Modular restaking on Arbitrum is rapidly emerging as a transformative force within decentralized finance, fundamentally reshaping how protocols approach both security and yield generation. As the Ethereum ecosystem continues to mature, the innovation of restaking – allowing staked assets to secure multiple services simultaneously – is driving a new era of capital efficiency, risk management, and protocol interoperability.

Arbitrum’s Modular Restaking: A New Security Paradigm

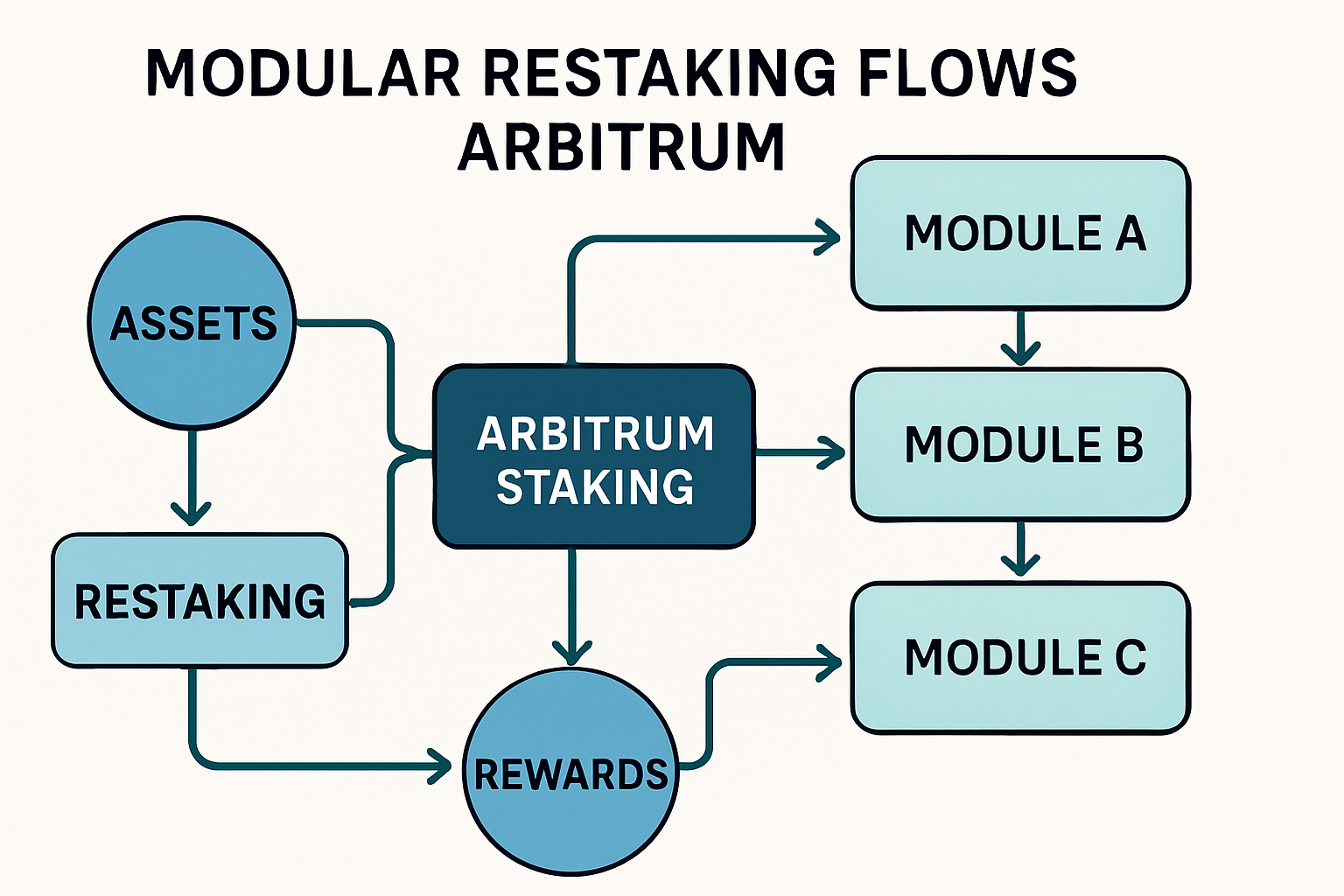

At the heart of this evolution lies the concept of shared or modular security. Traditional staking models typically lock assets into securing a single network or protocol. Modular restaking protocols on Arbitrum, however, enable these same assets to be deployed across several decentralized applications (dApps), bolstering their defenses without requiring additional capital inflows. This shared security model means that if you stake on Arbitrum today with ARB priced at $0.3337, your capital can secure not just one protocol but an entire suite of services.

This approach is exemplified by platforms like Symbiotic, which have introduced cross-chain restaking capabilities. Here, ERC-20 tokens representing staked positions can be deposited to support security across multiple networks and dApps. The result? Enhanced resilience against attacks and greater overall robustness throughout the Arbitrum ecosystem. As highlighted by industry research, such asset-agnostic frameworks are paving the way for permissionless modular security layers that benefit both protocols and their users.

Optimizing Yield with Advanced Restaking Strategies

The implications for yield generation are equally significant. By unlocking the ability to earn rewards from multiple sources using a single staked asset, modular restaking introduces new pathways for maximizing returns while diversifying risk exposure. Stakers can participate in native restaking (directly securing protocols), leverage liquid staking tokens (LSTs), or even utilize liquidity provider tokens as collateral within integrated DeFi strategies.

Innovative projects like YieldNest have taken this further with AI-managed MAX LRTs – liquid restaking tokens that dynamically allocate capital across staking, restaking, and DeFi products based on real-time market conditions. This unified approach abstracts away much of the complexity involved in managing multiple positions while providing participants with higher risk-adjusted yields and continuous liquidity.

The impact is clear: modular restaking protocols are now regarded as one of the fastest-growing sectors in DeFi’s landscape, second only to core lending markets in terms of total value locked (TVL) growth rates.

Strategic Initiatives Fueling Restaking Growth on Arbitrum

ArbitrumDAO’s DeFi Renaissance Incentive Program (DRIP) is another major catalyst accelerating adoption. With up to 24 million ARB tokens committed to fostering new strategies – including leveraged looping for yield-bearing ETH and stablecoins – DRIP aims to drive liquidity, efficiency, and innovation throughout the network’s rapidly expanding DeFi economy. The first season has already seen leading lending protocols benefit from increased incentives, spurring both user engagement and protocol development.

This strategic alignment between infrastructure upgrades and incentive programs underscores why many analysts now view modular restaking on Arbitrum as a foundational pillar for Ethereum’s next phase of growth.

Arbitrum (ARB) Price Prediction 2026-2031

Forecast based on modular restaking adoption, DeFi growth, and Arbitrum’s ecosystem expansion

| Year | Minimum Price | Average Price | Maximum Price | Yearly % Change (Avg) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $0.28 | $0.40 | $0.55 | +20% | Modular restaking adoption grows, but volatility remains high; DRIP incentives continue. |

| 2027 | $0.33 | $0.52 | $0.78 | +30% | DeFi composability and cross-chain restaking mature; regulatory clarity improves investor sentiment. |

| 2028 | $0.45 | $0.68 | $1.10 | +31% | Yield optimization platforms and liquid restaking tokens (LRTs) drive capital inflow; competition from other L2s increases. |

| 2029 | $0.62 | $0.92 | $1.45 | +35% | Arbitrum cements itself as a DeFi hub; institutional DeFi interest rises, but macro volatility persists. |

| 2030 | $0.82 | $1.18 | $1.85 | +28% | Restaking becomes mainstream in the Superchain; further scalability and security upgrades implemented. |

| 2031 | $1.05 | $1.46 | $2.20 | +24% | Arbitrum ecosystem matures with sustained TVL, robust developer activity, and new use cases. |

Price Prediction Summary

Arbitrum (ARB) is poised for steady growth through 2031, driven by its leadership in modular restaking, DeFi incentives, and technological innovation. While short-term volatility remains possible, the long-term outlook is positive, with ARB potentially exceeding $2 under bullish scenarios as restaking becomes a DeFi standard.

Key Factors Affecting Arbitrum Price

- Adoption of modular restaking protocols and cross-chain security solutions

- Success of ArbitrumDAO’s DeFi incentive programs (e.g., DRIP)

- Growth and integration of liquid restaking tokens (LRTs) and yield optimization platforms

- Regulatory clarity and global DeFi acceptance

- Competition from other Layer 2 and restaking-enabled platforms

- Overall crypto market cycles and macroeconomic trends

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Looking ahead, the convergence of modular restaking protocols with Arbitrum’s high-throughput infrastructure is likely to further amplify both security and yield opportunities. As more decentralized applications integrate with restaking frameworks, the network effect intensifies: each new protocol secured by restaked assets increases overall resilience and deepens the liquidity pool available for innovative DeFi products.

One of the most compelling aspects for participants is how modular restaking supports a composable DeFi economy. Rather than siloing capital in isolated staking contracts, users can fluidly allocate staked ARB or LSTs across lending markets, insurance primitives, and emerging cross-chain services. This composability is driving a wave of protocol experimentation, where risk can be distributed, rewards optimized, and new financial primitives rapidly iterated.

Risk Considerations and Evolving Best Practices

Despite these advances, it’s crucial for investors to remain vigilant about the unique risks that modular restaking introduces. As assets are reused to secure multiple protocols, correlated risks may arise: a vulnerability in one dApp could propagate across others sharing the same security layer. To mitigate this, leading platforms are adopting dynamic slashing mechanisms, advanced monitoring tools, and AI-driven risk assessment engines that continuously evaluate protocol health. These measures help ensure that while yield potential is maximized, systemic threats are proactively managed.

Transparency remains a cornerstone of trust in this evolving landscape. Protocols that provide clear reporting on validator performance, slashing events, and smart contract audits will continue to attract more sophisticated capital. For those considering participation in Arbitrum’s modular restaking economy at today’s ARB price of $0.3337, due diligence on platform security practices should be as much a priority as yield optimization.

What’s Next for Modular Restaking on Arbitrum?

The trajectory for modular restaking is set to accelerate as interoperability standards mature and bridges like EigenLayer-Arbitrum become more seamless. Expect continued growth in liquid restaking tokens (LRTs), deeper integration with real-world asset protocols, and an expanding toolkit for institutional risk management, each reinforcing Arbitrum’s position at the center of Ethereum’s DeFi innovation stack.

For developers and investors alike, staying informed about these advances will be critical. The rapid evolution of arbitrum restaking protocols, combined with robust incentive programs like DRIP and sophisticated risk controls, points toward a future where capital efficiency and decentralized security are not trade-offs but mutually reinforcing strengths.

As always in DeFi: balance your pursuit of yield with disciplined risk management, and embrace the opportunities that modular restaking unlocks as Arbitrum continues to shape the next era of decentralized finance.