Ethereum’s staking landscape is entering a new era, and liquid restaking tokens (LRTs) are at the heart of this transformation. As of October 2025, with Ethereum trading at $4,353.07, LRTs are powering a layered yield revolution that is redefining both capital efficiency and composability in DeFi. The core innovation? LRTs allow users to unlock their staked and restaked ETH positions, putting those assets to work across multiple protocols while earning several streams of rewards.

How Liquid Restaking Tokens Multiply Yield Streams

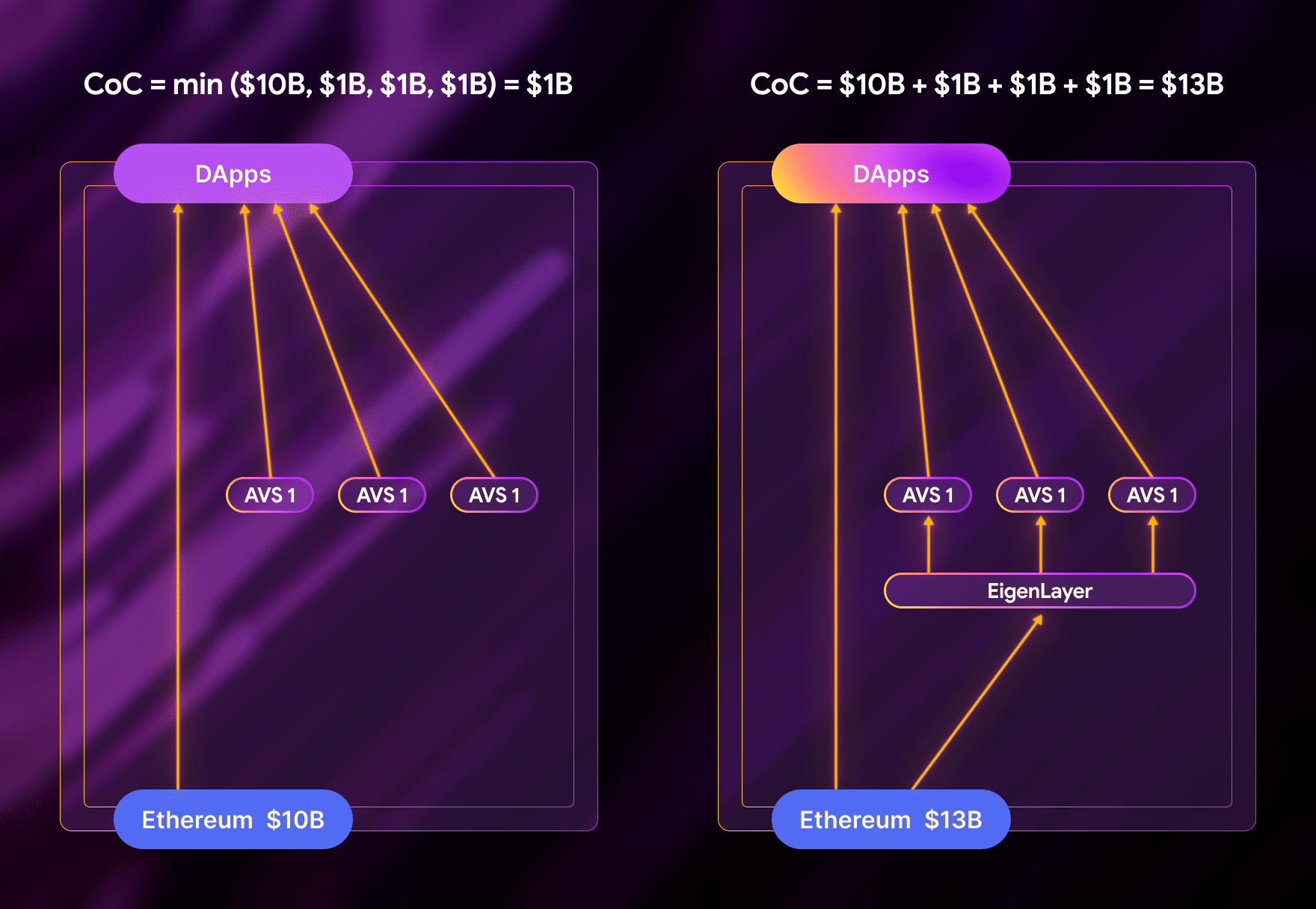

Traditionally, when you staked ETH or deposited it into a liquid staking protocol like Lido or Rocket Pool, your capital was locked – you earned a single layer of rewards from network validation. With EigenLayer, the paradigm shifts: users can deposit either native ETH or existing liquid staking tokens (LSTs), then opt-in to secure additional Actively Validated Services (AVSs). In return, they receive an LRT that represents their restaked position.

This LRT is not just a receipt – it’s a composable yield-bearing asset. You can supply it as collateral in lending protocols, deploy it in liquidity pools, or use it to farm incentives across DeFi. All the while, your underlying ETH continues to accrue both base staking rewards and EigenLayer AVS rewards.

“Restaking lets you reuse staked ETH to earn more by securing multiple services, boosting yield without adding new capital. “ (bitcoin. tax)

The Protocols Shaping the LRT Sector

The explosive growth of liquid restaking has spawned specialized protocols that issue their own unique LRTs:

- EtherFi: Users deposit ETH and receive eETH, which can be used across DeFi platforms while accruing staking and EigenLayer yields (coinmarketcap. com).

- Renzo: Offers ezETH, giving access to extra AVS rewards through EigenLayer (hashkey. cloud).

- Kelp DAO: Issues rsETH, letting users restake their LSTs to secure web3 infrastructure while earning incentives (mpost. io).

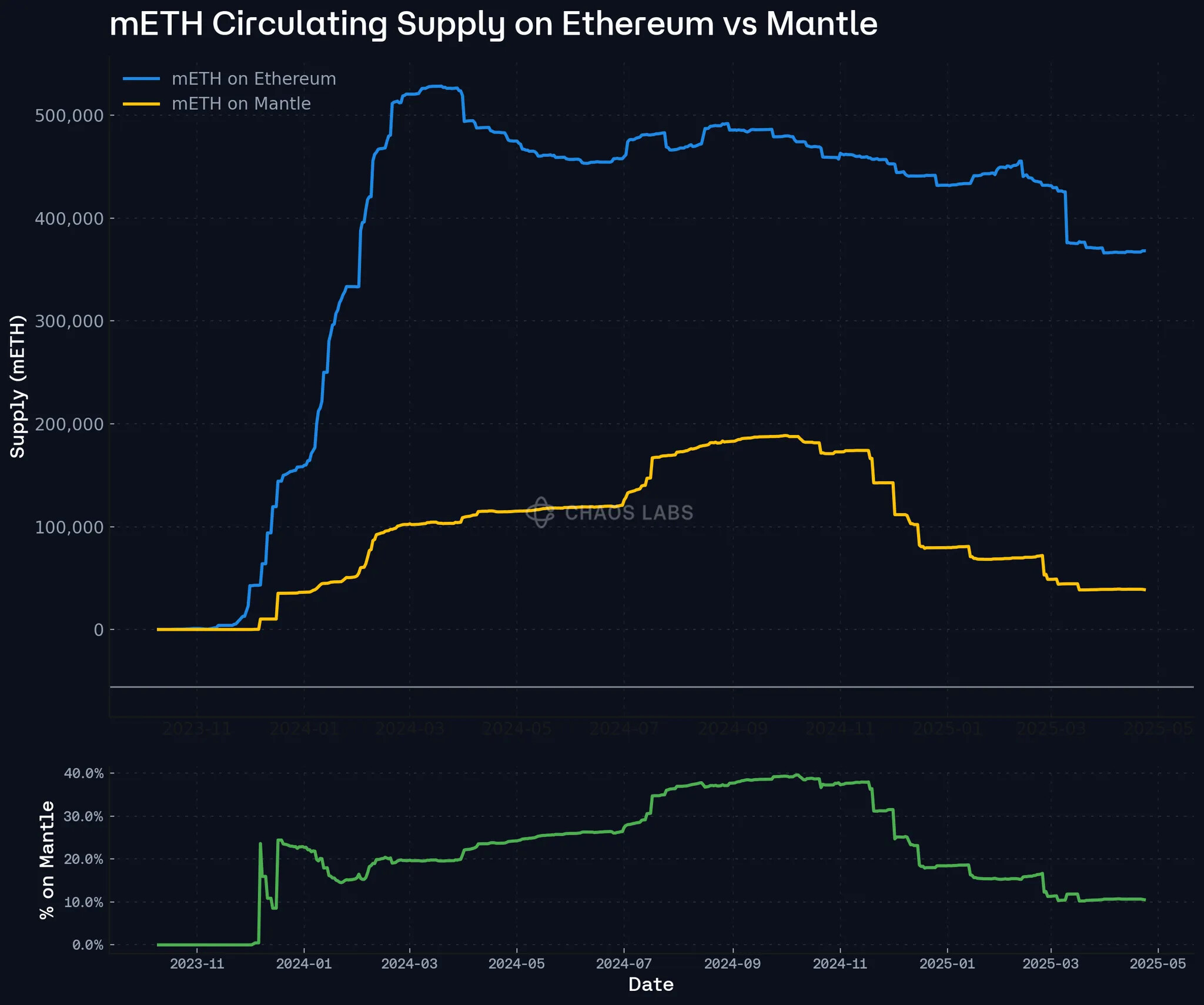

The combined total value locked (TVL) in these protocols soared past $3.5 billion by February 2024 (theblock. co). However, as of October 2025, TVL had dropped about 37% from its December 2024 peak, reflecting shifting user demand and evolving incentive structures (thedefiant. io). Still, market leaders continue to innovate around capital efficiency and risk management.

LRT Composability: The Engine Behind DeFi Capital Efficiency

The true power of LRTs lies in their composability within DeFi ecosystems. By representing restaked ETH as liquid derivatives, users gain flexibility previously unavailable with traditional staking models. For example:

- You can use eETH or ezETH as collateral on lending platforms like Aave or Morpho Blue.

- You can provide liquidity on DEXes such as Uniswap v4 or Curve, earning trading fees in addition to staking yields.

- You can participate in governance or farm protocol-native tokens using your LRT holdings.

This multi-layered approach not only maximizes returns but also diversifies risk exposure, users are no longer solely dependent on one protocol’s reward stream or security assumptions.

Ethereum (ETH) Price Prediction 2026-2031

Professional forecast considering liquid restaking trends, market cycles, and DeFi sector developments post-2025 TVL drop

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,800 | $4,600 | $5,700 | +5.6% | Recovery after restaking sector slump; stable DeFi adoption and gradual return of TVL |

| 2027 | $4,200 | $5,250 | $6,800 | +14.1% | LRTs mature, new DeFi integrations; regulatory clarity boosts institutional interest |

| 2028 | $4,700 | $6,000 | $8,200 | +14.3% | Ethereum scalability upgrades; EigenLayer and LRTs widely adopted in DeFi |

| 2029 | $5,200 | $6,800 | $9,500 | +13.3% | Bullish cycle; cross-chain restaking, ETH as multi-chain collateral |

| 2030 | $5,900 | $7,700 | $11,200 | +13.2% | ETH reaches new cycle highs; mainstream DeFi adoption, competition from L2s |

| 2031 | $6,300 | $8,400 | $13,000 | +9.1% | Market matures; new use cases in RWAs and enterprise DeFi, but competition intensifies |

Price Prediction Summary

Ethereum is forecast to resume its growth trajectory following the 2025 restaking sector TVL drop, supported by ongoing innovation in liquid restaking tokens and DeFi integration. The minimum price scenario reflects potential bearish cycles or regulatory headwinds, while the maximum price scenario accounts for significant adoption of LRTs, Ethereum 2.0 scalability, and strong institutional participation. Yearly average price growth is projected between 9% and 14%, with volatility expected as the market navigates adoption, competition, and macroeconomic shifts.

Key Factors Affecting Ethereum Price

- Recovery and growth in liquid restaking protocols (LRTs) and EigenLayer adoption post-2025

- Ethereum network upgrades improving scalability and DeFi functionality

- Regulatory clarity attracting institutional capital to Ethereum and DeFi

- Potential for new DeFi primitives and cross-chain integrations leveraging ETH as collateral

- Risks from competition with other L1/L2 chains and possible regulatory headwinds

- Macro market cycles impacting risk appetite and crypto sector valuations

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Risks and Rewards of Layered Yield Strategies

LRT-powered strategies aren’t risk-free. Smart contract exploits, slashing events on underlying validators, or sudden changes in AVS incentives can impact both principal and yield. The recent 37% TVL drop underscores how quickly sentiment, and returns, can shift when incentives dry up or composability risks materialize.

Yet, for active Ethereum restakers and DeFi strategists, these risks are a calculated trade-off for the potential of outsized, layered returns. The most successful participants rigorously monitor protocol health, AVS reward schedules, and market liquidity to dynamically rebalance their LRT allocations. Tools like on-chain analytics dashboards and smart contract audit alerts are now essential in every serious restaker’s toolkit.

Protocols are also innovating around risk management. Some LRT platforms implement insurance funds or slashing protection mechanisms to mitigate validator risks. Others are experimenting with dynamic reward allocation models that adjust yields based on real-time AVS demand and protocol revenue. These advances help stabilize returns and attract a more risk-averse class of capital into the layered yield ecosystem.

What’s Next for Liquid Restaking Tokens?

With Ethereum holding steady at $4,353.07, the market is watching closely to see how LRT protocols will adapt to the new incentive landscape. As TVL consolidates from speculative highs, expect a shift toward more sustainable yields driven by real economic activity in AVSs rather than short-term token incentives. Protocols that can prove long-term utility, such as securing decentralized oracles, rollup sequencers, or cross-chain bridges, are best positioned to capture future growth.

Top Strategies to Maximize DeFi Capital Efficiency with LRTs

-

Leverage LRTs (e.g., eETH, ezETH, rsETH) as Collateral in DeFi Lending Protocols: Use liquid restaking tokens such as EtherFi’s eETH, Renzo’s ezETH, or Kelp DAO’s rsETH as collateral on lending platforms like Aave or Compound. This enables you to borrow stablecoins or other assets while your LRTs continue to earn staking and restaking rewards, maximizing capital efficiency.

-

Participate in Yield Aggregators Optimized for LRTs: Deploy your LRTs into specialized yield aggregators such as Yearn or Beefy Finance that support LRT strategies. These platforms automatically optimize and compound rewards from both staking and DeFi activities, unlocking layered yields.

-

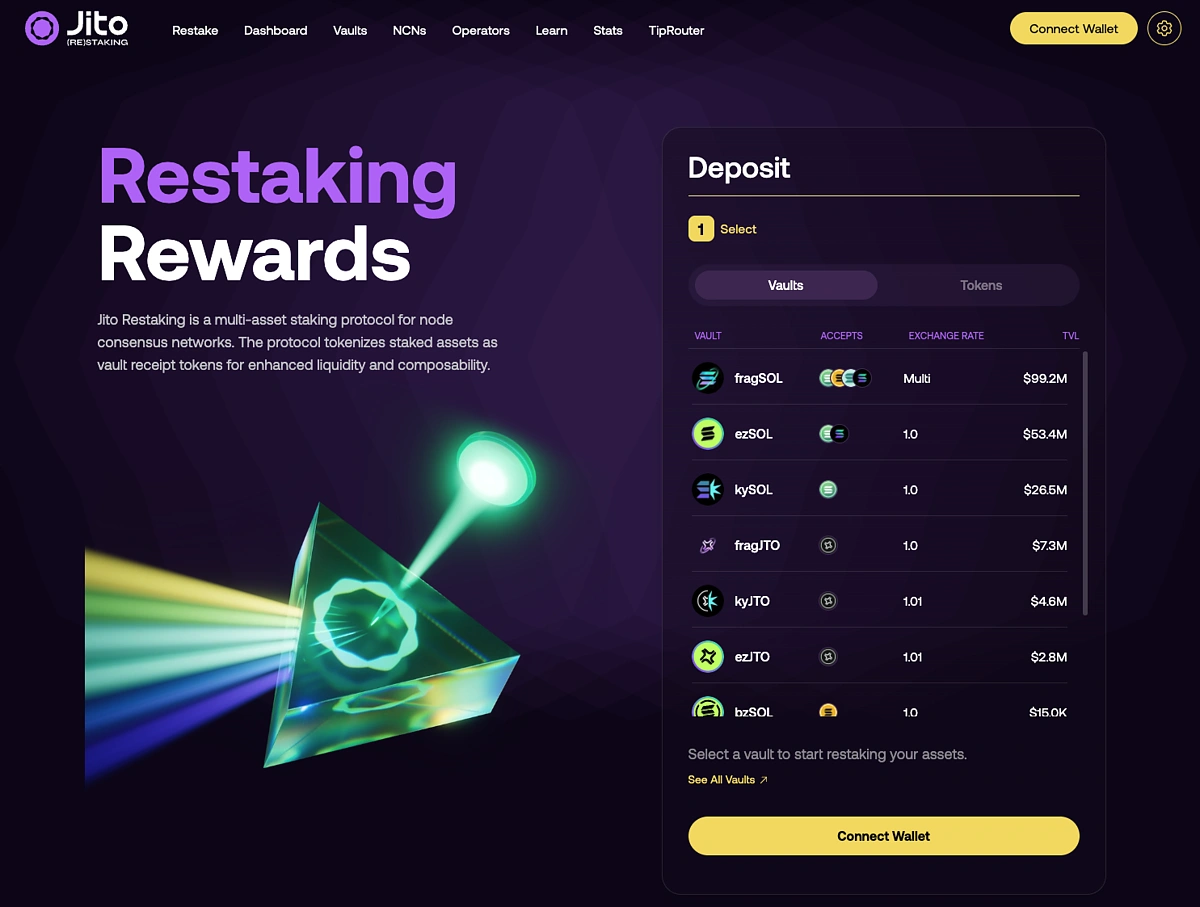

Restake LSTs via EigenLayer-Integrated Protocols: Deposit LSTs such as Lido’s stETH or Rocket Pool’s rETH into EigenLayer-integrated protocols like EtherFi, Renzo, or Kelp DAO to mint LRTs. This unlocks additional AVS rewards while preserving liquidity for further DeFi use.

-

Utilize LRTs for Cross-Protocol Arbitrage: Take advantage of price discrepancies between LRTs (e.g., eETH, ezETH, rsETH) across different DeFi platforms and liquidity pools. Active arbitrage can enhance returns while maintaining exposure to multi-layered staking yields.

For DeFi users seeking composable yield opportunities, the next wave will likely include:

- Automated LRT vaults: Smart contracts that optimize AVS selection and yield harvesting across multiple protocols.

- LRT index products: Diversified baskets of restaked ETH derivatives to spread risk and simplify portfolio management.

- Cross-chain expansion: Bridged LRT assets enabling layered rewards beyond Ethereum mainnet.

This evolving landscape rewards proactive research and technical diligence. As always in DeFi, letting the charts, and the code, tell the story is paramount.

“Restaking is not just about stacking yields; it’s about unlocking a new layer of composability for Ethereum’s capital base. ”

The liquid restaking sector is still young, but its impact is already being felt across every corner of Ethereum finance. Whether you’re a validator looking to maximize your ETH productivity or a DeFi power user chasing multi-protocol rewards, understanding the mechanics, and risks, of LRTs is now table stakes for success in 2025’s layered yield game.