Cloud computing is undergoing a seismic shift as blockchain-grade trust is fused with the flexibility of off-chain infrastructure. At the heart of this transformation lies EigenLayer restaking, an Ethereum-native innovation that now secures over $20 billion in total value locked (TVL). As decentralized applications and AI workloads proliferate, the demand for verifiable, censorship-resistant, and tamper-proof cloud services has never been greater. EigenLayer’s restaking protocol and its flagship EigenCloud platform are rapidly emerging as the backbone of this new, verifiable cloud stack.

Restaked Security: The Foundation of Verifiable Cloud Infrastructure

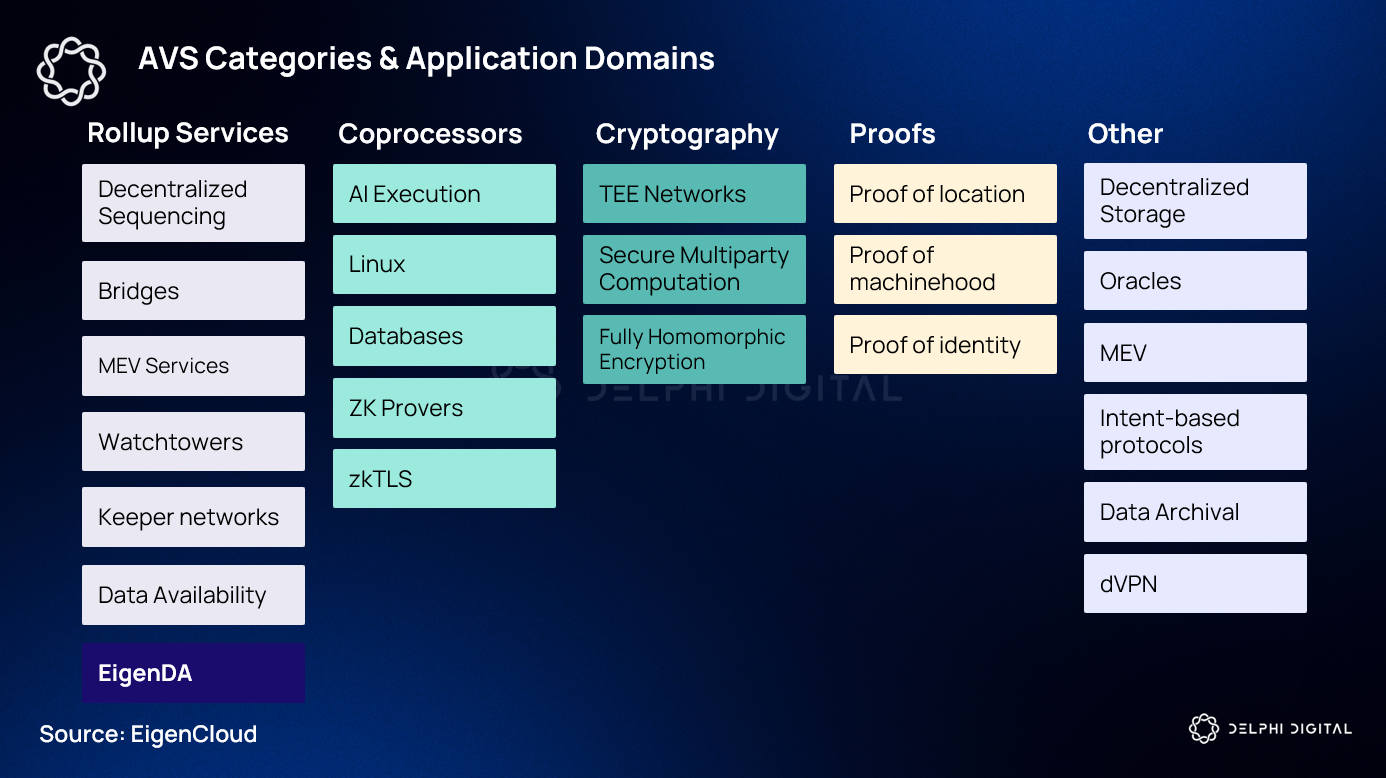

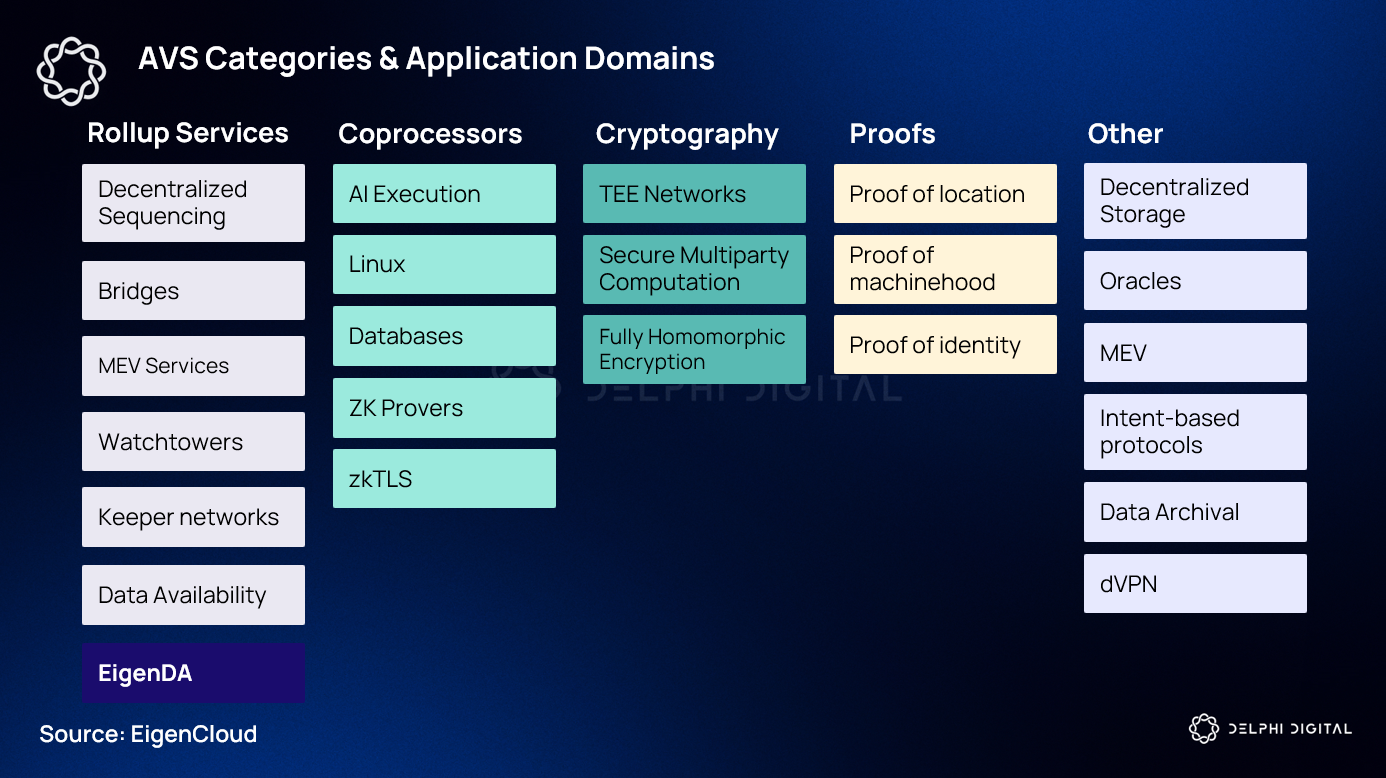

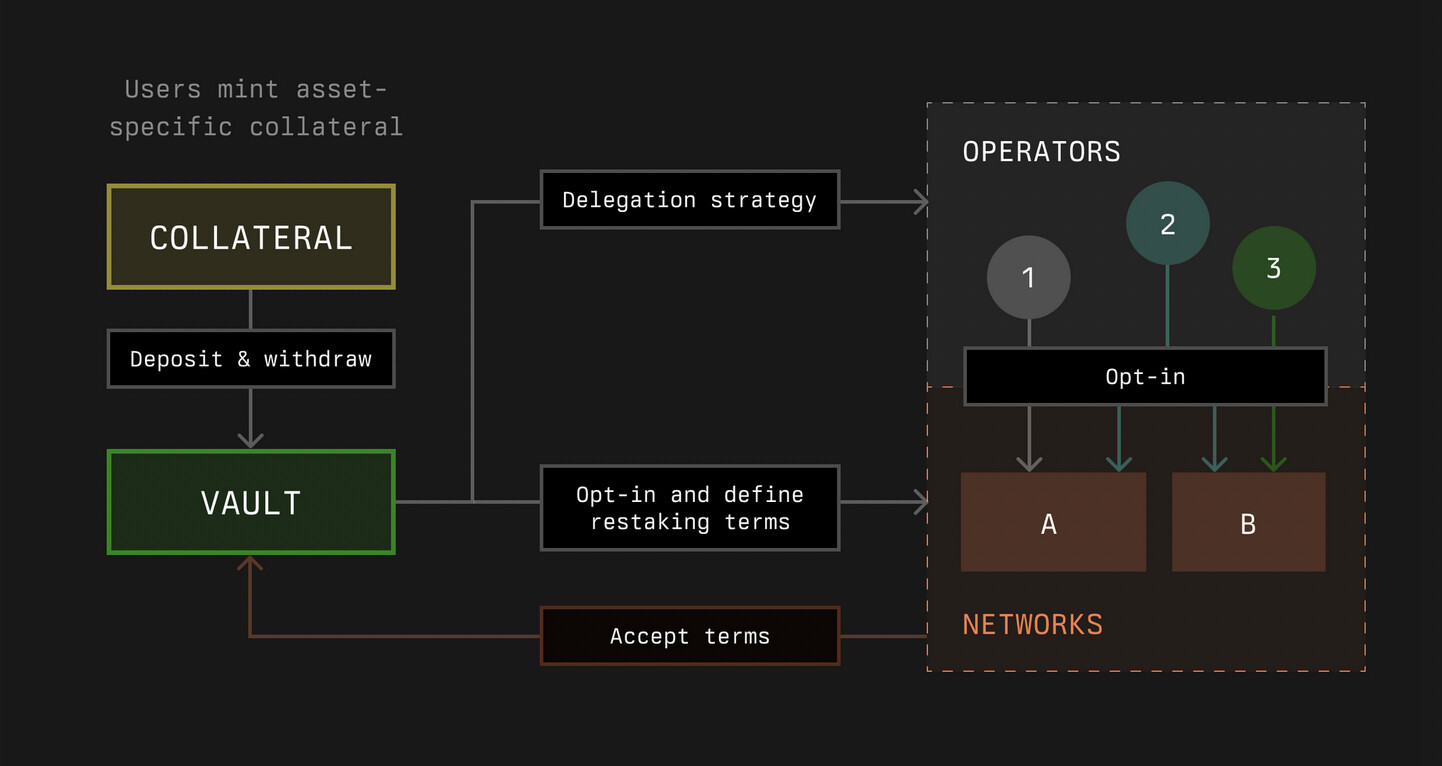

The genius of EigenLayer lies in its ability to extend Ethereum’s robust security model to a broad array of off-chain applications without requiring each project to bootstrap its own validator set or token economics. Through restaking, users can lock up ETH, Liquid Staking Tokens (LSTs), EIGEN tokens, bEIGEN, or any ERC20 asset into EigenLayer smart contracts. These assets then serve as collateral underpinning Actively Validated Services (AVSs): modular services ranging from data availability layers to zero-knowledge proof generation and verifiable AI compute.

This pooled security model enables AVSs to inherit Ethereum’s economic guarantees while maintaining operational independence. Developers can now launch decentralized cloud services, such as EigenDA for high-throughput data availability or EigenCompute for verifiable off-chain computation, without sacrificing trust assumptions.

The Rise of AVS Adoption: From Data Availability to Deterministic AI

2025 has marked an inflection point in AVS adoption. With integrations spanning Mantle Network, ZKsync, and Coinbase’s Base chain, EigenLayer’s multi-chain verification capabilities have catalyzed a new era for both DeFi and AI infrastructure. Notably, EigenAI, a deterministic AI module built atop EigenCloud, allows users to cryptographically verify not only AI prompts and outputs but also the precise model version used, solving the notorious “black box” problem plaguing conventional AI systems.

The trio of primitives provides EigenDA, EigenVerify, and EigenCompute: form the backbone of this verifiable stack:

- EigenDA: Delivers scalable data availability secured by restaked ETH.

- EigenVerify: Facilitates decentralized verification of off-chain proofs.

- EigenCompute: Provides tamper-resistant compute resources with execution guarantees.

This architecture empowers developers to build applications that span traditional finance rails, blockchain settlements, and even real-world agentic AI, all while retaining cryptoeconomic security at their core.

How Slashing Mechanisms Reinforce Trust in Decentralized Cloud

A critical component underpinning EigenLayer’s credibility is its slashing mechanism, introduced on April 17,2025. If AVS operators fail to meet their commitments, whether due to downtime or malicious behavior, their staked assets are subject to slashing penalties. This direct alignment between operator incentives and service reliability is essential for scaling trustless infrastructure beyond the boundaries of Ethereum L1.

Ethereum (ETH) Price Prediction 2026-2031 Post-EigenLayer Slashing Upgrade

Forecasts based on EigenLayer’s restaked security, slashing upgrade, and verifiable cloud infrastructure adoption. All prices in USD.

| Year | Minimum Price | Average Price | Maximum Price | Potential % Change (Avg vs. 2025) | Key Scenario |

|---|---|---|---|---|---|

| 2026 | $3,200 | $4,500 | $5,800 | +15% | Expansion of AVSs; strong EigenCloud adoption |

| 2027 | $3,800 | $5,400 | $7,000 | +38% | Broader Layer-2 integration; increased institutional staking |

| 2028 | $4,100 | $6,250 | $8,200 | +59% | Regulatory clarity; AI & cloud verifiability mainstream |

| 2029 | $4,500 | $7,200 | $9,600 | +84% | ETH as backbone for modular Web3 services |

| 2030 | $5,000 | $8,350 | $11,000 | +113% | Global enterprise adoption; robust AVS ecosystem |

| 2031 | $5,400 | $9,500 | $13,000 | +142% | ETH leads decentralized compute; competition from alt-L1s |

Price Prediction Summary

Ethereum’s price outlook from 2026 to 2031 is positive, driven by EigenLayer’s innovations in restaking, verifiable cloud infrastructure, and expanding multi-chain services. The slashing upgrade has reinforced network security, attracting more institutional and developer participation. While volatility and competition remain, ETH is poised for substantial growth, especially as it underpins new decentralized AI and off-chain trust use cases.

Key Factors Affecting Ethereum Price

- Adoption rate of EigenLayer’s restaked security and AVSs

- Growth of EigenCloud and verifiable AI infrastructure

- Institutional and enterprise participation in staking

- Regulatory clarity for staking and modular blockchains

- Integration with Layer-2 solutions and multi-chain ecosystems

- Competition from other smart contract platforms (e.g., Solana, Avalanche)

- Macro crypto market cycles and global economic conditions

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Economics Behind Restaking: Dual-Token Dynamics and TVL Growth

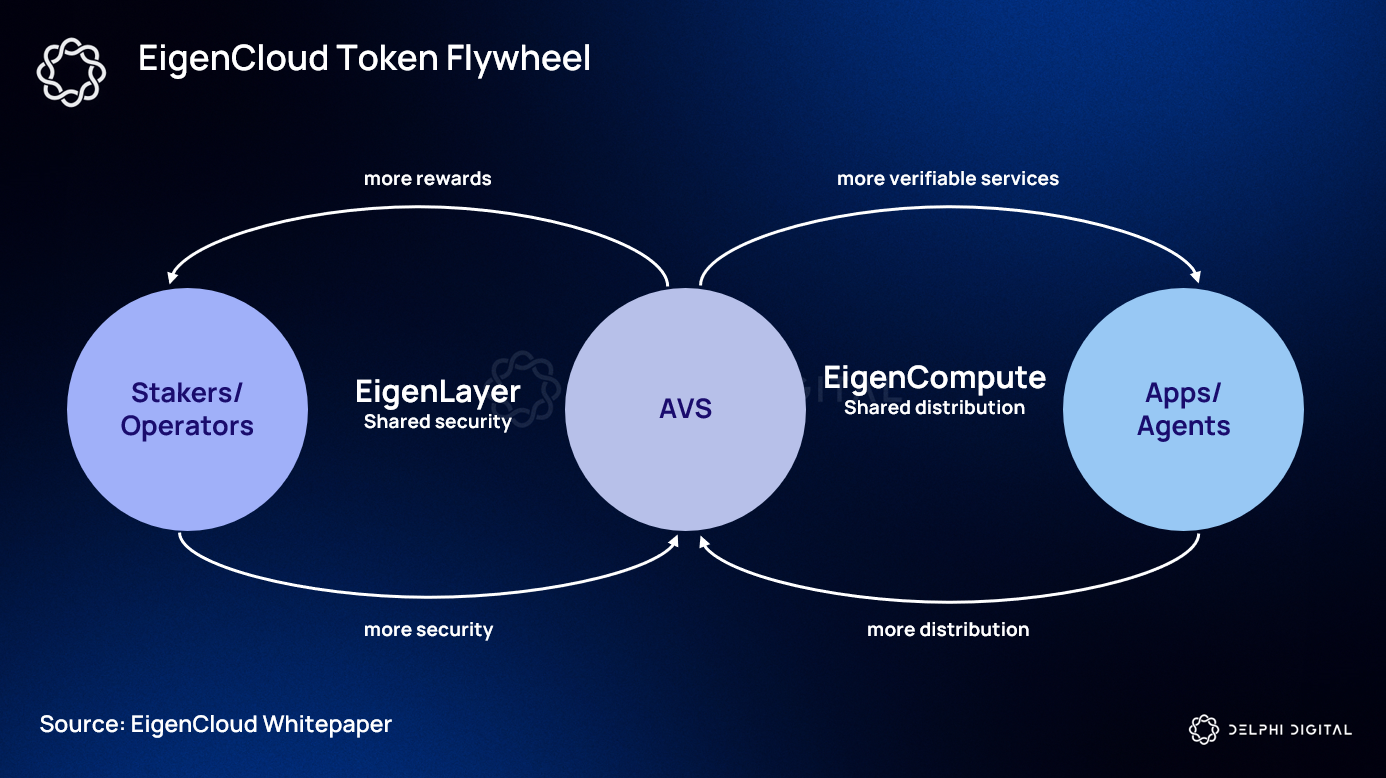

The introduction of dual-token staking via EIGEN and bEIGEN has further diversified participation in the ecosystem while enhancing liquidity options for stakers. As more value accrues within EigenLayer contracts, currently at $20 billion TVL, the economic security available for AVSs continues to deepen. This flywheel effect not only attracts developers seeking robust security guarantees but also incentivizes validators with new reward streams tied directly to service performance.

The current price of Ethereum stands at $3,923.82, reflecting sustained confidence in both base-layer staking yields and the expanding utility unlocked by restaked protocols like EigenLayer. For those tracking market implications or considering participation as either a staker or AVS operator, understanding these dynamics is crucial as competition intensifies among modular blockchain networks.

As the EigenLayer ecosystem matures, the interplay between restaked ETH, EIGEN, and bEIGEN introduces new layers of capital efficiency and risk management. Stakers can now dynamically allocate their assets across a spectrum of AVSs, balancing yield opportunities with varying risk profiles. This modular approach is rapidly making EigenLayer the default security substrate for next-generation decentralized cloud infrastructure.

What sets the verifiable cloud stack apart is not just its technical architecture but its ability to foster real trust in off-chain computation and AI. With EigenAI and EigenCompute, developers can build applications where every step, from data ingestion to model inference, is auditable and cryptographically secure. This is especially critical as enterprises begin integrating agentic AI into workflows that span both traditional finance and decentralized ledgers.

Practical Use Cases: Verifiable AI, Decentralized Oracles, and Beyond

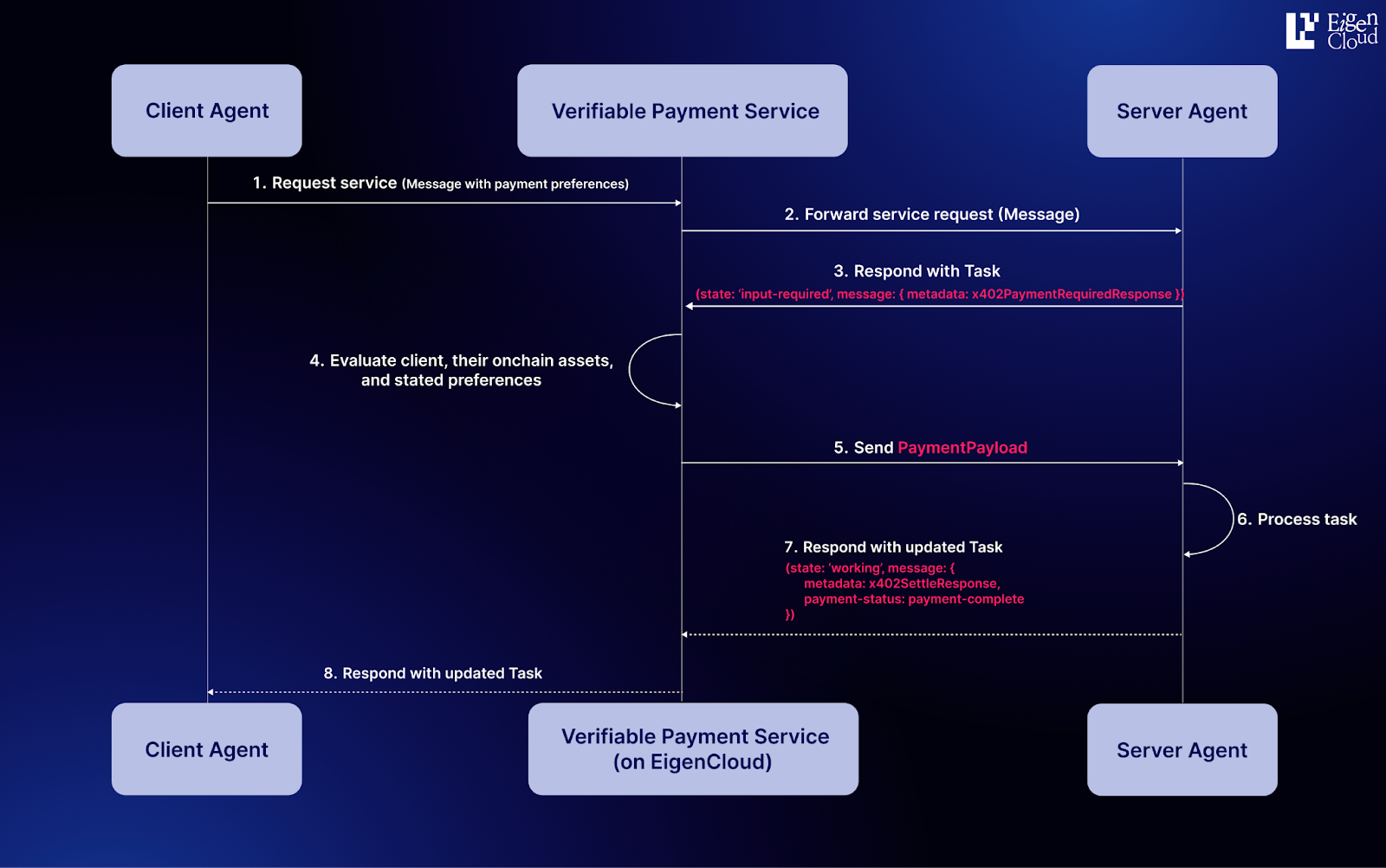

The practical implications are profound. Decentralized oracles leverage EigenLayer’s pooled security to deliver tamper-proof data feeds for DeFi protocols. Meanwhile, verifiable AI services built on EigenAI enable users to confirm the integrity of every model output, eliminating trust gaps that have long plagued black-box machine learning systems. Financial institutions are piloting cross-chain settlement engines secured by restaked ETH, while developers are experimenting with privacy-preserving zero-knowledge proofs validated via EigenVerify.

Key Applications Enabled by EigenLayer Restaking

-

EigenCloud: Verifiable AI Infrastructure — EigenCloud leverages EigenLayer’s restaked security to deliver verifiable AI services. Developers can cryptographically verify AI prompts, outputs, and model versions, ensuring transparency and trust in AI-driven applications beyond the blockchain.

-

EigenDA: Scalable Data Availability for Rollups — As a core Actively Validated Service (AVS), EigenDA uses restaked ETH to provide high-throughput, decentralized data availability for Ethereum rollups and Layer 2 networks, supporting scalable and secure blockchain applications.

-

EigenVerify: Off-Chain Computation Verification — EigenVerify enables trust-minimized verification of off-chain computations, allowing decentralized apps to confidently interact with external data and processes while maintaining blockchain-grade security guarantees.

-

Multi-Chain Verification on Base and Layer 2s — EigenLayer’s multi-chain verification feature extends restaked security to networks like Coinbase’s Base chain and ZKsync, enabling AVSs to secure applications across multiple chains without compromising Ethereum’s security model.

-

Decentralized Zero-Knowledge Proof Services — Through integrations with ZKsync and Mantle Network, EigenLayer powers decentralized zero-knowledge proving, enhancing privacy and scalability for Web3 applications by leveraging pooled restaked security.

-

Slashing-Backed Operator Accountability — The slashing mechanism introduced in April 2025 ensures that operators of AVSs are held accountable for failures or malicious actions, reinforcing the reliability and integrity of verifiable cloud services.

This convergence of cryptoeconomic guarantees and flexible cloud primitives is already attracting partnerships from major players like Google Cloud, which recently integrated with EigenCloud to enable trusted AI agents in payment workflows across both fiat rails and blockchains.

Scaling Secure Infrastructure: Multi-Chain Verification and Modular Expansion

A pivotal development in 2025 has been the rollout of multi-chain verification capabilities. By extending restaked security to Layer 2 networks such as Coinbase’s Base chain, Mantle Network, and ZKsync, EigenLayer allows AVSs to scale horizontally without fragmenting trust assumptions or requiring siloed validator sets. This not only enhances scalability but also ensures that applications on these networks benefit from Ethereum’s battle-tested security model, now priced at $3,923.82 per ETH.

The modularity inherent in this approach means that new AVSs can be onboarded rapidly as demand for verifiable services grows across verticals, from gaming to institutional finance to healthcare data marketplaces.

The Road Ahead: A Trust Layer for the Open Internet

The launch of EigenCloud marks a watershed moment for decentralized infrastructure. By abstracting away blockchain complexity while offering robust cryptographic guarantees for both on-chain and off-chain activity, it democratizes access to trust-minimized computation for all developers, not just crypto natives.

This evolution is driving a flywheel of adoption: more stakers mean deeper economic security; deeper security unlocks new classes of AVSs; more AVSs attract further developer innovation. The result is an emergent trust layer underpinning not just Ethereum but the broader open internet, one where verifiability becomes a baseline expectation rather than an afterthought.

Maya Lundgren covers digital asset infrastructure trends at Eigenlayer Restaking. For a deeper dive into how verifiable AI works atop restaked security primitives like EigenAI and EigenCompute, explore our extended guide here.