Ethereum’s staking landscape has undergone a dramatic transformation with the advent of EigenLayer liquid staking. As of September 2025, Ethereum trades at $4,531.74, reflecting robust market confidence in its evolving infrastructure. EigenLayer is at the forefront of this evolution, introducing a new paradigm: restaking. This mechanism allows users to redeploy their already-staked ETH or liquid staking tokens (LSTs) – such as stETH (Lido), rETH (Rocket Pool), and cbETH (Coinbase) – to secure additional decentralized services beyond the Ethereum base layer. The result is a powerful boost in capital efficiency, security, and yield opportunities across DeFi.

How Restaking Redefines Ethereum Liquid Staking Protocols

The traditional model for liquid staking on Ethereum enabled users to stake ETH through protocols like Lido or Rocket Pool and receive a tradable token (e. g. , stETH or rETH) representing their claim on the underlying assets and accrued rewards. While this increased liquidity and composability in DeFi, it left considerable untapped potential for further yield generation and network utility.

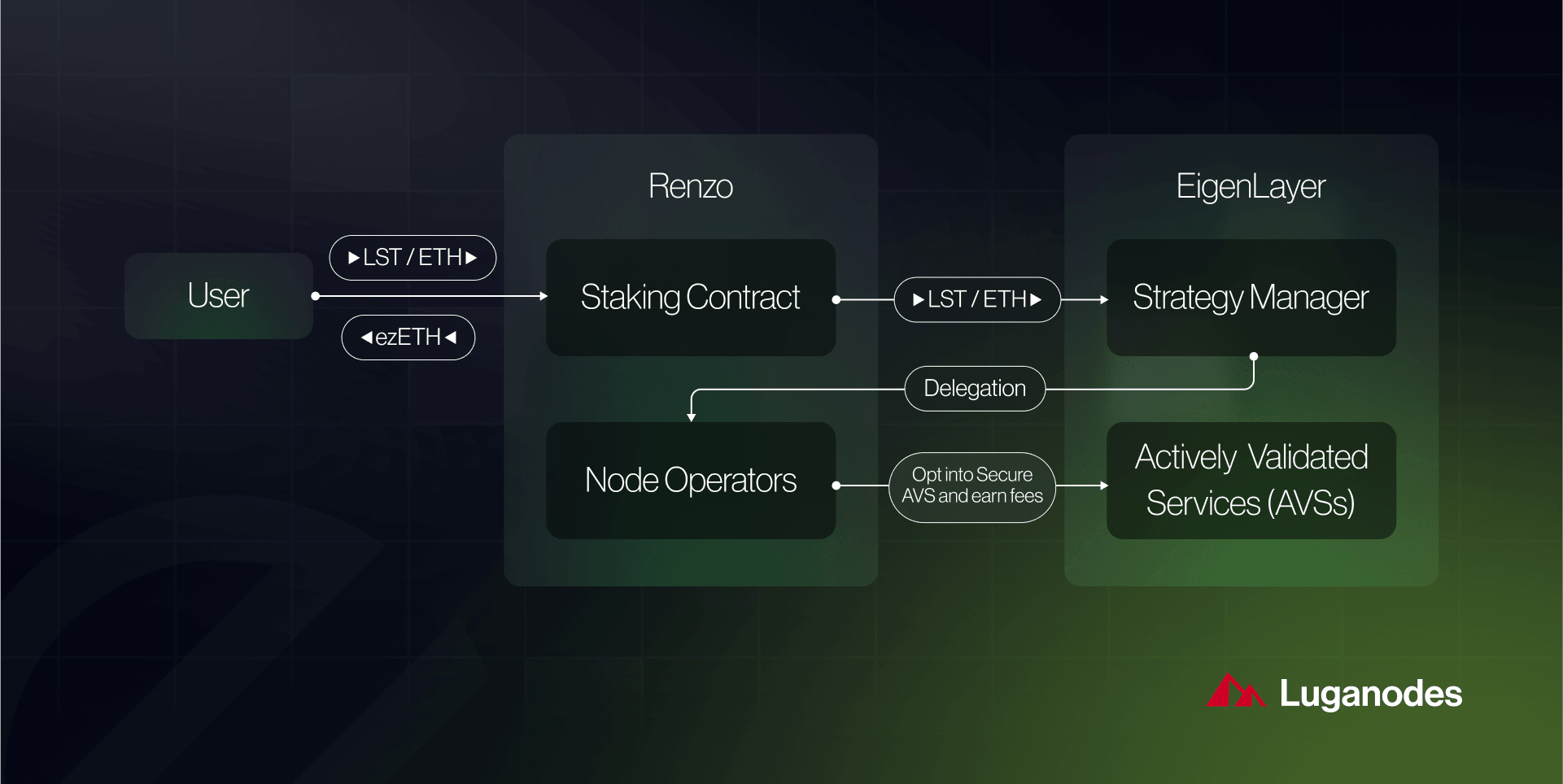

EigenLayer’s restaking protocol changes this dynamic by enabling both liquid restaking and native restaking. In liquid restaking, users deposit their LSTs directly into EigenLayer’s smart contracts without running validator nodes. This approach democratizes participation, letting anyone with LSTs access new streams of rewards by supporting a diverse array of decentralized applications (AVSs). For those running validator nodes, native restaking via EigenPods allows them to redirect withdrawal credentials to EigenLayer contracts, multiplying their impact across multiple protocols while earning additional incentives.

“The importance of liquid restaking within EigenLayer cannot be overemphasized. It makes participation in the ecosystem more capital-efficient. ” – Hacken

Deposit Caps Lifted: A Catalyst for DeFi Innovation

The removal of deposit caps on all supported LSTs by late 2023 marked a pivotal moment for EigenLayer’s adoption cycle. No longer constrained by protocol-imposed limits, users poured assets into EigenLayer contracts – driving total value locked (TVL) above $18 billion by mid-2024 (Reuters). This influx signaled increased trust in both the security model and the promise of higher yields from emerging AVSs that leverage Ethereum’s security through restaked collateral.

The inclusion of new LSTs such as ankrETH (Ankr), swETH (Swell), and LsETH (Liquid Collective) further broadened participation options (Ankr Blog). Each addition expands the pool of eligible assets that can be put to work securing not just Ethereum itself but also a growing suite of permissionless services, from oracle networks to cross-chain bridges, thus multiplying utility for stakers.

The Market Impact: Yield Optimization Meets Systemic Risk

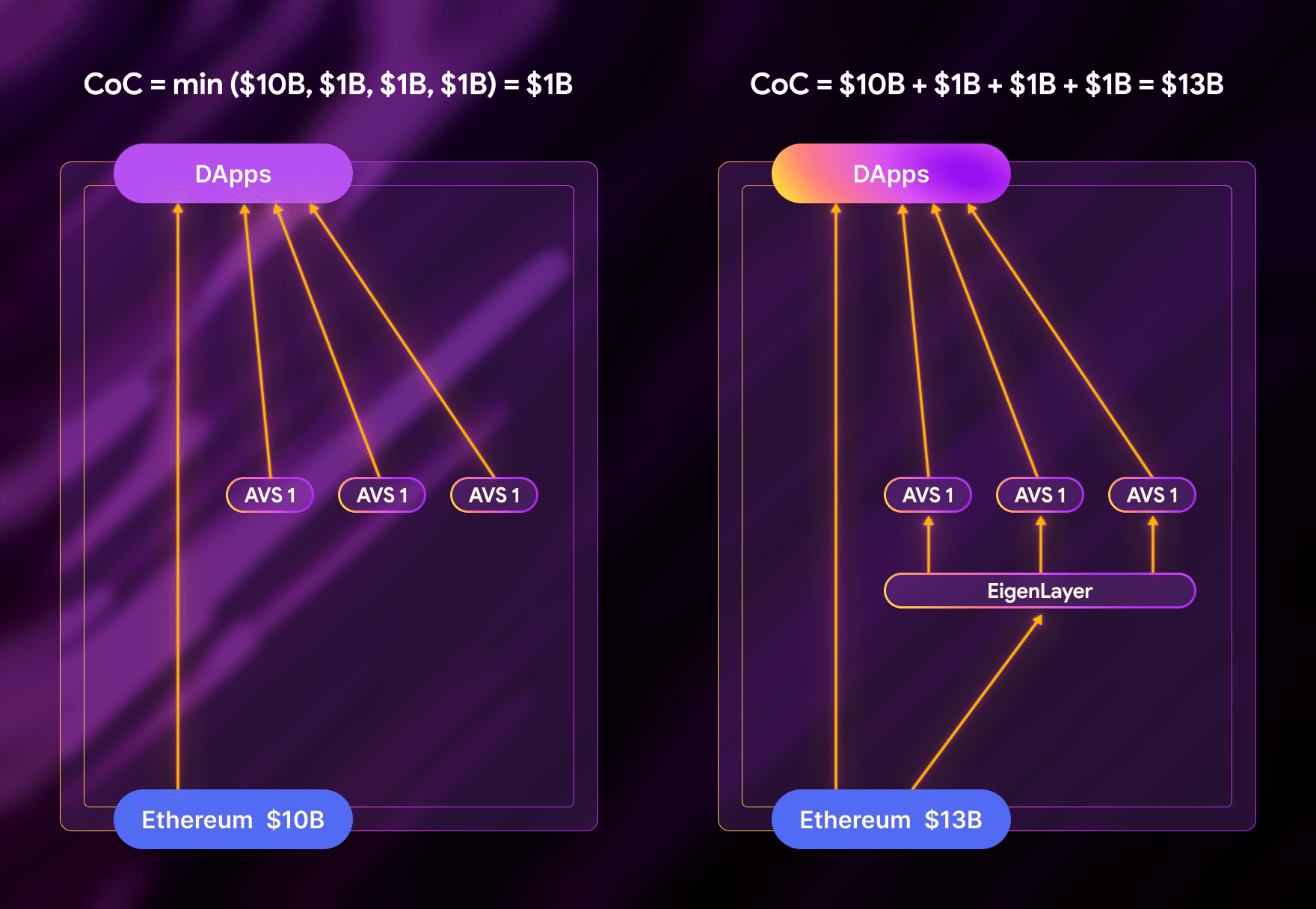

The surge in TVL reflects intense demand among investors for enhanced yields, EigenLayer currently offers approximately 4.2% returns depending on protocol specifics (Metalamp.io). However, this gold rush is not without risk. By enabling rehypothecation, whereby staked assets are reused across multiple protocols, EigenLayer introduces new vectors for systemic risk. If slashing events occur or if AVS services experience failures, cascading effects could threaten both individual participants and broader network stability (Blockworks).

This complexity underscores why thorough due diligence is essential before engaging in DeFi restaking. The promise is clear: maximize capital efficiency while helping secure next-generation decentralized infrastructure. Yet participants must understand withdrawal credential management, slashing conditions, and how each AVS leverages their collateral.

Ethereum (ETH) Price Prediction 2026-2031: Impact of EigenLayer Restaking

Forecast based on EigenLayer TVL growth, staking innovations, and evolving DeFi trends

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (%) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,950 | $5,100 | $6,700 | +12% (avg) | DeFi TVL growth continues, staking yields attract new capital. Regulatory clarity improves sentiment. |

| 2027 | $4,400 | $5,800 | $8,100 | +13.7% (avg) | Competing L1s/L2s increase pressure. New use cases for restaked ETH emerge. |

| 2028 | $4,950 | $6,650 | $9,500 | +14.7% (avg) | Mainstream adoption of restaking. Some volatility as protocols mature. |

| 2029 | $5,600 | $7,500 | $11,200 | +12.8% (avg) | ETH benefits from broader DeFi/AI integration. Macro cycles may cause short-term dips. |

| 2030 | $6,200 | $8,400 | $13,000 | +12% (avg) | Ethereum 3.0 upgrades, EigenLayer and liquid staking reach mass adoption. Regulatory risks linger. |

| 2031 | $7,000 | $9,250 | $15,200 | +10.1% (avg) | ETH solidifies as DeFi backbone, but faces competition from new chains and protocol risks. |

Price Prediction Summary

Ethereum’s price outlook through 2031 is broadly bullish, supported by the rapid adoption of EigenLayer’s restaking and the ongoing expansion of liquid staking. While price appreciation is expected to be strong, especially as TVL and utility grow, periods of volatility and regulatory uncertainty may introduce downside risk. The minimum and maximum ranges reflect both potential slashing events and bullish scenarios tied to major DeFi adoption and technological upgrades.

Key Factors Affecting Ethereum Price

- EigenLayer TVL growth and adoption of restaking protocols

- Expansion and integration of liquid staking tokens (LSTs)

- Ethereum protocol upgrades (e.g., scalability, security)

- Regulatory clarity or crackdowns on DeFi and staking

- Competition from alternative L1s and L2s

- Macro market cycles and risk sentiment

- Potential for network slashing or smart contract exploits

- Mainstream financial adoption of Ethereum and DeFi

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Why Liquid Restaking Is Central to DeFi’s Future Trajectory

The narrative around restaking isn’t just about higher APYs, it’s about transforming how economic security is provisioned across Web3 ecosystems. By creating an open marketplace where AVSs can “rent” Ethereum’s robust security through opt-in validation by restakers (FinancialContent), EigenLayer positions itself as an indispensable layer within Ethereum’s modular architecture.

As EigenLayer matures, its influence on the broader Ethereum liquid staking protocols ecosystem becomes undeniable. The protocol’s composability allows for new DeFi primitives, such as restaked-LST vaults and modular security marketplaces, to flourish. These innovations enable both retail users and institutional players to optimize their risk-reward profiles with unprecedented flexibility, making restaking a core pillar in the next stage of Ethereum’s evolution.

Navigating the Risks: What Stakers Need to Know

Despite the clear upside, participants must remain vigilant. The rehypothecation of staked assets via restaking introduces layered complexities that can amplify losses during adverse events. For example, if an AVS malfunctions or is compromised, restakers could be subject to slashing penalties that cascade through interconnected protocols. This risk is not merely hypothetical, the interdependencies created by EigenLayer’s model demand a robust understanding of smart contract security, AVS governance, and withdrawal rights management.

Moreover, as more protocols integrate with EigenLayer and TVL continues to rise above $18 billion, the systemic importance of sound risk frameworks grows. Ongoing audits, transparent governance processes, and community-driven oversight will be essential in safeguarding both individual stakers and the health of the overall DeFi ecosystem.

Key Benefits and Risks of Using EigenLayer for Liquid Restaking

-

Enhanced Capital Efficiency: EigenLayer enables users to redeploy their staked ETH or liquid staking tokens (LSTs), such as stETH (Lido), rETH (Rocket Pool), and cbETH (Coinbase), to secure additional decentralized services—maximizing the utility and yield of each staked asset.

-

Access to Higher Yields: By participating in restaking, users can earn extra rewards on top of standard staking returns. As of September 2025, Ethereum (ETH) is priced at $4,531.74, and EigenLayer’s TVL has surpassed $18 billion, reflecting strong demand for these enhanced yields.

-

Broader Participation via LST Integration: EigenLayer supports a growing range of LSTs, including ankrETH (Ankr), swETH (Swell), and LsETH (Liquid Collective), allowing users who do not operate validator nodes to participate in restaking and DeFi security.

-

Increased Network Security: By extending Ethereum’s security to additional decentralized applications, EigenLayer helps reinforce the overall ecosystem, making it more robust against attacks and failures.

-

Complexity and Slashing Risks: Restaking introduces new risks, including the potential for slashing (loss of staked assets) if delegated services misbehave. Participants must carefully manage withdrawal credentials and understand protocol-specific slashing conditions.

-

Potential for Systemic Risk: The rehypothecation of ETH through restaking could lead to cascading failures if multiple services experience issues simultaneously, amplifying the impact across the DeFi ecosystem.

Community Pulse: Sentiment Around Restaking’s Future

The Ethereum community remains divided on whether this new paradigm will ultimately make DeFi safer or introduce new forms of fragility. Some see EigenLayer as a gateway to sustainable yield generation and protocol-level resilience; others warn that unchecked rehypothecation could set the stage for systemic shocks if not carefully managed.

To gauge sentiment, we asked our readers:

How do you feel about participating in liquid restaking via EigenLayer?

With Ethereum (ETH) currently at $4,531.74 and EigenLayer’s total value locked surpassing $18 billion, liquid restaking is gaining traction. By depositing liquid staking tokens like stETH, rETH, or cbETH into EigenLayer, users can earn extra rewards and help secure more decentralized services. However, this comes with new risks and complexities. What’s your take?

Looking Ahead: The Future of Restaking on Ethereum

With Ethereum (ETH) currently priced at $4,531.74, capital efficiency and yield optimization remain top priorities for both retail investors and institutions navigating DeFi’s rapid expansion. As more LSTs become eligible for restaking, and as AVS diversity increases, EigenLayer is poised to become a foundational component in Ethereum’s security stack.

Yet, success will hinge on continued education, transparency around risks, and innovation in risk management tools. For those willing to navigate these challenges thoughtfully, liquid restaking offers a pathway not only to higher yields but also to active participation in shaping the future trust layer of decentralized finance.