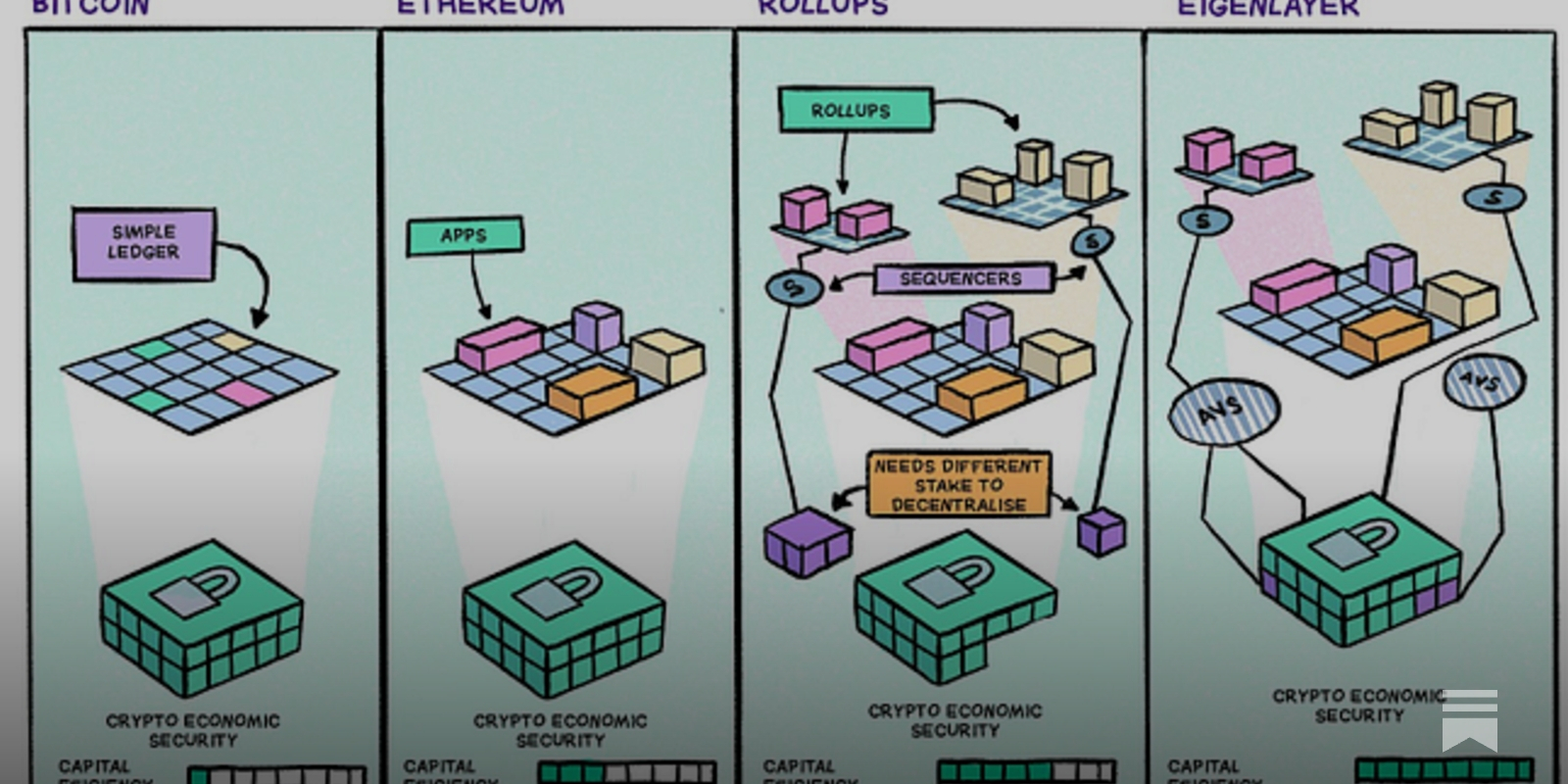

Restaked rollups are rapidly redefining the Ethereum scalability landscape. By fusing the efficiency of rollups with the robust security guarantees of restaking, these protocols promise a new paradigm for decentralized apps and modular blockchain infrastructure. The concept is simple yet powerful: leverage staked ETH, via protocols like EigenLayer, to extend Ethereum’s security to off-chain rollup environments. This mechanism not only amplifies trust-minimized scaling but also unlocks new economic incentives for stakers and developers.

How Restaked Rollups Work

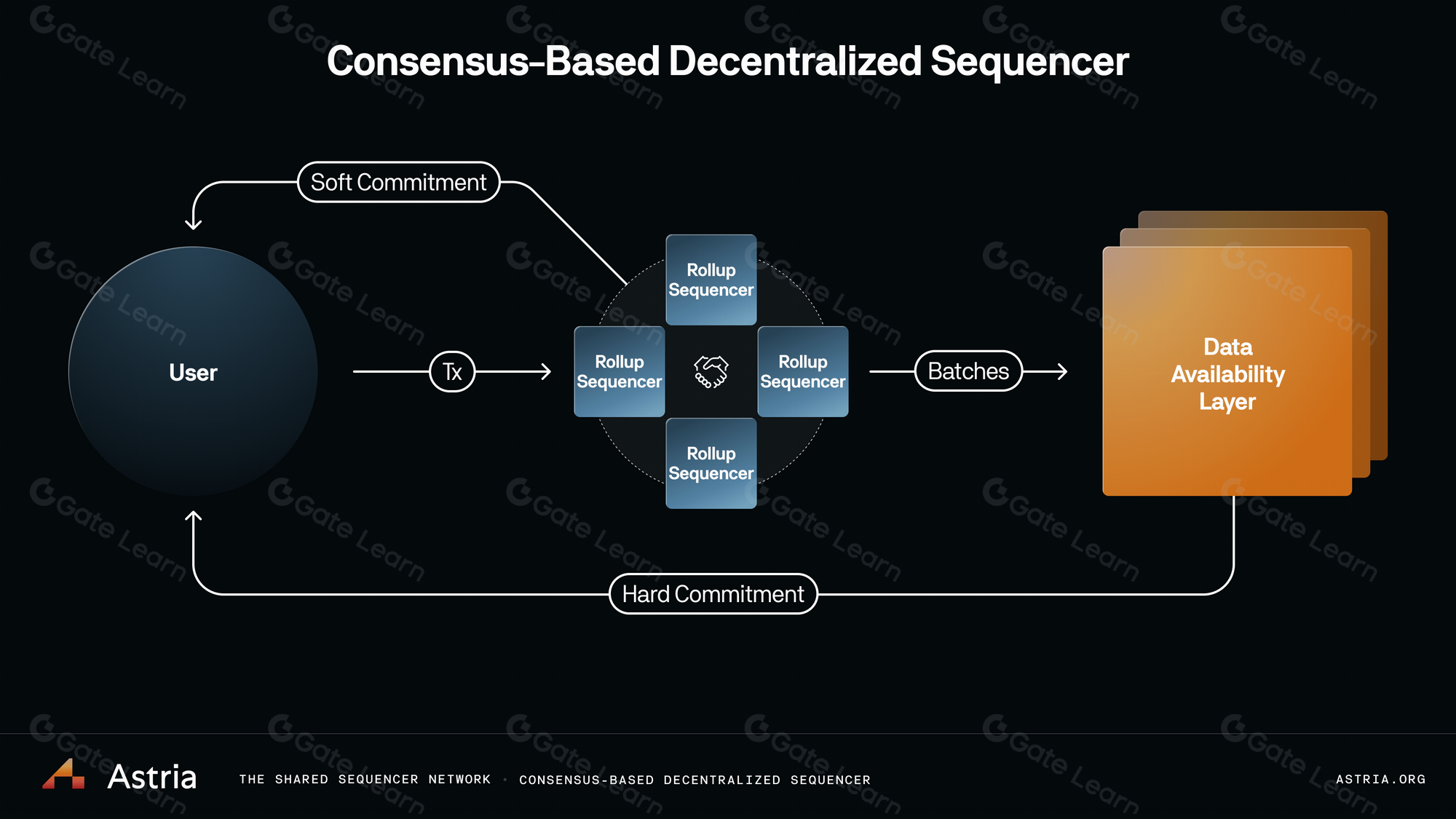

At their core, restaked rollups combine three innovations: decentralized sequencing, cryptographic verification, and fast finality. Traditional rollups already scale Ethereum by bundling transactions off-chain and submitting proofs to the mainnet. Restaked rollups take this further by tapping into the security pool of restaked ETH or liquid staking tokens (LSTs), provided through EigenLayer’s middleware protocol.

This approach means that validators who already secure Ethereum can “restake” their assets to also secure additional services, such as decentralized sequencers or data availability layers, for these emerging rollup chains. The result is a layered security model where economic penalties for malicious behavior are enforced by slashing both on Ethereum and within the AVS (Actively Validated Service) ecosystem.

EigenLayer’s Role in Rollup Security

EigenLayer is pioneering this restaking primitive, acting as a coordination marketplace where stakers, operators, and services converge. Instead of building isolated security models for every new chain or application, projects can plug into EigenLayer’s AVS suite, benefiting from pooled trust and capital efficiency. This not only reduces fragmentation but also increases network resilience against attacks.

Recent integrations highlight this trend: Swell partnered with AltLayer, EigenDA, and Chainlink to launch a Layer 2 focused on liquid restaked assets, demonstrating how restaked rollups can deliver native yield opportunities while maintaining high throughput and low fees (source). Meanwhile, EigenLayer’s expansion into Mantle Network and ZKsync brings its modular security framework beyond Ethereum mainnet, enabling decentralized zero-knowledge proving and scalable data availability across ecosystems.

Key Benefits of Restaked Rollups for Developers & Users

-

Enhanced Security via Restaking: Restaked rollups leverage EigenLayer’s restaking mechanism, allowing rollups to inherit Ethereum’s robust security by utilizing restaked ETH. This significantly reduces the risk of attacks and increases trust for both developers and users.

-

Decentralized Sequencing & Verification: By integrating decentralized sequencing and verification services from EigenLayer AVSs, restaked rollups minimize single points of failure and censorship risks, ensuring more reliable and transparent operations.

-

Faster Finality for Transactions: Restaked rollups offer accelerated transaction finality compared to traditional rollups, improving user experience and enabling developers to build latency-sensitive applications.

-

Native Restaking Yield Opportunities: Users can earn additional yield by participating in restaking protocols like Swell and AltLayer, which natively support liquid restaked assets and provide incentives for securing the network.

-

Lower Fees & Increased Scalability: Restaked rollups, such as those built with AltLayer and EigenDA, offer reduced transaction costs and higher throughput, making decentralized applications more accessible and efficient.

-

Expanded Ecosystem Integration: With EigenLayer’s expansion to platforms like Mantle Network and ZKsync, restaked rollups benefit from broader interoperability and access to advanced data availability and zero-knowledge proving services.

The Modular Future: Beyond Mainnet

The rise of restaking rollup protocols signals a shift toward composable blockchain architectures. By decoupling execution from consensus, and allowing third-party AVSs to compete on service quality, EigenLayer is setting the stage for a more dynamic Ethereum ecosystem. This creates fertile ground for experimentation in governance models, MEV minimization strategies, and cross-chain interoperability.

The numbers are compelling: as more ETH is staked (and now restaked), the aggregate value securing these systems grows, further incentivizing honest participation while deterring adversarial actors through credible slashing risks. In effect, Eigenlayer rollup security becomes a shared utility available to any project willing to participate in this open marketplace.

One of the most compelling aspects of restaked rollups is their ability to unlock new forms of yield and utility for both stakers and developers. By integrating with EigenLayer, rollup teams can tap into a ready-made security pool, reducing the overhead required to bootstrap trust for new networks. For users, this means access to chains that combine Ethereum-grade security with the low fees and high throughput characteristic of advanced Layer 2s.

These developments are not just theoretical. The recent collaboration between Swell, AltLayer, EigenDA, and Chainlink is a case in point: their rollup leverages EigenLayer’s restaking to deliver native yield on liquid restaked assets while maintaining robust decentralization (read more). This model is rapidly gaining traction as projects look to deploy scalable applications without sacrificing security or composability.

Risks and Open Questions

Despite the promise, several open questions remain. The introduction of additional slashing conditions and cross-protocol dependencies increases complexity. Developers must rigorously audit AVS logic to avoid unintended vulnerabilities. Economic incentives must be carefully balanced so that restaked ETH cannot be easily exploited by sophisticated adversaries seeking to game slashing mechanisms or extract MEV at scale.

There’s also the question of governance: as AVSs proliferate, will the EigenLayer community maintain sufficient oversight to prevent centralization within operator sets? With more value at stake across multiple services, governance frameworks will need to evolve quickly to ensure alignment between stakers, operators, and protocol teams.

What’s Next for Restaked Rollups?

The expansion of EigenLayer beyond Ethereum mainnet – through partnerships with Mantle Network, ZKsync, and others – points toward a future where modular security becomes a standard feature across chains. As data availability layers like EigenDA mature and decentralized sequencing becomes more robust, expect an explosion in permissionless experimentation around rollup architectures.

The race is now on for developers to leverage these building blocks in creative ways: deploying application-specific rollups secured by pooled ETH collateral; experimenting with novel forms of validator incentives; or integrating decentralized oracles directly into rollup consensus. Each innovation further cements restaked rollups as a cornerstone technology for Ethereum scalability.

Top Restaked Rollup Projects in 2025

-

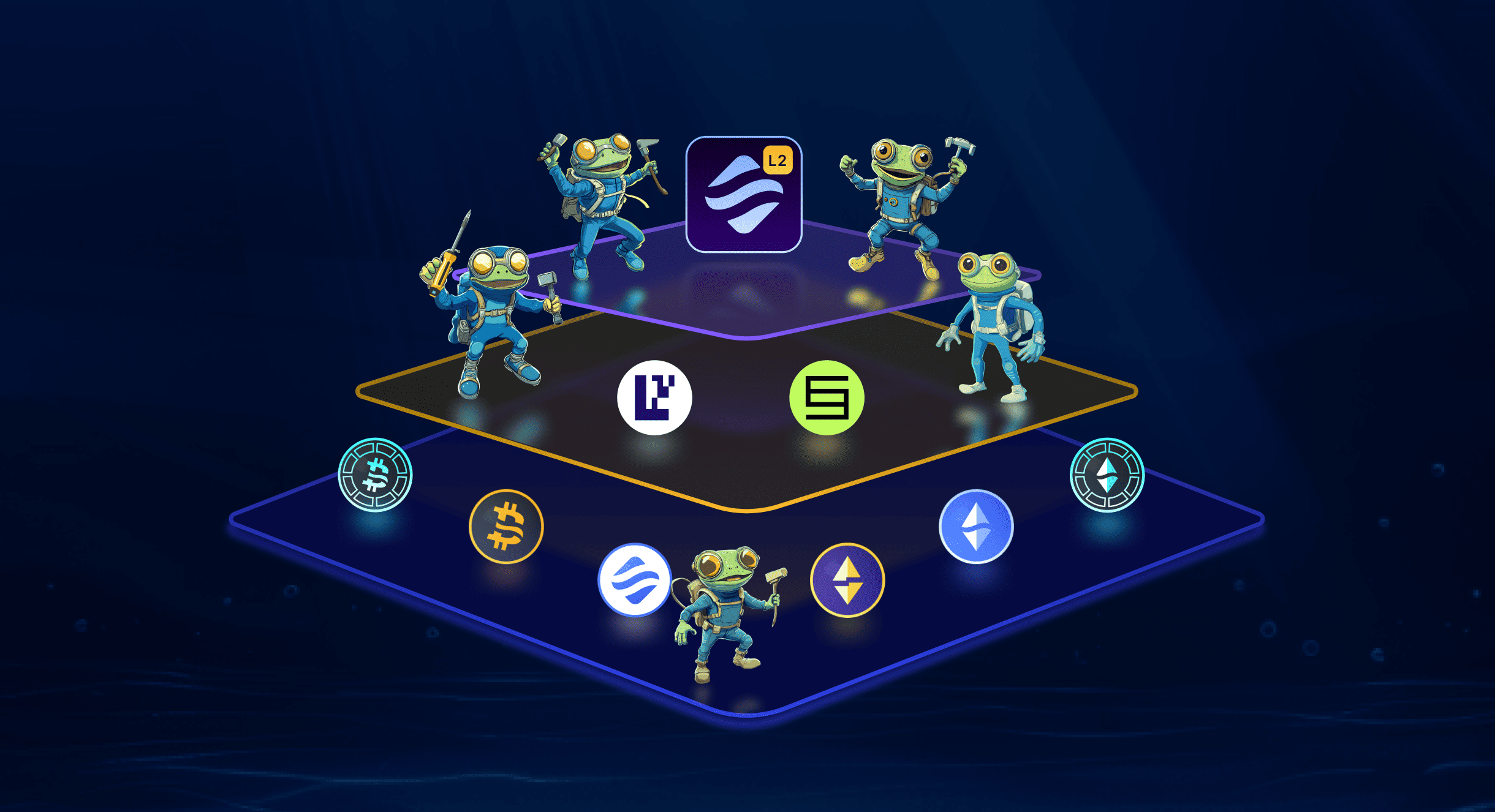

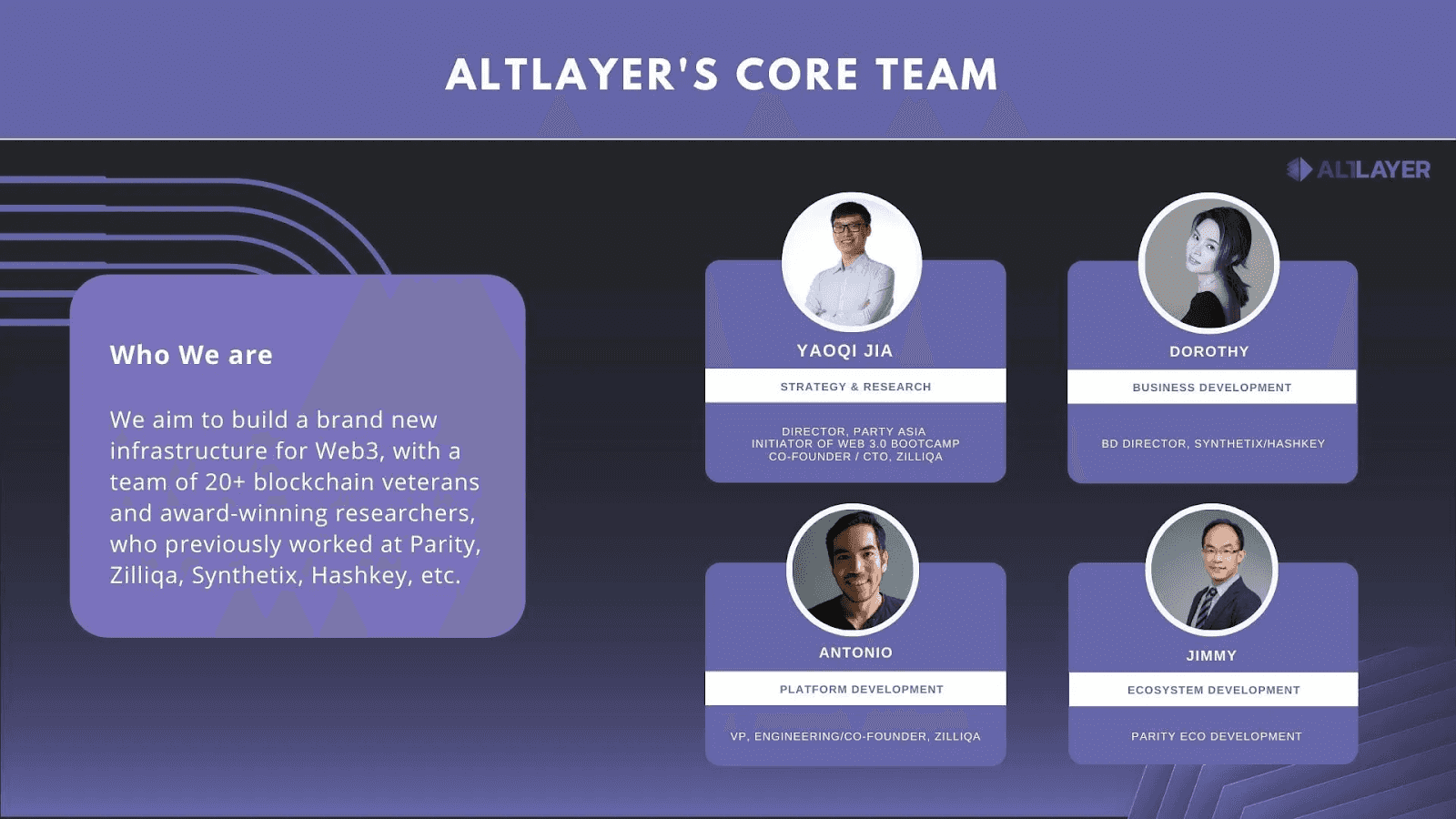

AltLayer: Pioneering restaked rollups with decentralized sequencing, verification, and fast finality, AltLayer is at the forefront of integrating EigenLayer’s restaking mechanisms to enhance rollup security and scalability.

-

Swell x AltLayer x EigenDA x Chainlink: This collaborative Layer 2 rollup leverages EigenLayer’s restaking, AltLayer’s rollup framework, EigenDA’s data availability, and Chainlink’s oracle services to create a secure, scalable platform for liquid restaked assets.

-

EigenDA: As a core Actively Validated Service (AVS) on EigenLayer, EigenDA provides decentralized data availability for restaked rollups, supporting fast finality and robust security for next-generation Layer 2 solutions.

-

Mantle Network: Through its integration with EigenLayer and EigenDA, Mantle Network extends Ethereum’s restaked security model to its modular Layer 2 ecosystem, enabling decentralized sequencing and enhanced data availability.

-

ZKsync: By adopting EigenLayer’s AVSs, ZKsync incorporates decentralized zero-knowledge proving and data availability, bringing restaked rollup security and scalability to its high-throughput Layer 2 platform.

The modular blockchain thesis is moving from theory into practice – with EigenLayer’s vision at the center. As composability increases and interoperability improves across ecosystems, expect a new wave of DeFi protocols, gaming platforms, and enterprise blockchains built atop this shared security substrate. For those watching Ethereum scalability closely, restaked rollups are no longer just an experiment; they are fast becoming the backbone of next-generation blockchain infrastructure.