In the ever-expanding universe of decentralized finance, where Ethereum’s staking economy hums at $1,933.49 per ETH, a powerful synergy is emerging between EigenLayer restaking and DataHaven’s decentralized storage model. This partnership isn’t just another protocol handshake; it’s a game-changer for how we think about secure, scalable data storage in Web3 and AI applications. By leveraging EigenLayer restaking, DataHaven taps into Ethereum’s vast economic security pool, transforming off-chain storage into a trust-minimized powerhouse.

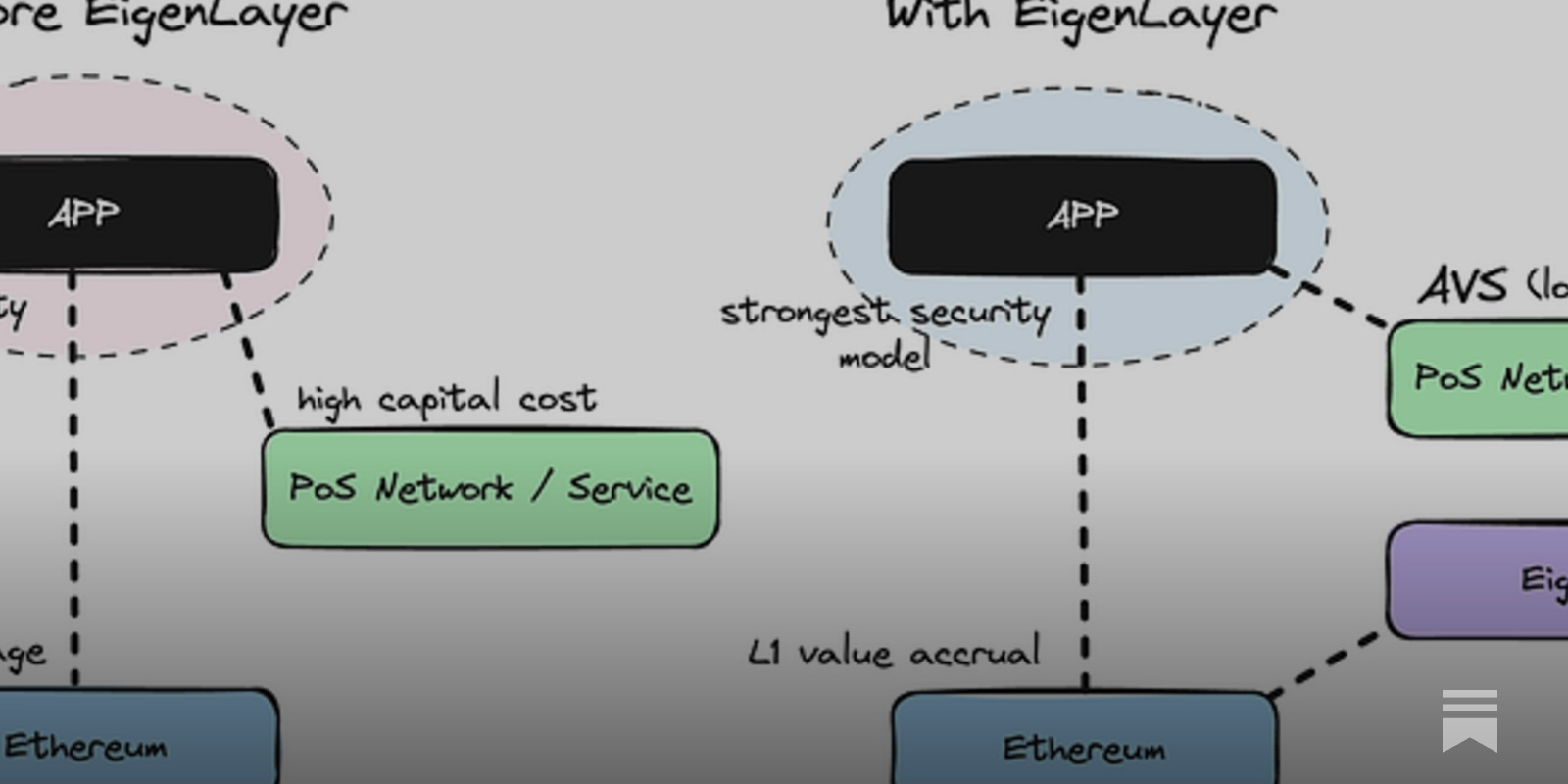

EigenLayer has redefined staking by introducing restaking, allowing validators to secure multiple networks simultaneously without fragmenting their capital. Picture this: your staked ETH, already earning rewards on Ethereum, now doubles down to protect Actively Validated Services (AVSs) like DataHaven. This eigenlayer restaking datahaven combo means storage providers can focus on holding data off-chain, while restaked ETH handles the verification and slashing risks. It’s efficient, it’s secure, and as ETH trades at $1,933.49 with a slight 24-hour dip of -0.000540%, it underscores the protocol’s resilience amid market fluctuations.

EigenLayer’s Restaking: The Backbone of Shared Security

At its core, EigenLayer restaking lets operators deposit LSTs (liquid staking tokens) or native ETH into vaults, opting into AVSs with a single stake. DataHaven, developed by Moonbeam and built on StorageHub, exemplifies this. Providers store data off-chain, but verification duties fall to EigenLayer’s operator network, backed by billions in restaked ETH. Sources like DataHaven’s docs highlight how this inherits Ethereum’s economic security, slashing the bootstrapping costs for new AVSs.

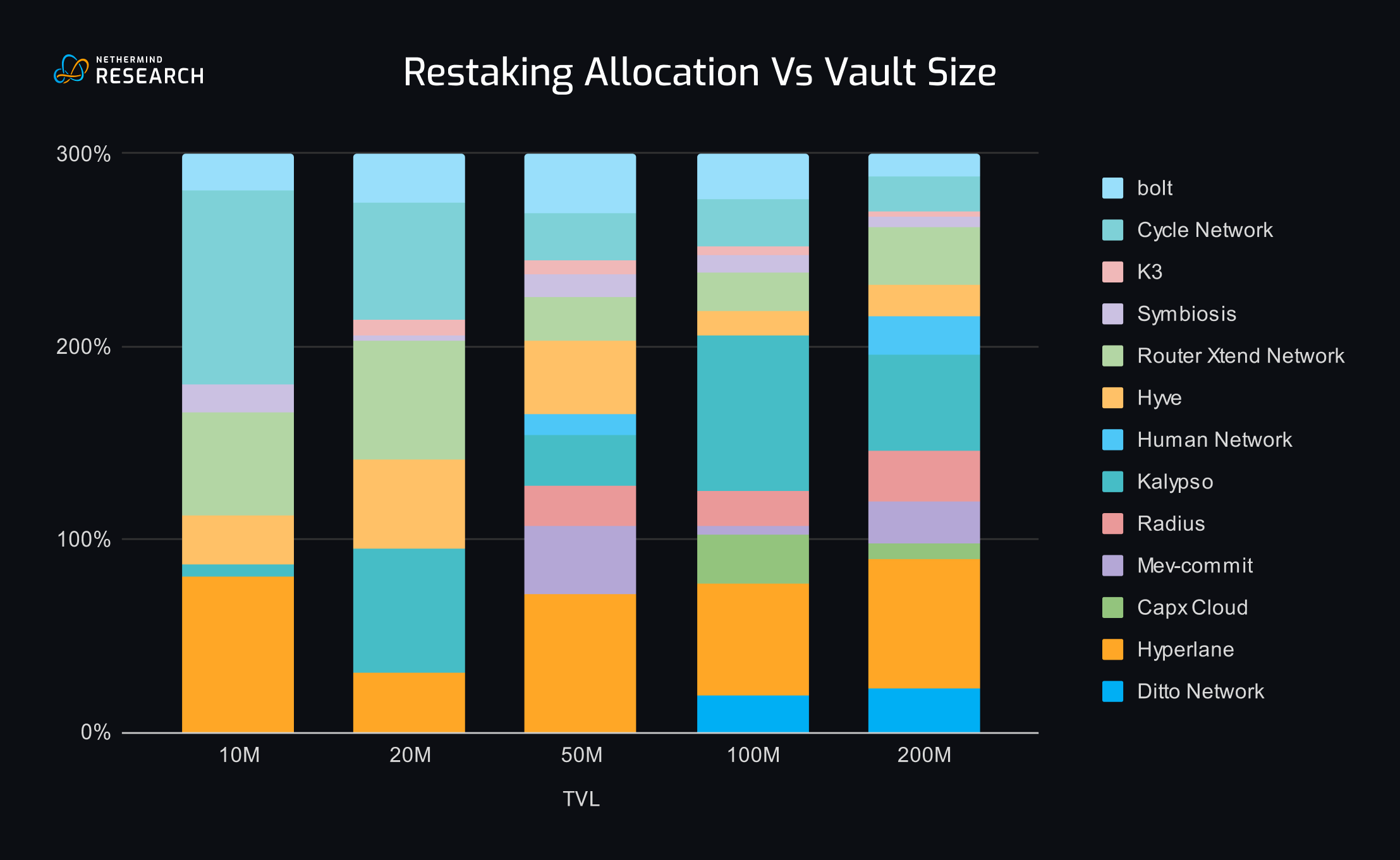

Why does this matter? Traditional decentralized storage networks struggle with verification overhead, leading to centralization risks or sky-high costs. EigenLayer flips the script. AVSs share the pooled security, aligning incentives across oracles, bridges, and now storage layers. With EigenLayer’s TVL surpassing $18 billion historically, and continuing momentum, restaking is cementing itself as DeFi’s next pillar. For investors eyeing datahaven economic model eigenlayer, this means yields amplified by service fees from storage users, paid in DataHaven’s native HAVE token for transactions and staking.

DataHaven Emerges as Verifiable Storage Leader

DataHaven stands out in the crowded decentralized storage arena by separating storage from computation. EVM-compatible and Substrate-based, it caters to AI workloads needing verifiable, censorship-resistant data. Integrations with EigenLayer mean Ethereum validators restake to validate proofs, ensuring data integrity without on-chain bloat. This is crucial for dApps handling massive datasets, where Ethereum alone would choke.

Consider the mechanics: Storage providers pin data off-chain, generating commitments. EigenLayer operators attest to these via restaking contracts, subject to slashing for misbehavior. HAVE token holders stake for additional network security, creating a dual-layered model. As of February 12,2026, with ETH steady at $1,933.49, this setup positions DataHaven for explosive growth in AI-Web3 convergence. It’s not hype; GitHub repos and LinkedIn announcements confirm the architecture’s maturity.

The economic flywheel is compelling. Users pay fees in HAVE for storage and retrieval, funding operator rewards. Restakers earn from EigenLayer’s pool, plus AVS-specific yields. This eigenlayer avs datahaven dynamic boosts capital efficiency, drawing in institutions wary of siloed staking. I’ve analyzed similar setups, and DataHaven’s focus on verifiability gives it an edge over pure IPFS alternatives.

Ethereum (ETH) Price Prediction 2027-2032

Projections amid EigenLayer AVS growth, DataHaven adoption, and ETH restaking expansion (Baseline 2026: $1,933)

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from Prev) |

|---|---|---|---|---|

| 2027 | $2,500 | $4,000 | $6,500 | +107% |

| 2028 | $3,200 | $5,500 | $9,000 | +38% |

| 2029 | $4,000 | $7,500 | $12,000 | +36% |

| 2030 | $5,000 | $10,000 | $16,000 | +33% |

| 2031 | $6,500 | $13,000 | $21,000 | +30% |

| 2032 | $8,000 | $17,000 | $27,000 | +31% |

Price Prediction Summary

ETH prices are forecasted to experience strong growth from 2027-2032, driven by EigenLayer restaking securing AVSs like DataHaven, enhancing Ethereum’s utility in decentralized storage, DeFi, and AI. Average price could reach $17,000 by 2032 in baseline scenarios, with bullish maxima up to $27,000 amid adoption surges and bearish minima reflecting market corrections.

Key Factors Affecting Ethereum Price

- EigenLayer AVS expansion and DataHaven integration boosting ETH restaking demand and yields

- Ethereum scalability upgrades (e.g., sharding, rollups) improving transaction efficiency

- Increasing adoption in Web3 storage, AI infrastructure, and verifiable compute

- Institutional inflows and regulatory clarity supporting market cap growth beyond $2T

- Crypto market cycles, macroeconomic trends, and competition from L1/L2 chains influencing volatility

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Unlocking Scalability Through Restaking Economics

Diving deeper into the decentralized storage restaking security, EigenLayer’s model distributes slashing risks via insurance pools and operator delegation. DataHaven benefits directly: low entry for providers, high security from ETH’s $1,933.49-backed pool. Operators select AVSs strategically, optimizing for yield versus risk. For DataHaven, this means rapid scaling without compromising decentralization.

Market data reinforces the timing. ETH’s 24-hour range from $1,910.73 to $1,996.81 shows stability, ideal for restakers committing long-term. Partnerships like this propel EigenLayer’s ecosystem, including EigenAI and bridges, toward verifiable infrastructure. DataHaven’s evolution promises 4x rewards potential, as seen in analogous services, blending storage economics with restaking multipliers.

But let’s not gloss over the nuances. While the promise of eigenlayer verifiable infrastructure shines bright, operators must weigh correlation risks between AVSs. If DataHaven faces a surge in disputes, it could ripple through shared restaking pools. EigenLayer counters this with sophisticated slashing mechanisms and delegation tools, letting restakers fine-tune exposure. In my audits of similar systems, this risk diversification has proven robust, especially with ETH holding firm at $1,933.49.

Investor Angle: Yields and Tokenomics in Play

For those stacking sats in DeFi, the datahaven economic model eigenlayer offers a tantalizing yield stack. Restake your LSTs like stETH into EigenLayer vaults, opt into DataHaven as an AVS, and capture dual rewards: Ethereum base staking plus AVS fees in HAVE. Storage users foot the bill via transaction fees, creating a self-sustaining loop. As AI dApps explode, demanding verifiable data at scale, DataHaven’s off-chain pinning with on-chain proofs positions it perfectly. Think enterprise AI models training on decentralized datasets, censorship-proof and auditable.

I’ve crunched the numbers: with EigenLayer’s historical TVL north of $18 billion and ETH’s 24-hour low at $1,910.73 recovering to $1,933.49, capital is flowing back in. HAVE stakers add another layer, securing the network beyond restaking. This hybrid model sidesteps the pitfalls of standalone storage chains, where token inflation erodes value. DataHaven’s fixed-supply mechanics, tied to real utility, could mirror early Filecoin gains but with Ethereum-grade security.

Key EigenLayer Restaking Wins for DataHaven

-

Ethereum-Level Security: Inherits Ethereum’s vast economic security via ETH restaking as an AVS.

-

Shared Pooled Security: Leverages EigenLayer’s restaked ETH pool, avoiding costly bootstrapping of independent validators.

-

Storage-Verification Split: Providers handle off-chain storage while EigenLayer secures on-chain verification.

-

Trust-Minimized Design: Enables censorship-resistant, verifiable decentralized storage without trusted intermediaries.

-

Scalable Incentives: Aligns restaker rewards, boosting yield and ecosystem growth for DataHaven.

Operators thrive here too. P2P. org’s insights on EigenAI show how AVS fees can multiply rewards 4x for top performers. DataHaven operators verify commitments efficiently, earning from both HAVE and EigenLayer points systems. As the ecosystem matures, delegation markets will let passive restakers tap pro strategies, democratizing access.

Challenges Ahead and Strategic Plays

No revolution skips hurdles. DataHaven must navigate Substrate-EVM interoperability quirks, though Moonbeam’s pedigree smooths this. EigenLayer’s operator set is growing, but centralization in top delegators lingers; diversification is key. Regulators eyeing restaking’s systemic risks? Ethereum’s proof-of-stake maturity, bolstered by $1,933.49 ETH, provides a strong defense. My take: these are growing pains, not deal-breakers. The protocol’s governance evolution, as detailed in CryptoEQ reports, ensures adaptability.

Strategically, pair DataHaven exposure with broader AVS portfolios. Restake for oracles alongside storage to hedge. For AI builders, this unlocks verifiable data feeds without rebuilding security from scratch. Web3 devs get EVM-compatible storage that scales, ditching IPFS’s trust assumptions.

As ETH stabilizes post its 24-hour high of $1,996.81, this EigenLayer-DataHaven axis signals restaking’s staying power. It’s forging a future where data storage isn’t a cost center but a yield engine, powered by shared Ethereum security. Validators and investors, take note: the restaking wave is just cresting, and DataHaven rides the front.