As Ethereum continues to evolve as the backbone of decentralized finance, the security model for validators is undergoing a significant transformation. EigenLayer restaking is at the forefront of this shift, introducing new mechanisms that both enhance rewards and reinforce network security. With Ethereum (ETH) currently trading at $3,947.23, restaking protocols like EigenLayer are attracting increased attention from validators seeking to maximize returns while supporting the next generation of Actively Validated Services (AVSs).

How EigenLayer Restaking Works for Ethereum Validators

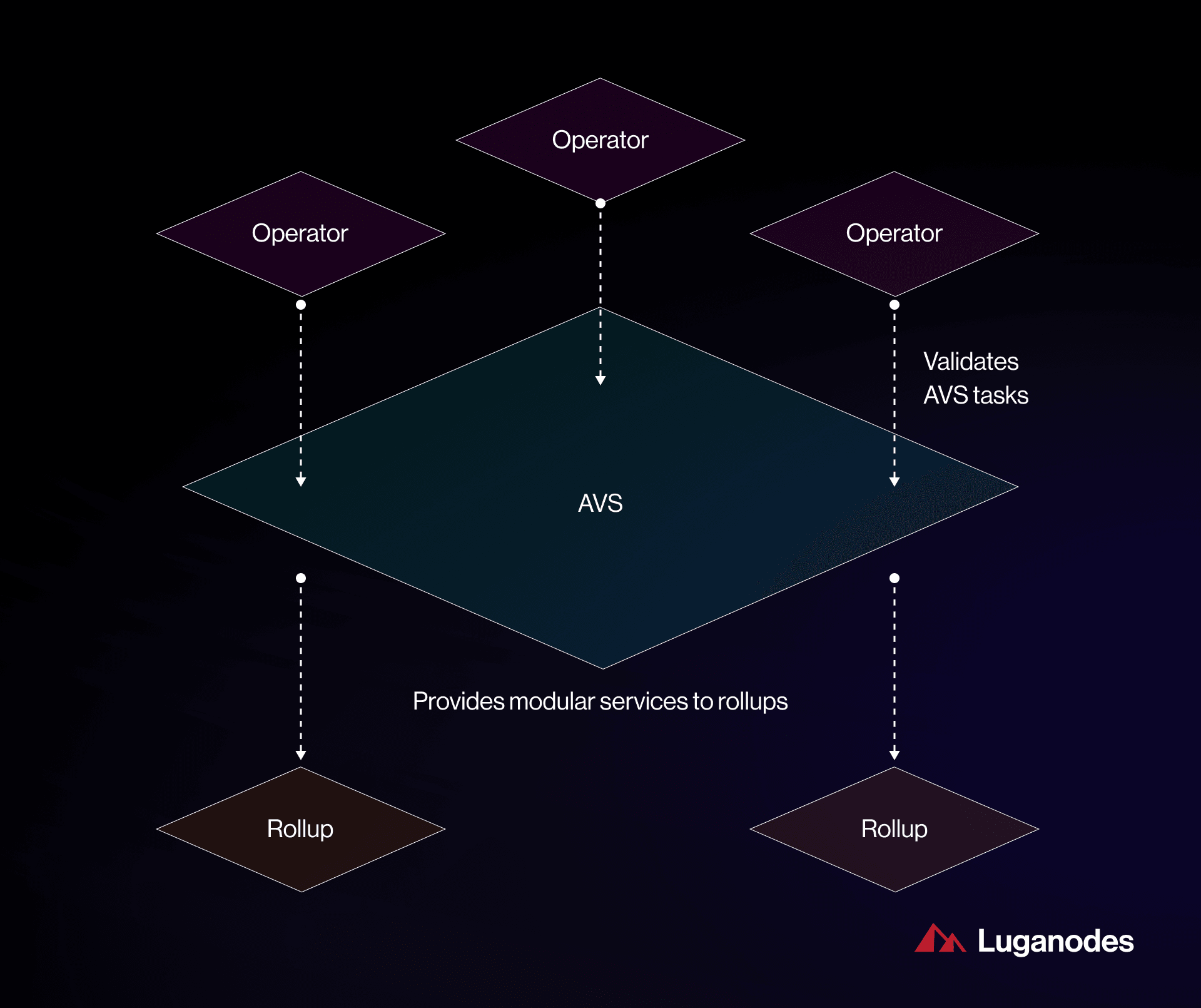

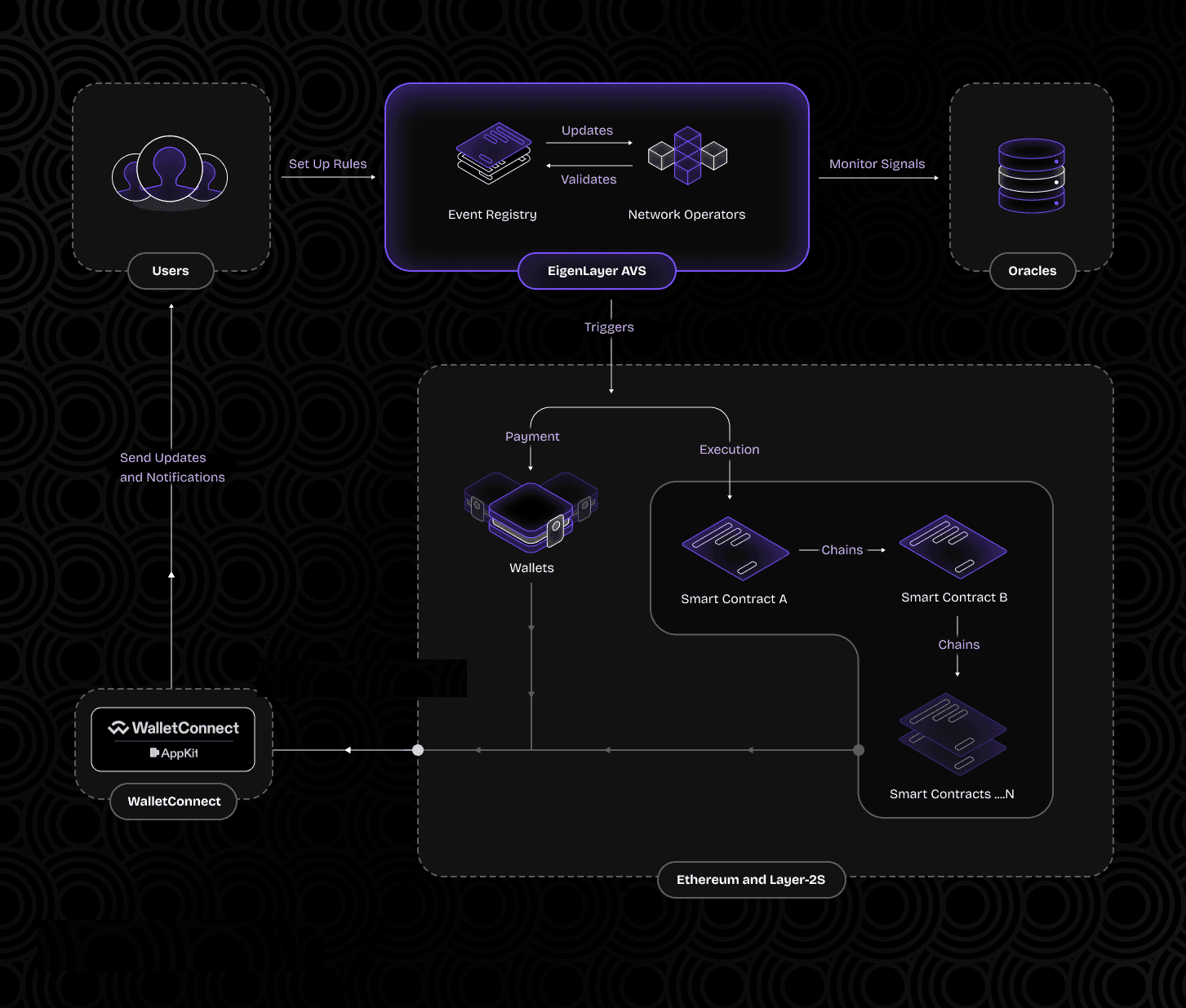

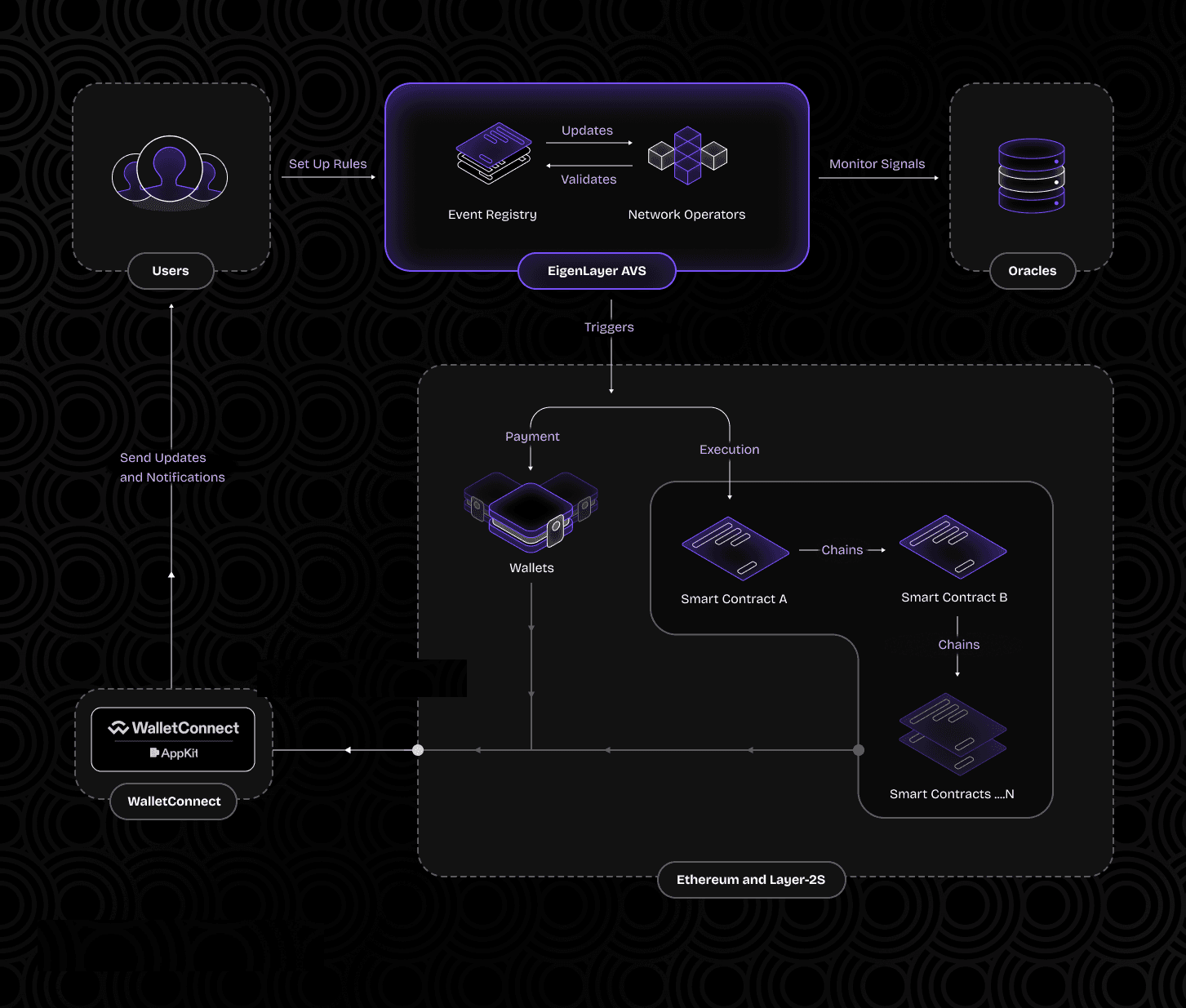

At its core, EigenLayer enables Ethereum validators to extend their staked ETH, either natively or via liquid staking tokens (LSTs) such as stETH, rETH, or cbETH, to secure additional protocols beyond the base Ethereum chain. This process is called restaking, and it allows validators to leverage their existing capital and infrastructure across multiple networks.

The critical innovation here is pooled security. Instead of every new protocol building its own validator set from scratch, AVSs can tap into the robust security provided by Ethereum’s established validator network. This not only reduces fragmentation but also raises the overall standard for protocol security in DeFi and beyond.

For a detailed walkthrough on the underlying mechanism, see the official EigenLayer Whitepaper.

Pooled Security: Raising the Bar for Protocol Protection

The concept of pooled security means that when an AVS joins EigenLayer, it inherits not just a validator set but also their collective economic stake. With ETH at $3,947.23, even modest participation by large validators translates into substantial collateral backing each AVS. This shared risk model incentivizes high standards across all participating protocols.

- Enhanced Slashing Conditions: Validators are now subject to slashing not just on Ethereum but also on any AVS they choose to secure. This dual-layer penalty system creates a strong disincentive against malicious or negligent behavior.

- Diversified Rewards: By restaking, validators can earn additional yield streams from supporting multiple AVSs, boosting total returns without requiring extra capital outlay.

- Lower Entry Barriers for New Protocols: Startups in DeFi or cross-chain infrastructure can bootstrap with institutional-grade security by leveraging EigenLayer’s validator pool instead of recruiting their own network from zero.

This free-market dynamic ensures that only well-governed and reliable AVSs attract validator support, further aligning incentives between protocol builders and stakers. For more on this economic paradigm shift, check out insights from Gate.com’s analysis of EigenLayer’s model.

The Dual-Edged Sword: Security Innovations and Validator Risk Mitigation

The introduction of restaking comes with both opportunity and risk for Ethereum validators. On one hand, it unlocks higher reward potential and more efficient use of locked capital; on the other hand, it exposes participants to additional slashing vectors if an AVS suffers an exploit or governance failure.

This dual-edged model demands vigilance: Validators must carefully vet which AVSs they support and monitor evolving slashing conditions across all layers they secure. The market-driven approach ensures that poorly designed protocols will struggle to attract meaningful restaked capital, a win for ecosystem integrity but a challenge for due diligence processes.

Market data shows that as of now, Ethereum trades at $3,947.23. This price point underscores the significant economic weight behind EigenLayer’s pooled security model. Validators are not only protecting the base chain but also securing billions in value across AVSs, amplifying both the responsibility and the rewards.

Restaking Protocol Benefits and New Security Innovations

The benefits of EigenLayer restaking for Ethereum validators go beyond simple yield optimization. By participating in this ecosystem, validators help bootstrap new protocols with instant, credible security, eliminating the cold start problem for emerging DeFi and cross-chain projects. This is particularly attractive in today’s competitive landscape, where time-to-market and security assurances are critical differentiators.

Security innovations introduced by EigenLayer include:

Top 3 Ways EigenLayer Restaking Boosts Validator Security

-

Pooled Security for AVSs: EigenLayer enables Ethereum validators to restake their ETH, extending Ethereum’s robust security to Actively Validated Services (AVSs). By leveraging the existing validator set, AVSs benefit from Ethereum’s pooled security without needing to bootstrap their own validator network.

-

Dual-Layer Slashing Incentives: Validators participating in EigenLayer restaking are subject to additional slashing conditions from both Ethereum and the AVSs they secure. This dual-layer mechanism incentivizes higher performance and reliability, reducing risks of validator misbehavior and enhancing overall protocol security.

-

Broader Participation via Liquid Restaking: EigenLayer supports both native ETH restaking and liquid staking tokens (LSTs) like stETH, rETH, and cbETH. This inclusivity allows more participants to contribute to network security, increasing decentralization and resilience across protocols.

Furthermore, liquid restaking broadens participation by allowing holders of LSTs like stETH or rETH to contribute to pooled security without unstaking from Ethereum. This flexibility increases decentralization and resilience while reducing capital inefficiency, a core tenet of modern DeFi design. For a deeper breakdown, see OKX’s guide on EigenLayer benefits and risks.

Validator Risk Mitigation in a Restaked World

Despite these advances, risk mitigation remains paramount. The dual-layer slashing mechanism means that validator misbehavior or technical failures can result in penalties on both Ethereum and any AVS they secure. As such, prudent risk management is essential:

- Diversification: Avoid overexposure by selectively supporting AVSs with robust governance and transparent codebases.

- Continuous Monitoring: Use real-time analytics tools to track slashing conditions and AVS performance metrics.

- Community Coordination: Engage with other validators through forums or DAOs to share insights on emerging risks.

This evolving landscape rewards those who stay informed and proactive. For real-time discussions on validator best practices and active governance proposals within EigenLayer, monitor conversations on crypto Twitter.

The Future of Restaking: What Comes Next?

The restaking paradigm is still young but rapidly maturing. As more protocols launch Actively Validated Services atop EigenLayer, expect increased competition among validators, and higher standards for both technical reliability and economic alignment. Liquid staking tokens will likely play a larger role as adoption grows, driving further decentralization.

The continued evolution of restaking protocol benefits hinges on three pillars: validator diligence, robust AVS governance, and an open marketplace for pooled security services. If these elements remain strong, the Ethereum ecosystem stands to gain unprecedented levels of protection against attacks while unlocking new reward streams for its most committed participants.