Ethereum’s security model has always relied on the economic weight of staked ETH, but with the rapid expansion of DeFi and new protocols, even robust systems can be stretched thin. Enter EigenLayer restaking: a mechanism that lets validators amplify their impact by putting their staked ETH to work across multiple protocols, not just Ethereum’s core chain. This innovation is transforming how validators think about network security and capital efficiency, unlocking new opportunities and some novel risks.

What Is EigenLayer Restaking?

At its heart, EigenLayer restaking is about leveraging your existing staked ETH to secure additional decentralized applications and protocols, called Actively Validated Services (AVSs): without unstaking or doubling your capital outlay. Validators can participate in two major ways:

- Liquid Restaking: Deposit liquid staking tokens (LSTs) like stETH or rETH into EigenLayer smart contracts. This allows you to simultaneously secure Ethereum and multiple AVSs.

- Native Restaking: Adjust validator withdrawal credentials so your staked ETH is directly linked to EigenLayer’s contracts, letting you natively restake without intermediaries.

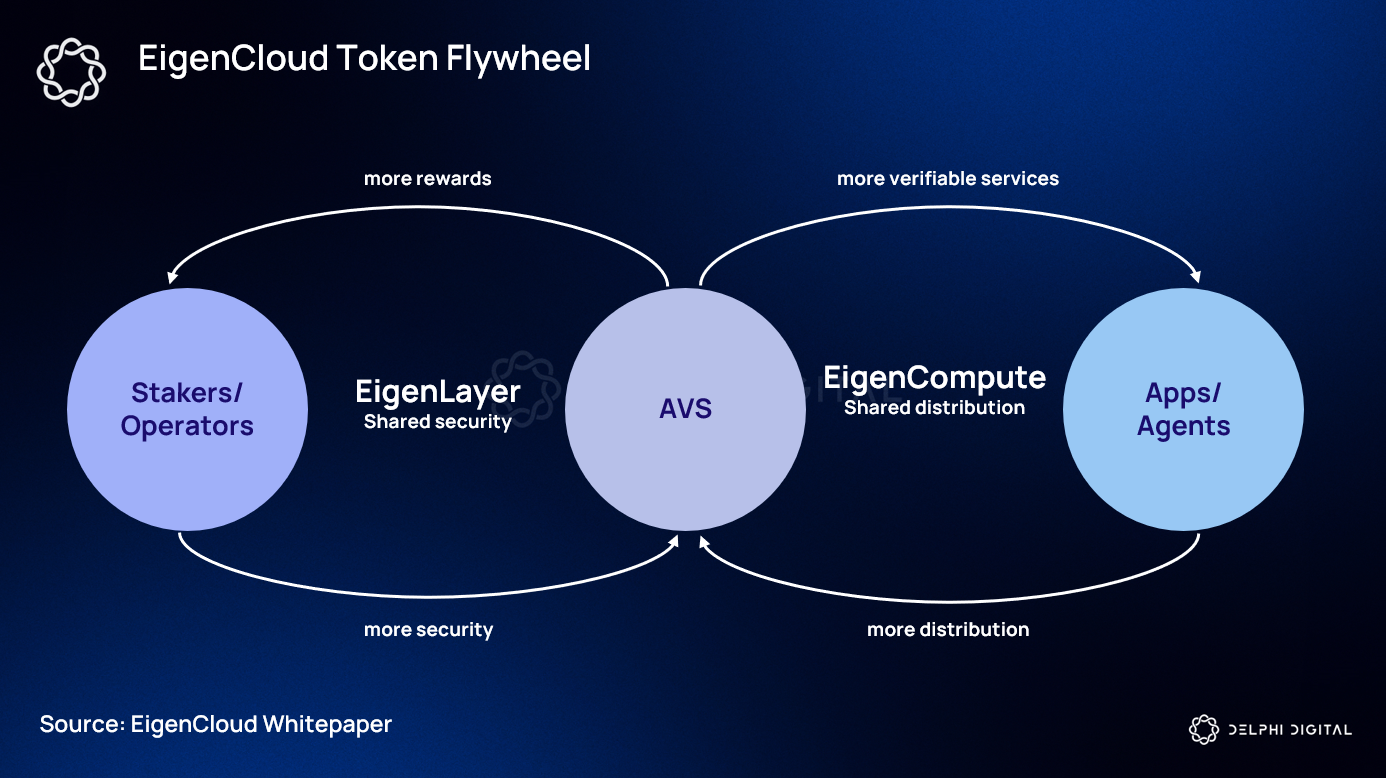

This pooled security model dramatically increases the cost and complexity for would-be attackers. By making it possible for the same economic stake to protect many services, EigenLayer creates a layered defense that is much harder to compromise than siloed validation sets.

Pooled Security: Raising the Bar for Attackers

The genius of EigenLayer lies in its ability to aggregate validator resources across protocols. When you restake, your ETH doesn’t just secure Ethereum, it also underpins AVSs that opt into EigenLayer’s model. This means an attacker must now compromise a much larger pool of capital to disrupt any single service protected by restaked ETH.

This collective approach leads to several key benefits:

- Stronger Deterrence: The more protocols share security via restaking, the higher the economic threshold for attacks.

- Network Effects: As more AVSs join EigenLayer, pooled security becomes even more formidable, a classic flywheel effect.

- Simplified Bootstrapping: New protocols don’t need to build their own validator sets from scratch; they can tap into Ethereum’s existing validator base through EigenLayer.

If you’re curious about how these mechanics play out in practice, or want a deeper technical dive, check out our companion guide on how restaking enhances validator security at a technical level.

The Rewards and Responsibilities for Validators

The upside for validators isn’t just about altruistically strengthening Ethereum or DeFi, it’s also financial. By participating in AVS validation through EigenLayer, you can earn extra rewards on top of standard staking yields. These rewards come from fees paid by AVSs seeking cryptoeconomic security without spinning up new networks from scratch.

BUT, and this is critical, restaking introduces new slashing conditions and operational complexities:

- You’re now accountable not just to Ethereum’s consensus rules but also those set by each AVS you support.

- Poor performance or downtime could trigger slashing across multiple protocols simultaneously.

- You’ll need robust monitoring tools and operational discipline to avoid cascading penalties.

This tradeoff between enhanced rewards and heightened risk makes protocol diligence absolutely essential. Before opting in, validators should carefully assess each AVS’s slashing logic and uptime requirements, there’s no substitute for doing your homework here!

Ethereum (ETH) Price Prediction Post-EigenLayer Adoption (2026-2031)

Professional outlook factoring in EigenLayer restaking, market cycles, and technology adoption.

| Year | Minimum Price | Average Price | Maximum Price | Yearly Change (%) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $3,400 | $4,200 | $5,100 | +10% | Early adoption of EigenLayer boosts validator rewards and network security. Volatility remains due to global macro conditions. |

| 2027 | $3,900 | $4,900 | $6,200 | +17% | Broader integration of restaking across DeFi. Regulatory clarity improves institutional participation. |

| 2028 | $4,500 | $5,700 | $7,400 | +16% | Ethereum upgrades (e.g., Danksharding) and high EigenLayer participation drive network value. Bullish sentiment builds. |

| 2029 | $4,200 | $6,300 | $8,800 | +11% | Market faces mid-cycle correction, but EigenLayer’s security model retains investor confidence. Growth in AVS applications. |

| 2030 | $4,800 | $7,400 | $10,200 | +17% | New DeFi and enterprise AVSs leverage EigenLayer. ETH becomes core security asset for multiple protocols. |

| 2031 | $5,400 | $8,600 | $12,300 | +16% | Matured restaking ecosystem. ETH supply constraints and widespread utility drive price to new highs. |

Price Prediction Summary

Ethereum’s price outlook for 2026-2031 is broadly bullish, supported by the widespread adoption of EigenLayer’s restaking mechanism, which enhances network security and validator rewards. While periods of volatility and corrections are expected, the progressive integration of Actively Validated Services (AVSs) and Ethereum protocol upgrades underpin steady growth. Regulatory advancements and increased institutional adoption will further solidify ETH’s market position.

Key Factors Affecting Ethereum Price

- EigenLayer restaking adoption and validator participation rates

- Ethereum protocol upgrades (scalability, security)

- Growth in DeFi and AVS ecosystems leveraging ETH restaking

- Global regulatory developments and institutional adoption

- Market cycles and macroeconomic conditions

- Competition from alternative Layer 1 and restaking protocols

- Potential risks from slashing penalties and liquidity constraints for validators

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Mitigating these risks comes down to preparation and ongoing vigilance. Validators who thrive in the EigenLayer era will be those who treat restaking as a professional operation, not a passive income stream. With the current Ethereum price holding at $3,828.08, even minor penalties can have real financial consequences, so every validator’s playbook should include:

For many, the most effective strategy is to automate monitoring and alerts across all supported AVSs. This helps catch downtime or misbehavior before it results in slashing. It’s also wise to stay engaged with both the EigenLayer core team and each AVS community, protocol upgrades and new risk disclosures often surface there first.

Restaking in Action: Validator Perspectives

The early results are promising. Validators report that restaking has not only diversified their reward streams, but also created a sense of shared mission across DeFi projects. As one operator recently put it on social media, “Restaking with EigenLayer feels like leveling up my node, I’m earning more, but I’m also helping bootstrap new protocols that might shape Ethereum’s future. ”

Of course, experiences vary based on technical setup and which AVSs you choose to support. Some validators prefer to restake only with mature protocols that have well-documented slashing conditions; others are willing to take on higher risk for higher reward by supporting experimental AVSs. There’s no one-size-fits-all approach here, your appetite for risk and operational bandwidth will dictate your optimal path.

If you’re weighing whether restaking is right for you, check out our detailed breakdown of EigenLayer’s impact on validator rewards and security. You’ll find case studies and scenario modeling based on real-world data since mainnet launch.

Looking Ahead: The Future of Restaking Protocols

EigenLayer isn’t just a tool for today, it’s laying the groundwork for a new paradigm in decentralized security. As more Actively Validated Services join the ecosystem, we’re likely to see:

- Increased capital efficiency: Validators can stack rewards from multiple sources without additional hardware or capital.

- Greater protocol diversity: Lower bootstrapping costs mean more experimentation and innovation at the application layer.

- Tighter integration with liquid staking: The interplay between LSTs and native restaking will continue to evolve as user needs change.

The bottom line? For Ethereum validators willing to embrace new responsibilities, and invest in operational excellence, restaking via EigenLayer represents both a way to supercharge returns and a chance to actively shape the next era of blockchain security.

If you’re ready to dive deeper or want practical tips on getting started, browse our guides on how restaking enhances security for validators or visit our FAQ section for beginners.