Cross-chain restaking is rapidly transforming the landscape of decentralized finance, offering crypto holders the ability to maximize yields across multiple blockchains without sacrificing liquidity or security. At the forefront of this movement is Ekox, a protocol that leverages EigenLayer’s shared security model to unlock new yield streams for Ethereum stakers while abstracting away technical complexity. In this analysis, we’ll dissect how Ekox’s innovative architecture and strategic partnerships are setting new standards for multi-chain staking yields and accessibility.

Ekox Restaking: The Liquid Bridge to Multi-Chain Yields

Restaking, as pioneered by EigenLayer, allows Ethereum validators to re-pledge their staked ETH or Liquid Staking Tokens (LSTs) to secure additional protocols. This model introduces a shared security layer, enabling new decentralized services (AVSs) to benefit from Ethereum’s robust validator set. However, direct participation in EigenLayer has typically required significant technical expertise and active management.

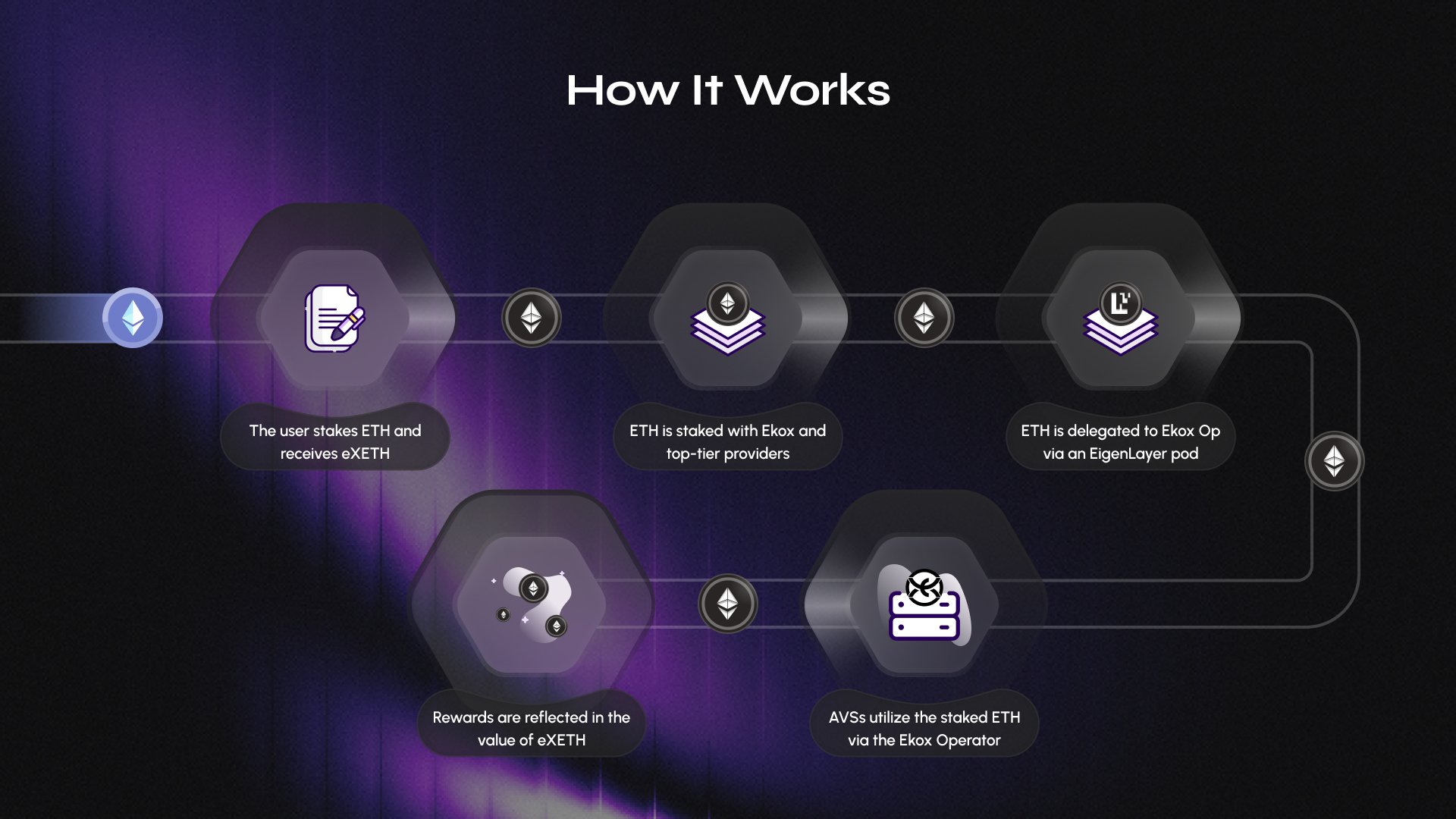

Ekox restaking addresses these barriers by offering a streamlined user experience. When users deposit ETH into Ekox, they receive eXETH – a liquid restaking token that represents both their Ethereum staking position and their exposure to EigenLayer AVS rewards. All staking and restaking rewards are auto-compounded into the value of eXETH, giving users a single token that tracks their growing multi-chain staking yields. This approach eliminates the need for manual validator setup or operator delegation, making advanced restaking strategies accessible to a much wider audience.

Cross-Chain Expansion: Ekox and Arichain Partnership

The true innovation behind Ekox lies in its cross-chain capabilities. Through a recent partnership with Arichain, Ekox now integrates multi-VM infrastructure with its modular restaking architecture. This means that users are no longer limited to Ethereum-based rewards; instead, they can tap into mutual liquidity pools and restake assets across compatible blockchain networks.

This collaboration effectively broadens the universe of available staking opportunities. By leveraging Arichain’s infrastructure, Ekox users can allocate their capital to secure protocols on other chains while maintaining the simplicity and liquidity of eXETH. The result is a more efficient, composable system for capturing diverse yield streams without the friction of bridging or lockups.

Key Benefits of Ekox’s Cross-Chain Restaking

-

Dual-Layer Yield Generation: Ekox enables users to earn both Ethereum staking rewards and additional yields from EigenLayer’s Actively Validated Services (AVSs), maximizing overall returns through a single platform.

-

Seamless Cross-Chain Opportunities: Through its partnership with Arichain, Ekox allows users to access restaking rewards across multiple blockchain networks, expanding earning potential beyond Ethereum.

-

Auto-Compounding Rewards: All staking and restaking rewards are automatically compounded into the value of eXETH, streamlining yield maximization without manual intervention.

-

Liquidity and Flexibility: The liquid restaking token eXETH provides users with ongoing liquidity, allowing them to trade or utilize their staked assets while still earning restaking yields.

-

User-Friendly Experience: Ekox abstracts away the technical complexities of validator setup, delegation, and operator selection, making advanced restaking strategies accessible to all users regardless of technical expertise.

How Ekox Abstracts Complexity for End Users

One of the persistent challenges in the restaking ecosystem has been the operational overhead required to participate. Setting up validators, managing delegations, and tracking multiple reward streams can quickly become overwhelming. Ekox solves this by handling all backend validator operations and operator selection on behalf of its users. This abstraction is critical for driving mainstream adoption of cross-chain restaking protocols.

The end result is that users can simply deposit ETH, receive eXETH, and benefit from dual-layer rewards: base Ethereum staking yields plus incremental rewards from securing AVSs and other supported networks. All rewards are transparently reflected in the eXETH price, with no manual intervention required. This model is particularly attractive for both retail and institutional investors seeking passive exposure to multi-chain staking yields without taking on additional technical risk.

Security remains paramount in any shared security blockchain environment. Ekox’s architecture is designed to minimize risk by actively vetting AVSs and supported networks, leveraging EigenLayer’s robust slashing and monitoring mechanisms. The protocol’s modular design ensures that only reputable and secure services are integrated, reducing the likelihood of validator misbehavior or cross-protocol contagion. This diligence is especially important as cross-chain restaking introduces new vectors for smart contract and consensus risk.

Transparency is another core pillar. Ekox provides granular reporting on staking allocations, yield sources, and validator performance. Users can track their eXETH-backed positions in real time, with all underlying reward streams and protocol interactions clearly documented. This level of disclosure supports informed decision-making and reinforces trust in the protocol’s operations.

Comparative Landscape: Ekox vs. Other Restaking Protocols

The liquid restaking sector has become increasingly competitive, with platforms like Eigenpie, Kelp DAO, and Swell Network offering their own takes on multi-chain staking yields. What sets Ekox apart is its seamless user experience and its focus on cross-chain interoperability. While most competitors concentrate on maximizing Ethereum-native yields, Ekox’s integration with Arichain unlocks a broader array of yield sources, all while preserving liquidity through eXETH.

For investors, the ability to earn from both Ethereum and emerging AVSs – as well as protocols on other chains – provides a powerful diversification tool. This is especially relevant in today’s volatile market, where single-chain exposures often carry outsized risk. By distributing validator capital across multiple networks, Ekox users can optimize for risk-adjusted returns while still benefiting from Ethereum’s foundational security guarantees.

The Future of Shared Security and Multi-Chain Yields

As the modular crypto ecosystem matures, protocols like Ekox are poised to play a critical role in shaping the next generation of DeFi infrastructure. The convergence of liquid restaking tokens, shared security, and cross-chain composability is creating new opportunities for both yield generation and protocol security. Ekox’s model – combining simplicity, transparency, and interoperability – is well positioned to capture this growth.

Looking ahead, continued innovation in validator management, risk mitigation, and reward optimization will be key differentiators. Strategic partnerships, such as the ongoing collaboration between Ekox and Arichain, will likely expand the universe of supported assets and AVSs, further enhancing the protocol’s utility for users seeking sustainable, multi-chain staking yields.

Ekox Roadmap: Upcoming Features & Milestones

-

Expansion of Cross-Chain Restaking via Arichain Partnership: Ekox is integrating Arichain’s multi-VM infrastructure to unlock cross-chain restaking, enabling users to earn yields from multiple blockchain networks through mutual liquidity pools.

-

Launch of Enhanced eXETH Utility: Ekox plans to expand the use cases for its liquid restaking token eXETH, allowing holders to access new DeFi protocols and participate in additional yield-generating strategies across supported networks.

-

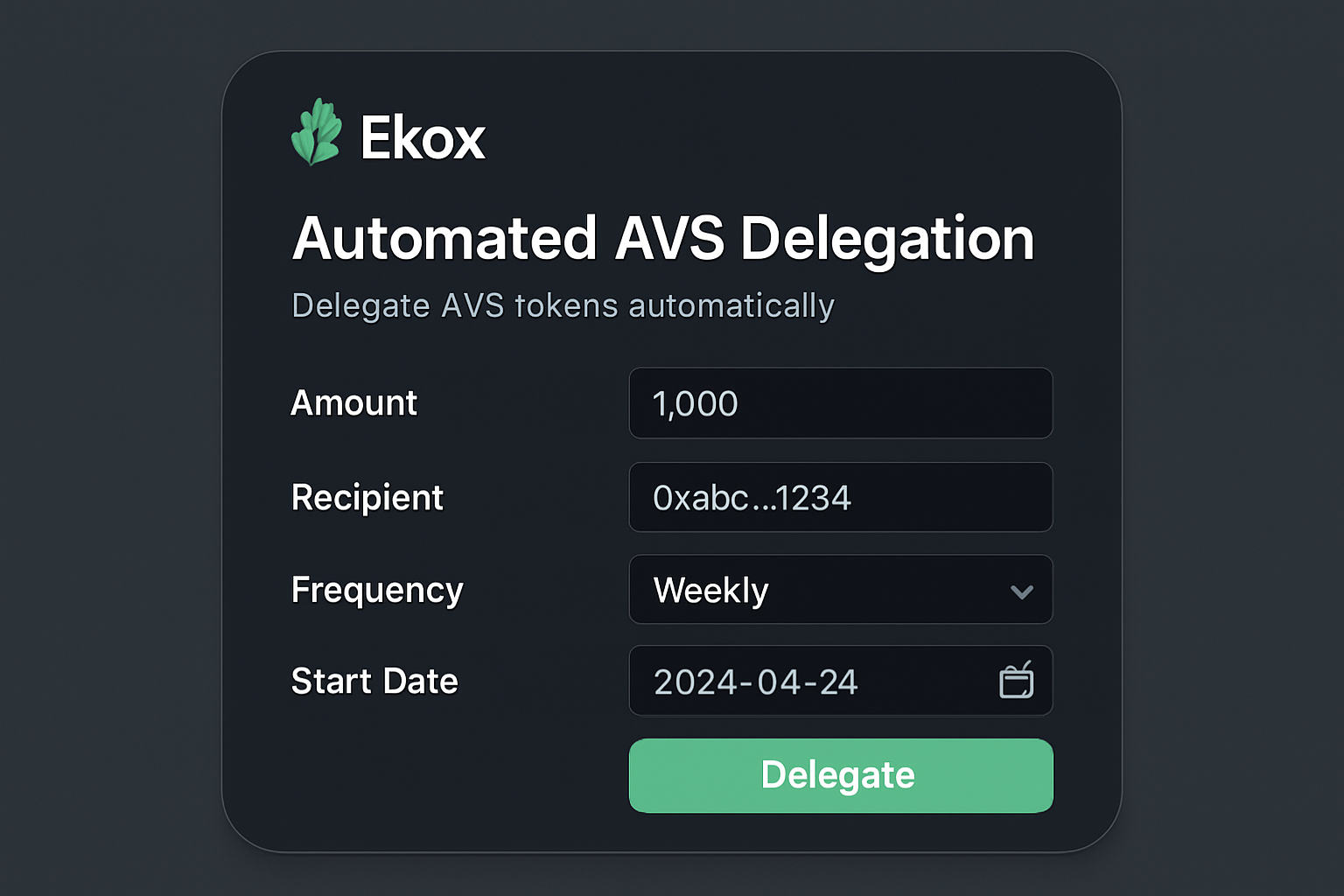

Automated AVS Delegation and Operator Selection: Upcoming features will further streamline validator and operator management, making it easier for users to participate in EigenLayer’s Actively Validated Services (AVSs) without technical barriers.

-

Broader Blockchain Network Integration: Ekox is working to support restaking across more blockchain ecosystems beyond Ethereum, expanding the range of rewards and security services available to users.

-

Advanced Analytics and Transparency Tools: The roadmap includes new dashboard features for real-time tracking of yields, restaking allocations, and cross-chain performance, enhancing transparency for all eXETH holders.

For those navigating the rapidly evolving world of Ethereum restaking, Ekox offers a compelling blend of yield maximization, operational simplicity, and cross-chain flexibility. As always, due diligence remains essential – but with protocols like Ekox leading the way, the future of multi-chain staking yields looks increasingly accessible and resilient.