Ethereum’s modular blockchain landscape is evolving rapidly, and EigenLayer’s restaking protocol is at the core of this transformation. As of September 2025, Ethereum trades at $4,205.61, reflecting renewed confidence in network security and capital efficiency. The rise of restaking is not just a trend but a new cryptoeconomic primitive that unlocks scalable trust for a range of decentralized applications, from rollups to AI protocols.

What Is EigenLayer Restaking? A New Security Primitive for Ethereum

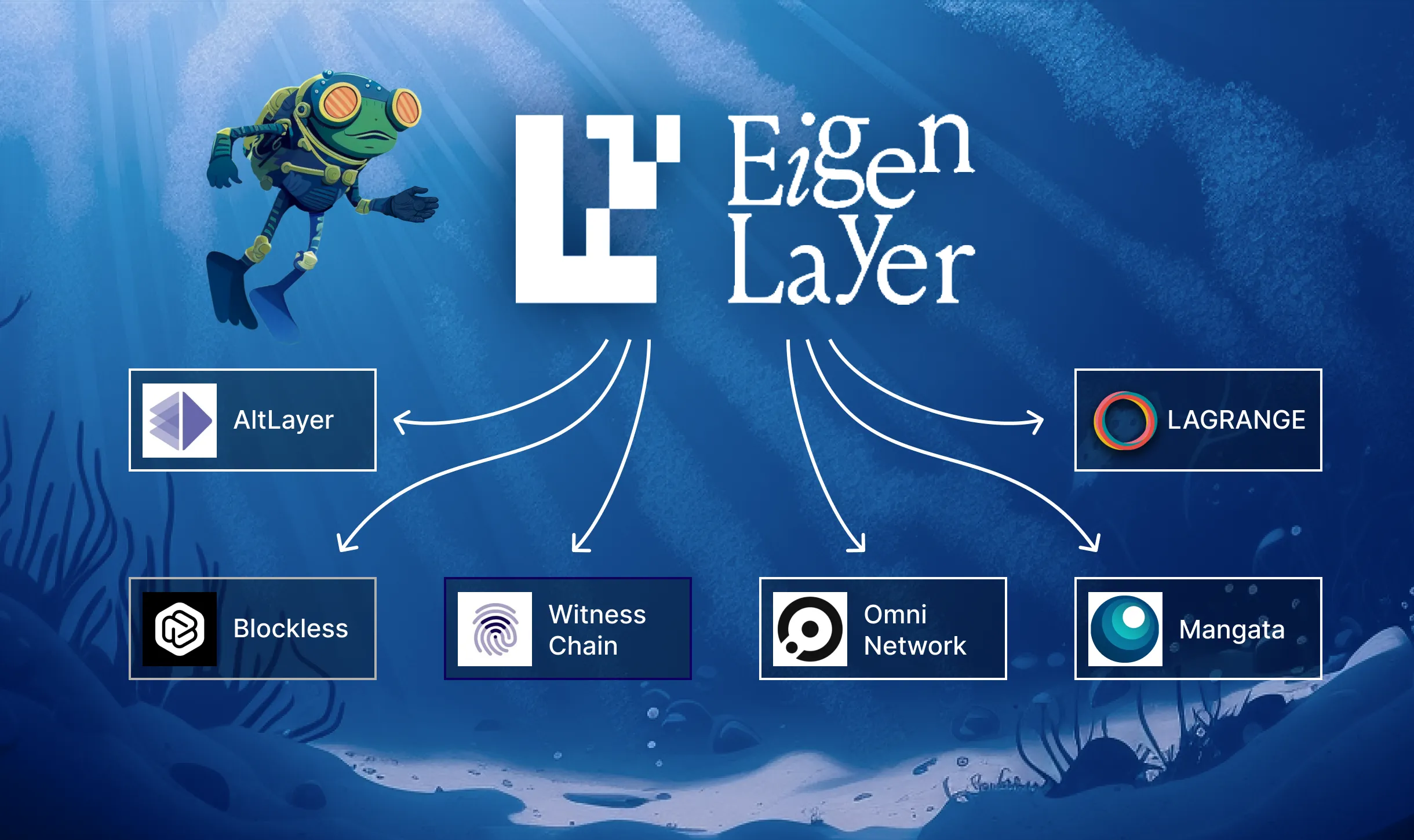

EigenLayer introduces restaking, allowing users to leverage their staked ETH or Liquid Staking Tokens (LSTs) to secure additional protocols beyond Ethereum itself. This means validators can opt-in to support multiple Actively Validated Services (AVSs) such as data availability layers, bridges, oracles, and even AI networks, all while earning extra yield.

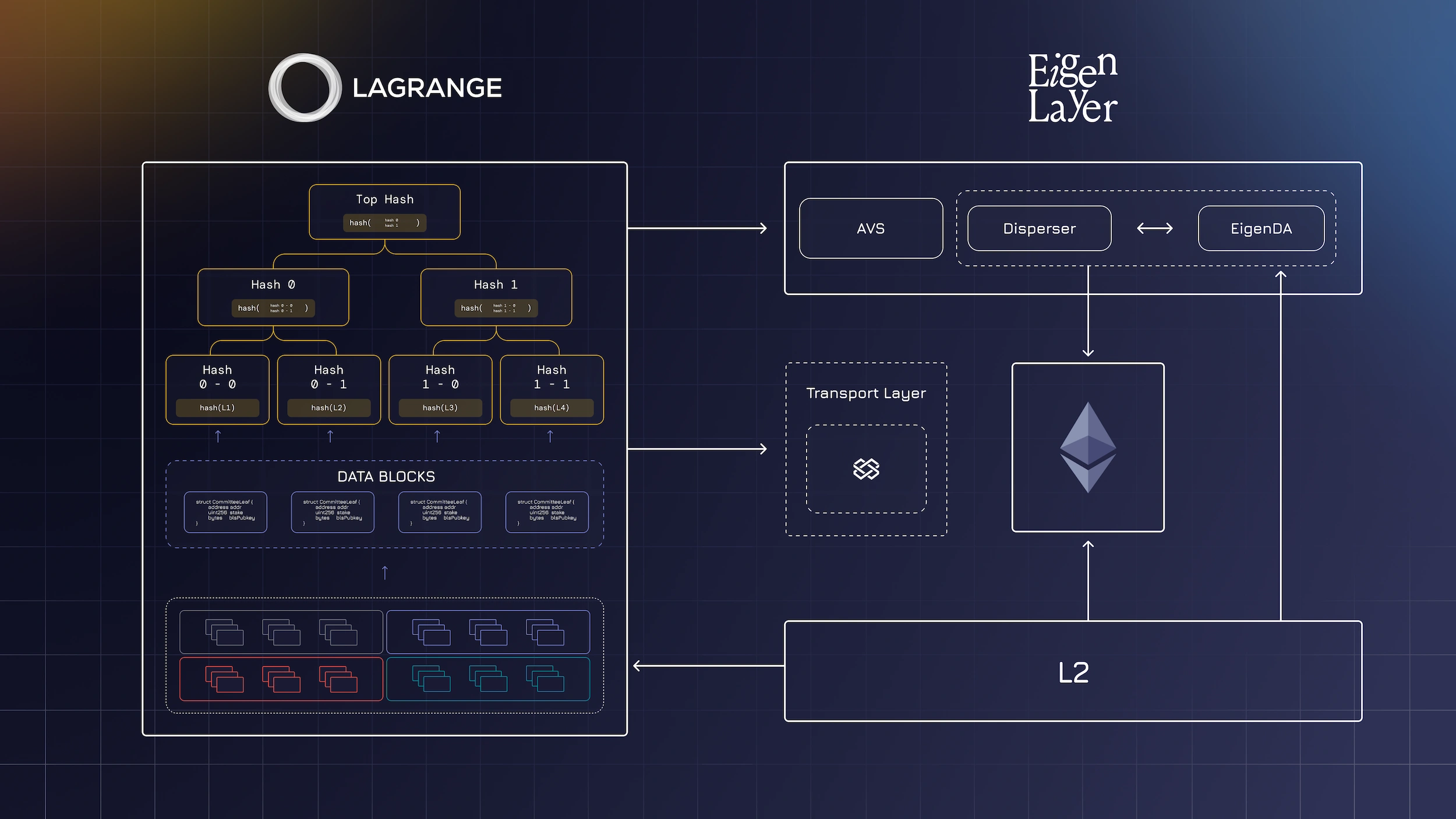

This shared security model is a fundamental shift from the traditional siloed approach where each protocol must bootstrap its own validator set. By pooling security across services, EigenLayer reduces fragmentation and increases capital efficiency for the entire Ethereum ecosystem. According to Blockworks, leading rollups like Mantle Network and ZKsync now use EigenDA (EigenLayer’s data availability module) to enhance their infrastructure.

How Modular Blockchains Leverage Shared Security

The modular blockchain thesis posits that chains should specialize in specific functions, execution, settlement, consensus, or data availability, rather than doing everything monolithically. However, this modularity creates new attack surfaces and coordination problems around validator incentives.

EigenLayer solves this by letting AVSs tap into Ethereum’s existing validator set via restaked ETH. Instead of spinning up isolated networks with weak economic guarantees, new protocols can inherit robust security from Ethereum’s $4,205.61 base layer. For example:

- Data availability layers: Projects like Mantle and ZKsync rely on EigenDA for high-throughput data storage secured by restaked ETH.

- Cross-chain bridges: AVSs can ensure liveness and censorship resistance without bootstrapping their own trust network.

- Oracles and middleware: Decentralized services gain instant validator coverage by integrating with EigenLayer.

This approach lowers operational costs for new protocols while enabling stakers to maximize returns on their capital, a win-win dynamic that accelerates innovation in DeFi and beyond.

AI Protocols Meet Crypto-Economic Security: The Ritual Chain Example

The intersection of AI protocols and crypto-economic security marks one of the most promising frontiers for EigenLayer restaking. AI networks require robust distributed infrastructure, high-availability nodes for model inference or training, that must remain censorship-resistant and economically incentivized.

Ritual Chain, an early adopter of EigenLayer’s framework, demonstrates how AVSs can use restaked ETH to bootstrap distributed operators with specialized hardware. This not only increases network liveness but also ensures fees flow back into the broader EigenLayer ecosystem as rewards for validators willing to provide these services.

Top AVS Use Cases Powered by EigenLayer Restaking

-

Data Availability Layers: EigenDA leverages restaked ETH to provide scalable, decentralized data availability for modular blockchains like Mantle Network and ZKsync, enhancing security and throughput.

-

Cross-Chain Bridges: Protocols such as Omni Network use EigenLayer’s shared security to validate cross-chain messaging, reducing the risk of bridge exploits and improving interoperability.

-

Decentralized Oracles: Witness Chain and similar AVSs harness EigenLayer’s validator set to secure off-chain data feeds, ensuring reliable and tamper-resistant oracle services for DeFi and dApps.

-

AI Protocols: Ritual Chain utilizes EigenLayer restaking to bootstrap decentralized AI inference and model training, increasing network liveness and censorship resistance for AI workloads.

-

ZK Light Clients: Lagrange State Committees employ EigenLayer’s restaked security to validate optimistic rollups and zk-proofs, enabling efficient and trust-minimized cross-chain communication.

The Economics: Why Restakers Are Flocking In at $4,205.61 ETH

The current price point of ETH at $4,205.61 makes restaking especially attractive for both existing stakers and new market entrants seeking additional yield without sacrificing principal safety. With more AVSs launching monthly, and network effects compounding, restakers are positioned at the center of a rapidly growing web of decentralized services across DeFi, gaming, AI inference markets, and more.

Ethereum (ETH) Price Prediction 2026-2031

Professional Forecast Incorporating EigenLayer-Driven Security, Modular Blockchain Adoption, and AI Protocol Integration

| Year | Minimum Price (Bearish Scenario) | Average Price (Base Case) | Maximum Price (Bullish Scenario) | Year-on-Year % Change (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $3,900 | $5,200 | $6,800 | +23.7% | Ongoing EigenLayer adoption boosts security narrative; steady DeFi and AI protocol growth |

| 2027 | $4,350 | $5,950 | $8,200 | +14.4% | More protocols integrate restaking; regulatory clarity improves institutional participation |

| 2028 | $4,900 | $6,850 | $10,000 | +15.1% | AI protocol expansion and cross-chain interoperability attract new capital |

| 2029 | $5,450 | $7,900 | $12,400 | +15.3% | Modular blockchain architectures mature; ETH becomes default security layer for AVSs |

| 2030 | $6,100 | $9,200 | $15,200 | +16.5% | Wider mainstream adoption; ETH staking and restaking dominate security markets |

| 2031 | $6,800 | $10,800 | $18,000 | +17.4% | ETH solidifies as foundational asset for blockchain security, data availability, and decentralized AI |

Price Prediction Summary

Ethereum’s price outlook for 2026-2031 is broadly bullish, underpinned by the transformative impact of EigenLayer’s restaking mechanism. As ETH becomes the backbone of security for modular blockchains and AI protocols, demand for staking and restaking is expected to rise. While regulatory and technological uncertainties could introduce volatility, the long-term trend points to substantial price appreciation, especially as new use cases and institutional adoption accelerate.

Key Factors Affecting Ethereum Price

- Widespread adoption of EigenLayer restaking by modular blockchains and AI protocols

- Expansion of Actively Validated Services (AVSs) requiring ETH security

- Regulatory clarity for staking and restaking services

- Ethereum network upgrades (e.g., scalability, energy efficiency)

- Competition from alternative Layer 1s and restaking protocols

- Institutional investment in ETH as a yield-bearing asset

- Macro market cycles and global economic conditions

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Restaking is not just a technical innovation, but a powerful economic engine. By allowing ETH holders to restake assets already earning rewards, EigenLayer transforms idle capital into productive security for dozens of emerging protocols. This has a compounding effect: as more AVSs join the EigenLayer ecosystem, demand for staked ETH rises, deepening both security guarantees and validator revenue streams. The result is a positive feedback loop that strengthens Ethereum’s modular stack and incentivizes long-term participation.

The Real-World Impact: Security Without Trade-Offs

Historically, new blockchains and decentralized services faced a tough trade-off: launch with weak security or invest heavily in building their own validator networks. EigenLayer’s model eliminates this dilemma by letting projects instantly inherit Ethereum’s battle-tested security at $4,205.61 per ETH. This shared security model also reduces systemic risk by minimizing the number of isolated networks vulnerable to attack.

For developers, this means faster time-to-market and lower operational overhead. For stakers and operators, it opens up diversified yield streams with robust slashing conditions that enforce honest behavior across all supported services. The protocol’s flexibility allows AVSs to define custom validation requirements, whether that’s computational power for AI inference or uptime guarantees for data availability, while aligning incentives through programmable rewards.

Decentralized AI: A New Revenue Model for Hardware Operators

The emergence of decentralized AI protocols like Ritual Chain on EigenLayer signals a paradigm shift in how compute resources are allocated and monetized. Instead of relying on centralized cloud providers, AI models can now run on globally distributed networks secured by restaked ETH. This not only democratizes access to high-value machine learning infrastructure but also creates sustainable fee flows for hardware operators willing to stake capital and provide services.

As the demand for on-chain AI grows, from inference markets to training decentralized LLMs, the role of EigenLayer as a coordination layer becomes even more critical. It ensures that operators are economically motivated to deliver reliability while giving protocol builders confidence in their network’s resilience against downtime or censorship.

Risks and Considerations in Restaking

No system is without risk. Restakers must be mindful of potential slashing penalties if they support malicious or faulty AVSs. Due diligence on each service’s economics, codebase, and governance is essential before opting in as an operator. Additionally, as restaking scales up, monitoring cross-service dependencies becomes crucial to avoid correlated failures or incentive misalignments.

Actionable insight: Validators should leverage real-time monitoring tools and regularly review AVS updates to minimize exposure to risky protocols while maximizing aggregate yield across the EigenLayer ecosystem.

The Road Ahead: A New Standard for Modular Blockchain Security

EigenLayer’s rapid adoption signals that restaking is poised to become the default security layer for modular blockchains and next-gen decentralized applications. As more protocols, from rollups leveraging EigenDA to AI inference markets, integrate with EigenLayer, expect further growth in total value restaked (TVR) and validator participation rates.

The ability to secure diverse services without fragmenting trust is unlocking unprecedented composability across DeFi, gaming, data markets, and beyond. For investors and builders alike, understanding how EigenLayer restaking works, and staying current with developments, is now table stakes for navigating Ethereum’s evolving landscape at $4,205.61.