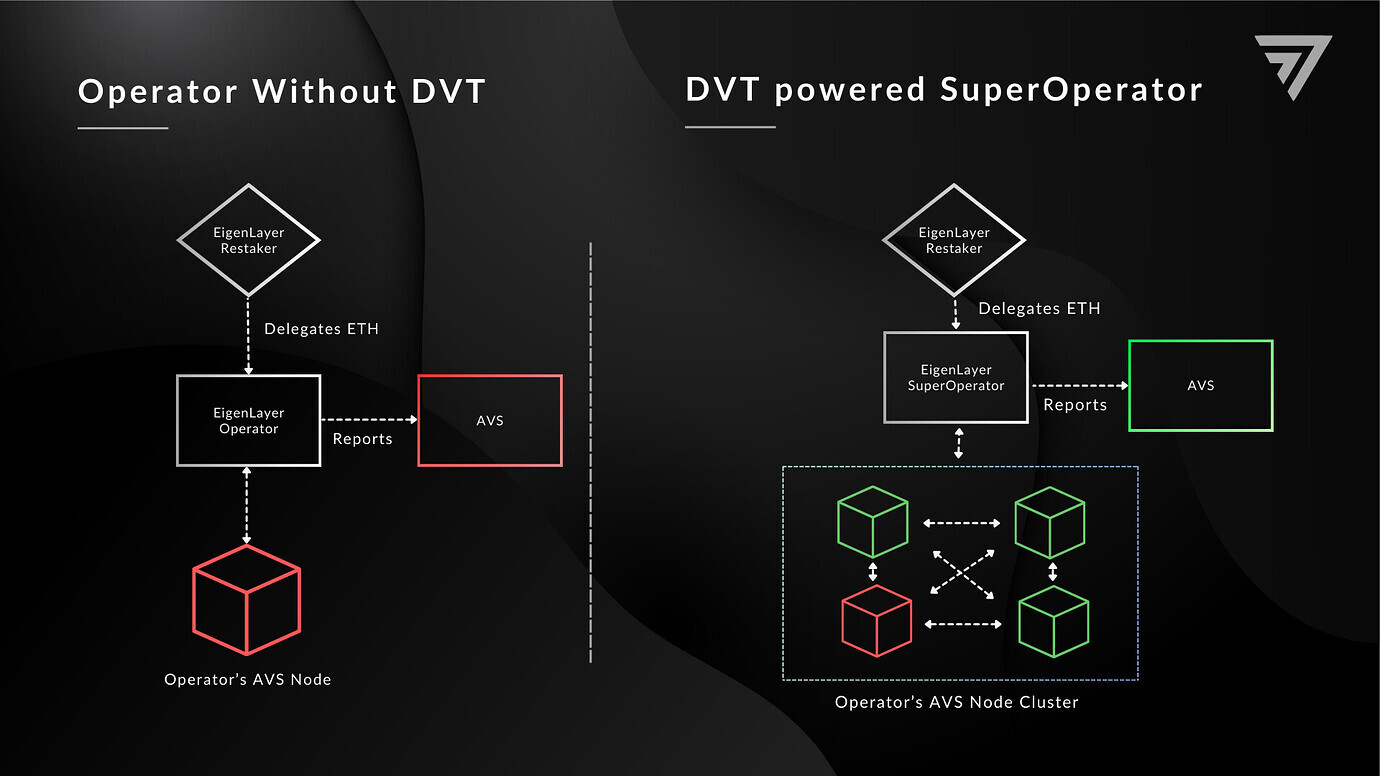

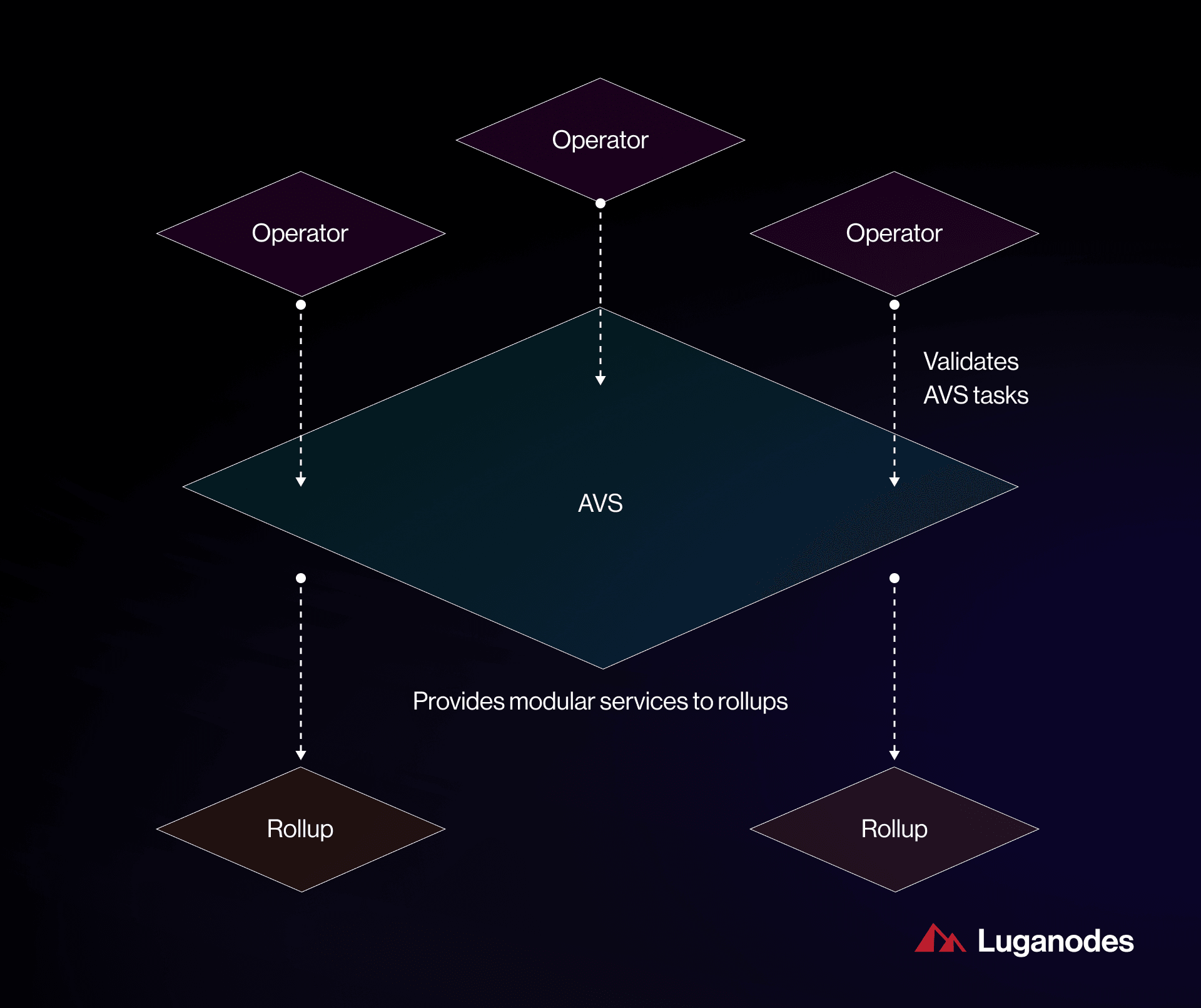

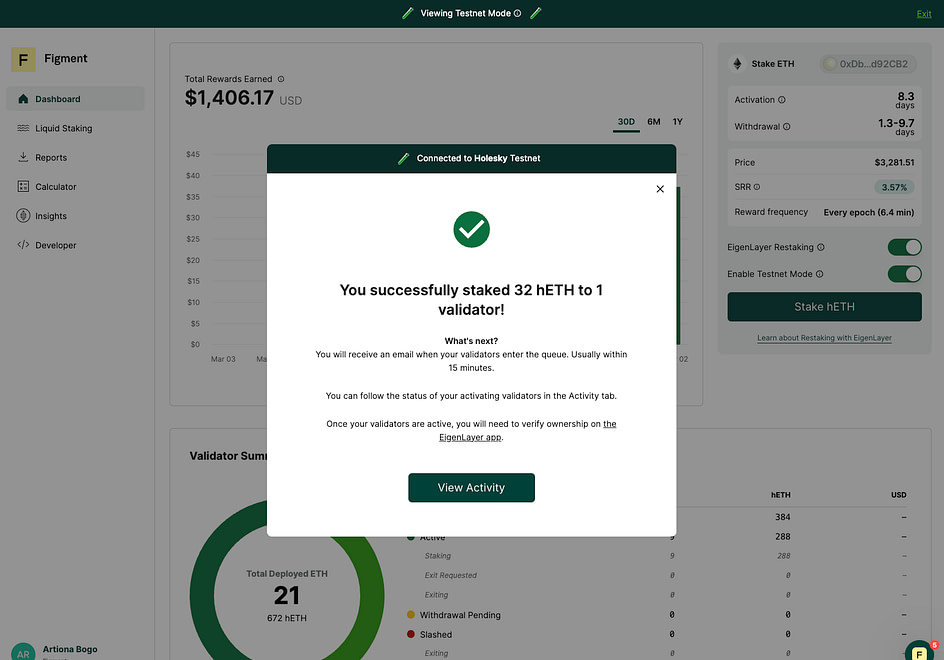

Traditionally, Ethereum validators earned rewards exclusively from securing the core network. However, EigenLayer introduces a paradigm shift by enabling these validators to “restake” their ETH or liquid staking tokens (LSTs) to secure additional protocols and Actively Validated Services (AVSs). This model offers:

- Enhanced capital efficiency: Validators can put their existing staked assets to work in multiple places simultaneously, unlocking new earning opportunities without additional capital outlay.

- Diversified revenue streams: By supporting AVSs or DeFi applications, validators receive protocol fees and extra incentives on top of base Ethereum staking rewards.

- Flexible participation: Both native restaking (directly with ETH) and liquid restaking (using LSTs like stETH or rETH) are supported, broadening access for all types of stakers.

This approach fundamentally changes how validators think about yield generation. Rather than being limited to one protocol’s rewards, they now have access to a dynamic marketplace of opportunities, each with its own risk-return profile.

The Security Multiplier: How Restaking Fortifies Ethereum’s Ecosystem

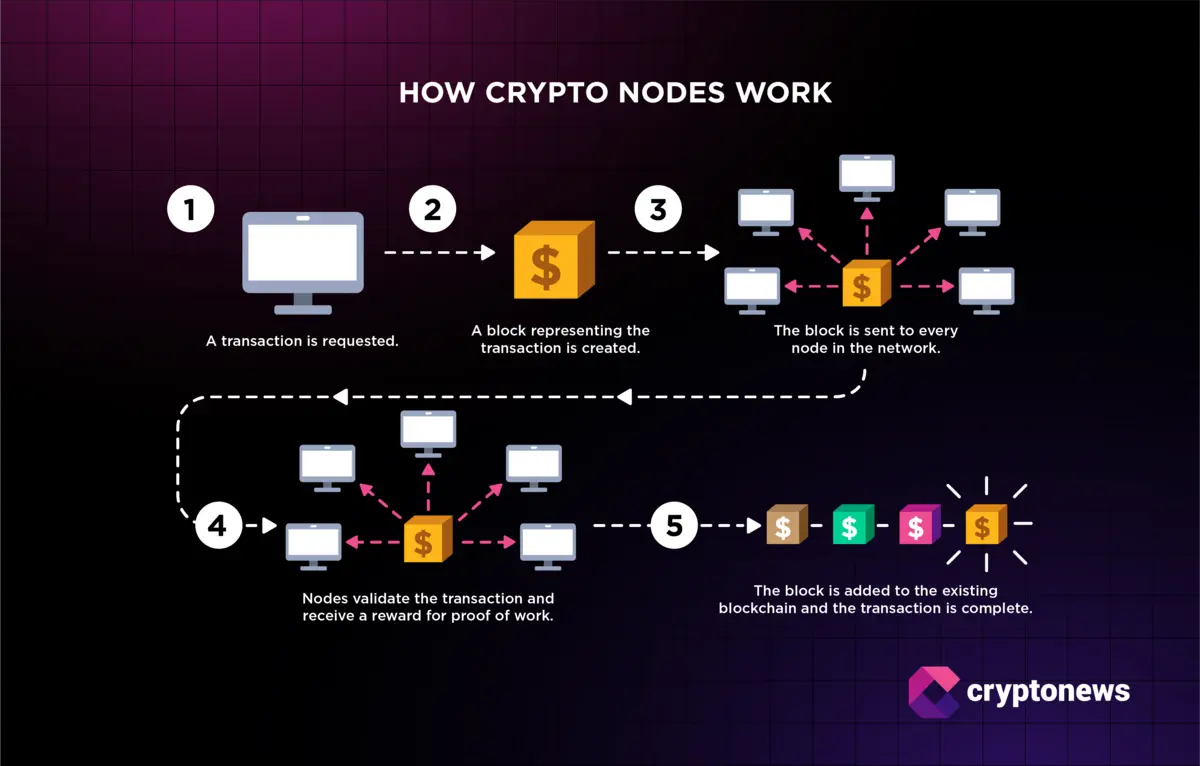

The implications go beyond just higher yields. By pooling security across multiple protocols through restaking, EigenLayer creates a shared security layer that makes attacks exponentially more expensive for malicious actors. If an attacker wants to compromise a validator participating in several AVSs via EigenLayer, they must now overcome not just the economic deterrents of Ethereum itself but those of every protocol relying on that validator’s stake.

This shared security model is enforced by robust slashing mechanisms, if a validator acts maliciously or fails to meet obligations on any supported protocol, their entire staked position is at risk. The result is a tightly aligned set of incentives encouraging honest behavior across all layers secured by EigenLayer restaking.

How Restaking Works: Native vs. Liquid Approaches

EigenLayer accommodates two primary methods for participation:

- Native Restaking: Validators directly commit their ETH to secure additional AVSs without converting it into an LST. This method appeals to those seeking maximum control over their assets and direct exposure to protocol-level risks and rewards.

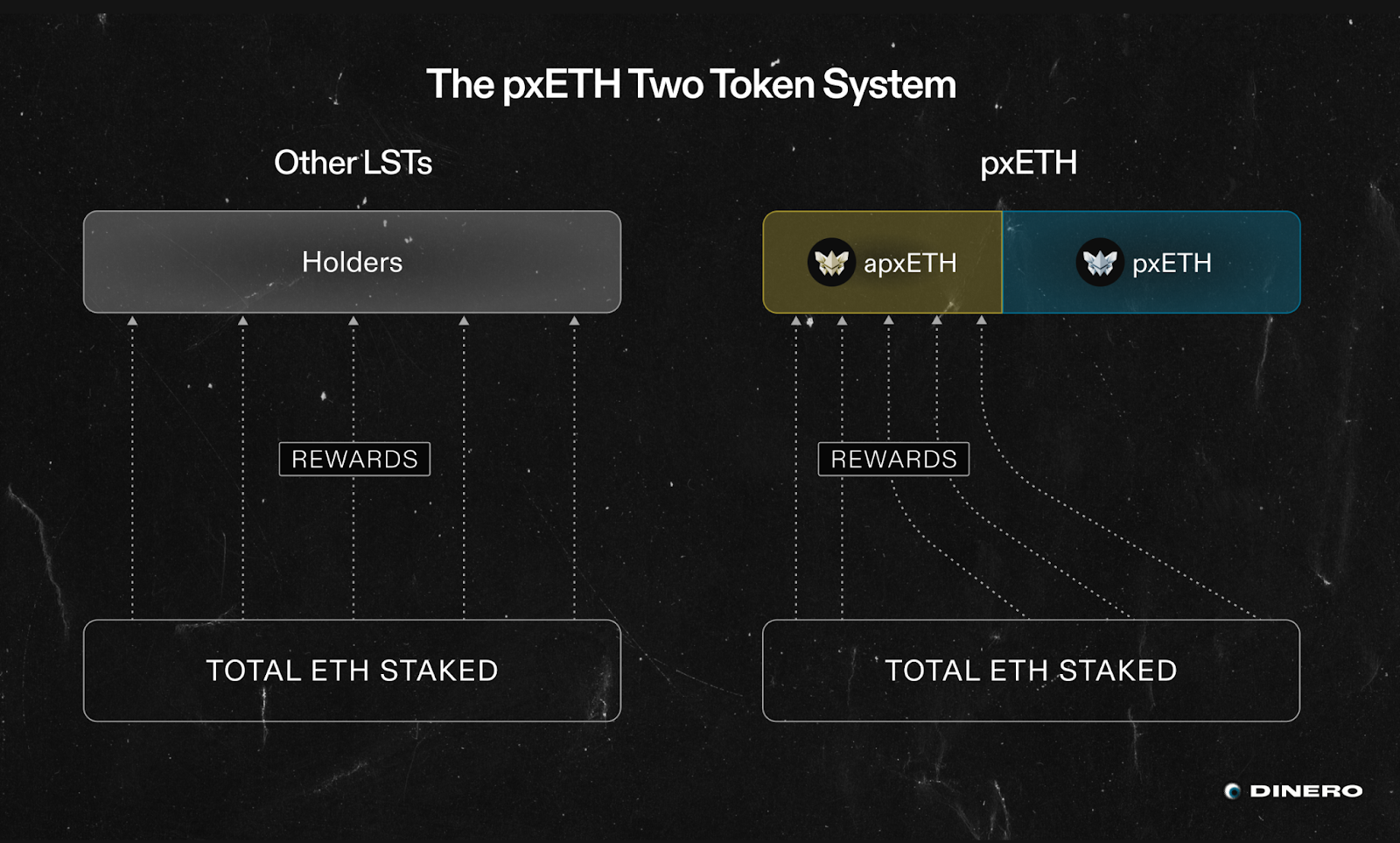

- Liquid Restaking: Stakers use popular LSTs such as stETH, rETH, or cbETH as collateral within EigenLayer smart contracts. This approach offers greater flexibility, users can trade or use their LSTs elsewhere while still participating in restaking reward programs.

The growing adoption of both models reflects demand for accessible yet robust ways to maximize staking utility while contributing meaningfully to the broader Ethereum ecosystem.

Ethereum (ETH) Price Prediction Post-EigenLayer Adoption (2026-2031)

Impact of EigenLayer Restaking on Ethereum Validator Rewards and Network Security

| Year | Minimum Price | Average Price | Maximum Price | Estimated % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $4,050 | $5,120 | $6,150 | +8.6% | Consolidation phase post-EigenLayer adoption; validator rewards attract more ETH stakers, increasing demand. |

| 2027 | $4,400 | $5,730 | $7,200 | +11.9% | Broader adoption of restaking; DeFi and AVS growth accelerate ETH utility. |

| 2028 | $4,900 | $6,680 | $8,950 | +16.6% | Bullish cycle driven by improved security and capital efficiency; regulatory clarity boosts institutional interest. |

| 2029 | $5,600 | $7,980 | $10,800 | +19.5% | ETH restaking becomes industry standard; cross-chain bridges and AVSs expand, maximizing validator revenue. |

| 2030 | $6,800 | $9,250 | $12,750 | +15.9% | Continued DeFi innovation and ETH as primary settlement layer; restaking risks well-mitigated. |

| 2031 | $7,500 | $10,300 | $14,900 | +11.3% | Mature network with extensive AVS ecosystem; ETH solidifies role as digital economy backbone. |

Price Prediction Summary

Ethereum’s price outlook from 2026 to 2031 is strongly supported by the adoption of EigenLayer’s restaking mechanism. This innovation is expected to enhance validator rewards, increase staking participation, and improve network security, all of which should drive steady price appreciation. While the market may experience cyclical volatility, the long-term trajectory for ETH remains positive, especially as more protocols leverage Ethereum’s security through restaking.

Key Factors Affecting Ethereum Price

- EigenLayer-driven staking rewards increasing ETH demand and validator participation.

- Rising adoption of Actively Validated Services (AVSs) leveraging Ethereum security.

- Improved capital efficiency and security attract DeFi and institutional users.

- Potential regulatory clarity supporting staking and restaking models.

- Risks from slashing penalties, liquidity constraints, and possible technical vulnerabilities.

- Competition from alternative L1s and restaking protocols may influence relative performance.

- Macro market cycles, global economic trends, and crypto regulation impacting overall sentiment.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

If you want more technical details about how EigenLayer improves validator security, see our analysis at /how-eigenlayer-restaking-enhances-ethereum-security-for-validators.

As EigenLayer’s restaking protocol matures, it is catalyzing a fundamental rebalancing of risk and reward for Ethereum validators. The ability to earn incremental rewards from multiple AVSs is powerful, but it comes with new considerations. Validators must carefully assess the risk profile of each protocol they support, as slashing on any one service can impact their entire staked position. This dynamic has prompted the emergence of risk assessment tools and dashboards to help validators make informed participation decisions.

Risks and Dynamic Incentives: Navigating the New Validator Landscape

While EigenLayer restaking unlocks additional yield, it introduces a more complex risk environment. Key risks include:

Top Risks for Validators Using EigenLayer Restaking

-

Increased Slashing Risk: Participating in EigenLayer restaking exposes validators to additional slashing penalties if they fail to meet obligations or engage in malicious behavior across any supported Actively Validated Service (AVS). This means a single mistake can result in loss of staked ETH across multiple protocols.

-

Smart Contract Vulnerabilities: Validators rely on EigenLayer’s smart contracts and those of integrated AVSs. Any bugs or exploits in these contracts could lead to loss of staked assets or rewards.

-

Liquidity Constraints: Restaked ETH may be subject to longer unbonding periods or withdrawal restrictions, reducing the ability to quickly access or move funds, especially during periods of network stress.

-

Operational Complexity: Running validators for multiple AVSs increases technical and operational demands. Misconfigurations or downtime can result in missed rewards or slashing events.

-

Cross-Protocol Risk Correlation: By restaking across several protocols, validators are exposed to correlated risks. An issue in one AVS could trigger slashing or losses affecting all restaked assets.

Slashing penalties are perhaps the most significant concern. If a validator fails to meet the obligations of any supported AVS or acts maliciously, they face slashing not just on that protocol but potentially across all protocols secured by their stake. This reinforces strong alignment between validators and the protocols they support but raises the stakes for operational security and diligence.

Liquidity risk also warrants attention. Restaking may involve extended unbonding periods, making it harder for validators to access their capital quickly in volatile markets. With ETH’s price at $4,716.39, even small changes in liquidity can have outsized effects on portfolio flexibility and overall returns.

Real-World Impact: Restaking in Action at $4,716.39 ETH

The current ETH price of $4,716.39 underscores renewed confidence in Ethereum staking innovations and protocols like EigenLayer that enhance both yield and security. As more AVSs come online, ranging from DeFi primitives to cross-chain bridges, validators are presented with a growing menu of opportunities for diversified earnings.

This evolving landscape is already influencing validator behavior. Many are opting for a hybrid approach, allocating some assets to native restaking for maximum control while using LSTs elsewhere for liquidity and composability within DeFi ecosystems.

If you’re considering restaking as part of your portfolio strategy, focus on protocols with transparent governance, robust slashing insurance mechanisms, and active community oversight. Balance remains key to resilient outcomes as this market matures.

The Future Outlook: Scaling Security Without Compromising Decentralization

The significance of EigenLayer’s shared security model extends beyond simple reward maximization, it lays groundwork for scalable decentralized trust across Ethereum’s rapidly expanding dApp universe. By enabling AVSs to bootstrap security without launching their own validator sets, EigenLayer accelerates innovation while preserving Ethereum’s core ethos of decentralization.

For stakers and validators alike, the calculus is shifting from single-protocol loyalty toward dynamic engagement across a spectrum of services, each offering unique incentives balanced against specific risks. As tools mature and transparency improves, expect broader adoption among both institutional players and individual crypto enthusiasts seeking optimized returns in an increasingly competitive landscape.

For deeper insights on how these mechanisms bolster validator security without sacrificing flexibility or decentralization, see our full analysis at /how-eigenlayer-restaking-enhances-ethereum-security-for-validators.