Ethereum’s native staking yield, once considered the gold standard for low-risk returns in decentralized finance (DeFi), is undergoing a radical transformation. As of today, with Ethereum (ETH) trading at $3,831.58, liquid restaking derivatives (LRDs) such as eETH and rsETH are redefining how investors optimize capital efficiency, yield stacking, and composability across the DeFi landscape. These assets are not just financial instruments; they represent a paradigm shift in how value is extracted from staked ETH while maintaining on-chain liquidity and flexibility.

From Staking to Liquid Restaking: The Yield Evolution

Traditional staking on Ethereum requires users to lock up their ETH to support network security, earning a base yield that has hovered around 3% annually. The advent of liquid staking tokens (LSTs) like stETH brought a breakthrough by allowing stakers to retain liquidity via tokenized representations of their locked ETH. Yet, even this innovation paled in comparison to the layered opportunities unlocked by LRDs.

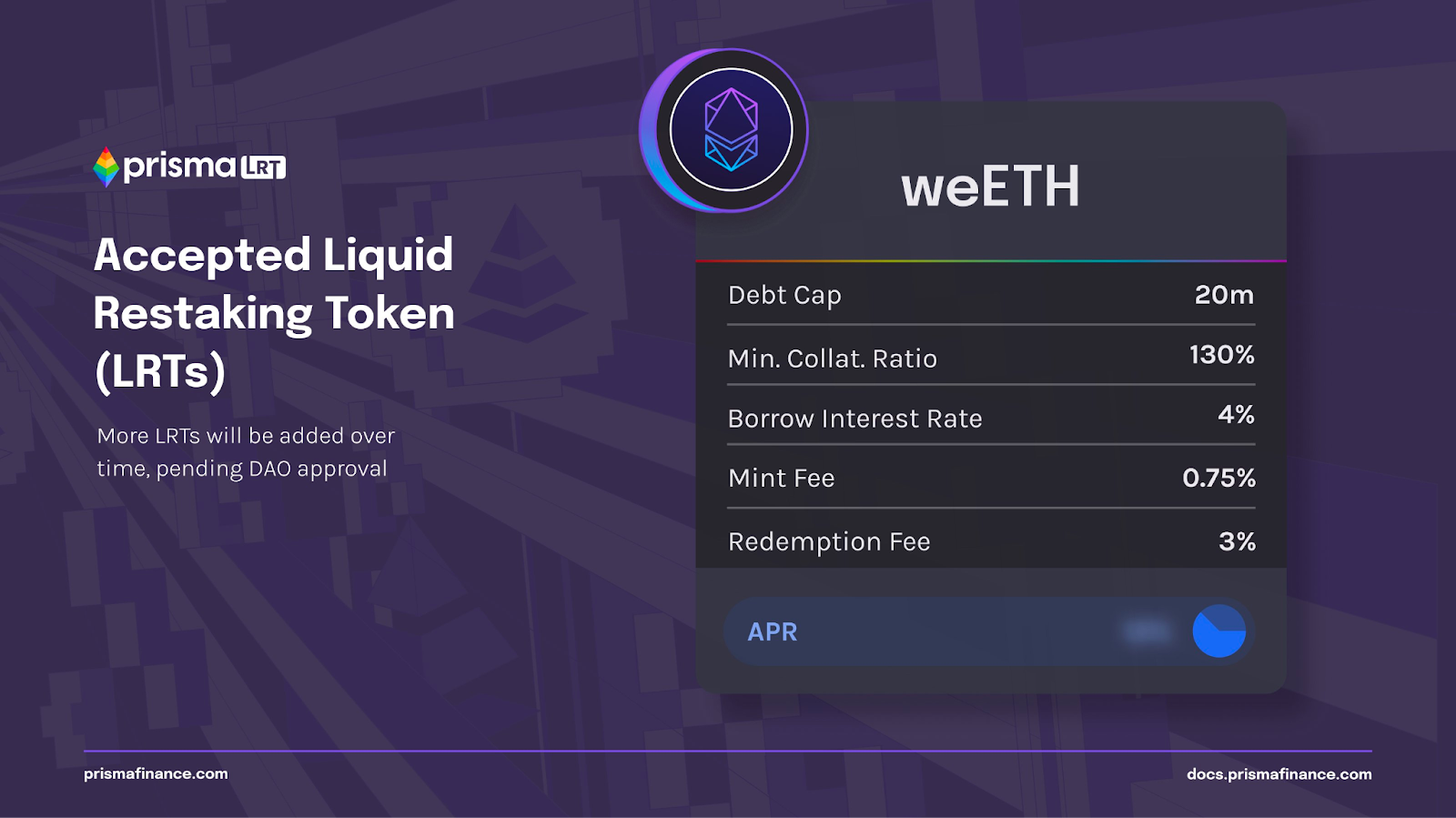

Liquid restaking derivatives, pioneered by protocols like Ether.fi’s eETH and KelpDAO’s rsETH, take things further by enabling holders to earn both the base Ethereum staking rewards and supplemental restaking incentives through EigenLayer and similar platforms. This is achieved by restaking LSTs into new protocols that secure additional decentralized services (AVSs), compounding rewards while keeping assets liquid for further DeFi strategies.

Pioneers: eETH and rsETH Lead the Dual Rewards Staking Boom

The explosive growth of LRDs is best illustrated by two flagship tokens:

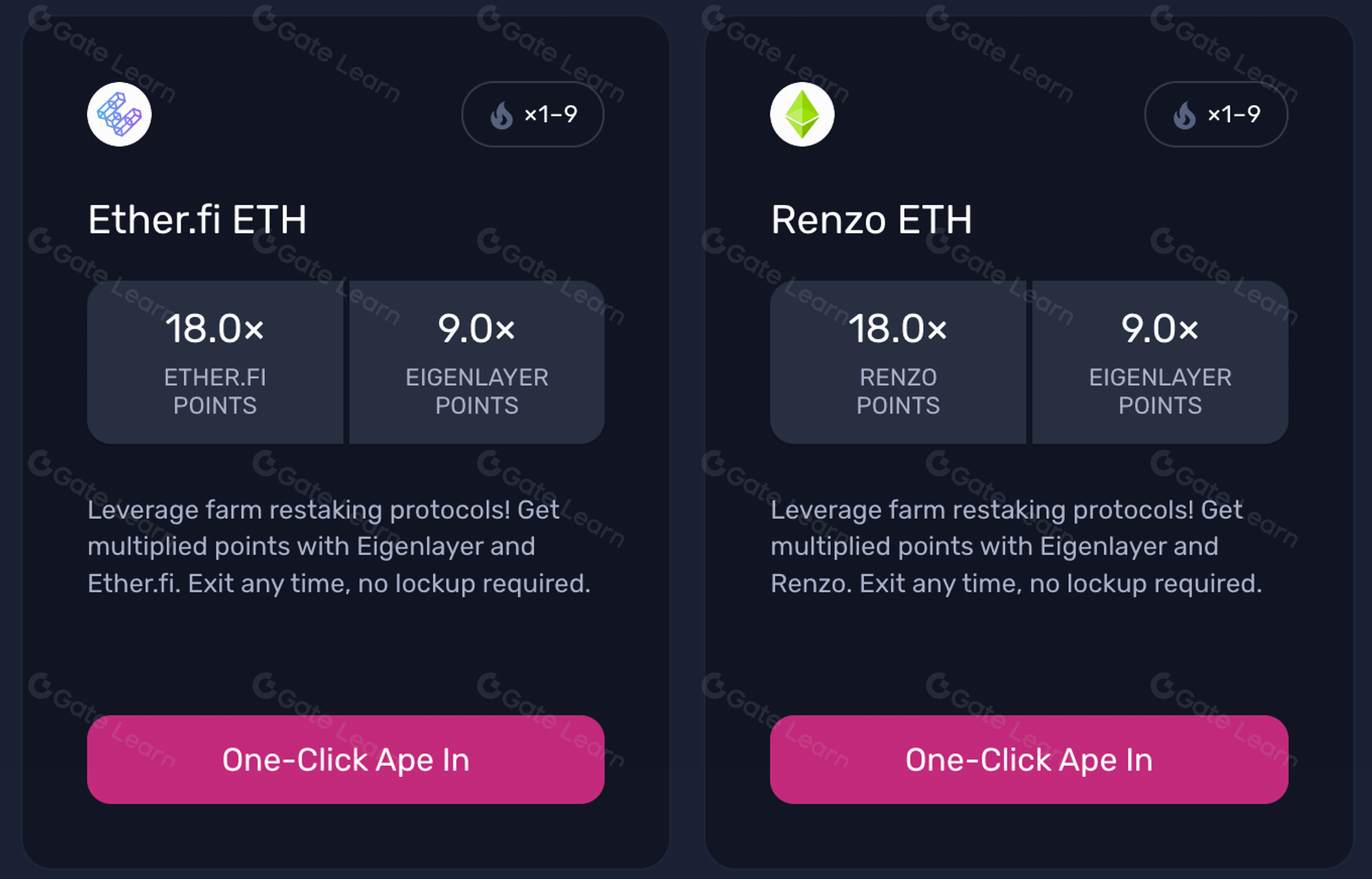

- eETH: Offered by Ether. fi, eETH automatically earns both Ethereum’s base staking rewards and EigenLayer’s restaking incentives. Users benefit from dual yields without needing to actively manage multiple positions or endure extended lock-up periods. This seamless approach has made eETH one of the most sought-after LRDs for sophisticated DeFi users.

- rsETH: KelpDAO’s rsETH extends this model with integration into platforms such as Polynomial Finance, allowing holders not only to accrue dual rewards but also to trade perpetual contracts with leverage. This composability turbocharges potential returns but also introduces new vectors for risk.

The result? APYs on these tokens have ranged from 10% up to 50%, substantially outpacing traditional single-layer staking yields (source). As capital flows into these products, DeFi power users can now deploy their assets across lending markets, DEXes, and derivatives platforms while still securing layered protocol incentives.

The Mechanics Behind Layered Yields and DeFi Composability

The secret sauce behind LRDs lies in their ability to unlock composable yield strategies without sacrificing liquidity:

- Layered Yield Generation: By restaking through EigenLayer or similar frameworks, users contribute their collateral toward securing multiple decentralized applications (AVSs), multiplying reward streams beyond basic validation duties.

- Liquidity Retention: Unlike native staking or direct restaking which enforce lockups, LRD holders can freely trade or deploy their tokens across DeFi protocols, maximizing capital efficiency at all times.

- Diversified Risk Exposure: With each new AVS supported via EigenLayer, LRD holders diversify protocol-level risk while potentially accessing unique incentive structures unavailable through vanilla staking alone (source).

This architecture is driving a surge in creative financial engineering across Ethereum’s ecosystem as developers build vaults, structured products, and quant-driven strategies tailored specifically for these new primitives.

Ethereum (ETH) Price & LRD Yield Prediction (2026-2031)

Forecast incorporating the impact of liquid restaking derivatives (eETH, rsETH) and evolving DeFi yield strategies

| Year | Minimum ETH Price | Average ETH Price | Maximum ETH Price | LRD APY Range (eETH/rsETH) | Key Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,200 | $4,250 | $5,600 | 10% – 40% | ETH consolidates above $3,000; LRDs maintain high APY but volatility persists |

| 2027 | $3,500 | $5,100 | $6,800 | 9% – 32% | DeFi adoption grows, ETH benefits from restaking security; APYs start to normalize |

| 2028 | $4,000 | $6,200 | $8,500 | 8% – 26% | Wider institutional entry and L2 integrations; LRD protocols mature, yields compress |

| 2029 | $4,500 | $7,500 | $10,200 | 7% – 22% | Macro uptrend, ETH as DeFi settlement layer; LRDs mainstream, APY stabilizes |

| 2030 | $5,000 | $8,800 | $12,000 | 6% – 18% | Regulatory clarity, ETH ETF potential; LRDs dominate yield strategies, risks well-managed |

| 2031 | $5,300 | $10,000 | $14,500 | 5% – 15% | ETH achieves ‘internet bond’ status; APYs align with sustainable DeFi growth |

Price Prediction Summary

Ethereum is positioned for steady long-term growth, driven by the success of liquid restaking derivatives (LRDs) like eETH and rsETH, which are transforming DeFi yield strategies. While APYs for LRDs are currently elevated, they are expected to gradually compress as the market matures, protocols become more secure, and competition increases. ETH price appreciation will be supported by increased utility, mainstream adoption, and improved capital efficiency, though investors should remain vigilant about volatility and protocol-specific risks.

Key Factors Affecting Ethereum Price

- Adoption of LRDs and restaking protocols (EigenLayer, Symbiotic, Karak)

- Ethereum network upgrades (scalability, security)

- Regulatory developments in DeFi and staking

- Macro market cycles and institutional interest

- Smart contract security and slashing risk management

- Competition from alternative L1s and L2s

- Evolution of DeFi and staking APY sustainability

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Yet, as the market for liquid restaking derivatives matures, the competitive landscape is rapidly evolving. New entrants like Symbiotic and Karak are experimenting with alternative restaking models, each offering distinct risk and reward profiles. Some protocols introduce dynamic allocation vaults, enabling users to optimize their exposure to different AVSs or adapt to shifting incentive structures in real time. This has led to a proliferation of yield optimization strategies that blend algorithmic asset management with manual curation by seasoned DeFi strategists.

Key Considerations for Ethereum Restakers in 2025

For those navigating this new paradigm, several factors should be weighed carefully:

Key Factors When Choosing eETH, rsETH, and Other LRDs

-

Yield Potential & APY Variability: Compare the annual percentage yields (APYs) offered by each LRD. For example, tokens like eETH and rsETH have reported APYs ranging from 10% to 50%, significantly higher than traditional ETH staking. However, these rates can fluctuate based on protocol incentives and market dynamics.

-

Liquidity & DeFi Integration: Evaluate how easily you can trade, lend, or use the LRD in DeFi platforms. eETH and rsETH are accepted on major protocols like Polynomial Finance, expanding their utility for leverage, trading, and yield farming.

-

Slashing & Restaking Risk: Understand the slashing mechanisms involved. Restaking exposes assets to additional slashing risks if validators misbehave or fail protocol requirements, potentially leading to loss of principal.

-

Market Liquidity & Price Stability: Consider the liquidity depth and price tracking of each LRD. While LRDs aim to closely track ETH’s price (currently $3,831.58), market volatility or protocol-specific issues can cause deviations, impacting your ability to exit positions at fair value.

-

Decentralization & Governance: Review how decentralized the protocol is and who controls upgrades or slashing decisions. Protocols like Ether.fi and KelpDAO have different governance models, affecting long-term security and user influence.

-

Track Record & Transparency: Favor LRDs with a proven operational history and transparent reporting. Established platforms typically provide regular audits, open-source code, and clear documentation, reducing risk for participants.

Smart contract risk remains a central concern. Each additional protocol layer introduces new vectors for bugs or exploits. Audits and on-chain insurance options are becoming more prevalent but cannot eliminate risk entirely. Slashing risk also grows with complexity; if an AVS secured by EigenLayer underperforms or acts maliciously, all restaked collateral may be partially penalized.

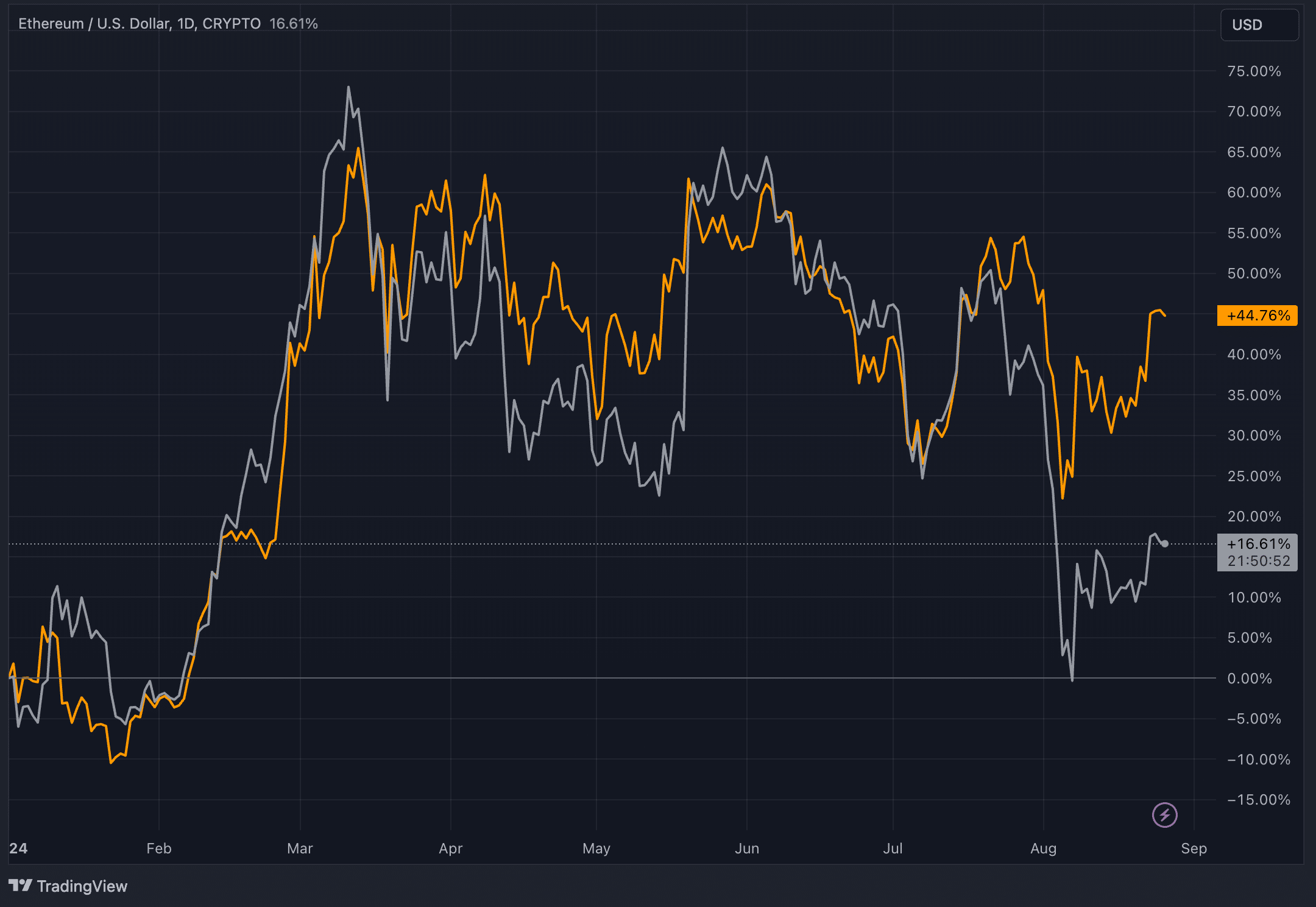

Market volatility is another dimension. The price of Ethereum sits at $3,831.58, but fluctuations can impact both the value of underlying assets and the demand for LRDs themselves. In bull markets, layered yields can amplify gains; in drawdowns, they can accelerate losses if leverage is involved or liquidity dries up on secondary markets.

The Road Ahead: Composability as the Engine of Innovation

The true promise of liquid restaking derivatives lies not just in higher yields but in their ability to serve as building blocks for more advanced financial products. As DeFi protocols race to integrate eETH and rsETH into lending pools, DEXes, options vaults, and structured products, we are witnessing an explosion in DeFi composability. This composability allows users to stack rewards across multiple protocols while maintaining agility to respond to changing market conditions.

The next wave will likely see cross-chain integrations and further abstraction of risk via insurance primitives or predictive analytics tools that help users dynamically rebalance their positions based on real-time incentives across EigenLayer’s growing ecosystem.

Navigating Risks While Maximizing Dual Rewards Staking

While the allure of double-digit APYs is strong, prudent investors must weigh these benefits against operational complexity and protocol risk. Continuous monitoring of smart contract security audits, protocol governance developments, and AVS performance metrics is essential for anyone seeking to maximize returns without being blindsided by adverse events.

Recent research highlights that professional yield strategists increasingly use quantitative models, factoring in slashing probabilities and dynamic APY projections, to allocate capital between traditional staking rewards and more speculative restaking incentives.

The Bottom Line: Liquid Restaking Derivatives Are Here to Stay

The rise of liquid restaking derivatives like eETH and rsETH marks a pivotal shift in Ethereum’s yield landscape. At today’s price point of $3,831.58, these instruments empower participants to extract layered value from their ETH holdings while unlocking unprecedented flexibility across DeFi’s most composable rails.

This trend shows no signs of slowing as new protocols push the envelope on what’s possible with staked capital, fueling both innovation and competition within Ethereum’s vibrant ecosystem.