In the rapidly expanding Ethereum restaking ecosystem, DataHaven’s integration with EigenLayer marks a transformative step for decentralized storage security. Launched on mainnet as of February 11,2026, DataHaven operates as an Autonomous Verifiable Service (AVS) within EigenLayer, harnessing restaked ETH to validate storage proofs and runtime integrity. This DataHaven EigenLayer integration eliminates the need for bespoke validator sets, tapping directly into Ethereum’s vast economic security pool while ETH holds steady at $1,941.37 amid a 24-hour dip of $-68.64, or -3.42%.

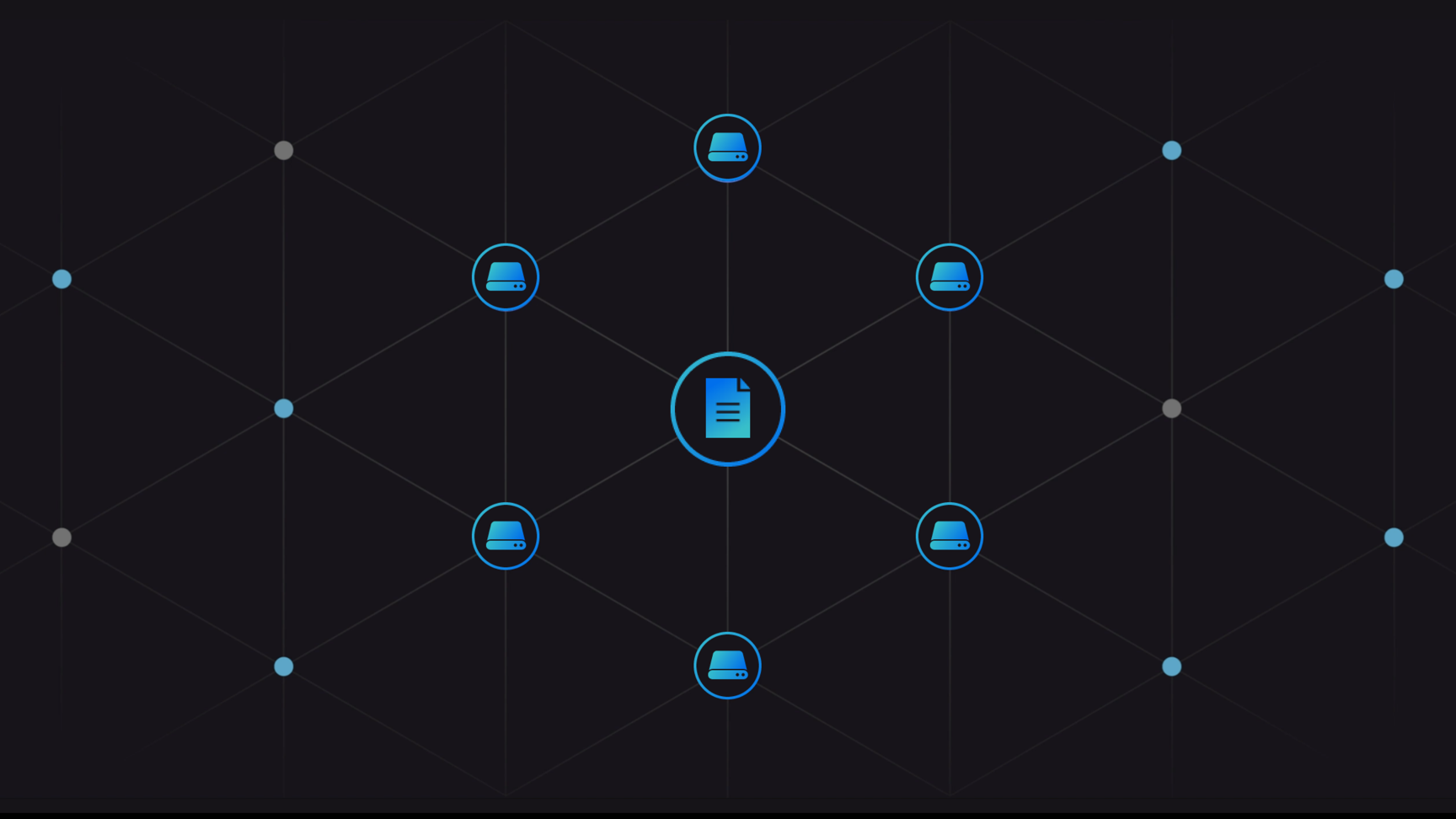

Built on an EVM-compatible Substrate chain, DataHaven targets production-scale, verifiable data storage tailored for AI-native workloads and modern Web3 apps. Unlike isolated storage networks, it bridges seamlessly to Ethereum via a trust-minimized mechanism, supporting API-based integrations, native bridging, and privacy features like privacy buckets. This setup promises tamper-proof data availability, a critical edge in an era where data integrity underpins everything from federated learning to onchain AI models.

Unpacking Restaking’s Role in Storage Validation

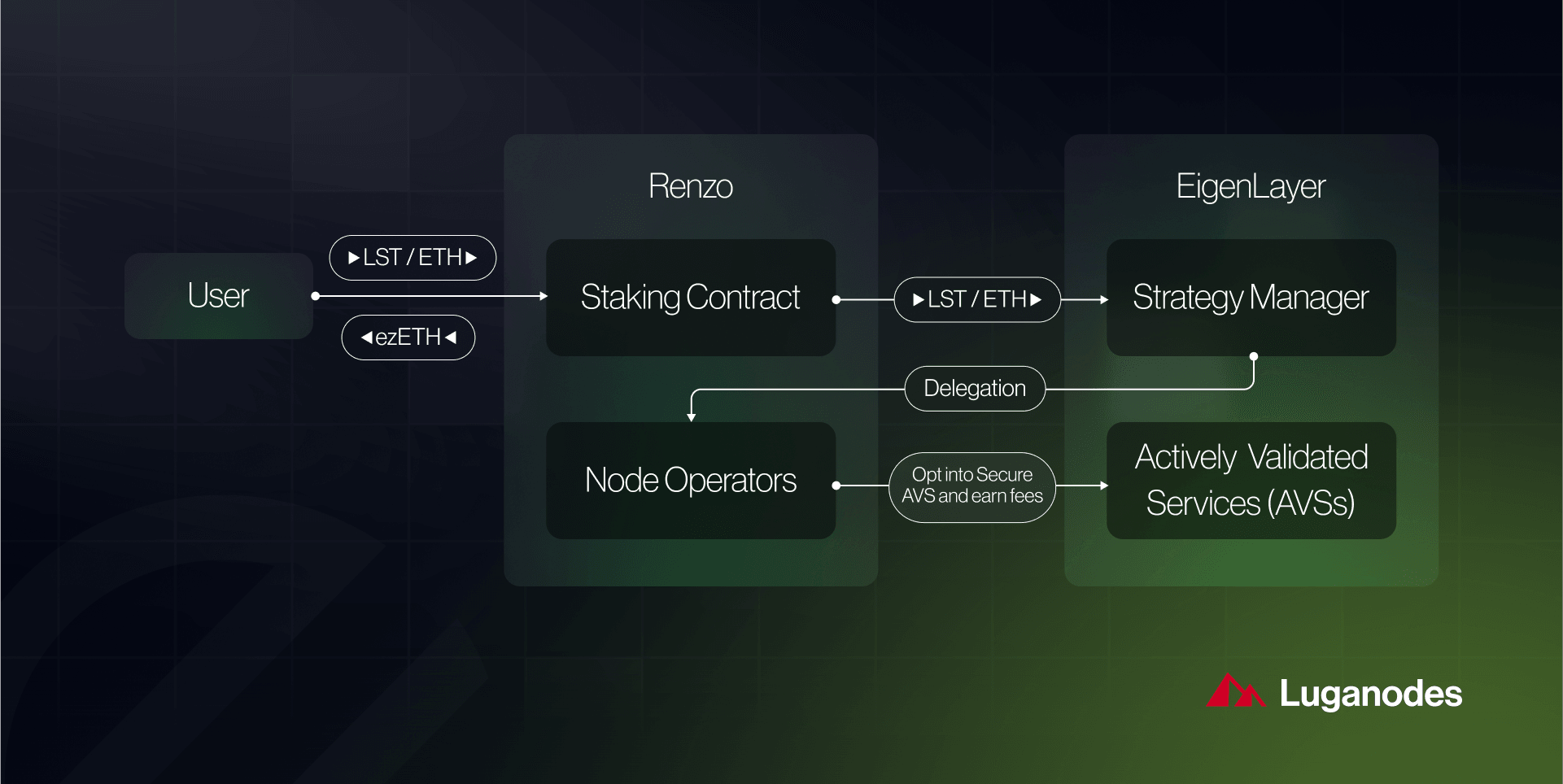

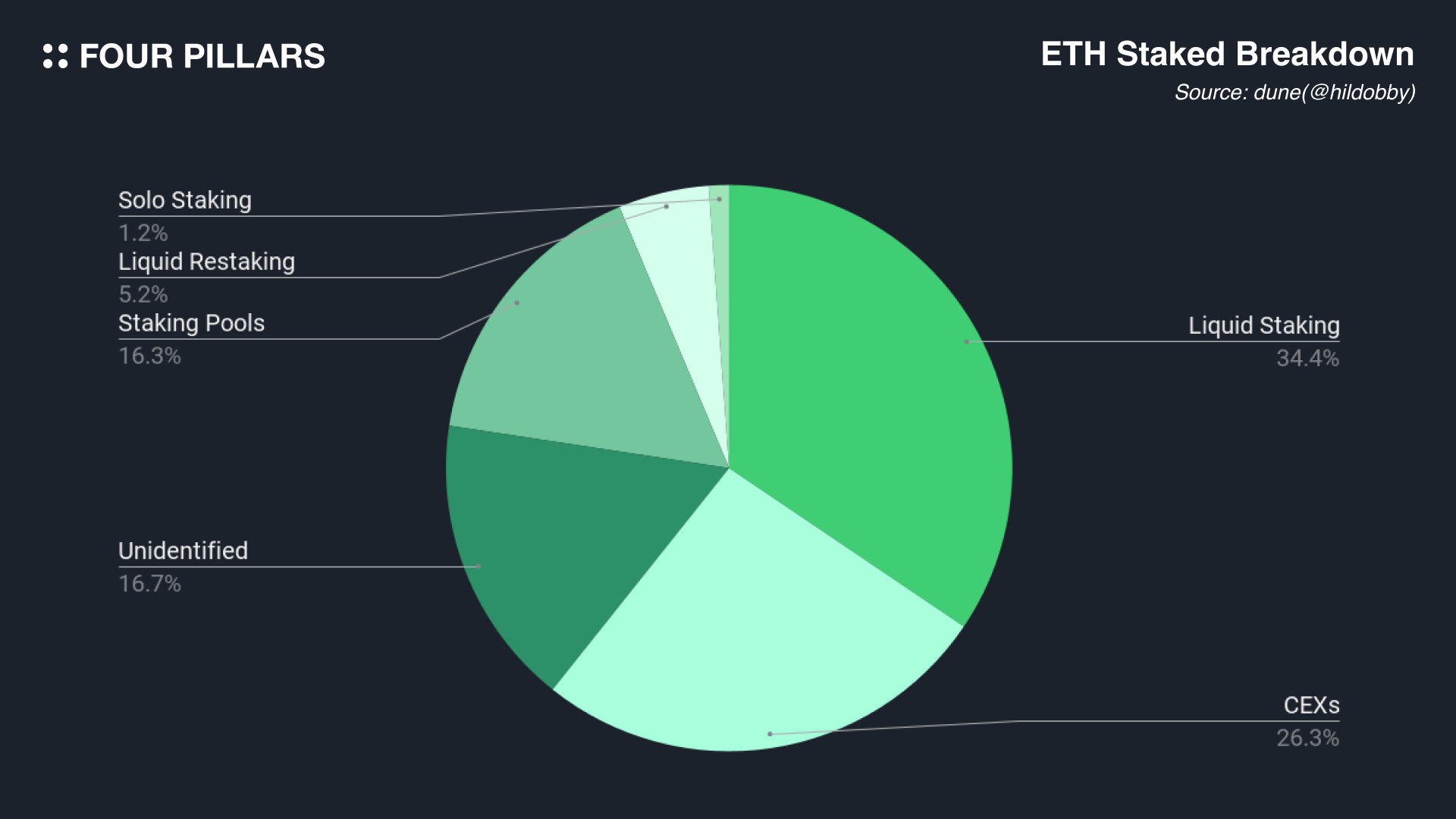

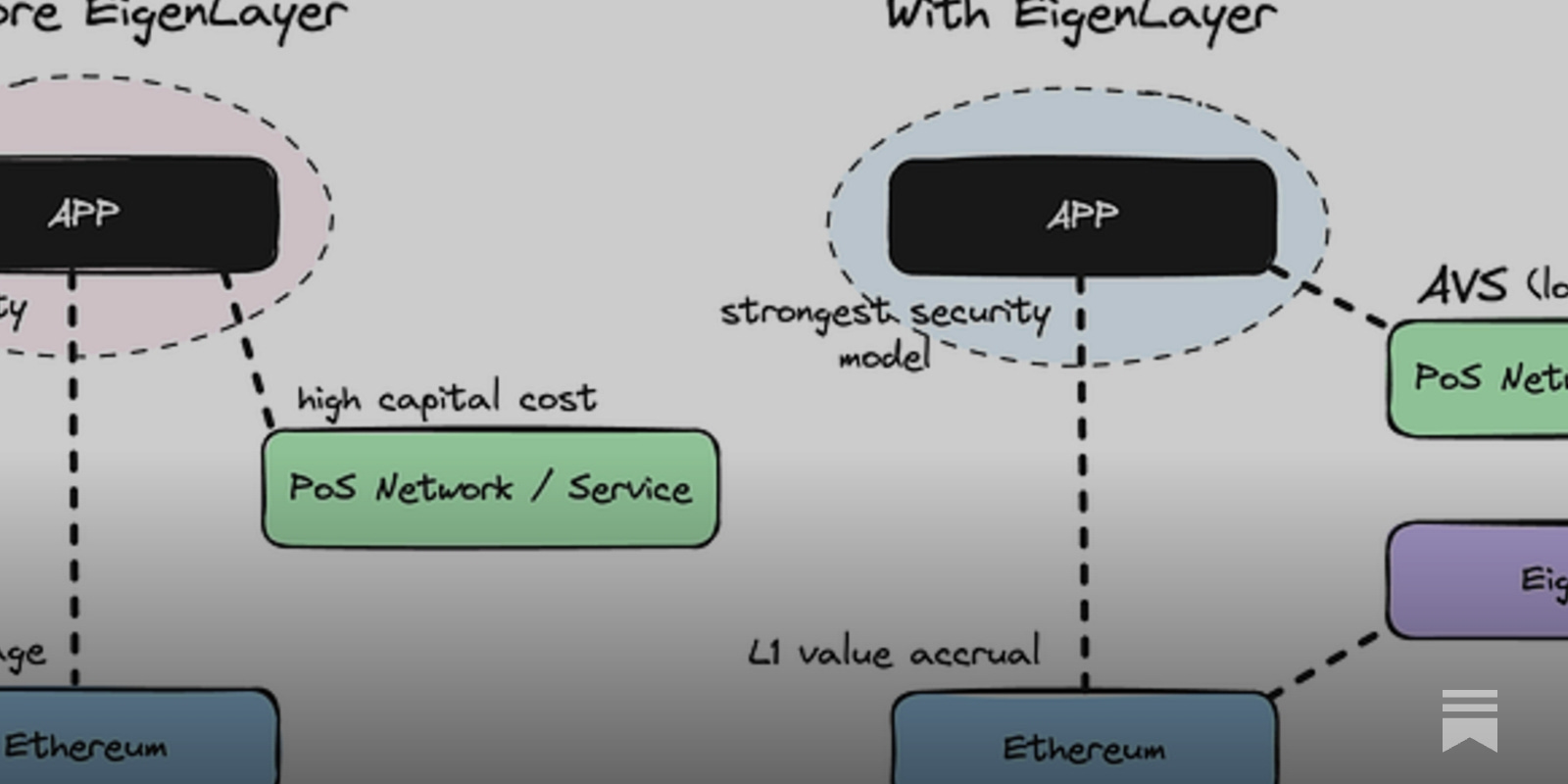

At its core, EigenLayer DataHaven restaking redefines how decentralized storage achieves economic security. Operators restake ETH through EigenLayer to attest to DataHaven’s storage proofs, slashing mechanisms enforcing honesty much like Ethereum’s consensus layer. This shared security model bootstraps robust defenses without diluting Ethereum’s base layer liquidity; restakers earn dual yields from both Ethereum staking and DataHaven duties.

Consider the implications: traditional storage protocols like Filecoin or Arweave demand independent token incentives and validator recruitment, often leading to fragmented security budgets. DataHaven sidesteps this by inheriting Ethereum’s battle-tested slashing economics. Research from EigenLayer’s documentation highlights how AVSs like DataHaven scale Ethereum’s security to specialized services, with over $10 billion in total value restaked ecosystem-wide as of late 2025. For storage specifically, this means verifiable retrievals at scale, optimized for high-throughput AI data pipelines.

“We’re the first decentralized storage platform secured through EigenLayer’s restaking protocol, ” notes DataHaven’s Levy, underscoring the pioneering trust alignment.

Bridging Ethereum and DataHaven: Interoperability Unlocked

The integration introduces a native, trust-minimized bridge that streamlines cross-chain data flows. Users deposit assets on Ethereum, which map to DataHaven equivalents without custodial risks, enabling fluid transactions and account abstraction. This is particularly potent for restaking decentralized storage, where applications query massive datasets without bridging friction.

DataHaven’s EVM compatibility further amplifies this: developers deploy familiar smart contracts atop a storage-optimized chain, all secured by restaked ETH. Privacy buckets add a layer of zero-knowledge proofs for sensitive data, vital for enterprise AI use cases. In my view, this positions DataHaven not as a mere utility layer but as Ethereum’s de facto data backbone, much like how L2s extended execution scalability.

AI and Web3 Workloads Get Verifiable Foundations

Purpose-built for AI-first demands, DataHaven excels in federated learning and machine learning datasets, where verifiability trumps raw capacity. Blockchains historically choked on storage scaling; DataHaven counters this via EigenLayer’s EigenLayer slashing storage guarantees, ensuring data persists under economic attack vectors.

Web3 apps benefit too: NFT metadata, DeFi oracles, and social graphs now enjoy production-grade persistence without centralized clouds. With mainnet live, integrations via APIs invite immediate adoption, potentially accelerating verifiable AI storage Eigenlayer narratives. Yet, as ETH lingers at $1,941.37, restaking yields remain attractive, blending storage alpha with Ethereum’s core returns.

Ethereum (ETH) Price Prediction 2027-2032: DataHaven EigenLayer Integration Impact

Forecasts driven by restaking growth, AVS adoption, and verifiable decentralized storage security

| Year | Minimum Price | Average Price | Maximum Price | YoY % Change (Avg) |

|---|---|---|---|---|

| 2027 | $2,500 | $3,500 | $5,200 | +80% |

| 2028 | $3,400 | $4,800 | $7,200 | +37% |

| 2029 | $4,500 | $6,500 | $9,800 | +35% |

| 2030 | $6,000 | $8,500 | $12,800 | +31% |

| 2031 | $7,800 | $11,200 | $16,800 | +32% |

| 2032 | $10,000 | $14,500 | $21,800 | +30% |

Price Prediction Summary

Ethereum (ETH) is set for substantial appreciation from 2027-2032, propelled by DataHaven’s integration as an EigenLayer AVS, boosting ETH restaking demand for AI/Web3 storage. Average prices projected to rise 315% cumulatively from 2026 baseline, with bullish scenarios reaching $21,800 by 2032 amid adoption surges.

Key Factors Affecting Ethereum Price

- DataHaven mainnet launch and EigenLayer restaking securing decentralized storage

- Rising AVS adoption increasing ETH economic security utility

- AI-driven demand for verifiable, production-scale data storage

- Ethereum scalability upgrades and EVM interoperability enhancements

- Crypto market cycle upswing post-2026 with institutional inflows

- Regulatory progress favoring staking and DeFi

- Macro risks, competition from alt-L1s, and economic volatility influencing min/max ranges

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Operators stand to gain significantly from this setup. By opting into DataHaven duties via EigenLayer, they diversify revenue streams beyond standard staking, with slashing conditions calibrated to storage-specific faults like proof failures or downtime. Early data from testnets suggests competitive APYs, potentially 5-10% additive yields depending on ETH at $1,941.37 and participation levels. This incentivizes operator growth, fortifying the network as adoption ramps.

Navigating Risks in Restaking Storage

No innovation arrives without hurdles. While EigenLayer DataHaven restaking boasts Ethereum-grade security, correlations in slashing risks loom large. A systemic attack on storage proofs could cascade to restakers, though EigenLayer’s operator decentralization mitigates this. Privacy buckets introduce ZK complexity, demanding rigorous audits to prevent exploits. Moreover, as DataHaven scales to petabyte levels, retrieval latency becomes a battleground; restaking secures persistence, but bandwidth optimizations lag peers like IPFS.

From a market lens, ETH’s current $1,941.37 price, down 3.42% in 24 hours to a low of $1,933.33, underscores volatility restakers navigate. Yet, this dip highlights restaking’s appeal: locked yields transcend spot price swings, drawing institutional capital eyeing long-term Ethereum primitives. DataHaven’s mainnet timing aligns with AVS maturation, where storage joins oracles and bridges in EigenLayer’s portfolio.

Key Integration Benefits

-

Ethereum Shared Security: Leverages EigenLayer restaking for unmatched economic security, securing storage proofs and runtime as an AVS without needing separate validators.

-

Verifiable Data Integrity: Ensures tamper-proof data availability and production-scale storage for AI and Web3 applications.

-

Seamless Interoperability: Trust-minimized bridge facilitates native Ethereum bridging, EVM support, and simplified cross-chain transactions.

-

Cost-Efficient Restaking: Minimizes overhead by utilizing restaked ETH, aligning economics with Ethereum ecosystem.

-

AI-First Capabilities: Optimized for federated learning, ML workloads, and privacy features like privacy buckets on mainnet.

Operator and Developer Perspectives

For operators, the pitch is straightforward: plug into DataHaven via EigenLayer dashboards, attest proofs, and collect fees. Middleware like restaking vaults simplifies delegation, lowering barriers for small-scale participants. Developers, meanwhile, access EVM tooling for dApps, with storage primitives baked in. Think onchain vector databases for AI agents or verifiable datasets for DeFi risk models; verifiable AI storage Eigenlayer becomes operational reality.

I’ve tracked restaking since inception, and DataHaven exemplifies its maturation beyond hype. It addresses a core Ethereum trilemma facet: scaling data without compromising verifiability. Paired with Moonbeam’s Polkadot roots for cross-chain flair, though Ethereum-centric, it carves a niche in the storage wars.

DataHaven delivers tamper-proof, verifiable storage secured by EigenLayer restaking, optimized for federated learning and ML workloads.

Mainnet features like API integrations and native Ethereum bridging lower entry points, fostering ecosystem flywheels. As restaked TVL climbs, expect DataHaven to anchor AI-Web3 convergence, where data scarcity yields to abundance under economic safeguards.

Looking ahead, this integration signals restaking’s pivot to real-world utilities. With ETH steady at $1,941.37 despite recent pressures, the protocol’s resilience shines. DataHaven doesn’t just store data; it fortifies Ethereum’s data layer, empowering builders to dream bigger in a verifiable world. Restakers, take note: the next yield frontier blends storage with staking, poised for outsized impact as AVSs proliferate.