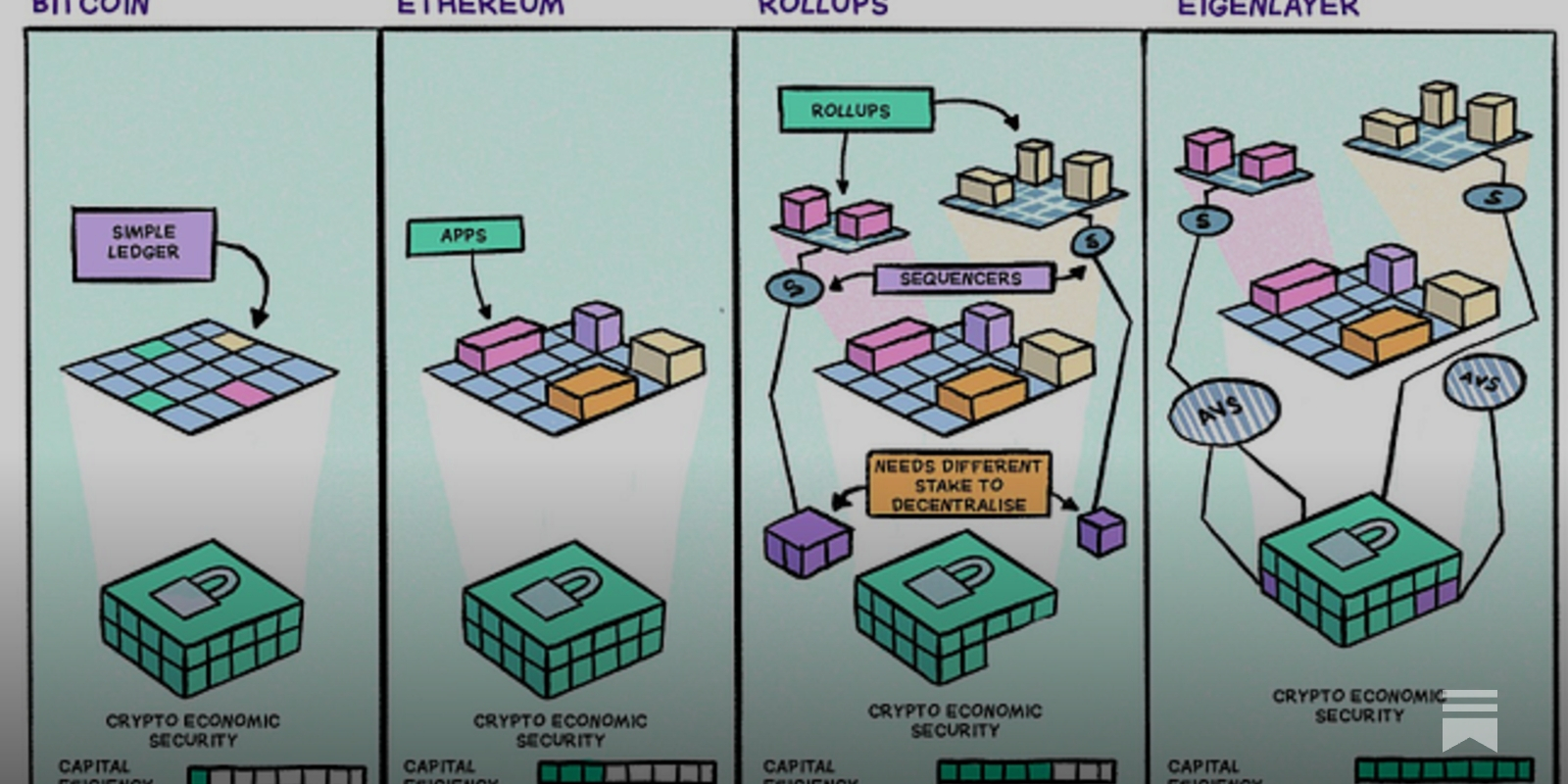

In the rapidly evolving world of decentralized finance (DeFi), EigenLayer’s restaking protocol has become a cornerstone innovation, redefining how security, capital efficiency, and yield opportunities are structured within the Ethereum ecosystem. By allowing users to redeploy their staked Ether (ETH) or liquid staking tokens (LSTs) across multiple protocols, EigenLayer is not just maximizing returns for participants but also underpinning a new era of modular security and open innovation in DeFi.

Restaking Explained: A Layered Approach to Security and Yield

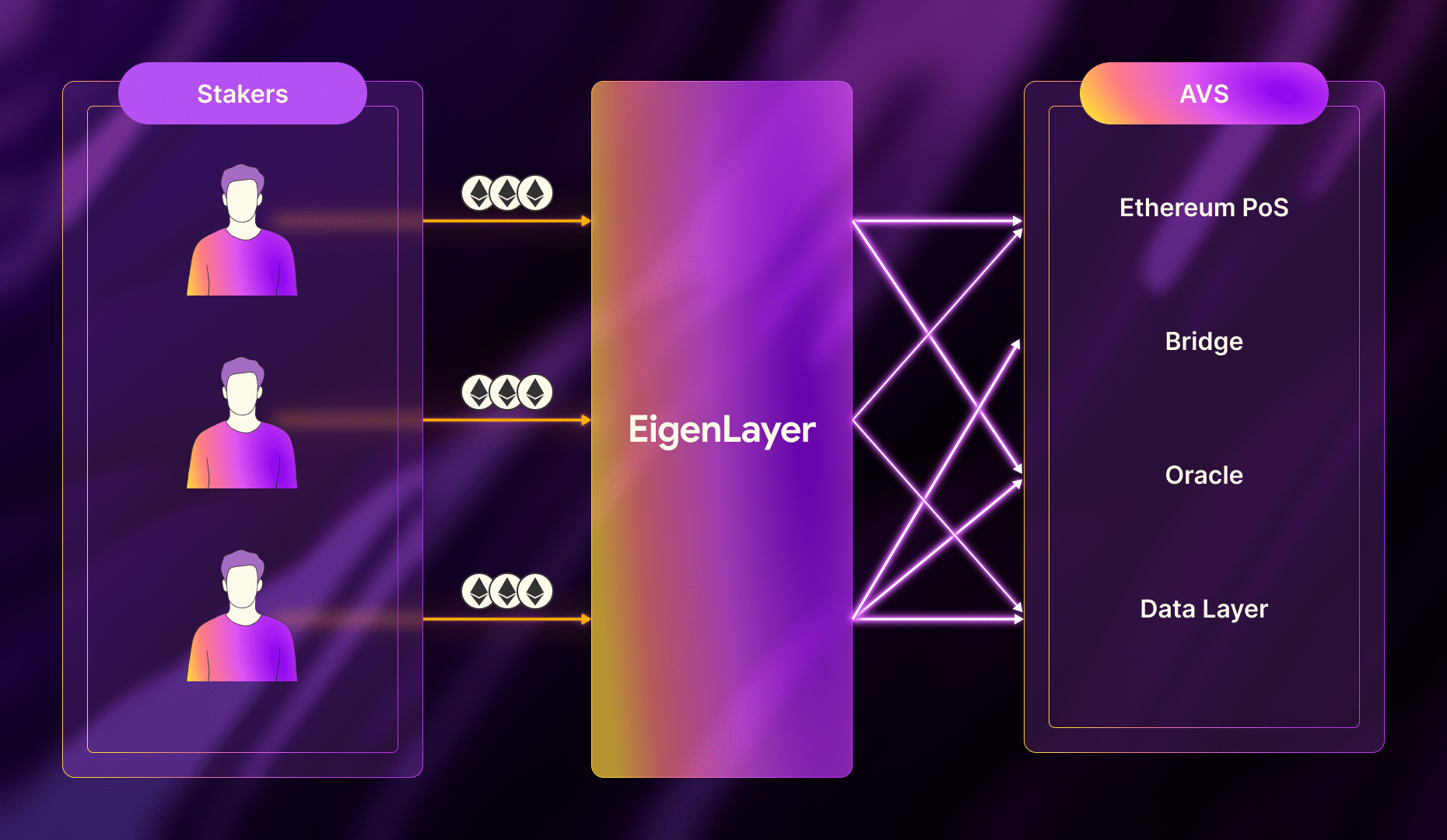

Restaking in DeFi refers to the practice of reusing already-staked assets, such as ETH or LSTs like stETH, rETH, or cbETH, to secure additional decentralized applications (dApps) beyond Ethereum’s consensus layer. Through EigenLayer’s smart contract infrastructure, users can opt-in to validating emerging Actively Validated Services (AVSs), such as bridges, oracles, and cross-chain protocols. This approach consolidates cryptoeconomic security across the ecosystem while enabling restakers to earn multiple reward streams without committing extra capital.

The result is a more robust and efficient DeFi landscape where new protocols can launch with inherited trust from Ethereum’s base layer rather than building siloed security models from scratch. As noted by leading analysts, this pooling effect increases the cost of attacks and strengthens the overall integrity of interconnected DeFi services.

Key Benefits for DeFi Ecosystems

Top 5 Benefits of EigenLayer Restaking in DeFi

-

Enhanced Security for DeFi Protocols: EigenLayer leverages Ethereum’s existing trust network, allowing restakers to secure multiple decentralized applications (dApps) and services. This pooled security increases the cost of attacks and reduces the need for each protocol to build its own security from scratch.

-

Increased Yield Opportunities: By restaking ETH or liquid staking tokens (LSTs) like Lido’s stETH, Rocket Pool’s rETH, or Coinbase’s cbETH, participants can earn rewards from both the Ethereum network and additional protocols, unlocking multiple streams of yield.

-

Improved Capital Efficiency: Restaking enables users to maximize the utility of their staked assets by securing several protocols simultaneously, optimizing returns without requiring additional capital outlay.

-

Support for DeFi Innovation: By providing a shared security layer, EigenLayer lowers the entry barrier for new dApps and services, fostering a more diverse and innovative DeFi ecosystem.

-

Institutional-Grade Participation and Growth: EigenLayer’s robust framework and dual yield potential have attracted significant institutional interest, contributing to rapid growth in total value locked (TVL), which reached approximately $8.35 billion by February 2024.

Eigenlayer DeFi integration delivers several tangible advantages:

- Enhanced Security: By leveraging Ethereum’s existing validator set, dApps secured via EigenLayer inherit battle-tested cryptoeconomic guarantees. This reduces fragmentation and risk across the ecosystem.

- Diversified Yield Streams: Restakers can simultaneously earn rewards from both Ethereum staking and AVS participation, potentially making restaking one of the most attractive sources of institutional yield in 2025.

- Capital Efficiency: Since users do not need to supply additional collateral to secure new protocols, capital can be used more productively throughout DeFi.

- Ecosystem Innovation: Lowering barriers for new dApps accelerates experimentation and growth within Ethereum’s modular architecture.

The Current State: Adoption Metrics and Institutional Momentum

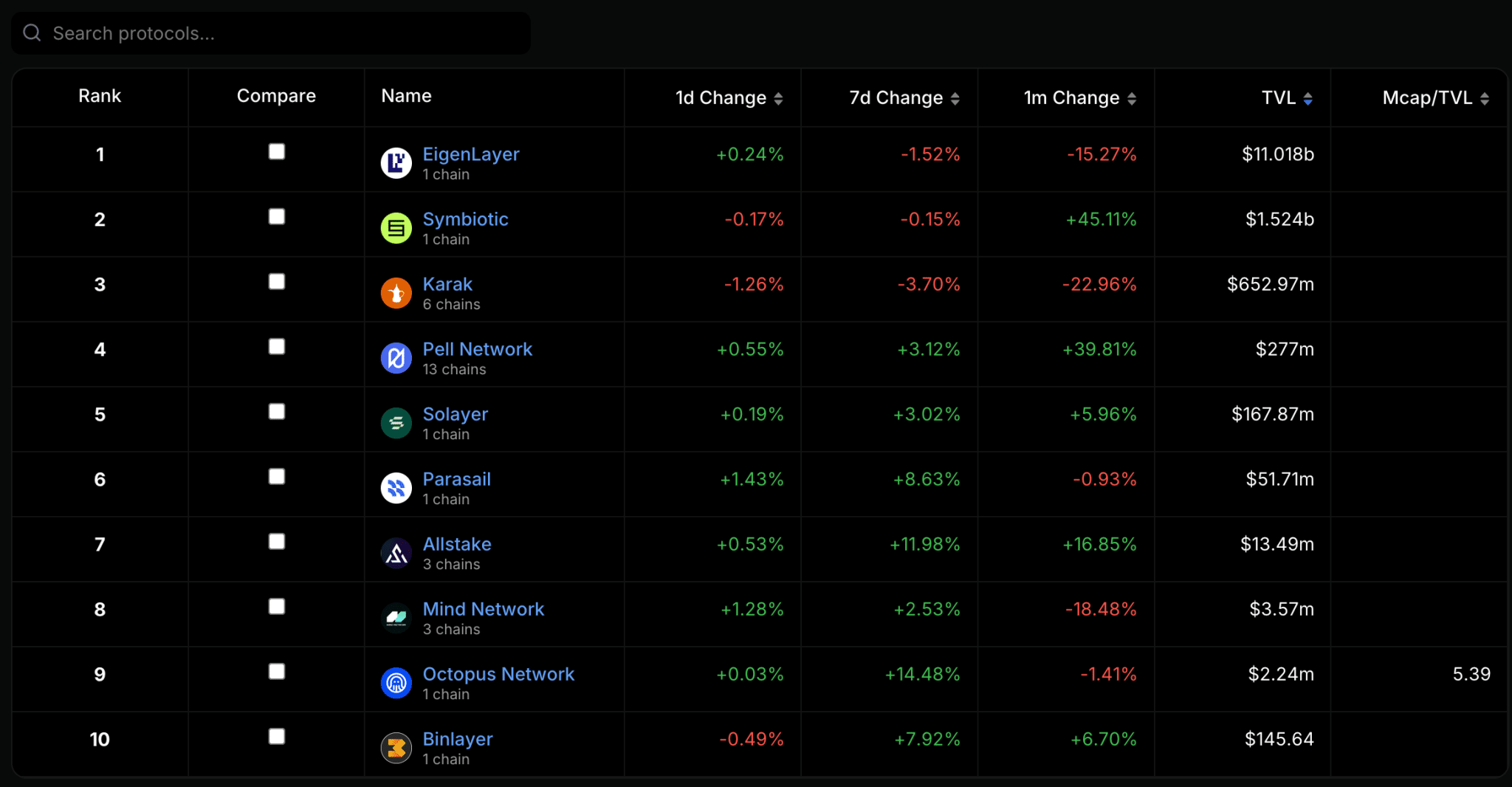

The numbers tell a compelling story about EigenLayer’s impact. As of January 2025, EigenLayer has captured approximately $14.08 billion in total value locked (TVL), representing a dominant 57.65% share among restaking protocols (source). This surge reflects both retail enthusiasm and growing institutional involvement, driven by dual yield opportunities, improved risk frameworks, and exposure to critical infrastructure like bridges and oracles that underpin modern DeFi.

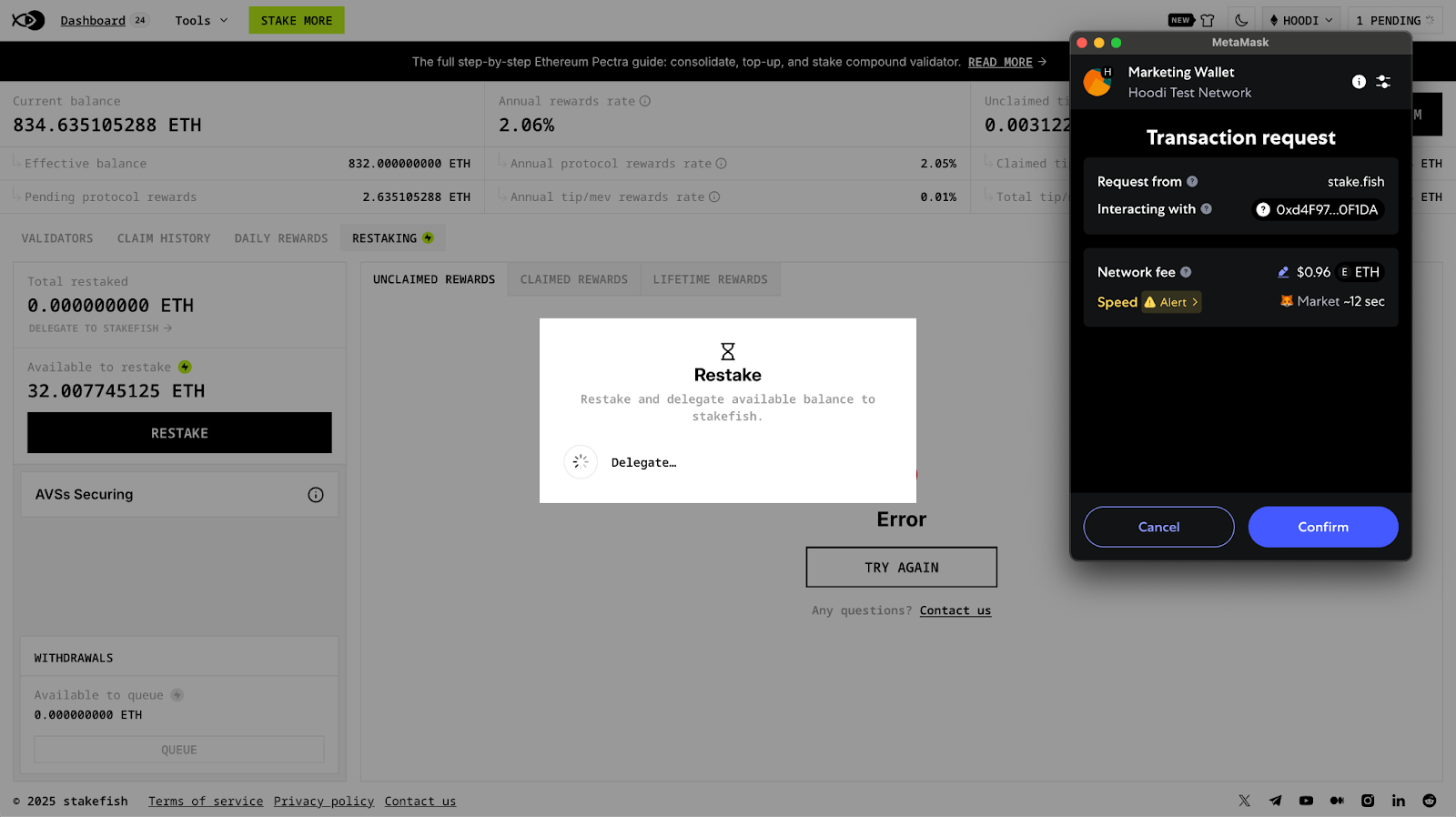

The September 2024 upgrade to EigenPods further enhanced user flexibility around reward harvesting and reinvestment, a crucial step in making restaking more accessible for sophisticated investors as well as everyday users (see details here). As capital continues flowing into restaking platforms, these upgrades will play an increasingly important role in shaping the future landscape of Ethereum-based financial services.

Institutional adoption has been particularly notable, with large asset managers and DeFi-native funds leveraging EigenLayer’s restaking model to diversify yield sources and gain exposure to the security infrastructure underlying Ethereum’s most critical protocols. The protocol’s composable architecture means that restaked assets can simultaneously secure multiple services, bridges, oracles, and data availability layers, without sacrificing liquidity or incurring excessive risk. This multi-layered approach is a key reason why restaking in DeFi is frequently cited as a driver of the next phase of ecosystem growth.

Risks and Considerations: Navigating the New Security Paradigm

Despite its promise, restaking introduces a new set of risks that both individual and institutional participants must carefully weigh. The complexity of EigenLayer’s smart contracts creates potential vectors for vulnerabilities or exploits, a concern echoed by security experts across the Ethereum community. In addition, as users opt into validating multiple AVSs, they are exposed to compounded slashing conditions. If any secured protocol experiences a significant failure or attack, restakers could face losses beyond those encountered in traditional staking models.

Market volatility also remains a factor; yield rates and token valuations can fluctuate rapidly in response to macroeconomic shifts or unforeseen technical incidents. For this reason, thorough due diligence on each AVS and ongoing monitoring of smart contract upgrades are essential best practices for anyone participating in Ethereum DeFi protocols through restaking mechanisms.

Top 4 Risks and Mitigation Strategies for EigenLayer Restakers

-

Smart Contract Vulnerabilities: EigenLayer relies on complex smart contracts, which may contain bugs or exploitable flaws. Mitigation: Engage with protocols that undergo regular, independent security audits and maintain robust bug bounty programs. Restakers should monitor audit reports and community disclosures for updates.

-

Slashing Risks: Restakers are exposed to additional slashing penalties from both Ethereum and the Actively Validated Services (AVSs) they secure. Mitigation: Carefully review each AVS’s slashing conditions before restaking, and diversify across multiple AVSs to spread risk. Consider using platforms that transparently communicate slashing events and risks.

-

Market Volatility: The value of staked assets and restaking rewards can fluctuate significantly due to crypto market volatility. Mitigation: Monitor market conditions, set up alerts for major price swings, and periodically rebalance your restaking positions to manage exposure.

-

Protocol Governance and Upgrades: Changes in EigenLayer’s governance or protocol upgrades can impact restaker rewards, terms, or security. Mitigation: Stay informed about governance proposals and protocol updates by following official EigenLayer channels, and participate in governance if possible to help shape protocol decisions.

Restaking Impact: A Catalyst for Modular DeFi Security

The broader impact of EigenLayer’s approach is clear: by creating a shared security marketplace atop Ethereum, it enables rapid innovation without compromising foundational trust assumptions. New dApps can launch with robust cryptoeconomic guarantees from day one, while established protocols benefit from an expanded validator base and deeper capital pools.

This modularization of security is already reshaping how developers architect DeFi applications, moving away from isolated silos toward interoperable systems that share risk and reward more efficiently. As more teams build on top of EigenLayer and integrate with its restaking primitives, expect continued growth in both TVL and the diversity of services relying on this security layer.

Looking ahead, the role of restaking in DeFi will likely expand as new Actively Validated Services emerge and user sophistication increases. With $14.08 billion currently locked in EigenLayer, a figure that underscores both confidence and momentum, the protocol stands as a testament to Ethereum’s capacity for reinvention through composability (see analysis). For those navigating this rapidly changing landscape, understanding the nuances of Eigenlayer DeFi integration will be essential not just for maximizing returns but also for safeguarding capital in an increasingly interconnected financial ecosystem.