With Ethereum’s price holding steady at $1,958.34 amid a 0.56% 24-hour gain, EigenLayer’s restaking ecosystem has locked over $30 billion in value, fueling a surge in restaked rollups. These innovative Layer 2 solutions leverage restaked ETH to deliver shared economic security and sub-second finality, slashing the risks of centralized sequencers and sluggish settlements that plague traditional rollups.

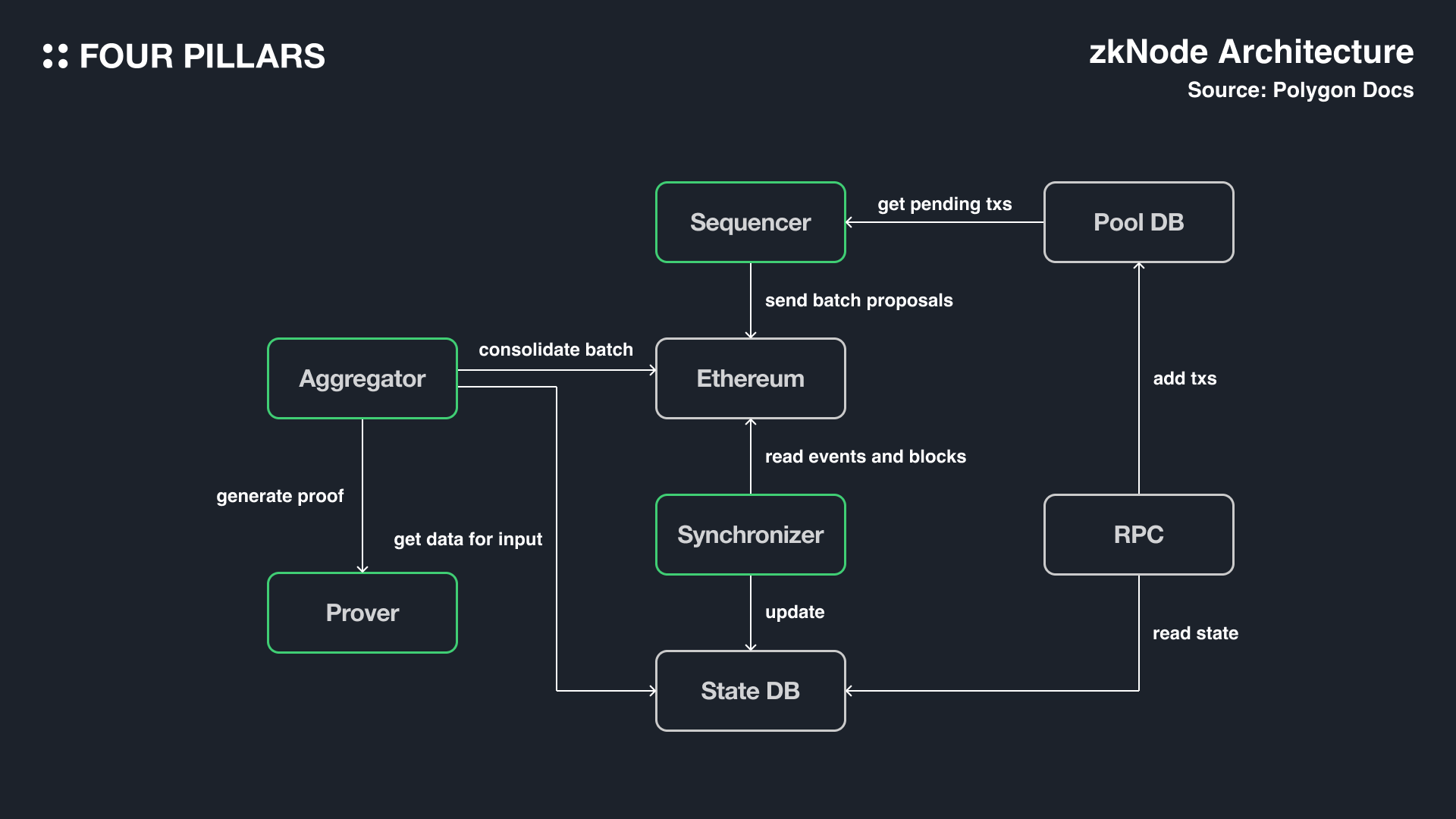

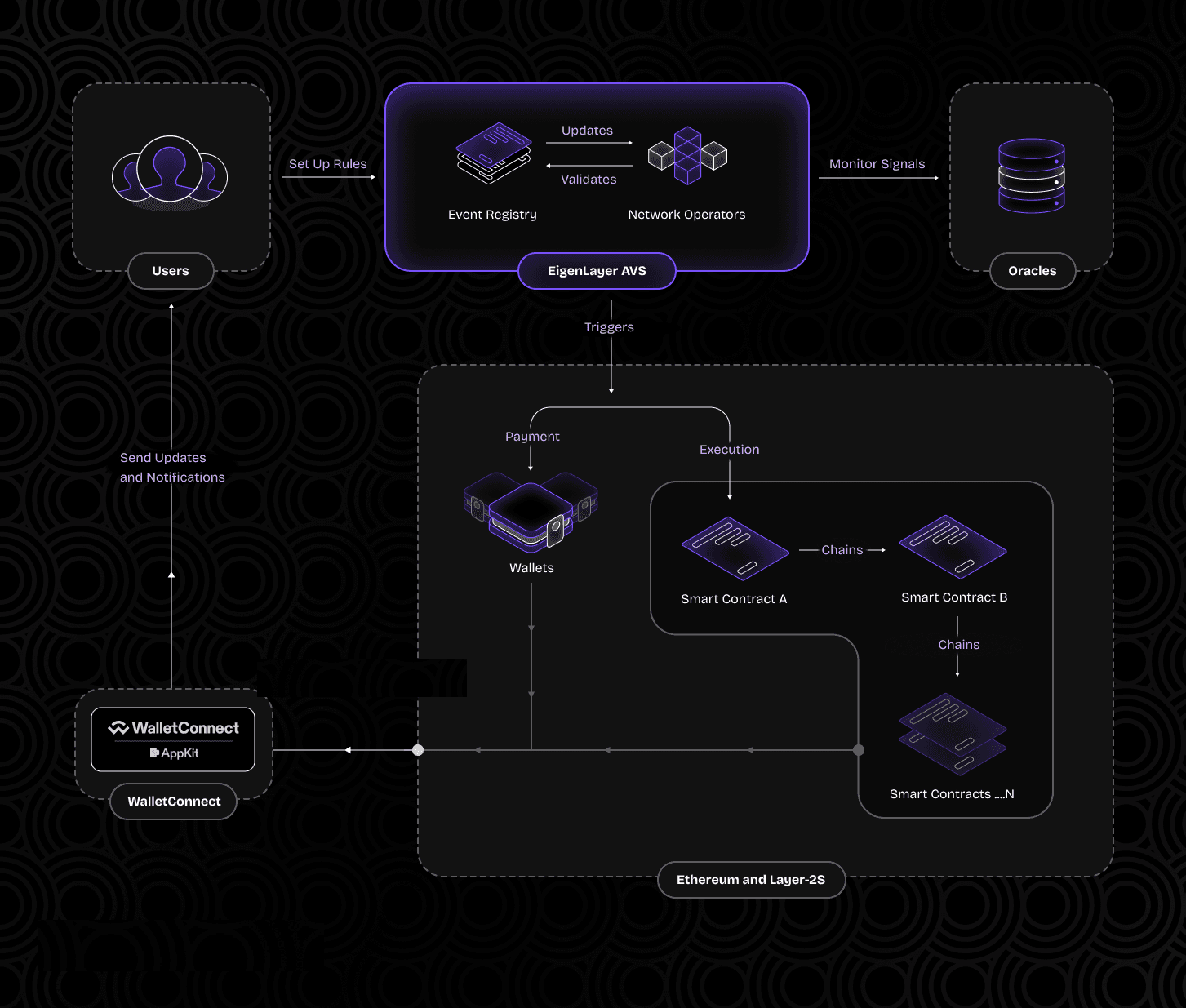

Restaked rollups represent EigenLayer’s push into vertically integrated security stacks. Operators monitor rollup states, validate blocks in real-time, and attest via restaked ETH, creating a robust defense layer without bespoke tokens. AltLayer’s blueprint integrates three key Actively Validated Services (AVSs): SQUAD for decentralized sequencing, VITAL for verification, and MACH for rapid finality. This trio transforms OP Stack or any rollup into a decentralized powerhouse.

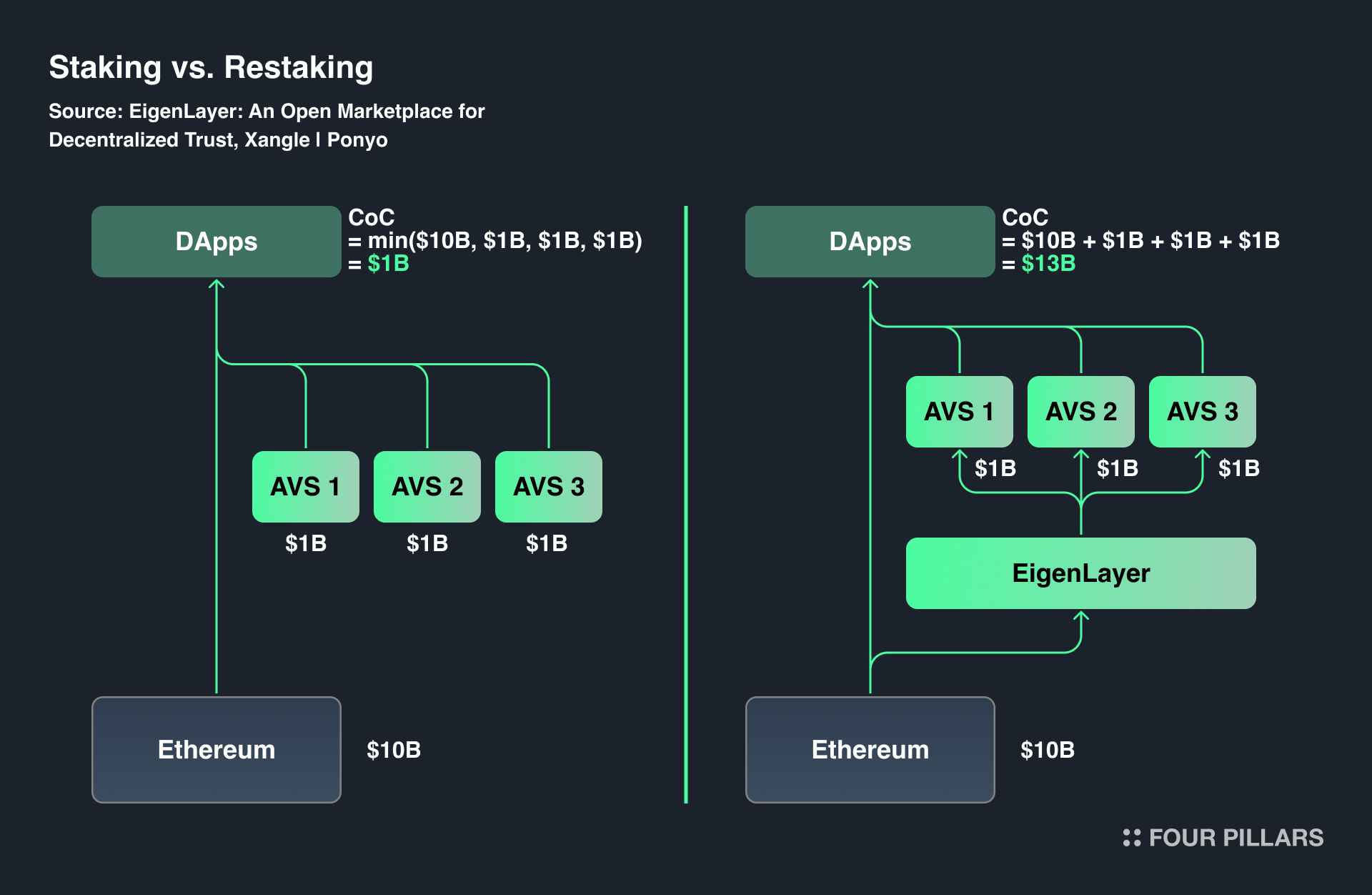

Why Shared Economic Security EigenLayer Changes the Game

EigenLayer restaking flips the script on crypto-economic security. Stakers deposit ETH into EigenPods, granting operators rights to secure external networks. For restaked rollups, this means pooled ETH slashes the bootstrapping costs of new chains. No more launching with thin liquidity or weak validator sets; instead, borrow Ethereum’s battle-tested security.

Restaked rollups add an extra security layer: operators watch the rollup, validate blocks, and attest quickly.

Data backs the momentum. TVL hitting $30B signals Ethereum teams piling in, with collaborations like Swell, AltLayer, and Chainlink building specialized L2s. The result? Enhanced decentralization and interoperability for stacks like OP or Arbitrum. Investors take note: restaking yields now compound ETH staking returns by 2-5% APY, depending on AVS slashing conditions.

Decentralized Sequencing with SQUAD: Breaking Sequencer Monopolies

Centralized sequencers remain rollups’ Achilles heel, vulnerable to MEV extraction and downtime. SQUAD, powered by EigenLayer operators, disperses sequencing duties across a permissionless set. Validators compete via restaked ETH bonds, ensuring liveness and censorship resistance. Early pilots show sequencing latency dropping 70%, a boon for high-throughput apps like DeFi and gaming.

Actionable insight: Validators should prioritize SQUAD AVS for exposure to rollup demand. On-chain metrics reveal operator sets growing 40% monthly, with restake rewards scaling alongside rollup TVL.

VITAL Verification: Eyes on Every Block

VITAL equips operators to independently verify rollup states against Ethereum L1. By attesting to data availability and execution integrity, it enforces ethereum restaking rollups finality without trusting rollup proposers. This shared security model cuts fraud proofs’ complexity, as restaked ETH acts as the ultimate backstop.

Consider Soneium’s integration: Astar Network, AltLayer, and EigenLayer combine for fast finality, letting validators earn extra while bolstering L2 uptime. For traders, this means tighter spreads and reliable oracles, critical as ETH hovers at $1,958.34.

Ethereum (ETH) Price Prediction 2027-2032

Forecasts driven by EigenLayer restaking growth, restaked rollups for shared security, and faster finality amid $30B+ TVL

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg from 2026 Base) |

|---|---|---|---|---|

| 2027 | $2,000 | $3,200 | $4,500 | +28% |

| 2028 | $2,500 | $4,200 | $6,000 | +31% |

| 2029 | $3,200 | $5,500 | $8,000 | +31% |

| 2030 | $4,000 | $7,200 | $10,500 | +31% |

| 2031 | $5,000 | $9,000 | $13,000 | +25% |

| 2032 | $6,000 | $11,500 | $16,500 | +28% |

Price Prediction Summary

Ethereum’s price is projected to experience robust growth from 2027-2032, fueled by EigenLayer’s restaking innovations surpassing $30B TVL, enabling restaked rollups with AVSs like VITAL, MACH, and SQUAD for superior L2 security and finality. Average prices climb from a 2026 base of $2,500 to $11,500 by 2032 (360%+ cumulative), with bear cases reflecting market downturns and bull cases capturing mass adoption.

Key Factors Affecting Ethereum Price

- Restaking TVL expansion and AVS adoption enhancing Ethereum ecosystem security

- Restaked rollups improving L2 decentralization, sequencing, verification, and finality

- Ethereum protocol upgrades (post-Dencun) boosting scalability

- Regulatory progress supporting staking and DeFi

- Crypto market cycles aligned with Bitcoin halvings

- Competition from L1s like Solana, offset by ETH’s restaking dominance and network effects

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Read more on restaked rollups and EigenLayer’s expansion.

MACH completes the stack by delivering sub-second economic finality. Operators attest to rollup checkpoints using restaked ETH, bypassing Ethereum’s 12-minute L1 finality. This unlocks real-time DeFi, payments, and gaming on L2s, with finality guarantees backed by Ethereum’s $30B restaking pool.

MACH Finality: Sub-Second Settlements Unlocked

Traditional rollups wait on Ethereum’s probabilistic finality, exposing users to reorg risks. MACH operators vote on rollup states, slashing malicious actors via restaked bonds. Pilots from AltLayer clock finality at 200ms, a 100x speedup. For EigenLayer restaking rollups, this means ethereum restaking rollups finality rivals centralized systems while staying decentralized.

Soneium exemplifies the payoff. Powered by Astar, AltLayer, and EigenLayer, it restakes ETH for fast finality, drawing validators seeking 3-4% extra APY. On-chain data shows operator diversity up 50% since launch, diluting centralization risks.

Restaked Rollups EigenLayer Benefits: Data-Driven Edge

Shared economic security EigenLayer isn’t theoretical. TVL at $30B reflects Ethereum teams betting big: 10x cheaper launches, 5x faster finality, zero sequencer downtime. Nexumo highlights restaking as a must for OP Stack upgrades, with operators validating blocks in seconds.

5 Key Benefits of EigenLayer Restaked Rollups

-

Pooled ETH Security: Shares restaked ETH for economic security via EigenLayer, with TVL over $30B.

-

Decentralized Sequencing: SQUAD AVS eliminates centralized sequencers for rollups.

-

Instant Verification: VITAL AVS enables operators to validate rollup blocks quickly.

-

Sub-Second Finality: MACH AVS delivers fast transaction finality under 1 second.

-

Extra Yields for Stakers: Restakers earn additional rewards on top of ETH staking APR.

Yield hunters: Restaking compounds base ETH staking (currently 3.5% APY) with AVS rewards. SQUAD offers 4.2%, VITAL 3.8%, MACH 2.9% as of February 2026. Total returns hit 7-10%, but factor in 0.1-1% slashing risk based on AVS maturity.

Risks, Rewards, and Validator Playbook

Restaking amplifies Ethereum’s security but introduces correlated slashing. A VITAL fault could burn 1% of restaked ETH across operators. Mitigate by diversifying AVSs and monitoring operator uptime via Dune dashboards- 99.9% liveness is table stakes.

Actionable steps for Ethereum teams:

- Audit your rollup for AltLayer compatibility- OP Stack integrations take 2 weeks.

- Restake via EigenPods; start with 32 ETH minimum for operator delegation.

- Target SQUAD for sequencing exposure- demand surges with L2 TVL.

- Track $1,958.34 ETH price; dips below $1,900 signal restaking entry points.

- Monitor TVL growth- $30B threshold unlocks institutional inflows.

Traders eye restaking tokens like EIGEN (post-airdrop unlocks). On-chain flows show $500M weekly inflows, pressuring ETH higher. As rollups capture 20% of Ethereum activity, restaked designs claim the lion’s share.

Bankless and Reflexivity peg EigenLayer as restaking’s killer app, extending ETH security composably. With ETH at $1,958.34 and 24h gains, validators restaking now position for the L2 boom. Deploy, attest, earn- the restaking collective awaits.