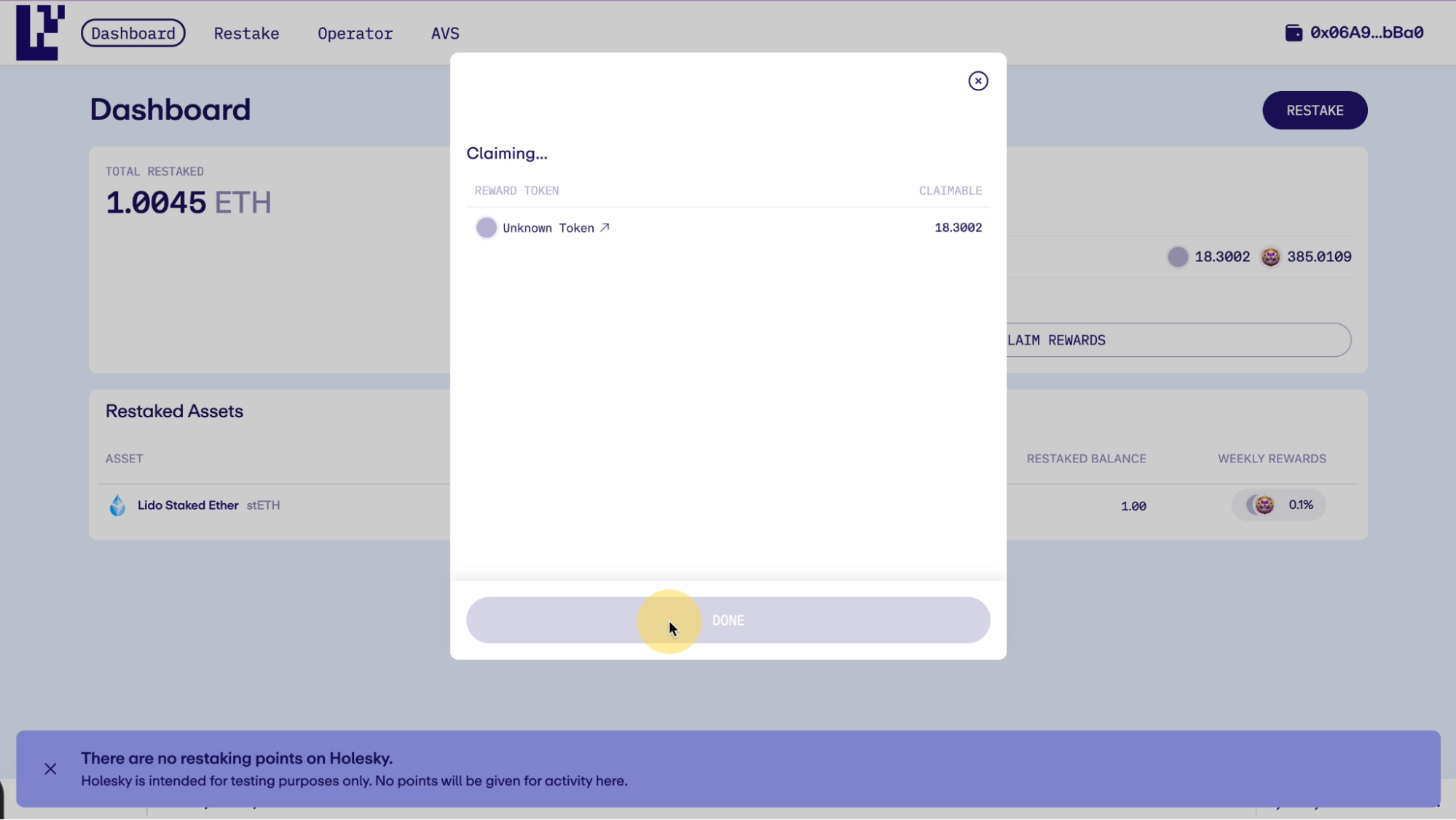

Ethereum’s validator landscape is transforming rapidly in 2024, thanks to the rise of EigenLayer restaking. For those tracking the latest market moves, Ethereum (ETH) is currently priced at $4,534.22, with a 24-hour gain of $76.58. This price surge underscores renewed interest in staking and validator strategies that maximize returns without sacrificing network security. In this article, we’ll explore how EigenLayer’s restaking protocol is reshaping validator yields, why it’s attracting billions in Total Value Locked (TVL), and what validators need to know about risk and reward in this new era.

Restaking: The Yield Multiplier for Ethereum Validators

The traditional approach to Ethereum staking has always been straightforward: lock up your ETH to secure the network and earn base rewards, typically ranging between 3% and 5% annualized. But as competition intensifies and staking rewards compress, validators are searching for ways to amplify their returns without taking on outsized risks.

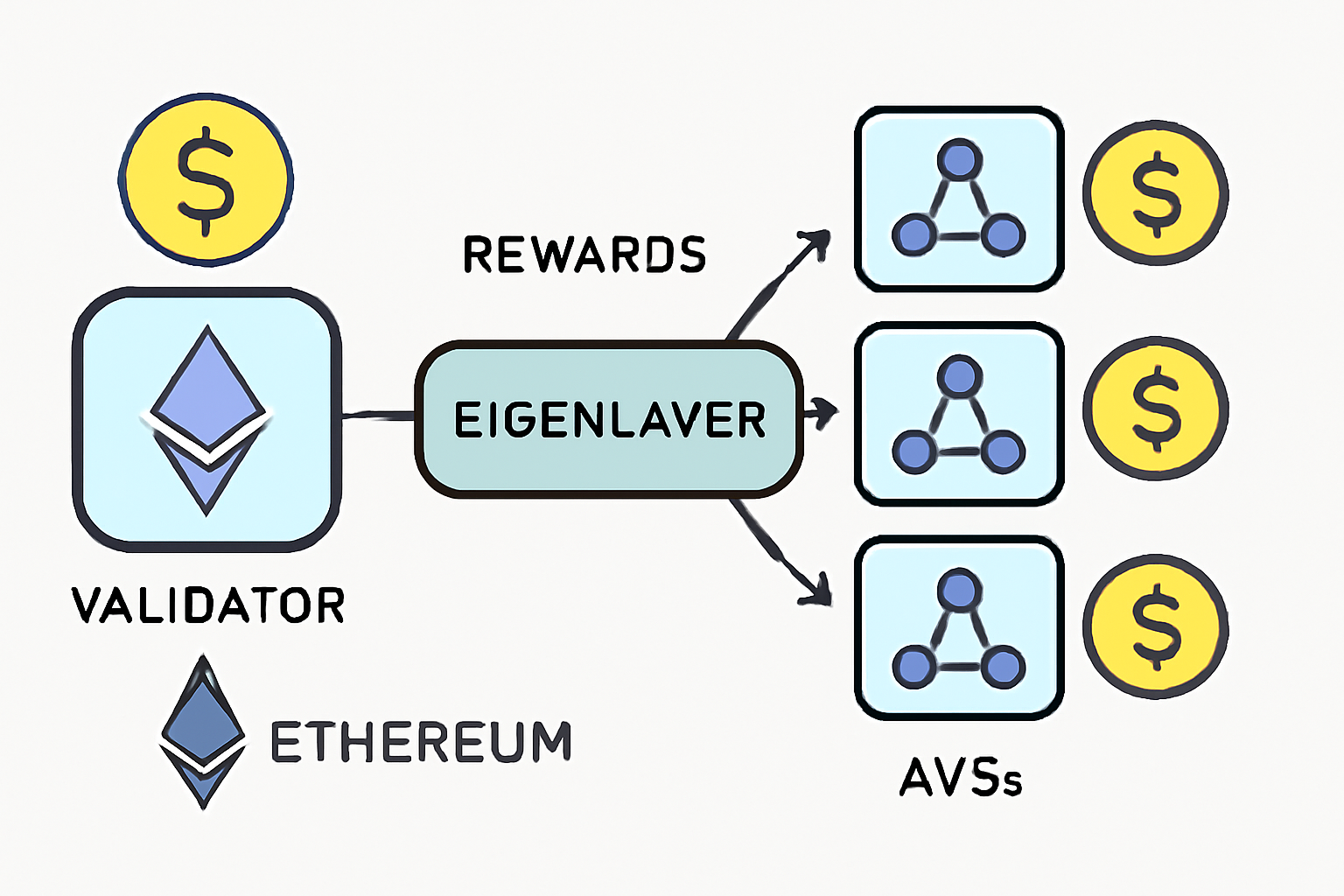

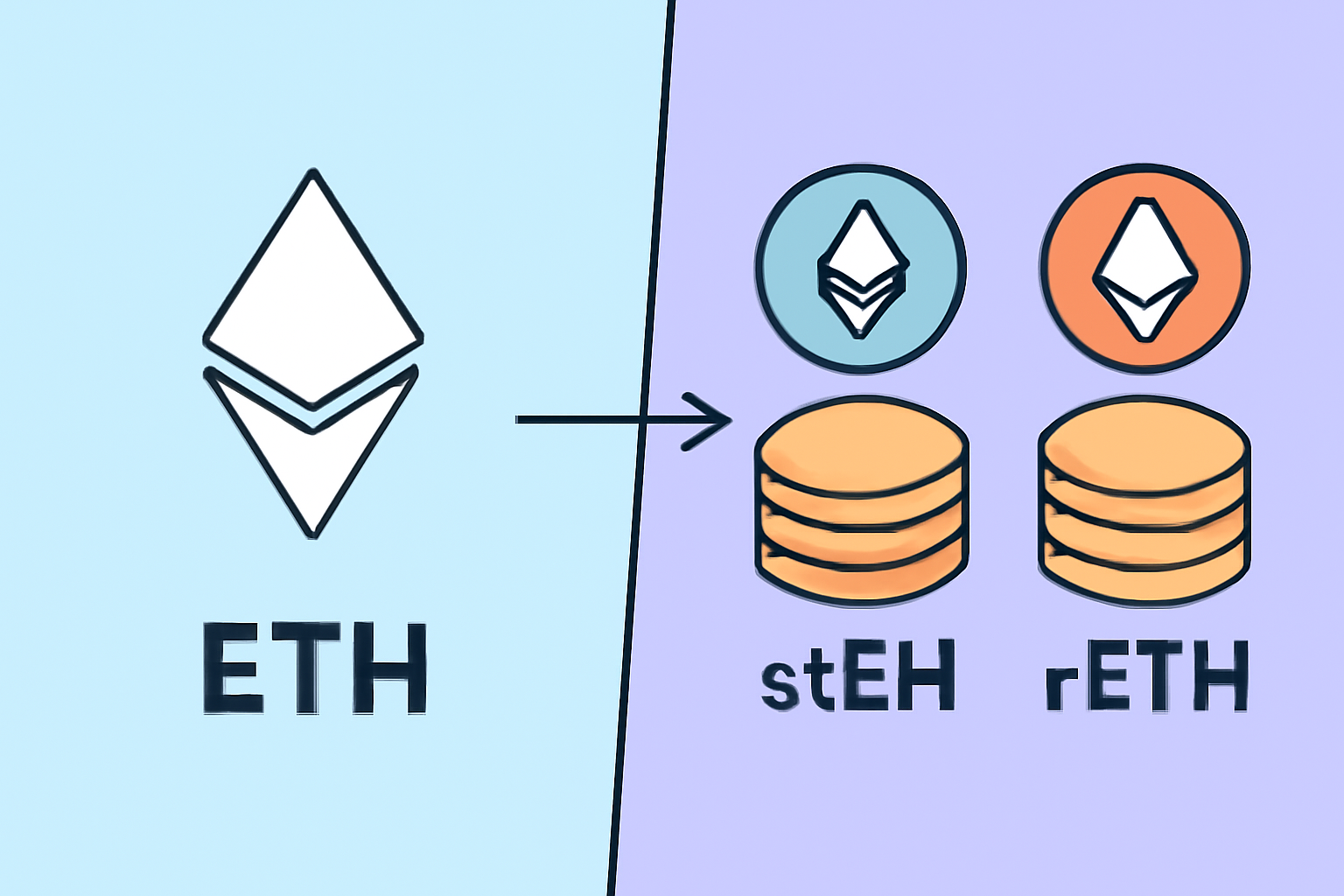

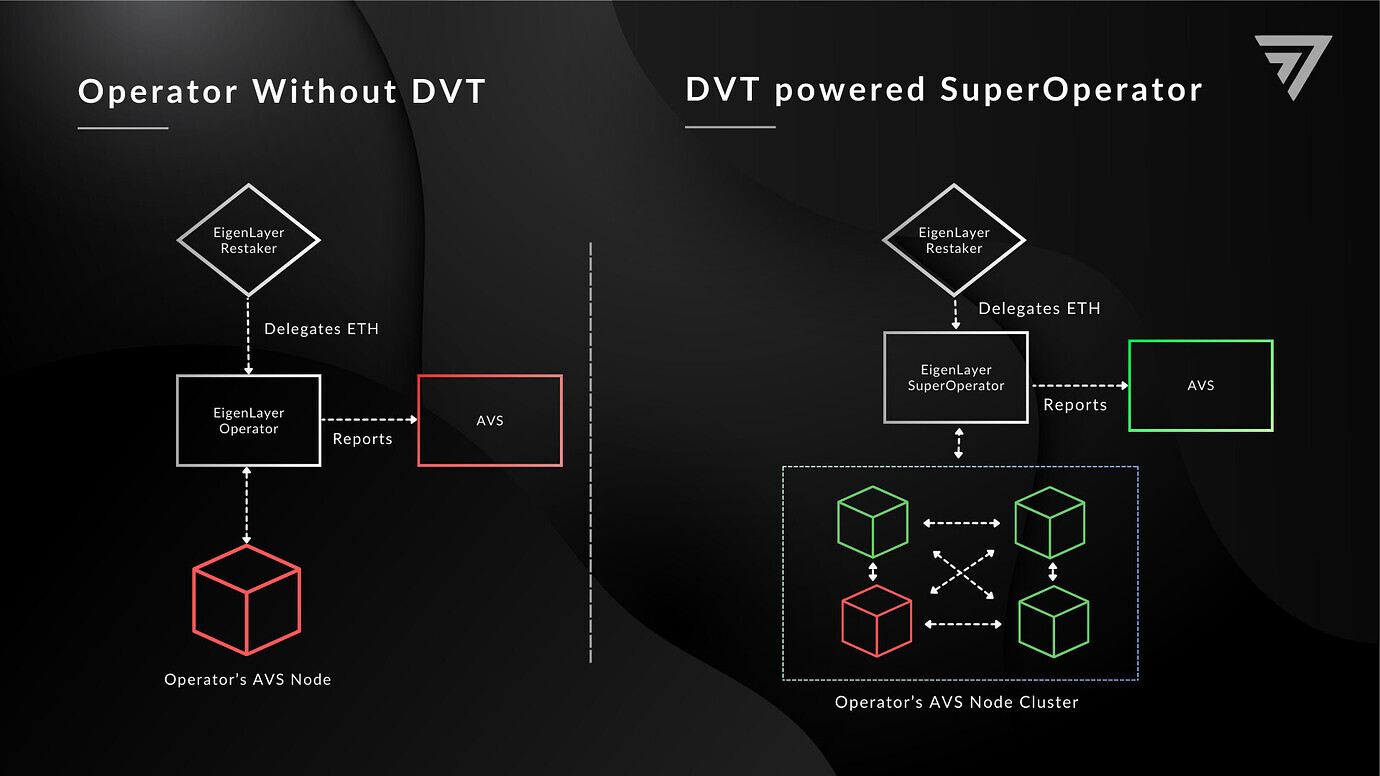

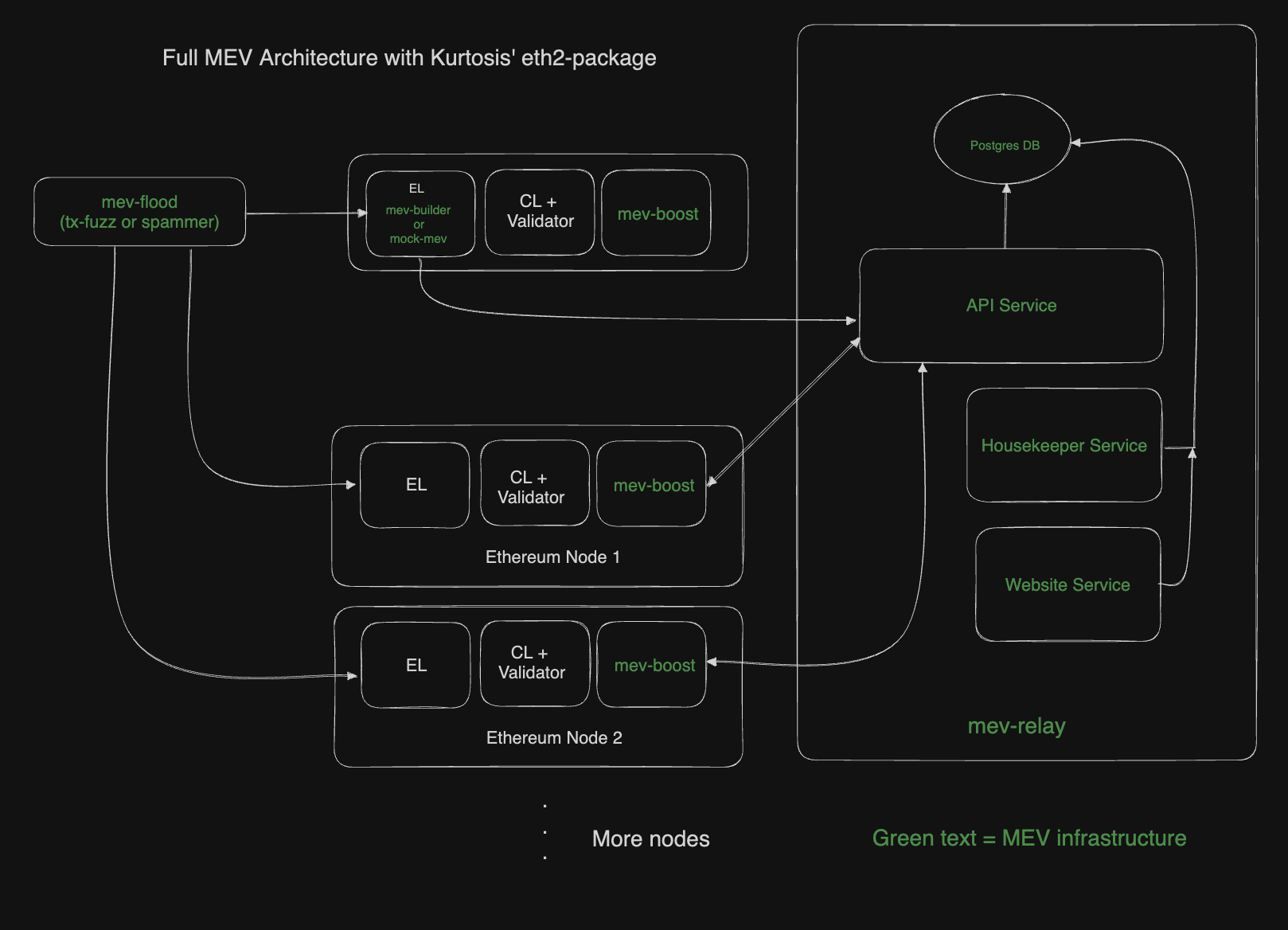

This is where EigenLayer restaking steps in as a game-changer. By allowing validators to “restake” their already-staked ETH or Liquid Staking Tokens (LSTs), EigenLayer enables them to secure additional decentralized services known as Actively Validated Services (AVSs). Validators can now earn dual rewards: the standard Ethereum staking yield plus extra incentives from AVSs they help secure.

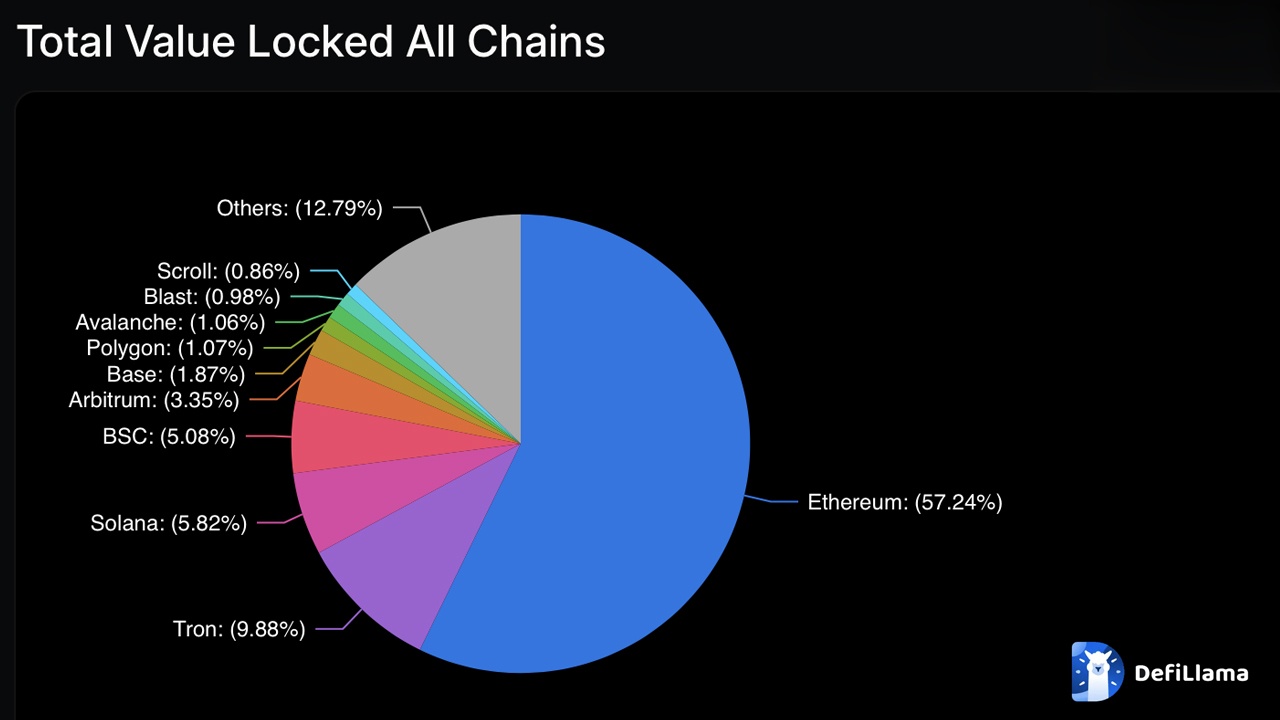

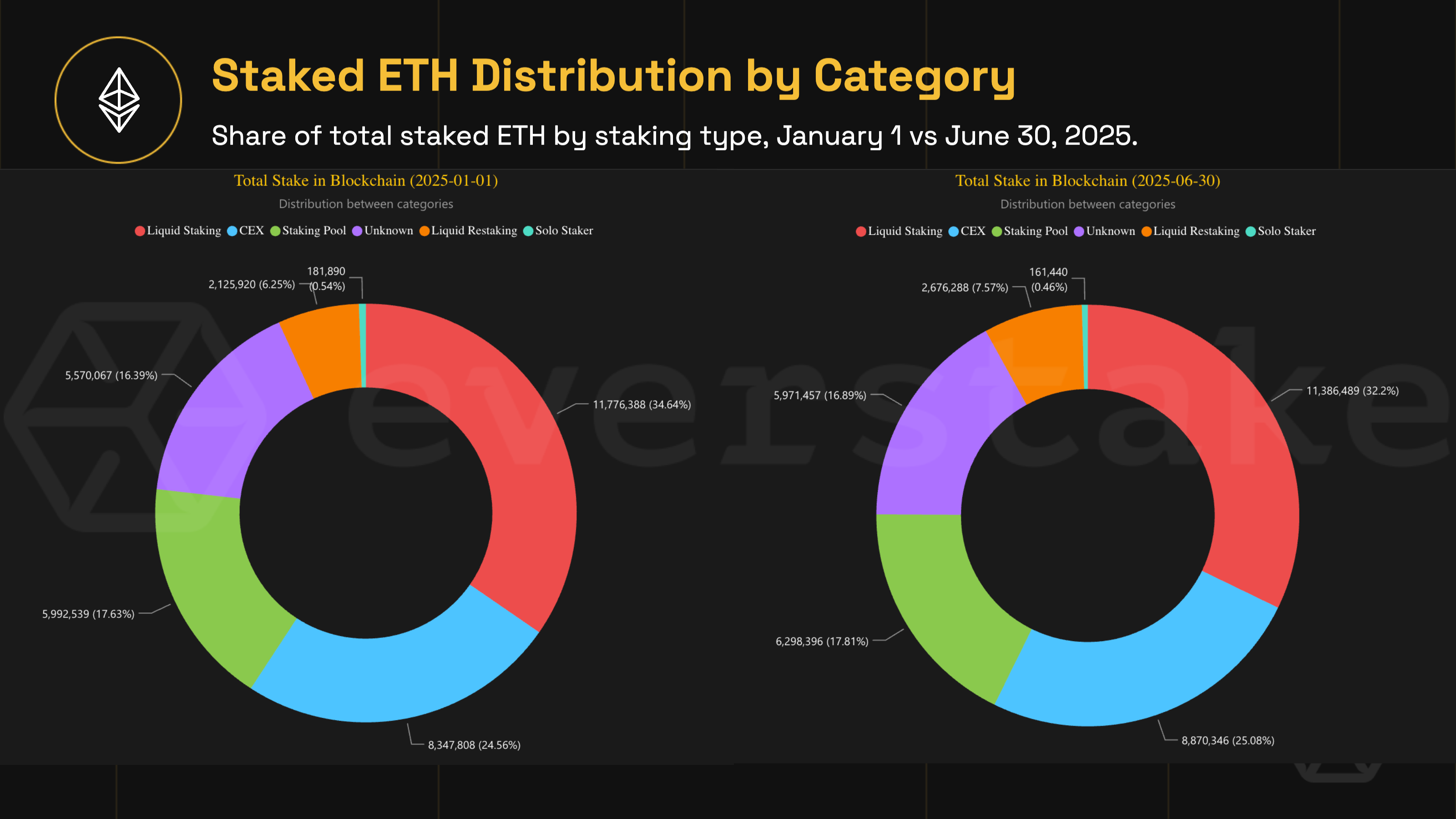

According to recent data, EigenLayer’s TVL soared from $1.1 billion to over $15 billion by April 2024, a meteoric rise that highlights its appeal among capital-efficient stakers (QuickNode Blog). As of late November 2024, more than 6.25 million ETH, worth nearly $19.3 billion, was locked in restaking protocols (Crypto.com Research). Native ETH accounts for over 83% of these tokens, signaling strong confidence from core network participants.

The Mechanics: How Restaking Works with AVSs

To understand why restaking supercharges yields, it helps to break down the mechanics:

- Validators first stake ETH or LSTs on Ethereum’s Beacon Chain.

- They opt-in to EigenLayer and “restake” these assets.

- Their staked collateral now secures both Ethereum and one or more AVSs.

- In return, validators receive rewards both from Ethereum consensus and from each AVS they support.

This dual-duty model increases capital efficiency, your staked assets work harder across multiple protocols without requiring additional capital outlay. The end result? Higher aggregate yields for validators willing to take on extra responsibility.

Current Market Data: Validator Rewards and TVL Surge

The numbers speak volumes about the momentum behind restaking protocols in 2024:

Key EigenLayer Adoption & Restaking Stats (2024)

-

Over 6.25 million ETH restaked via EigenLayer as of late November 2024, representing a massive influx of validator participation. This equates to billions of dollars in value secured through restaking.

-

EigenLayer TVL surged from $1.1B to over $15B in 2024, reflecting rapid adoption and growing confidence in restaking as a yield-enhancing strategy for Ethereum validators.

-

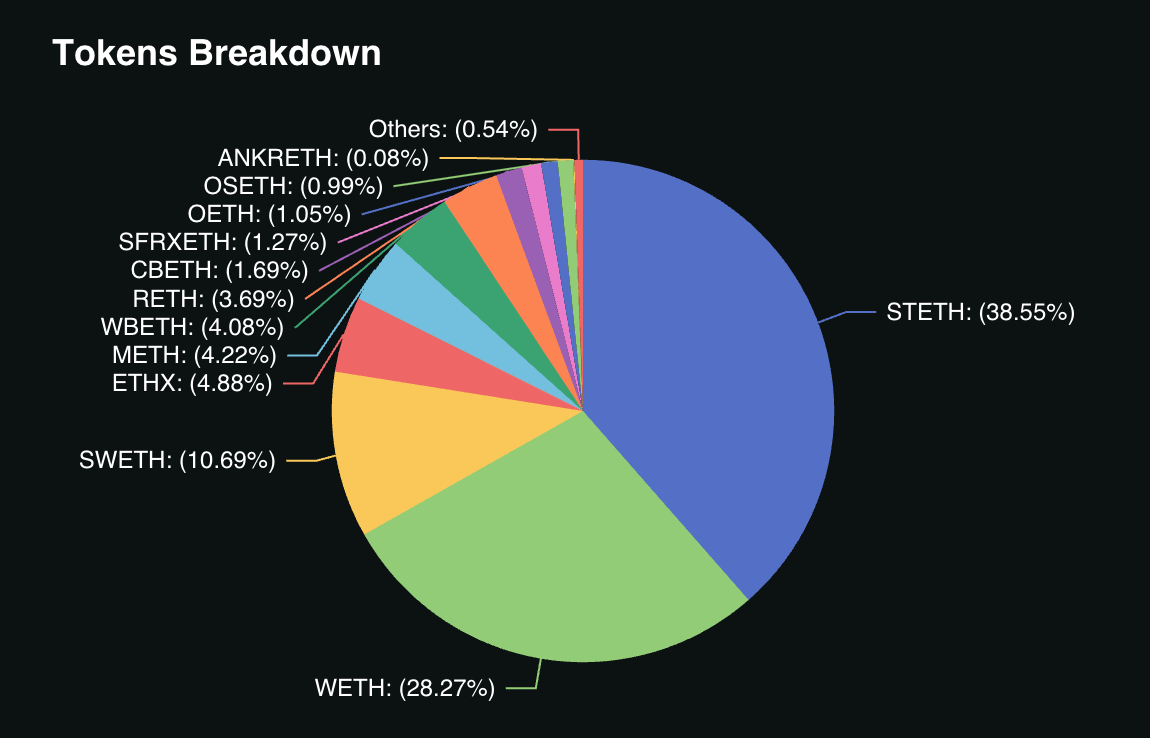

83.7% of restaked tokens are native ETH, with the remainder in Liquid Staking Tokens (LSTs), highlighting strong validator preference for native assets when leveraging EigenLayer.

-

Approximately 17% of all staked ETH on Ethereum is now restaked through EigenLayer, demonstrating significant validator engagement with the protocol.

-

98.26% of all restaked ETH is captured by EigenLayer, making it the dominant platform for restaking in the Ethereum ecosystem.

The current market environment reflects both enthusiasm and caution. While only around 17% of total staked ETH on the Beacon Chain is being restaked (CoinGecko Learn), nearly all of this activity flows through EigenLayer, capturing over 98% of the segment’s volume (Crypto.com Research). This concentration signals trust in EigenLayer’s design but also highlights its influence over validator economics as slashing penalties are set for rollout later in 2024.

Ethereum (ETH) Price Prediction 2026-2031

Incorporating the impact of EigenLayer restaking, yield innovations, and evolving market dynamics

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg vs. Prev Year) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,950 | $5,100 | $6,200 | +12.5% | Market consolidates post-restaking boom; regulatory clarity improves; ETH benefits from increased validator yields |

| 2027 | $4,200 | $5,750 | $7,100 | +12.7% | Broader DeFi adoption; restaking reaches maturity; ETH demand grows as AVS applications expand |

| 2028 | $4,500 | $6,500 | $8,200 | +13.0% | New staking innovations; ETH becomes key settlement asset; competition from L2s and alt-L1s intensifies |

| 2029 | $5,200 | $7,400 | $9,800 | +13.8% | Macro recovery boosts risk assets; ETH supply deflation strengthens; restaking risks well-managed |

| 2030 | $5,750 | $8,350 | $11,200 | +12.8% | ETH ecosystem expands with real-world use cases; institutional adoption increases |

| 2031 | $6,400 | $9,200 | $12,500 | +10.2% | Sustained growth; ETH strengthens as Web3 infrastructure backbone; regulatory risks remain but are navigated |

Price Prediction Summary

Ethereum is poised for steady growth through 2031, underpinned by innovations like EigenLayer restaking that enhance validator yields and network security. While short-term volatility is expected, the combination of technological improvements, DeFi expansion, and increasing institutional adoption supports a progressive price outlook. Minimum price estimates reflect potential macro or regulatory headwinds, while maximum scenarios capture bullish outcomes from ecosystem breakthroughs and broader crypto market rallies.

Key Factors Affecting Ethereum Price

- EigenLayer and restaking adoption rate and risk management (slashing, AVS security)

- Global regulatory developments and potential ETH ETF approvals

- Competition from alternative L1s and L2 scaling solutions

- Macro environment: inflation, interest rates, and global risk appetite

- Staking and restaking yield dynamics affecting validator incentives and ETH supply

- Growth of real-world and enterprise use cases for Ethereum

- Institutional investment flows and market cap expansion potential

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The New Validator Playbook: Balancing Yield Against Risk

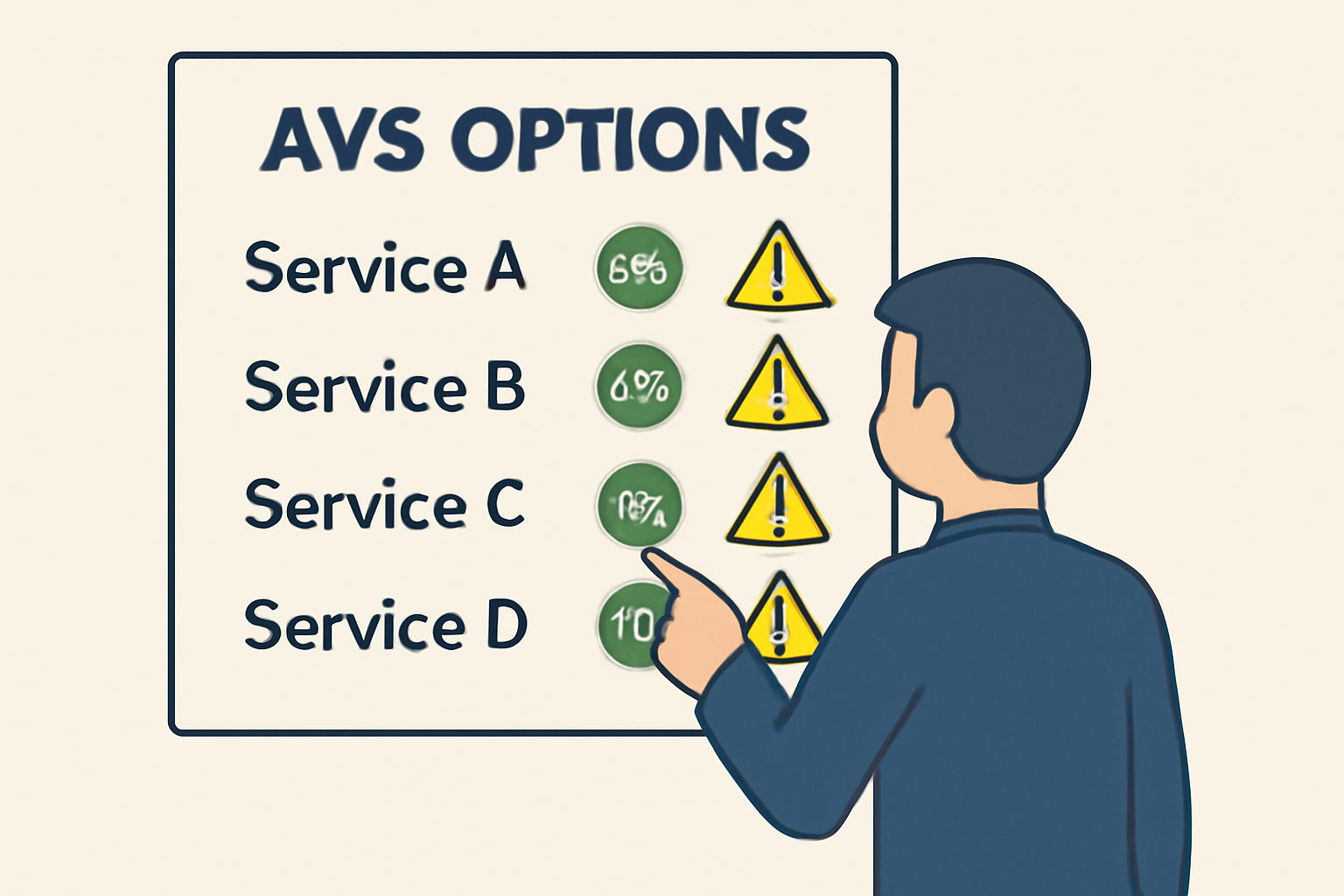

The appeal of incremental yield is clear, but so are the new risks introduced by multi-protocol exposure. As validators chase higher returns through restaking strategies, they must also navigate increased operational complexity and potential slashing events stemming from AVS failures or misbehavior.

I’ll dive deeper into risk management strategies and sustainable staking approaches in the second half of this article. For now, it’s evident that EigenLayer restaking isn’t just a fleeting trend, it’s fundamentally redefining what it means to be an Ethereum validator in today’s high-stakes landscape.

Validators who embrace restaking are rewriting the rules of capital efficiency and reward optimization. Yet, as the EigenLayer ecosystem matures, staking strategies must evolve to account for both the upside and the new categories of risk that come with securing multiple protocols.

Risk Management: Navigating Slashing and Complexity

One of the most significant changes in 2024 is EigenLayer’s upcoming introduction of slashing penalties for AVS-related misbehavior. While Ethereum’s base layer already penalizes validators for downtime or malicious actions, restakers now face potential losses if an AVS they secure suffers a security breach or operational failure. This dual exposure means that risk assessment is no longer just about Ethereum: validators must scrutinize each AVS’s codebase, governance, and economic incentives before opting in.

Operational complexity also rises. Validators need robust monitoring tools to track performance across both Ethereum and every AVS they support. Automation helps, but ultimately, vigilance is key, especially as more Actively Validated Services launch and compete for validator attention.

The market recognizes these risks. While yields can be significantly higher than vanilla staking, sometimes exceeding 7% when including AVS rewards, the specter of slashing keeps most professional validators focused on best-in-class risk controls and diversified exposure.

Staking Strategies: Maximizing Yield with Sustainable Practices

For those building a sustainable validator business, a few guiding principles stand out:

Top Strategies for Maximizing Validator Rewards with EigenLayer

-

Diversify Across Multiple AVSs: Restake with a range of Actively Validated Services (AVSs) on EigenLayer to spread risk and tap into multiple reward streams. This approach helps mitigate the impact of underperforming or high-risk AVSs while maximizing overall yield potential.

-

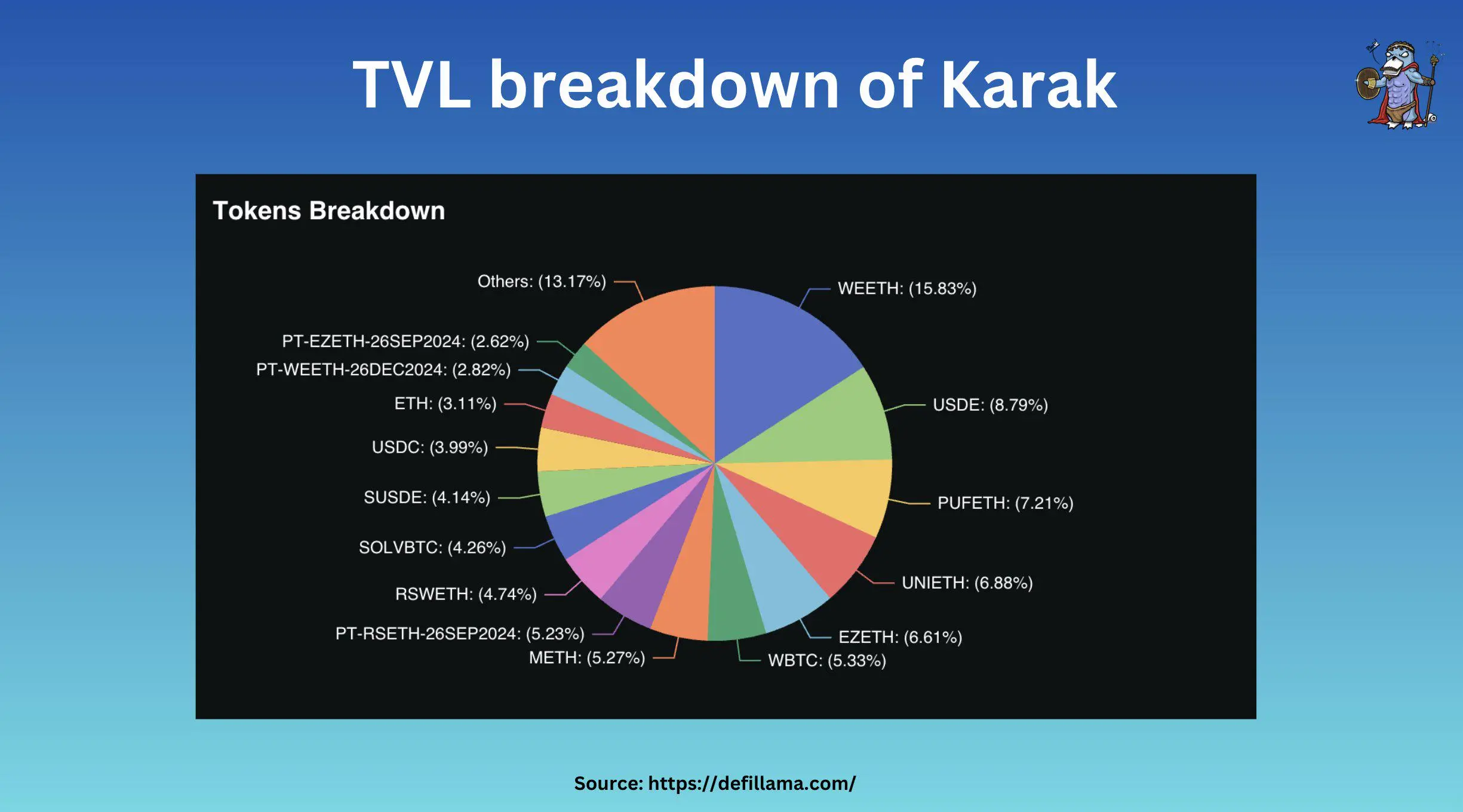

Utilize Liquid Staking Tokens (LSTs) for Flexibility: Leverage established LSTs like Lido’s stETH or Rocket Pool’s rETH for restaking. These tokens offer enhanced liquidity, allowing validators to access DeFi opportunities while still earning yields from both Ethereum and AVSs.

-

Monitor Slashing Risks and Upcoming Protocol Changes: Stay informed about EigenLayer’s evolving slashing mechanisms (expected to be fully implemented in late 2024). Regularly review AVS risk profiles and protocol updates to avoid unexpected penalties that could erode rewards.

-

Optimize Validator Performance and Uptime: Ensure your validator infrastructure is robust and highly available. Consistent uptime and reliable performance are critical for maximizing both Ethereum and AVS rewards while minimizing the risk of slashing.

-

Engage with Established Restaking Platforms and Tools: Use reputable platforms like EigenLayer’s official restaking portal and analytics tools such as Dune Analytics or EigenLayer Stats to track yields, monitor risks, and identify new AVS opportunities.

Diversification across different AVSs can help spread risk, though it requires careful vetting of each service’s reliability and slashing conditions. Automation through smart monitoring scripts reduces manual overhead but should be paired with human oversight to catch edge cases. Finally, ongoing education: staying up to date with protocol upgrades, new AVS launches, and evolving slashing policies, is essential for long-term success.

The Community Pulse: What Validators Are Saying

The real innovation isn’t just higher yield, it’s giving stakers a seat at the table in securing Ethereum’s next generation of services. But with great power comes great responsibility. – Leading Ethereum Validator (2024)

This sentiment echoes throughout staking communities. Many see EigenLayer as a way to future-proof their operations against declining base yields while actively participating in the direction of decentralized infrastructure.

Looking Ahead: The Roadmap for Restaking Protocols in 2025

The explosive growth in Total Value Locked, from $1.1 billion to over $15 billion in just twelve months, shows that validator appetite for enhanced rewards is only accelerating (QuickNode Blog). As more Actively Validated Services come online and slashing mechanisms mature, we can expect competition among AVSs to drive innovation in reward structures and risk management tools alike.

The future will likely bring even more sophisticated staking derivatives and insurance solutions tailored specifically to restakers. For now, though, the core playbook remains clear: stay informed, diversify exposure where possible, automate monitoring, and always weigh incremental yield against real-world risk.

If you’re exploring how to optimize your own staking strategy or want deeper dives into specific Actively Validated Services launching on EigenLayer this year, keep following our coverage at Eigenlayer Restaking. The landscape is changing fast, and those who adapt early are best positioned to thrive as validator economics continue their transformation through 2025.