Ethereum’s restaking revolution is in full swing, with protocols like Ekox leading the charge to redefine what’s possible for both network security and staker returns. The market is watching closely as Ethereum (ETH) holds at $3,932.54, and new models of liquid restaking are unlocking capital efficiency and composability that simply weren’t feasible in the previous cycle. But what makes Ekox’s eXETH truly game-changing isn’t just its yield – it’s the way it fuses modular DeFi security with unified liquidity across the entire Ethereum ecosystem.

Ethereum Technical Analysis Chart

Analysis by Tessa Caldwell | Symbol: BINANCE:ETHUSDT | Interval: 4h | Drawings: 7

Technical Analysis Summary

Begin by drawing a major downtrend line from the early October high (just above $4,800) to the mid-October low (around $3,750). Mark horizontal support at $3,870 (recent local low) and resistance at $4,000 (psychological and recent price cap). Highlight the consolidation channel between $3,870 and $4,000 over the past week. Use rectangles to shade the consolidation zone. Add a callout near $3,932 to note the current price equilibrium. Use vertical lines to mark the October 7 peak and October 13 trough, as these are key inflection points. If analyzing for a swing trade, consider a long position in the lower third of the channel, with a stop just below $3,870 and a target near $4,000.

Risk Assessment: medium

Analysis: Although support at $3,870 has held and new DeFi protocols are driving fresh narratives, the lack of decisive momentum and risk of further breakdown below $3,800 justify caution. Reward-to-risk is attractive for swing trades within the current range, but positions should be sized conservatively.

Tessa Caldwell’s Recommendation: Accumulate near support for medium-term swing positions with stops below $3,800.

Wait for a confirmed breakout above $4,000 for directional conviction.

Use tight risk controls and avoid overexposure.

Key Support & Resistance Levels

📈 Support Levels:

- $38700 – Recent local low and base of current consolidation range.strong

- $38000 – Major psychological and historical support zone,tested mid October.moderate

📉 Resistance Levels:

- $40000 – Round-number psychological resistance and recent range ceiling.strong

- $42000 – Former support now acting as resistance post-breakdown.moderate

Trading Zones (medium risk tolerance)

🎯 Entry Zones:

- $38700 – Swing long entry at lower bound of consolidation anticipating move back to range high.medium risk

🚪 Exit Zones:

- $40000 – First profit target at resistance and range top.💰 profit target

- $38000 – Stop loss below consolidation support to minimize downside.🛡️ stop loss

Technical Indicators Analysis

📊 Volume Analysis:

Pattern: Likely declining volume during consolidation watch for spikes on breakout/breakdown.

Volume contraction through recent range is typical of accumulation.Major moves should be accompanied by surge in volume for confirmation.

📈 MACD Analysis:

Signal: Likely neutral to slightly bullish if histogram begins to turn up.

MACD is expected to be flat in this range but bullish cross with price action above $40000 would signal momentum shift.

Applied TradingView Drawing Utilities

This chart analysis utilizes the following professional drawing tools:

Trend Line, Horizontal Line, Rectangle, Vertical Line, Callout, Long Position, Short Position

This technical analysis by Tessa Caldwell is for educational purposes only and should not be considered as financial advice.Trading involves risk,and you should always do your own research before making investment decisions.Past performance does not guarantee future results.The analysis reflects the author’s personal methodology and risk tolerance (medium).

Why Liquid Restaking Matters More Than Ever

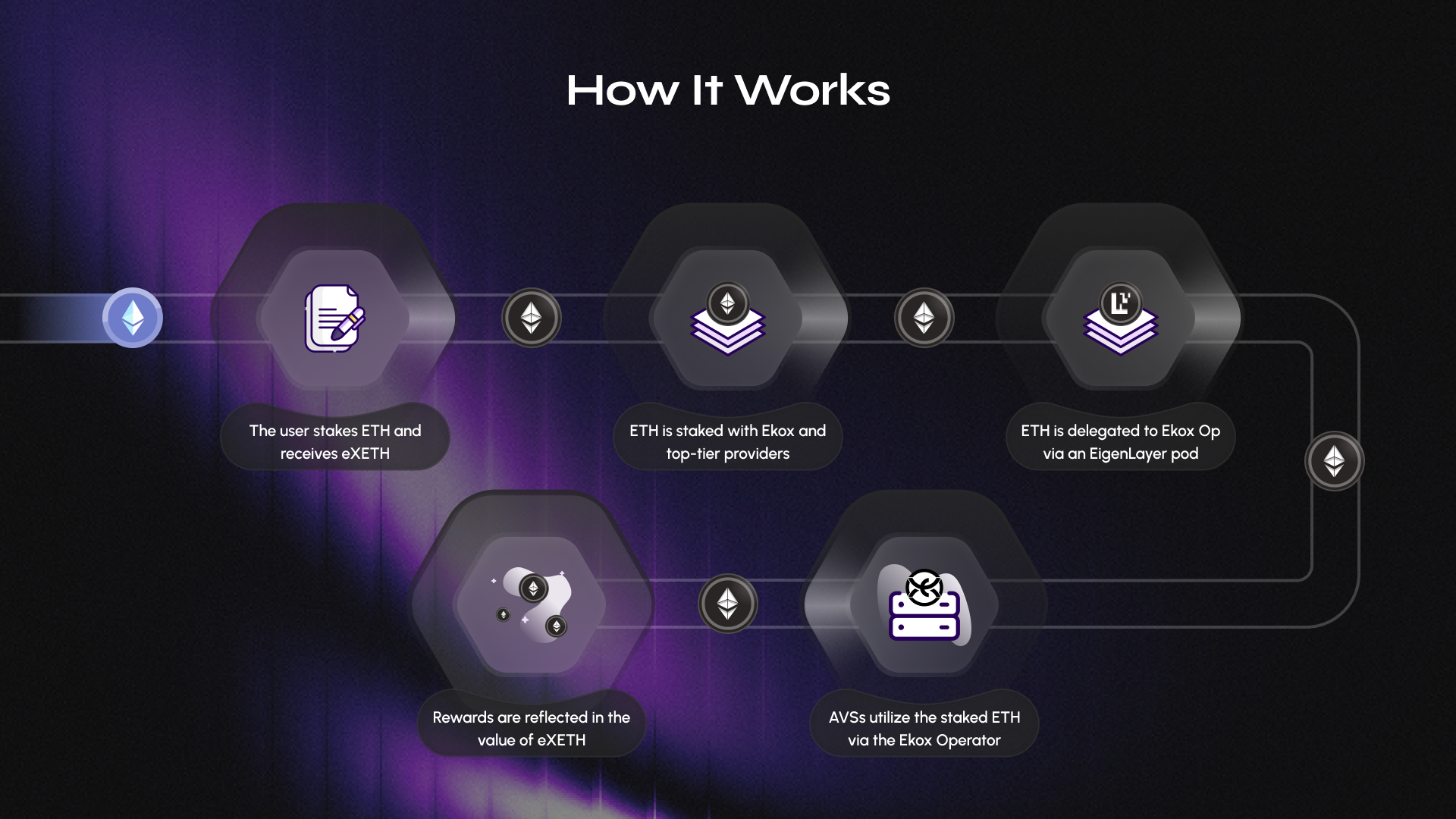

Let’s set the stage: traditional staking on Ethereum locks up your ETH, limiting access to DeFi opportunities and forcing a trade-off between securing the network and maximizing capital efficiency. Liquid staking protocols solved part of this by issuing liquid tokens like stETH or rETH, but these only captured base Ethereum yields. Enter liquid restaking, where protocols like Ekox allow users to earn not just from Ethereum consensus, but also from actively validated services (AVSs) via EigenLayer – all while keeping assets liquid.

This dual-yield model is at the heart of what makes eXETH so compelling. By holding a single ERC-20 token, users can:

- Capture both staking and restaking rewards

- Benefit from continuous auto-compounding

- Retain full access to DeFi composability

- Diversify risk across multiple AVSs and operators

The result? Stakers no longer have to choose between yield, security, or liquidity – they get all three.

The Modular Security Engine Behind Ekox Restaking

Security in DeFi is never one-size-fits-all, especially as new AVSs launch with varying risk profiles. Ekox tackles this challenge with a modular approach: when you deposit ETH into Ekox, it is restaked not just on Ethereum validators but dynamically allocated across multiple AVSs via EigenLayer. This allocation isn’t random; it’s driven by real-time risk scoring models, operator performance analytics, and yield optimization frameworks.

This means your staked assets are spread intelligently – reducing exposure to any single operator or service failure while maximizing aggregate reward potential. For users who want exposure to high-growth AVSs without micromanaging allocations or tracking dozens of dashboards, this is a massive leap forward in usability and peace of mind.

[technical_chart: A TradingView chart showing eXETH/ETH performance since launch]

Unified Liquidity: The Superpower of eXETH in DeFi 2.0 Infrastructure

The other pillar of Ekox’s design is unified liquidity. Because eXETH is an ERC-20 token, it can flow freely across lending markets, DEXs, yield farms, and cross-chain bridges. There are no withdrawal queues or lockups tying you down; your capital remains nimble even as it secures both Ethereum L1 and emerging AVSs.

This flexibility is more than just a convenience – it fundamentally changes how stakers interact with decentralized finance. Instead of chasing short-term yields or getting trapped in siloed protocols, users can put their eXETH to work wherever opportunities arise while still accruing restaking rewards under the hood.

The recent partnership between Ekox and Arichain takes this vision even further by enabling cross-chain liquidity flows and smart modular restaking on a multi-VM Layer 1 blockchain environment. This positions eXETH as not just an Ethereum-native asset but a bridge token for unified security across chains.

Ethereum (ETH) Price Prediction 2026-2031

Professional ETH Price Forecast Based on Liquid Restaking Trends and eXETH Ecosystem (Baseline: $3,932.54 as of Q4 2025)

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | % Change (Avg. YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,500 | $4,400 | $5,300 | +12% | Continued adoption of liquid restaking protocols like Ekox; ETH consolidates above 2025 base. |

| 2027 | $3,900 | $5,200 | $6,500 | +18% | DeFi growth, improved modular security, and wider eXETH integration drive demand. |

| 2028 | $4,400 | $6,100 | $8,200 | +17% | Cross-chain restaking and institutional adoption accelerate ETH utility. |

| 2029 | $4,800 | $7,100 | $9,800 | +16% | Ethereum upgrades, rollups, and restaking yield innovations boost value. |

| 2030 | $5,300 | $8,250 | $12,000 | +16% | Regulatory clarity and DeFi composability reach new heights; ETH tests new ATHs. |

| 2031 | $6,000 | $9,600 | $15,000 | +16% | Mature restaking landscape, ETH as DeFi backbone, and global adoption. |

Price Prediction Summary

Ethereum’s price outlook for 2026-2031 is bullish, driven by the transformative impact of liquid restaking solutions like Ekox’s eXETH. These innovations are expected to enhance capital efficiency, security, and liquidity, attracting both retail and institutional participants. While market volatility and regulatory risks persist, the ongoing evolution of Ethereum’s ecosystem positions it for substantial long-term growth.

Key Factors Affecting Ethereum Price

- Adoption and expansion of liquid restaking protocols (e.g., Ekox, eXETH) enhancing ETH utility and yields.

- Ethereum network upgrades improving scalability, security, and transaction throughput.

- Growth in DeFi, cross-chain interoperability, and institutional participation.

- Global regulatory environment, including clarity on staking and restaking.

- Competition from alternative smart contract platforms (e.g., Solana, Avalanche).

- Macro-economic factors affecting crypto markets (e.g., interest rates, risk appetite).

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

With Ethereum (ETH) steady at $3,932.54, the demand for capital-efficient staking solutions is intensifying. Ekox’s eXETH is at the forefront, offering a blueprint for how liquid restaking can serve as the backbone of next-generation DeFi infrastructure. As composability becomes a non-negotiable for serious DeFi users, eXETH’s ability to move frictionlessly between protocols is setting a new standard for unified liquidity on Ethereum and beyond.

How Ekox’s Modular Security Reduces Risk and Maximizes Yield

What truly differentiates Ekox from other restaking protocols is its modular security engine. Instead of passively delegating ETH to a fixed set of AVSs, Ekox employs an adaptive allocation strategy powered by real-time analytics. This means your restaked assets are distributed dynamically based on operator reliability, AVS risk scores, and prevailing yield conditions.

This approach helps mitigate systemic risks that can arise from overexposure to a single validator or service. If an AVS underperforms or introduces new vulnerabilities, Ekox’s allocation engine can route funds elsewhere, without any action required from the user. For stakers who want exposure to emerging AVSs but don’t have time to monitor every risk variable, this is a game-changer.

Top 5 Benefits of Modular Restaking with Ekox

-

Dual Yield Streams: With Ekox’s eXETH, users earn rewards from both Ethereum staking and EigenLayer restaking, maximizing potential returns through a single, liquid token.

-

Continuous Compounding: All staking and restaking rewards are automatically compounded into the value of eXETH, allowing users to grow their holdings effortlessly over time.

-

Unified Liquidity: As an ERC-20 token, eXETH is fully fungible and transferable across DeFi platforms, enabling lending, borrowing, and trading without lock-up periods—enhancing capital efficiency.

-

Modular Security & Diversification: Ekox dynamically allocates restaked ETH across multiple AVSs using risk scoring and performance metrics, reducing exposure to any single service and strengthening network security.

-

Cross-Chain Interoperability: Through partnerships like Arichain, Ekox extends unified liquidity and smart modular restaking across blockchains, improving user experience and DeFi accessibility.

The protocol’s transparent analytics dashboard further empowers users by providing insights into current allocations, risk exposures, and historical performance. This level of transparency is rare in DeFi and speaks to Ekox’s commitment to both security and user empowerment.

eXETH in Action: Real-World Use Cases and Composability

The power of liquid restaking tokens like eXETH lies in their versatility. Whether you’re supplying liquidity on decentralized exchanges, participating in lending markets, or yield farming across multiple chains, eXETH remains fully productive, earning both base consensus rewards and additional restaking yields simultaneously.

For example, imagine using eXETH as collateral in a lending protocol while it continues to accrue compounded staking and restaking rewards in the background. Or deploying it into an automated yield optimizer that leverages cross-chain bridges made possible by Ekox’s partnership with Arichain. These scenarios are no longer theoretical, they’re live options for today’s DeFi users seeking both flexibility and maximum return on ETH holdings.

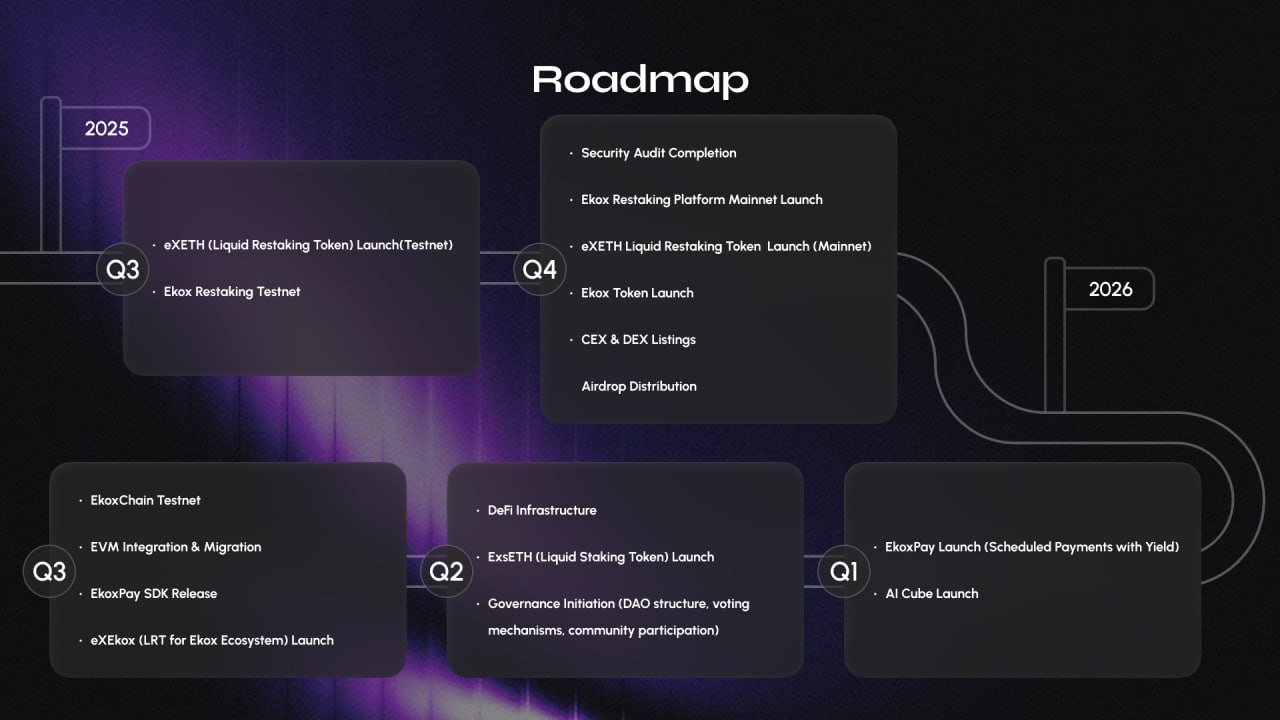

Looking Ahead: Ekox Restaking as a Core Layer of DeFi 2.0

The rapid evolution of liquid restaking protocols is pushing Ethereum toward even greater capital efficiency and security modularity. As more AVSs come online through EigenLayer, and as cross-chain interoperability becomes table stakes, Ekox’s approach positions it as a foundational layer for the next era of decentralized finance.

If you’re exploring advanced staking strategies or want to understand how unified liquidity can amplify your returns without sacrificing safety, now is the time to pay attention to protocols like Ekox. The combination of modular security allocation and seamless ERC-20 composability gives stakers unprecedented control over both risk and reward, all while keeping assets liquid at every step.

[technical_chart: A TradingView chart showing eXETH/ETH performance since launch]