Ethereum’s DeFi landscape is experiencing a profound shift as liquid restaking tokens (LRTs) like eXETH gain traction. With Ethereum (ETH) currently trading at $3,831.52, investors are increasingly seeking ways to maximize capital efficiency and compound yields without sacrificing liquidity. LRTs are quickly emerging as the go-to solution for users looking to tap into both staking rewards and the expanding universe of Actively Validated Services (AVSs) through protocols like EigenLayer.

What Makes Liquid Restaking Tokens Different?

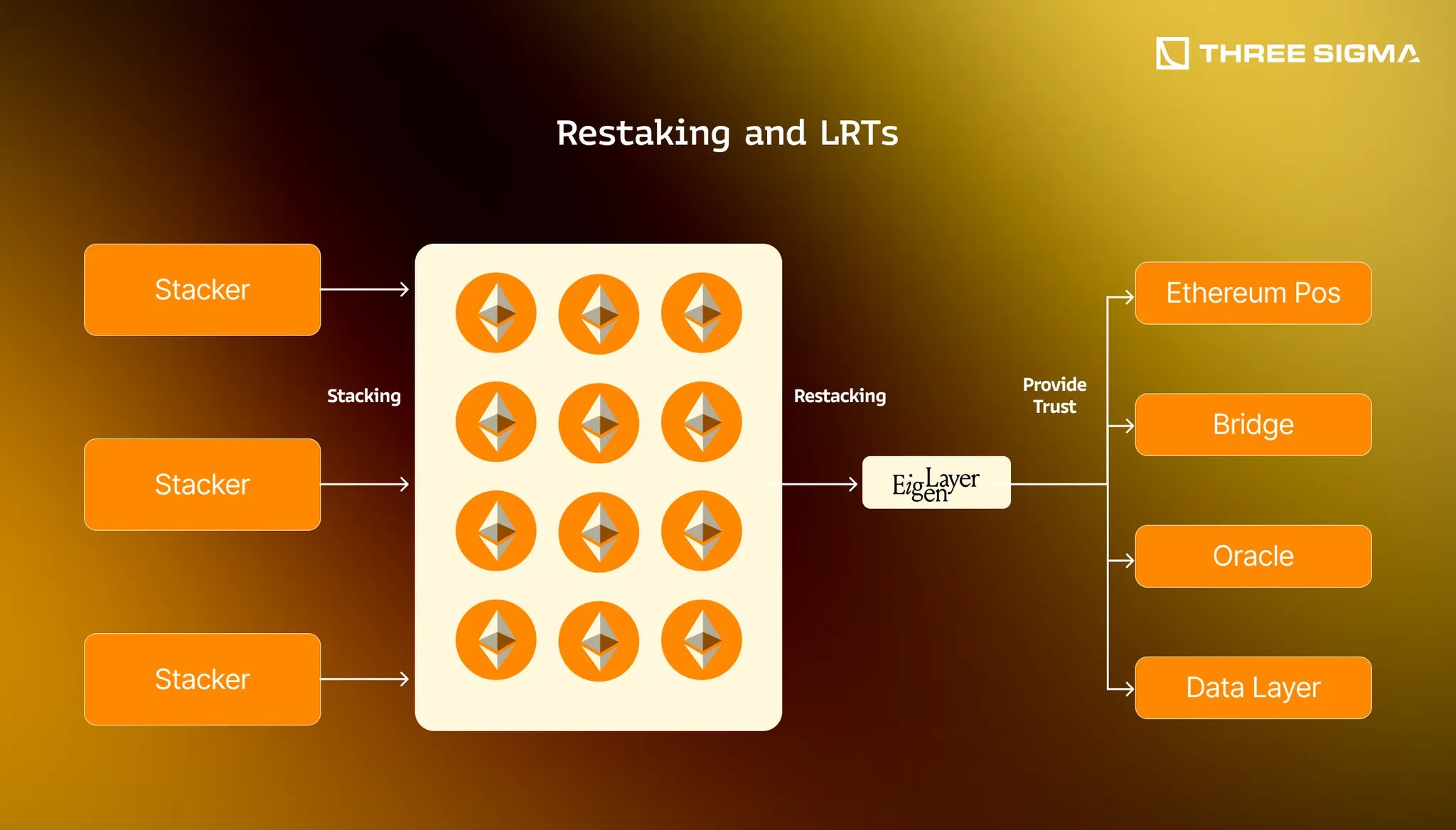

The concept of liquid staking has already brought flexibility to Ethereum by allowing users to stake ETH and receive liquid staking tokens (LSTs) such as stETH. These LSTs can be freely traded or used in DeFi, sidestepping the illiquidity of traditional staking. However, LRTs like eXETH take this one step further by enabling users to “restake” their staked assets, securing multiple services and generating additional yield streams on top of core staking rewards.

Unlike standard liquid staking tokens, LRTs let you:

- Earn dual rewards: Base Ethereum staking yield plus extra incentives from AVS participation

- Maintain liquidity: Freely trade or deploy LRTs in DeFi protocols while your underlying ETH works in multiple layers

- Boost capital efficiency: Maximize returns on the same ETH without committing new capital

This composability is a game changer for sophisticated DeFi strategies, letting investors unlock more value from each ETH they hold.

The eXETH Mechanism: Compound Yields, Seamless Liquidity

eXETH by EKOX exemplifies how LRTs are pushing boundaries. Here’s how it works:

- Deposit and Minting: Users deposit ETH into EKOX and mint eXETH at the current exchange rate.

- Auto-Compounding Rewards: Both Ethereum staking and EigenLayer restaking rewards are automatically reinvested, so your eXETH balance grows passively over time.

- Redemption Flexibility: Whenever you want out, redeem your eXETH for ETH at a rate that reflects all accrued rewards.

This automation not only reduces manual management but also ensures that holders benefit from continuous compounding – a key driver behind the surging demand for LRTs in 2025.

LRT Adoption Surges as Capital Efficiency Becomes King

The numbers paint a compelling picture: since early 2024, total value locked in liquid restaking tokens has jumped over 8,300%, reaching $13.8 billion. Protocols such as Ether. fi and EKOX have rapidly climbed the leaderboard by offering robust solutions that let users stack yields while retaining full token mobility (see Cointelegraph coverage). This growth is fueled not just by attractive yields but also by increased awareness around capital efficiency – why park your ETH in one protocol when you can earn from several simultaneously?

Ethereum (ETH) Price Prediction 2026-2031: Impact of Liquid Restaking Tokens

Forecast based on emerging LRT adoption, DeFi yield innovations, and current 2025 market conditions ($3,831.52 ETH price baseline)

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | Year-over-Year Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $2,950 | $4,200 | $5,800 | +9.6% | Continued LRT adoption, moderate DeFi growth, some regulatory uncertainty |

| 2027 | $3,450 | $5,100 | $7,100 | +21.4% | Broader use of LRTs, ETH 2.0 improvements, growing institutional interest |

| 2028 | $3,900 | $5,900 | $8,400 | +15.7% | Mainstream DeFi integration, new AVS use cases, possible regulatory clarity |

| 2029 | $4,250 | $6,800 | $10,200 | +15.3% | DeFi and LRTs reach maturity, competition from L2s and other chains |

| 2030 | $4,900 | $7,900 | $12,500 | +16.2% | ETH solidifies as DeFi backbone, high capital efficiency, robust AVS ecosystem |

| 2031 | $5,400 | $8,800 | $14,300 | +11.4% | Widespread financialization, global adoption, but mature growth phase |

Price Prediction Summary

Ethereum is positioned for progressive growth through 2031, driven by the rapid expansion of liquid restaking tokens like eXETH, which enhance DeFi yields and capital efficiency. The base case predicts ETH will steadily appreciate, with the average price rising from $4,200 in 2026 to $8,800 by 2031. Bullish scenarios could see ETH reaching over $14,000 if DeFi and LRT adoption accelerate, while bearish outcomes could result from regulatory headwinds or competitive threats. The introduction of LRTs is a major catalyst, but market cycles and global economic factors will influence volatility and price discovery.

Key Factors Affecting Ethereum Price

- Growth and adoption of Liquid Restaking Tokens (LRTs) such as eXETH, increasing DeFi yields and capital efficiency

- Ethereum network upgrades (e.g., scalability, ETH 2.0) and technical improvements

- Regulatory clarity or restrictions on DeFi and staking protocols

- Competition from other L1 and L2 networks, especially those with restaking features

- Institutional adoption and integration with traditional finance

- Macroeconomic conditions affecting crypto market cycles (e.g., global liquidity, risk appetite)

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

LRT DeFi Integration: Unlocking New Strategies

LRTs like eXETH aren’t just passive yield tools; they’re also composable ERC-20 assets that slot seamlessly into lending markets, AMMs, and yield aggregators. With more protocols integrating support for these tokens every month, users can now borrow against their restaked collateral or deploy it across complex strategies – all while continuing to accrue dual-layer rewards.

This level of flexibility is a major reason why liquid restaking tokens are drawing in both institutional and retail capital. By using eXETH within DeFi, investors can participate in liquidity pools, provide collateral for loans, or even stack additional rewards through yield farming protocols. The possibilities for compounding returns and optimizing portfolio strategies are broader than ever before.

Risks and Considerations in the Restaking Era

While the benefits are substantial, it’s important to recognize the risks that come with restaking DeFi. LRTs like eXETH inherit smart contract risk from both their underlying staking protocols and any new services they secure via EigenLayer. Additionally, if an Actively Validated Service (AVS) fails or is compromised, stakers could face slashing events that impact their principal. Protocol complexity also introduces new attack surfaces and potential governance challenges as more layers are added to the staking stack.

- Smart contract vulnerabilities: Each protocol integration increases risk exposure.

- Slashing penalties: Misbehavior or failures on AVSs can lead to loss of staked ETH.

- Liquidity mismatches: Market demand for LRTs may fluctuate during periods of volatility.

- Governance risks: Protocol upgrades or parameter changes can impact token holders unexpectedly.

This makes due diligence critical. Investors should review audits, track the performance of underlying AVSs, and remain aware of protocol governance decisions before allocating significant capital to LRTs or building strategies around them. For those willing to manage these risks, however, the reward profile remains highly attractive compared to traditional staking or passive holding.

Key Differences: LRTs vs. LSTs in Ethereum DeFi

-

Yield Sources: Liquid Staking Tokens (LSTs) like stETH or rETH earn rewards solely from Ethereum staking, while Liquid Restaking Tokens (LRTs) such as eXETH offer dual yield streams—combining Ethereum staking rewards with additional returns from securing Actively Validated Services (AVSs) via protocols like EigenLayer.

-

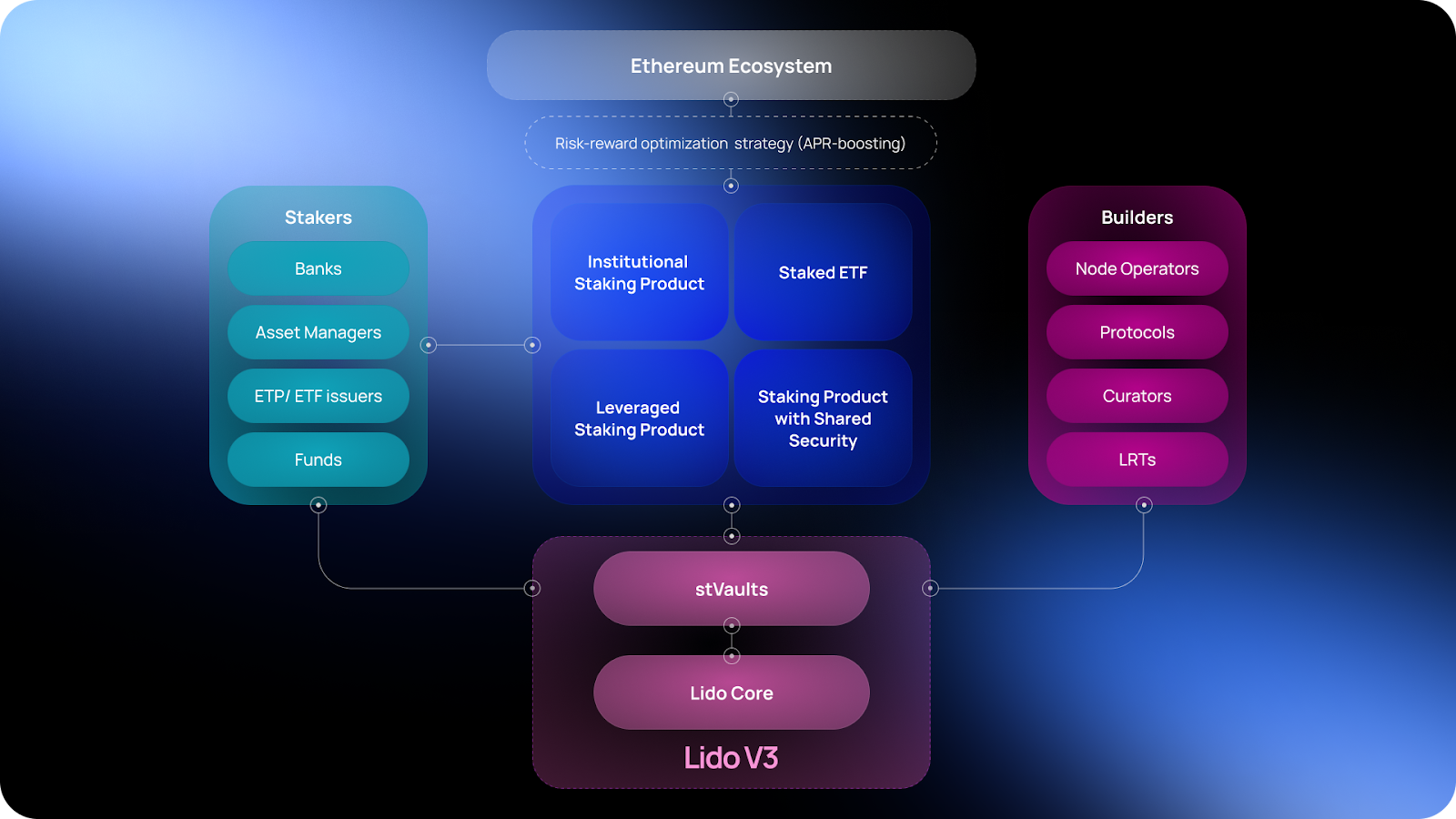

Underlying Mechanism: LSTs represent staked ETH within a liquid staking protocol (e.g., Lido, Rocket Pool). In contrast, LRTs like eXETH represent restaked ETH positions—where staked ETH is further committed to secure multiple services, unlocking extra yield without additional capital.

-

DeFi Utility & Liquidity: Both LSTs and LRTs are ERC-20 tokens and maintain liquidity for use in DeFi (lending, borrowing, yield farming). However, LRTs like eXETH are designed for greater composability and capital efficiency, as they can participate in multiple protocols and yield strategies simultaneously.

-

Auto-Compounding Rewards: Many LRTs (e.g., eXETH) feature auto-compounding of both staking and restaking rewards, increasing token value over time without manual intervention. Most LSTs only auto-compound staking rewards.

-

Risk Profile: LSTs carry risks related to Ethereum staking (slashing, validator downtime). LRTs add restaking risks—including exposure to AVS failures or slashing events on additional services, making the risk profile more complex.

The Future: LRTs at the Heart of Ethereum’s Yield Layer

The rapid ascent of eXETH and its peers signals a new era where Ethereum’s base layer becomes a launchpad for increasingly sophisticated yield products. As more AVSs come online through EigenLayer and as DeFi protocols race to integrate LRT support, users can expect even richer opportunities for yield stacking, potentially making single-layer staking obsolete for advanced investors.

The current price of ETH at $3,831.52 reflects not only network fundamentals but also growing demand for capital-efficient yield solutions like eXETH. With over $13.8 billion now locked in liquid restaking tokens across leading platforms (source), it’s clear that this trend is more than a passing phase, it’s reshaping how value flows through Ethereum’s financial ecosystem.

If you’re exploring ways to make your ETH work harder, without giving up flexibility, now is an opportune moment to study how liquid restaking tokens operate within your broader portfolio strategy. As always in DeFi: stay informed, assess risk carefully, and be ready to adapt as innovation continues at breakneck speed.