Ethereum’s rapid evolution is reshaping how capital flows through DeFi, and Ekox’s eXETH liquid restaking is at the forefront of this transformation. As Ethereum (ETH) holds steady at $4,139.12, with a 24-hour change of and $94.18 ( and 0.0233%), capital efficiency and yield optimization are more critical than ever for both retail and institutional participants. The rise of liquid restaking protocols like Ekox is redefining how ETH holders maximize returns while retaining full flexibility across the DeFi landscape.

Dual Yield Without Sacrificing Liquidity: How eXETH Unlocks New Possibilities

Traditional staking locks up ETH, making it unavailable for other DeFi opportunities. Ekox’s eXETH changes this paradigm by issuing an ERC-20 liquid restaking token when users deposit ETH. This token not only represents the user’s stake in Ethereum’s consensus layer, but also provides exposure to EigenLayer Actively Validated Services (AVSs). The result? Holders earn dual-layer rewards, ETH staking yields plus EigenLayer AVS incentives, all while maintaining liquidity to deploy capital across DeFi protocols.

This approach is more than just a technical upgrade; it’s a practical leap in capital efficiency. By auto-compounding rewards directly into the value of eXETH, Ekox eliminates the need for manual claims or complex reward management. The token’s value appreciates over time, reflecting both sources of yield and allowing users to benefit from seamless, hands-off compounding. As a freely tradable ERC-20, eXETH can be integrated into lending, yield farming, and modular DeFi strategies, further enhancing its utility.

Ekox in the Context of the Liquid Restaking Boom

The surge in liquid restaking is not happening in a vacuum. According to industry analysts and recent Ekox documentation, protocols like eXETH are part of a broader movement to stack multiple yield streams while keeping liquidity intact. Competing solutions such as Renzo and Enzyme Finance are also leveraging automated compounding and modular strategies, but Ekox’s focus on dual yield and seamless DeFi integration sets it apart.

Ekox’s modular architecture supports a range of DeFi integrations, including its upcoming EkoxPay system and AI Cube yield optimization tools. These innovations allow users to customize risk and reward profiles, automate strategy selection, and bridge liquidity between staking, restaking, and other DeFi primitives. The flexibility and composability of eXETH enable it to serve as a foundational asset for advanced Ethereum restaking strategies in 2025 and beyond.

Market Data: eXETH’s Traction as ETH Holds at $4,139.12

With Ethereum’s current price at $4,139.12, the demand for efficient capital deployment is clear. The ability to earn compounded yields without locking up assets is especially attractive in a market where ETH’s price volatility and DeFi opportunities are both high. By offering a liquid, dual-yield token, Ekox is capturing the attention of sophisticated investors and DeFi strategists seeking to maximize returns while minimizing opportunity cost.

Looking ahead, analysts expect continued growth in liquid restaking adoption as users become more comfortable with modular DeFi strategies and automated yield compounding. The integration of eXETH into diverse protocols and its compatibility with existing DeFi infrastructure position Ekox as a key player in the next phase of Ethereum capital efficiency.

Ethereum (ETH) & eXETH Price Prediction 2026-2031

Forecasts based on current market data, liquid restaking trends, and DeFi adoption. Prices reflect potential performance of both ETH and eXETH, as eXETH value tracks and compounds ETH rewards.

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | % Change (Avg YoY) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $3,700 | $4,800 | $6,200 | +16% | ETH consolidates, eXETH adoption grows in DeFi |

| 2027 | $4,100 | $5,650 | $7,800 | +18% | DeFi protocols integrate LRTs, ETH Layer 2 scaling matures |

| 2028 | $4,900 | $6,700 | $9,500 | +18.6% | Institutional adoption, regulatory clarity, high AVS incentives |

| 2029 | $5,500 | $7,900 | $11,400 | +17.9% | Restaking and modular DeFi strategies mainstream |

| 2030 | $6,200 | $9,200 | $13,800 | +16.5% | ETH 3.0 upgrades, cross-chain LRTs expand |

| 2031 | $7,000 | $10,700 | $16,200 | +16.3% | Widespread DeFi/TradFi integration, global ETH settlement |

Price Prediction Summary

Ethereum and eXETH are forecast to experience steady growth through 2031, with average annual price appreciation between 16–19%. The dual-yield and capital efficiency of eXETH are expected to drive greater adoption in DeFi, supporting upward price momentum. Bullish scenarios depend on continued protocol innovation, institutional participation, and positive regulatory developments, while downside risks include market corrections, increased competition, and potential security incidents in restaking protocols.

Key Factors Affecting Ethereum Price

- Adoption of liquid restaking tokens (LRTs) like eXETH across DeFi ecosystems

- Growth in ETH staking rates and AVS reward incentives via EigenLayer

- Technical upgrades to Ethereum (scalability, security, interoperability)

- Regulatory clarity for staking and DeFi protocols globally

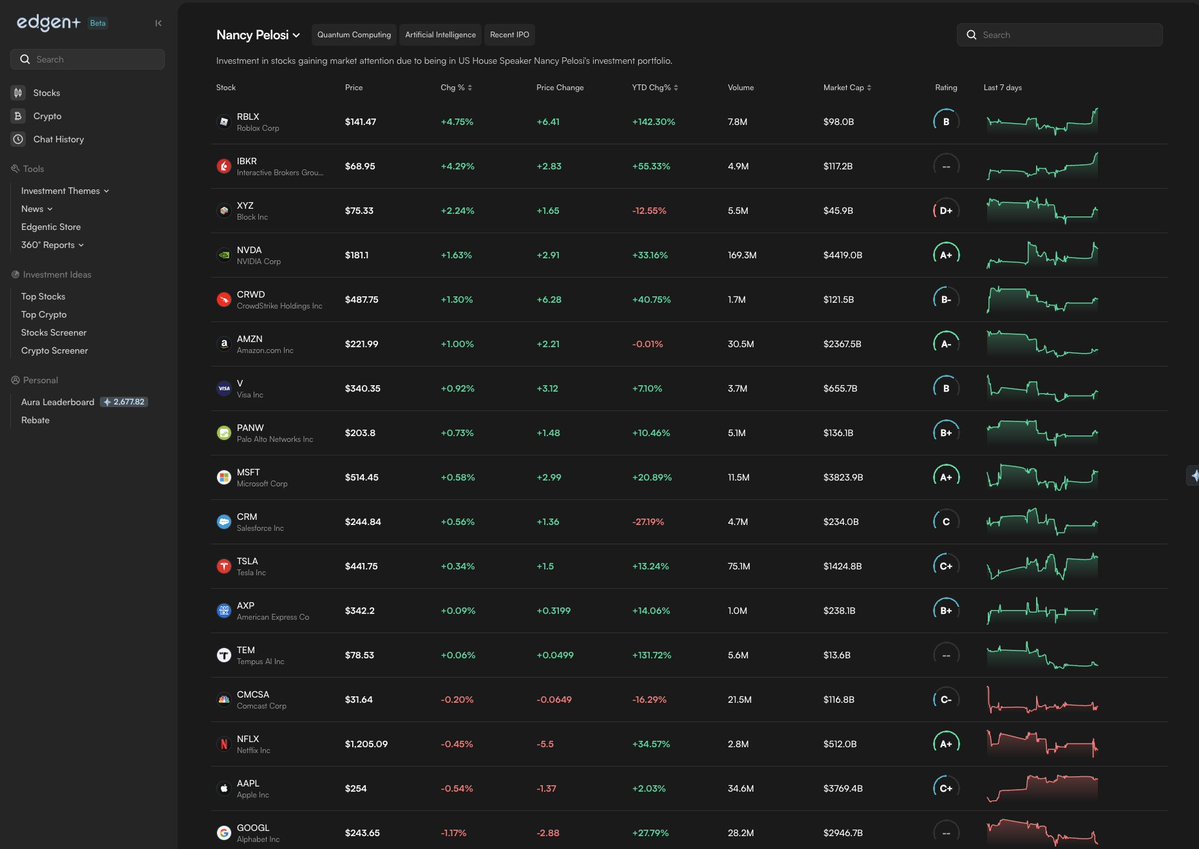

- Institutional entry and TradFi/DeFi convergence

- Emergence of competing restaking platforms or security risks in LRT protocols

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Ekox’s eXETH also addresses a major pain point for institutional participants: the need for composability without introducing excessive risk. By leveraging EigenLayer’s AVS rewards and Ethereum staking yields in a single token, eXETH enables treasuries, DAOs, and sophisticated DeFi managers to layer multiple yield streams on top of their core ETH position. This is especially relevant as more organizations seek to optimize idle assets while maintaining the flexibility to respond to shifting market conditions.

Another standout feature is Ekox’s commitment to transparency and security. All staking and restaking operations are on-chain and verifiable, aligning with the ethos of trustless finance. The auto-compounding mechanism is executed via robust smart contracts, reducing manual intervention and the potential for user error. As the DeFi landscape matures, these safeguards are crucial for attracting both retail and institutional capital.

How eXETH Integrates With DeFi: Real-World Use Cases

eXETH’s ERC-20 standard ensures seamless integration across the DeFi stack. Users can deploy eXETH as collateral in lending protocols, participate in liquidity mining, or stack it in modular yield strategies. This interoperability is driving a new wave of capital efficiency, as users no longer face trade-offs between staking rewards and DeFi participation. Instead, they can pursue both simultaneously, compounding returns and enhancing portfolio flexibility.

Top DeFi Protocols Supporting eXETH & Their Unique Features

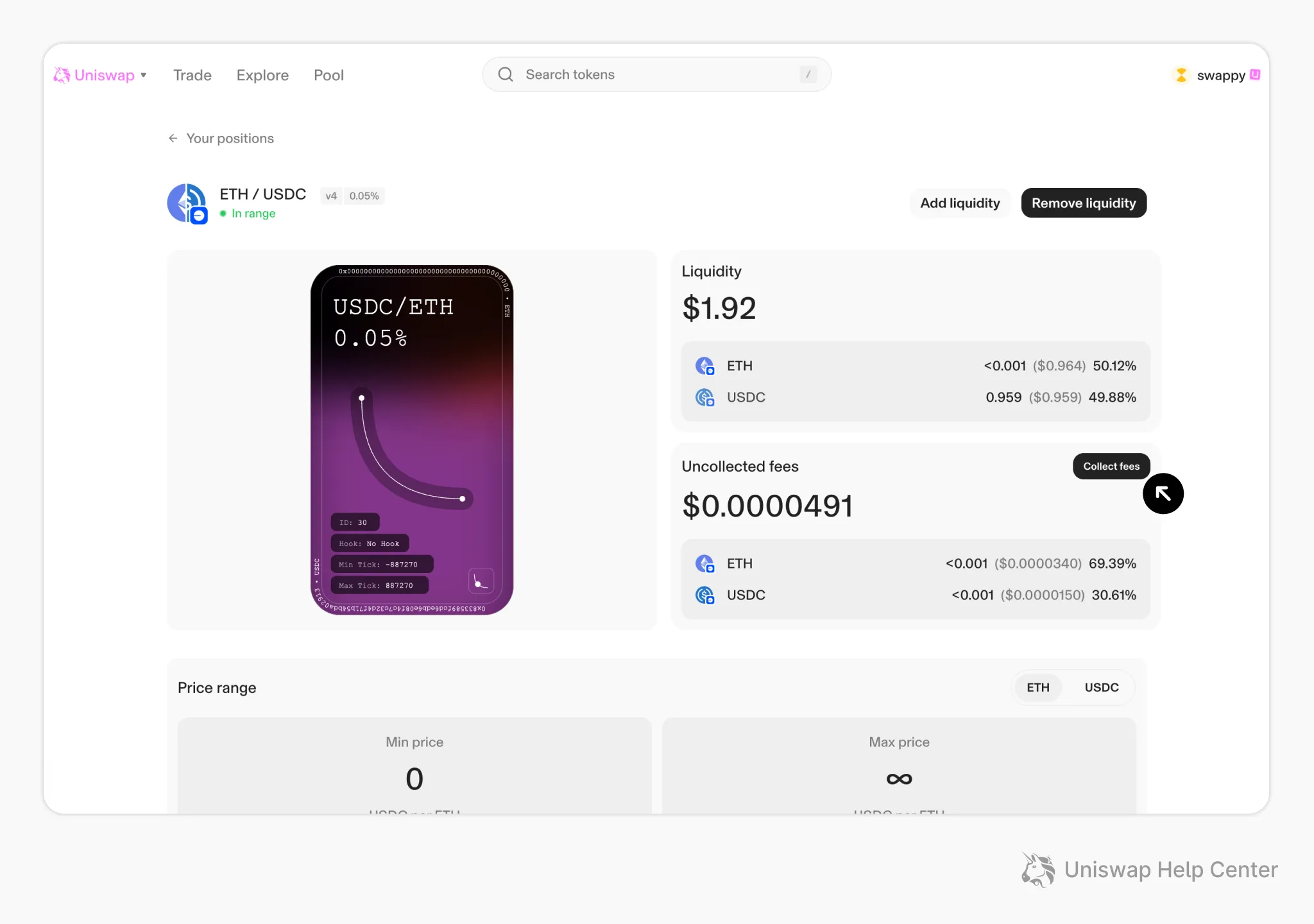

-

Uniswap: As the leading decentralized exchange, Uniswap enables users to trade eXETH against ETH and stablecoins, providing deep liquidity and efficient price discovery. Uniswap’s permissionless pools allow anyone to supply eXETH liquidity and earn trading fees, making it a primary venue for eXETH holders to maintain liquidity while participating in DeFi.

-

Aave: The popular lending protocol Aave integrates eXETH as a collateral asset, allowing users to borrow stablecoins or other tokens against their eXETH holdings. This unlocks additional capital efficiency, as users can leverage staked ETH rewards while accessing DeFi loans without unstaking.

-

Enzyme Finance: Enzyme supports eXETH in its asset management vaults, enabling automated yield strategies. Users can deposit eXETH into Enzyme-powered vaults to benefit from automated compounding, risk management, and seamless exposure to optimized DeFi strategies.

-

Balancer: Balancer offers flexible liquidity pools that include eXETH, allowing users to create or join multi-asset pools for improved capital efficiency and yield farming. Balancer’s dynamic pool weights and incentives make it a versatile platform for eXETH liquidity providers.

-

Curve Finance: Curve specializes in stable and like-kind asset swaps, offering efficient trading and low slippage for eXETH pairs. Curve’s integration allows eXETH holders to swap between LRTs and other staking tokens with minimal impermanent loss, maximizing composability across DeFi.

Ekox’s upcoming integrations, such as EkoxPay and AI Cube, promise further yield optimization. EkoxPay will enable direct payments and transfers using eXETH, expanding its utility beyond yield generation. AI Cube introduces algorithmic strategy selection, dynamically adjusting user allocations to maximize risk-adjusted returns. These innovations keep Ekox at the cutting edge of liquid restaking protocols.

Managing Risk in an Expanding Liquid Restaking Ecosystem

While the benefits are compelling, it’s important to recognize the risks inherent in restaking. Smart contract vulnerabilities, protocol exploits, and AVS slashing events can impact returns or principal. Ekox addresses these challenges with multi-layered security audits, transparent on-chain reporting, and a modular architecture that allows users to customize exposure based on their risk tolerance.

As competition in the liquid restaking space intensifies, protocols that combine robust security with flexible yield strategies are likely to capture the lion’s share of new capital inflows. For investors and DeFi builders alike, eXETH represents a pragmatic path to maximizing Ethereum capital efficiency without sacrificing liquidity or security.

With Ethereum holding firm at $4,139.12, the landscape is ripe for innovation. Ekox’s eXETH stands out as a foundational building block for next-generation DeFi strategies, allowing users to unlock dual yield while preserving their ability to move quickly as new opportunities arise. As liquid restaking protocols mature and integrations deepen, eXETH is well positioned to remain a core asset for both active traders and long-term ETH holders.