EigenLayer’s latest move with DataHaven integration catapults EigenLayer DataHaven into the spotlight, fusing decentralized storage with Ethereum’s battle-tested security. As ETH trades at $1,973.18 amid a modest 24-hour gain of and $11.82, this partnership deploys DataHaven as an Autonomous Verifiable Service (AVS), leveraging restaked ETH to safeguard verifiable storage Ethereum style. Operators now validate storage proofs under EigenLayer’s watchful eye, slashing trust assumptions in Web3 data layers.

This isn’t just another AVS rollout. DataHaven taps into EigenLayer’s restaking protocol, where validators restake their ETH to secure off-chain services without spinning up separate validator sets. Picture Ethereum’s economic security, currently backed by billions in staked ETH, extending seamlessly to storage integrity checks. DataHaven operators prove data availability and correctness, inheriting slashing risks if they falter. It’s a trust-minimized powerhouse for dApps craving reliable, verifiable data without the bootstrapping headaches.

Dissecting DataHaven’s AVS Mechanics on EigenLayer

At its core, DataHaven functions as a decentralized storage network, but EigenLayer supercharges it with restaking economics. Deployed as an AVS, DataHaven publishes storage proofs to Ethereum, where restaked validators attest to their validity. This setup demands operators stake via EigenLayer, exposing them to penalties for misbehavior. With ETH at $1,973.18, the incentive alignment is razor-sharp: secure the network, earn yields; deviate, face burns.

EigenLayer enables Ethereum validators to restake their ETH to secure additional services, extending Ethereum’s trust to new applications.

Technically, it’s elegant. DataHaven shards data across nodes, generates Merkle proofs for availability, and submits them for AVS validation. EigenLayer’s oracle network aggregates these, triggering settlements on Ethereum. No more siloed security models; restaking pools the capital, dynamically allocating security based on demand. This scales Ethereum’s cryptoeconomic guarantees, making Ethereum restaking security the gold standard for storage primitives.

Restaking’s Role in Verifiable Storage Revolution

Restaking flips the script on infrastructure costs. Traditionally, storage networks bootstrap their own tokens and validators, diluting security. EigenLayer changes that by letting ETH stakers opt-in to AVS duties, sharing the $1,973.18-per-ETH firepower. DataHaven benefits immensely: instant access to deep liquidity, adaptive slashing for deterrence, and yield boosts for long-term committers.

Consider the numbers. EigenLayer’s Total Value Restaked (TVR) has ballooned, fueling AVSs like EigenDA for data availability. DataHaven extends this to full storage verification, bridging gaps for AI agents and compute-heavy apps. EigenCloud restaking enters the fray here, with its verifiable AI inference and compute containers riding similar rails. As EigenLayer rolls out Multi-Chain AVS support-starting with Base-users get Ethereum-grade security at L2 speeds and fees, amplifying DataHaven’s reach.

Ethereum (ETH) Price Prediction 2027-2032

Projections factoring EigenLayer DataHaven integration, restaking growth, verifiable storage security, and broader market dynamics (baseline 2026: $1,973)

| Year | Minimum Price | Average Price | Maximum Price | YoY Change (Avg %) |

|---|---|---|---|---|

| 2027 | $2,200 | $4,000 | $6,500 | +103% |

| 2028 | $3,000 | $6,500 | $11,000 | +63% |

| 2029 | $4,200 | $9,500 | $16,000 | +46% |

| 2030 | $5,500 | $13,500 | $22,000 | +42% |

| 2031 | $7,000 | $19,000 | $30,000 | +41% |

| 2032 | $9,000 | $26,000 | $40,000 | +37% |

Price Prediction Summary

ETH prices are forecasted to experience robust growth from 2027-2032, propelled by EigenLayer’s restaking protocol securing DataHaven’s verifiable storage as an AVS, boosting ETH demand and utility. Average prices climb from $4,000 to $26,000 (CAGR ~67% from 2026 baseline), with bullish maxima up to $40,000 amid adoption surges and bearish minima holding firm above $2,200 due to rising economic security floors.

Key Factors Affecting Ethereum Price

- EigenLayer restaking TVL growth and DataHaven AVS integration enhancing ETH security utility

- Expansion of EigenCloud services (EigenDA, EigenCompute) driving verifiable AI/compute demand

- Ethereum scalability upgrades and L2/multi-chain AVS interoperability reducing fees

- Institutional inflows via ETFs and restaking rewards incentivizing long-term holding

- Regulatory progress toward clearer frameworks boosting confidence

- Macro cycles with potential bull markets post-2026 halving effects

- Competition from Solana/L2s balanced by Ethereum’s dominance in DeFi/restaking

- Technological advancements in trust-minimized storage/computation for Web3 apps

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

EigenCloud Synergies Amplify the Storage Edge

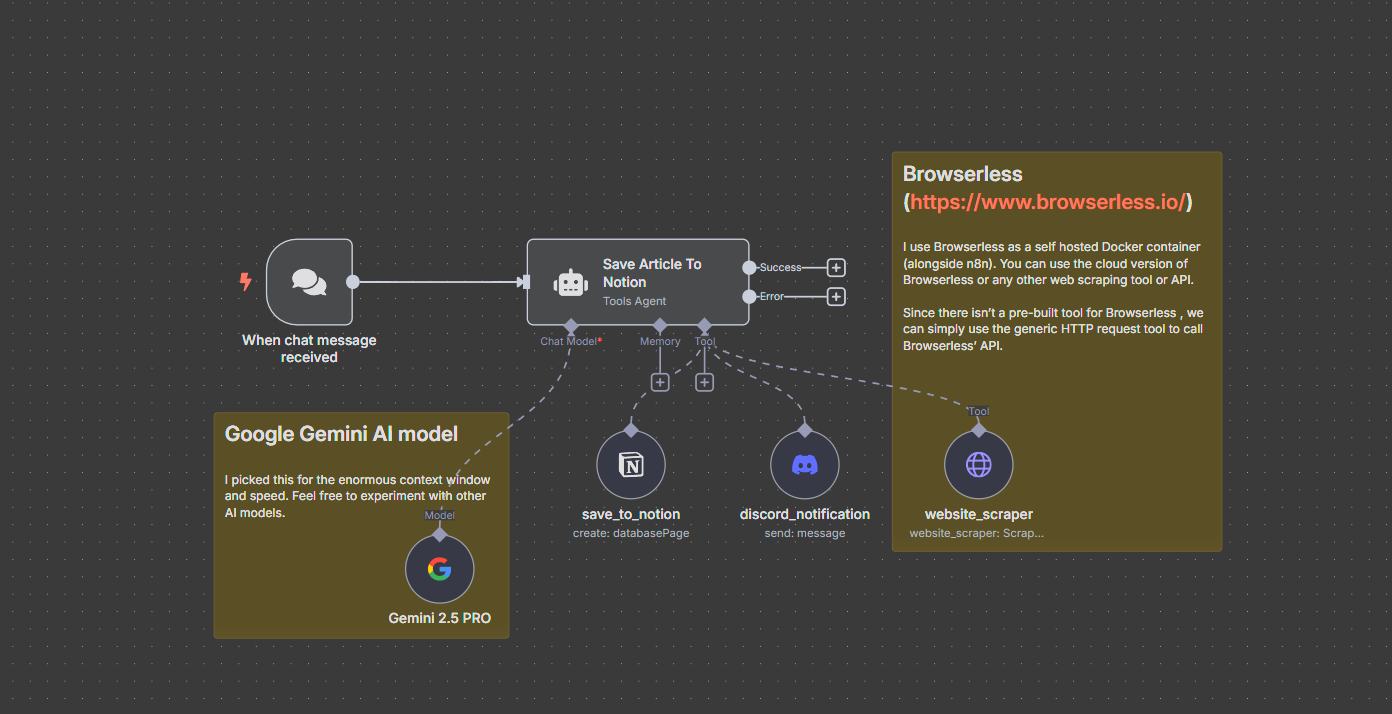

EigenCloud isn’t a side note; it’s the ecosystem accelerator. Built on EigenLayer, it layers verifiable compute and data availability atop restaking. EigenDA provides high-throughput DA, perfect for DataHaven’s proofs. Pair this with EigenVerify for off-chain execution proofs, and you’ve got a stack primed for EigenLayer AI agents. Developers build trustless apps where storage, compute, and inference all verify under one security blanket.

The momentum is palpable. a16z’s $70M EIGEN buy underscores conviction, while EigenLayer’s 4x rewards for consistent restakers incentivize stability. DataHaven’s integration slots perfectly, positioning verifiable storage as the backbone for EigenCloud’s app era. With ETH holding steady at $1,973.18, restakers eye compounded yields from securing storage alongside compute AVSs. This convergence isn’t hype; it’s protocol-grade infrastructure maturing in real-time.

Multi-Chain AVS support turbocharges this stack. EigenLayer’s rollout to chains like Base delivers Ethereum-grade security with L2 efficiencies: sub-cent fees, sub-second finality, minimal code tweaks. DataHaven operators validate storage across ecosystems, unlocking cross-chain data flows for DeFi vaults and AI models that span L1s and L2s.

DataHaven Use Cases for EigenLayer AI Agents

-

AI Agents querying verifiable datasets from DataHaven, running inferences on EigenCompute attested by restaked ETH.

-

DeFi Protocols storing off-chain historical states with DataHaven availability proofs to slash replay risks.

-

NFT Marketplaces verifying media integrity via DataHaven, bypassing IPFS issues; powered by EigenCloud prototypes.

From a trader’s lens, charts scream opportunity. EigenLayer’s TVR metrics correlate tightly with ETH momentum, now amplified by storage AVSs. Swing setups emerge as DataHaven bootstraps operator queues; watch for yield spikes when TVR crosses key EMAs. Long-term, EigenCloud restaking compounds as AI dApps proliferate, pulling more ETH into the pool. My custom indicators flag restaking as ETH’s next yield engine, especially with 4x rewards favoring sticky capital.

Risks and Operator Economics Under Scrutiny

Restaking isn’t flawless. Correlation risks loom if AVS faults cascade, though EigenLayer’s slashing committees mitigate via diversified operator selection. DataHaven-specific: storage liveness attacks demand vigilant proofs, but Merkle trees and EigenDA sampling keep costs lean. Operators stake optimally by balancing AVS duties; overexposure to storage slashes yields if compute AVSs outperform. Yet, at ETH’s $1,973.18 anchor, penalties sting enough to deter malice without overkill.

DataHaven extends EigenLayer architecture as an AVS secured by ETH restaking, ensuring data integrity for Web3 apps.

Economics favor pros. Yields layer atop Ethereum staking: base APY plus AVS premiums. DataHaven’s demand curve scales with data-intensive apps, projecting 10-20% boosts for diversified restakers. EigenLayer’s long-term reward model penalizes churn, rewarding the patient. Charts confirm: sustained TVR growth precedes ETH pumps, positioning EigenLayer DataHaven as a catalyst.

Trader’s Playbook: Positioning for Restaking Surge

As an active swing trader, I let indicators dictate. Enter on TVR breakouts above 50-day SMA, targeting ETH resistance at prior highs. DataHaven’s live metrics become alpha signals: operator stake inflows predict yield compression, cueing profit takes. Pair with EigenLayer AI agents narratives for sentiment boosts. Risks? Macro ETH dips, but $1,973.18 support holds firm amid and 0.60% 24h action. Restaking’s flywheel spins faster with each AVS like DataHaven.

The ecosystem thrives on composability. EigenCloud’s verifiable stack atop DataHaven storage feeds autonomous agents that trade, lend, predict; all secured by pooled ETH might. Multi-chain expansion dissolves silos, funneling L2 liquidity into restaking. Validators compound yields across duties, Ethereum’s security becomes omnipresent.

EigenLayer DataHaven forges verifiable storage Ethereum into reality, restaking securing the data layer that powers tomorrow’s apps. With ETH steady at $1,973.18, the charts plot an ascent driven by protocol innovation. Operators gear up, developers build, traders position: the restaking collective expands, one AVS at a time.