Ethereum’s restaking economy is entering a new phase as EigenLayer’s Actively Validated Services (AVS) rollout accelerates, fundamentally altering both yield opportunities and security models for validators and DeFi protocols. With Ethereum (ETH) currently trading at $4,050.65, EigenLayer’s TVL has surged past $18 billion by mid-2025, reflecting explosive demand from stakers seeking to optimize returns through restaking mechanisms that go far beyond traditional staking yields.

AVS Rollout: The Engine Behind Yield Layering

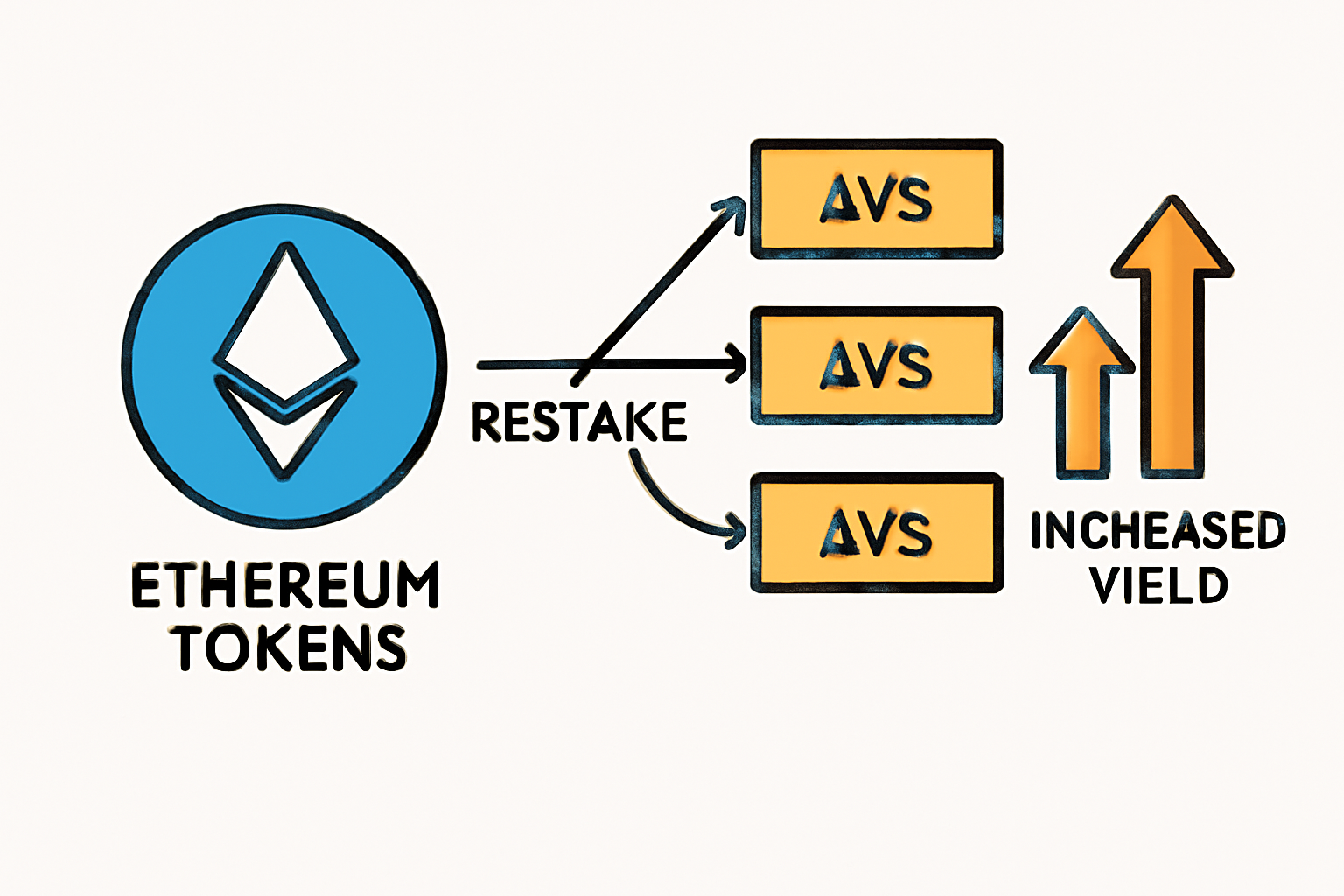

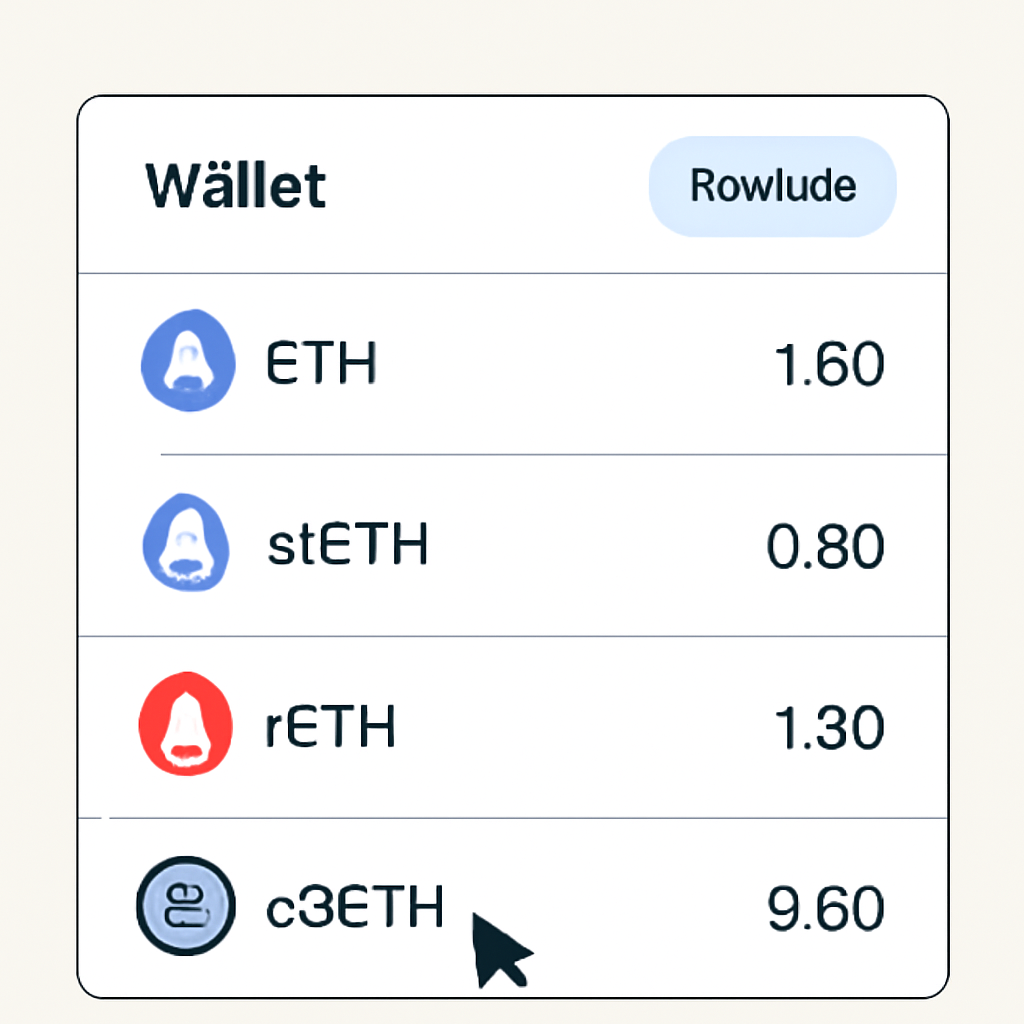

Actively Validated Services are the cornerstone of EigenLayer’s promise: enabling users to leverage their already-staked ETH or liquid staking tokens (LSTs) to secure a growing suite of decentralized applications and protocols. This approach unlocks layered yields, stacking rewards from core Ethereum staking with additional AVS incentives. According to market data, restakers are now earning an average total APY near 5%, with 3.18% attributed to base ETH staking and the remainder sourced from AVS participation (source).

The result is a powerful flywheel effect: as more AVSs launch on EigenLayer, demand for security rises, which in turn attracts more stakers seeking higher yields. However, this dynamic is highly sensitive to the balance between AVS demand and the supply of restaked ETH, a point underscored by recent analyst warnings about potential yield compression (source).

Security Reinvented: Slashing Mechanisms Take Center Stage

The introduction of robust slashing protocols in April 2025 marked a critical evolution for EigenLayer’s shared security model. Previously, critics argued that pooled restaking without meaningful penalties could amplify systemic risk if operators or AVSs misbehaved. The new slashing system holds both operators and affiliated AVSs directly accountable, misconduct can now result in real economic losses for bad actors, aligning incentives across all participants (source).

This upgrade has already led to increased institutional confidence in the protocol. Operators are now incentivized not just by higher yields but also by reputational risk, creating a more robust foundation for Ethereum shared security as more capital flows into the ecosystem.

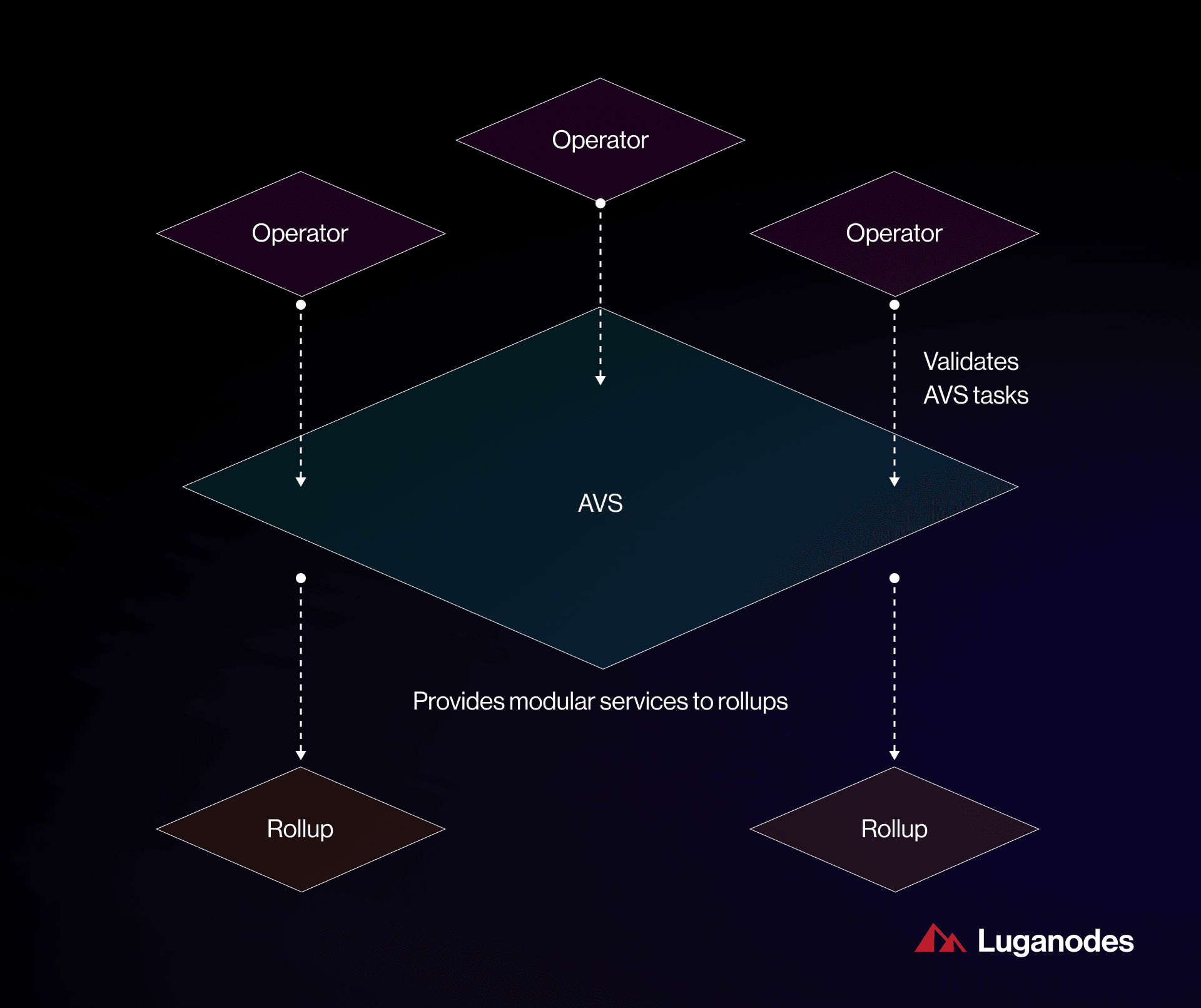

Multi-Chain Verification: Scaling Security Across L2s

EigenLayer isn’t stopping at Ethereum mainnet. Its expansion into multi-chain verification, currently live on Base Sepolia testnet, enables AVSs to tap into EigenLayer’s security while operating across Layer 2 networks like Base. This move is expected to lower operational costs, boost transaction speeds, and extend EigenLayer’s reach as mainnet deployment approaches in Q3 2025 (source).

This cross-chain capability positions EigenLayer as a backbone for decentralized infrastructure where security becomes portable and composable, a crucial step for scaling DeFi restaking protocols while maintaining rigorous trust assumptions.

Ethereum (ETH) Price Prediction Post-EigenLayer AVS Rollout (2026-2031)

Forecasts consider EigenLayer’s impact on yield, security, and multi-chain adoption, with 2025 price baseline at $4,050.65.

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | YoY % Change (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $3,600 | $4,550 | $6,000 | +12.4% | Yield stabilization, AVS adoption ramps up, minor regulatory headwinds |

| 2027 | $3,900 | $5,250 | $7,800 | +15.4% | Multi-chain AVS on mainnet, DeFi usage grows, stable yields |

| 2028 | $4,400 | $6,200 | $9,200 | +18.1% | Layer 2 scaling matures, global institutions enter, ETH as settlement layer |

| 2029 | $5,000 | $7,300 | $11,500 | +17.7% | ETH burn and restaking synergy, regulatory clarity, high AVS demand |

| 2030 | $5,800 | $8,600 | $13,800 | +17.8% | Cross-chain integration, mainstream adoption, ETH as DeFi backbone |

| 2031 | $6,400 | $10,200 | $16,400 | +18.6% | ETH supply constraints, widespread AVS security, institutional-grade staking |

Price Prediction Summary

Ethereum is expected to benefit from EigenLayer’s AVS rollout, unlocking new yield opportunities and enhancing network security. While short-term volatility may persist due to yield fluctuations and evolving regulation, the medium- to long-term outlook is bullish, especially as multi-chain AVS adoption and institutional participation accelerate. By 2031, ETH could reach an average price above $10,000 if key trends continue.

Key Factors Affecting Ethereum Price

- EigenLayer’s AVS adoption and impact on staking yield

- Total Value Locked (TVL) in restaking protocols

- Development of robust slashing and security mechanisms

- Regulatory clarity on restaking and liquid staking in major jurisdictions

- Ethereum’s Layer 2 scaling and multi-chain AVS expansion

- DeFi and institutional adoption of ETH as collateral and settlement asset

- Potential yield crises and market imbalances between restaked ETH supply and AVS demand

- Competition from other Layer 1 and restaking-enabled blockchains

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

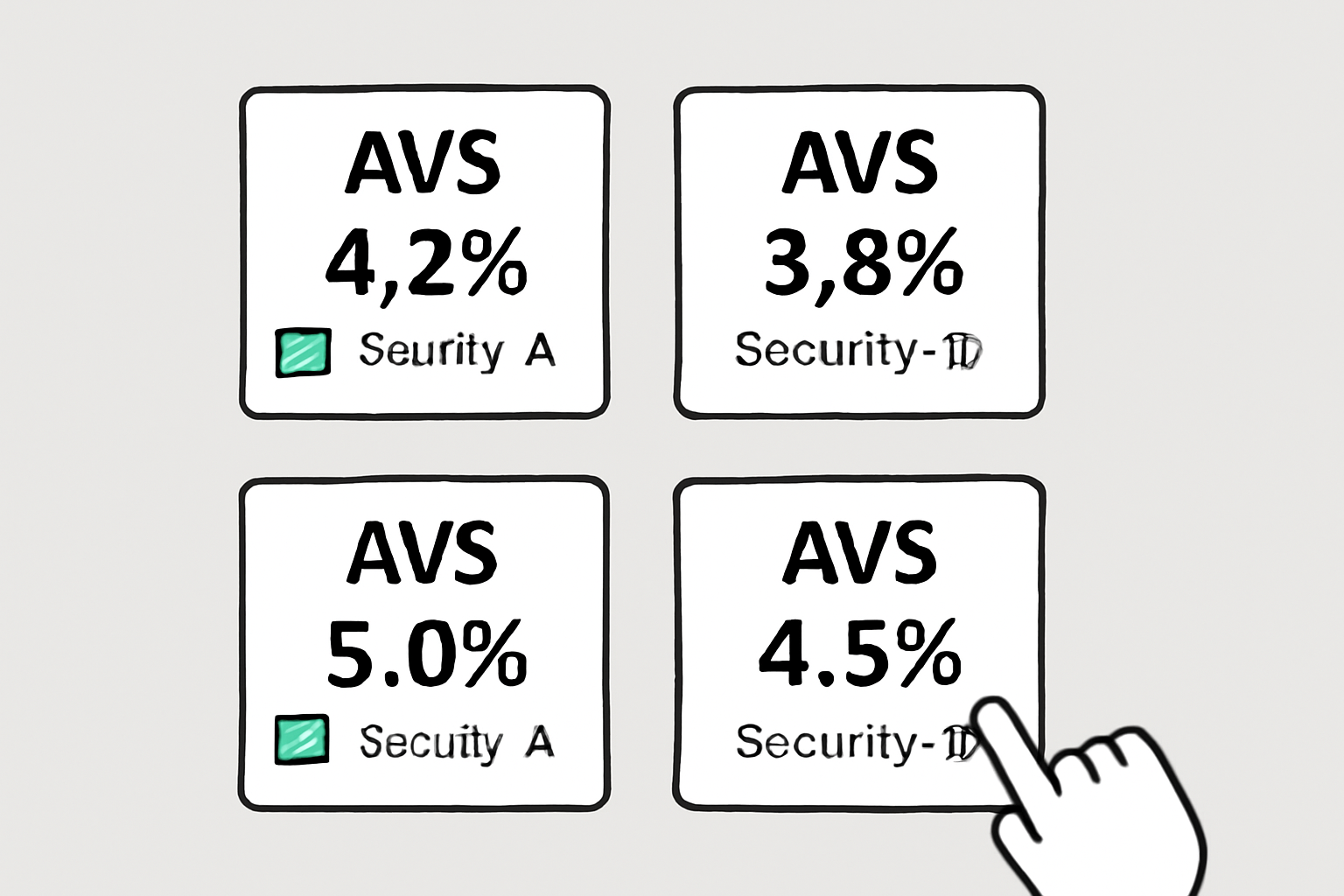

As the EigenLayer AVS adoption curve steepens, restakers and operators are recalibrating their strategies to maximize returns while managing new risks. The interplay between EIGEN staking demand and the evolving security landscape is driving innovation in both protocol design and validator economics. Notably, the ability to restake across multiple AVSs is fueling a competitive market for validator services, with operators differentiating themselves on uptime, slashing resilience, and integration with emerging DeFi primitives.

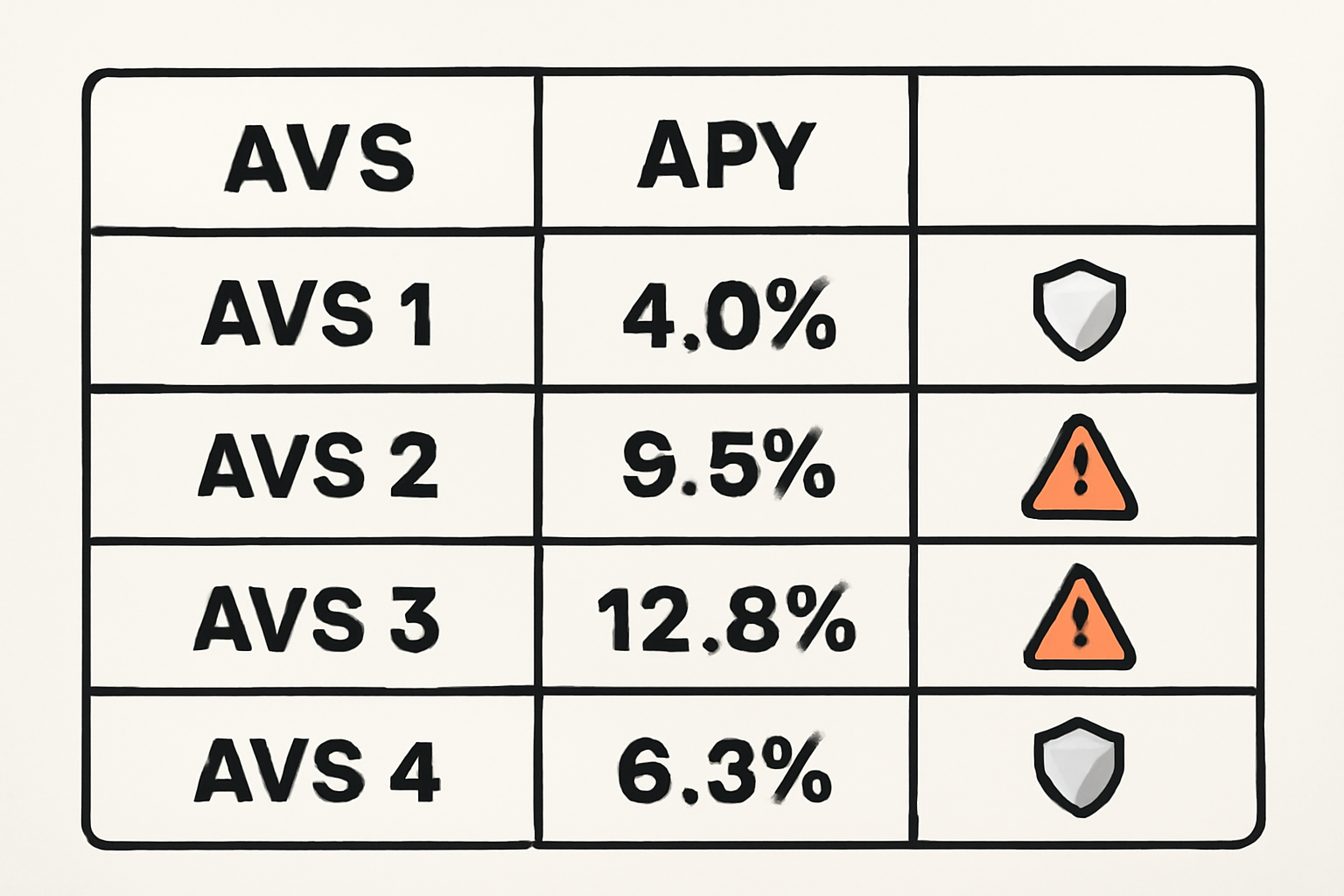

However, the surge in restaked ETH has prompted concerns about a potential yield crisis. If AVS demand lags behind the influx of capital seeking yield, APYs could compress rapidly. This dynamic is already visible as supply-side participation outpaces new AVS launches, a scenario that could challenge the sustainability of layered yields unless innovative use cases continue to emerge. For restakers, monitoring AVS onboarding rates and operator performance metrics will be crucial for navigating these shifts.

Key Considerations: Navigating Yield Compression and Security Tradeoffs

The introduction of slashing has fundamentally altered risk calculus for all participants. Operators must now invest in robust monitoring and fail-safe systems to avoid penalties, while restakers need to assess not just headline APYs but also slashing exposure and operator track records. This new paradigm incentivizes professionalization within the validator community and sets a higher bar for protocol reliability.

For those evaluating entry or expansion into EigenLayer’s ecosystem, consider these factors:

- Monitor real-time ETH price movements: With Ethereum trading at $4,050.65, even minor price shifts can impact net returns when combined with variable AVS rewards.

- Diversify across AVSs: Spreading exposure reduces idiosyncratic risk from any single service or operator.

- Track slashing events: Recent enforcement actions have highlighted the importance of due diligence on operator history and protocol governance (source).

The Road Ahead: Restaking Protocols in a Multi-Chain World

The upcoming mainnet launch of multi-chain verification will be a pivotal moment not just for EigenLayer but for Ethereum shared security as a whole. By allowing Actively Validated Services to bridge across Layer 2s like Base while anchoring back to Ethereum’s economic finality, EigenLayer is setting a precedent for portable trust models that could underpin future DeFi infrastructure at scale (source).

In this rapidly evolving environment, vigilance remains key. Restakers who actively monitor market dynamics, protocol upgrades, and operator performance will be best positioned to capture sustainable yields while mitigating downside risk. As always in DeFi: trade the trend, respect the risk, and stay data-driven as new opportunities emerge within Ethereum’s expanding restaking landscape.