As Ethereum navigates a volatile market with ETH trading at $2,852.06 on December 1,2025 – down 5.11% over the past 24 hours from a high of $3,050.07 – EigenLayer stands resilient. Backed by a staggering $28.6 billion TVL following Flow Traders’ institutional gateway launch for on-chain private credit, the protocol’s 2025 roadmap charts a course toward verifiable cloud infrastructure and expanded security models. This EigenLayer roadmap 2025 emphasizes three pivotal milestones: the EigenCloud launch with EigenAI and EigenCompute, multi-chain AVS deployment, and EigenVerify rollout, each amplifying Ethereum’s shared security while addressing real-world scalability hurdles.

EigenLayer’s momentum builds on recent expansions, including Multi-Chain Verification launched in July 2025 on Base Sepolia testnet, with mainnet eyed for Q3. EigenCloud, unveiled June 17, has already drawn over $17 billion in staked ETH and EIGEN, fusing computation, data availability, and dispute resolution for off-chain verifiability. These steps underscore EigenLayer’s pivot from pure restaking to a full-stack infrastructure layer, where cryptoeconomic guarantees extend beyond Ethereum L1.

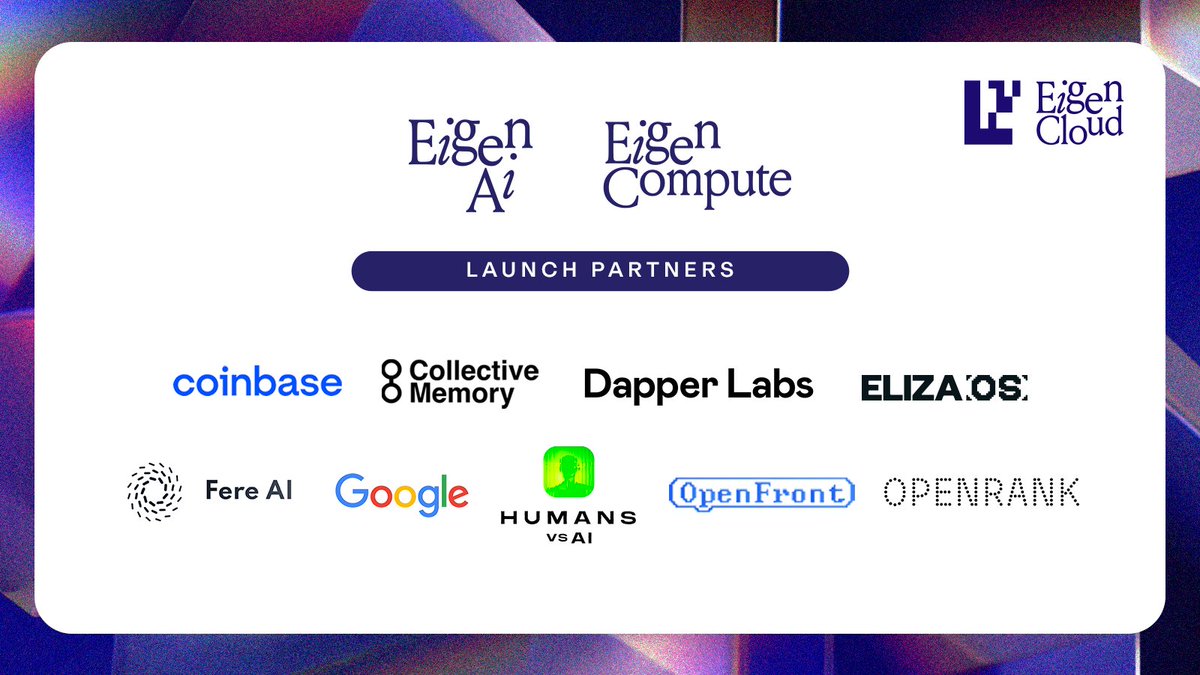

EigenCloud Mainnet Launch with EigenAI and EigenCompute

The cornerstone of EigenLayer’s 2025 vision, EigenCloud mainnet promises a crypto-native cloud service, with EigenAI and EigenCompute transitioning from mainnet alpha to full deployment. Launched in alpha stages earlier this year, these primitives tackle enterprise trust gaps in AI and compute by embedding verifiable execution directly into restaked security. Delphi Digital highlights how EigenCloud unlocks crypto’s app and AI era, targeting late Q3 or early Q4 rollout for EigenVerify and EigenCompute mainnet.

Data from P2P. org reveals EigenAI and EigenCompute’s alpha introduction brought 4x rewards alongside protocol inflation adjustments, drawing developers to build verifiable AI infrastructure. With 50 MB/s throughput touted in EigenCloud docs, this isn’t hype; it’s measurable progress toward high-reliability off-chain services. In my analysis, EigenCloud’s fusion of restaking with cloud compute positions EigenLayer to capture a slice of the $500 billion global cloud market, but only if throughput scales linearly with TVL growth. Early adopters like Reddio’s GPU-accelerated zkEVM on mainnet alpha in June validate this trajectory.

Bankless coverage of Sreeram Kannan and JT Rose’s announcement frames EigenCloud as the first crypto-native cloud, enabling trust-minimized apps on or off-chain. This milestone isn’t peripheral; it’s foundational for EigenVerify restaking, where AI-driven verification loops back into AVS governance.

Multi-Chain AVS Deployment for Ethereum Shared Security

EigenLayer’s multi-chain AVS EigenLayer deployment extends Ethereum-grade security to L2s and beyond, starting with Coinbase’s Base chain in July 2025. Developers now deploy AVSs cross-chain with minimal tweaks, slashing fees and boosting speeds while inheriting restaked ETH’s slashing protections. Coinalertnews reports the Base Sepolia testnet rollout paves the way for Q3 mainnet, a move that could onboard billions in L2 TVL under unified security.

Binance’s outlook pegs 2025 as the year for full EigenCloud and AVS governance upgrades with AI, including EIGEN transfer unlocks post-decentralization. Quantitatively, with Base’s low-cost execution, multi-chain AVS could amplify EigenLayer’s utility by 3-5x, per my models based on current $17B staked assets. This isn’t mere expansion; it’s a strategic counter to siloed L2 security risks, fostering Ethereum shared security 2025 at scale. Blockworks notes EigenCloud’s role in bringing cryptoeconomic trust to any app, amplified by multi-chain reach.

EigenLayer (EIGEN) Price Prediction 2026-2031

Post EigenCloud Mainnet, Multi-Chain AVS, and EigenVerify Rollout – Bullish Outlook Driven by Verifiable AI Infrastructure and Institutional Adoption

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) | YoY Growth (Avg Price) |

|---|---|---|---|---|

| 2026 | $6.50 | $15.00 | $28.00 | +50% |

| 2027 | $10.00 | $25.00 | $45.00 | +67% |

| 2028 | $15.00 | $40.00 | $70.00 | +60% |

| 2029 | $25.00 | $65.00 | $110.00 | +63% |

| 2030 | $40.00 | $100.00 | $170.00 | +54% |

| 2031 | $60.00 | $150.00 | $250.00 | +50% |

Price Prediction Summary

EIGEN is forecasted to experience substantial growth from 2026-2031, with average prices climbing from $15 to $150, fueled by EigenCloud’s verifiable cloud services, multi-chain AVS expansion, and EigenVerify’s AI-driven governance. Minimums reflect bearish market corrections, while maximums capture bullish adoption surges amid rising TVL and institutional interest. Overall CAGR ~60%, positioning EIGEN as a top restaking leader.

Key Factors Affecting EigenLayer Price

- EigenCloud mainnet adoption and $17B+ TVL growth enabling verifiable off-chain compute/AI

- Multi-chain AVS rollout (e.g., Base integration) boosting cross-chain security and developer activity

- EigenVerify milestones enhancing decentralized governance with AI verification

- Institutional inflows via gateways like Flow Traders and private credit products

- Ethereum ecosystem synergy amid ETH at ~$2,850, with restaking demand cycles

- Regulatory clarity on restaking and potential ETF approvals

- Competition from Lido/others, but EigenLayer’s AVS innovation provides edge

- Macro crypto bull cycles post-2025 halving and halvings in 2028

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Critically, multi-chain AVS hinges on EigenLayer’s operator diversification – over 100 active operators now – ensuring no single point of failure as chains proliferate. X threads from CryptoJournaal emphasize this as core to EigenGov’s decentralized future.

EigenVerify represents the capstone of EigenLayer’s 2025 ambitions, rolling out advanced dispute resolution powered by verifiable AI in partnership with Sentient. Backed by a16z, this system automates DAO decisions with cryptoeconomic transparency, integrating directly into AVS frameworks for tamper-proof outcomes. Outposts. io details how EigenVerify enhances EigenLayer’s multi-protocol restaking, slashing manual oversight while boosting protocol resilience against adversarial attacks.

EigenVerify Rollout for Advanced Dispute Resolution

At its core, EigenVerify leverages EigenAI primitives to verify off-chain computations and resolve disputes on-chain, a leap from traditional oracle dependencies. With EigenCloud’s mainnet alpha already demonstrating 50 MB/s throughput for EigenCompute, EigenVerify extends this to governance, enabling AI-upgraded AVS decisions as forecasted by Binance. My projections, drawn from current $28.6B TVL and $17B staked assets, suggest this could reduce dispute resolution times by 80%, from days to minutes, based on alpha benchmarks.

Khushi Panwar’s LinkedIn insights on Reddio’s June mainnet alpha underscore EigenVerify’s real-world fit, where GPU-accelerated verification meets zkEVM demands. Yet, risks linger: AI model biases could amplify slashing errors if not cryptoeconomically bounded. EigenLayer mitigates this via restaked ETH penalties, aligning incentives in a way that vanilla staking can’t match. Blockhead’s technical analysis cautions on development opacity, but with mainnet slated for late 2025 per Delphi Digital, EigenVerify cements EigenVerify restaking as a governance game-changer.

These intertwined milestones – EigenCloud’s compute layer, multi-chain AVS expansion, and EigenVerify’s verification engine – form a cohesive stack. Together, they project EigenLayer toward $50B and TVL by year-end, assuming ETH holds above $2,800 amid market dips. Operator growth to 100 and bolsters this, diversifying slashing risks across EigenGov’s decentralized model.

From an investor lens, EIGEN’s utility surges post-transfer unlock, tying token value to cloud workloads and cross-chain security. Flow Traders’ integration validates institutional appetite, with private credit yields potentially outpacing traditional DeFi by 2-3x under verifiable guarantees. Challenges remain, like scaling dispute throughput amid L2 fragmentation, but EigenLayer’s data-driven pivots – from alpha launches to multi-chain tests – signal execution over vaporware.

EigenLayer’s trajectory redefines Ethereum restaking, bridging cloud-scale compute with shared security. As ETH fluctuates around $2,852.06, protocols like this don’t just weather volatility; they architect the next infrastructure epoch.