With Ethereum’s price standing at $4,482.46, the ecosystem is witnessing a paradigm shift as EigenCloud’s EigenAI and EigenCompute move from Mainnet Alpha into center stage. These innovations are not just buzzwords or incremental upgrades; they are foundational pillars in extending blockchain-grade trust to the rapidly expanding frontier of decentralized AI and off-chain computation.

EigenCloud: Building Trust for Off-Chain AI

As the market for decentralized applications matures, one of the most persistent challenges has been establishing verifiable trust in computations that occur outside of the blockchain’s deterministic environment. EigenCloud, developed by EigenLayer, directly addresses this gap by leveraging Ethereum restaking to secure its two flagship modules: EigenAI and EigenCompute.

The protocol currently secures over $19.93B in total value locked (TVL), representing a significant share of staked assets now being used to collateralize not just Ethereum but a growing range of Autonomous Validation Services (AVSs) and off-chain applications. This architecture allows Ethereum stakers to earn additional rewards while reinforcing cryptoeconomic security for next-generation decentralized services.

How EigenCompute Enables Verifiable Off-Chain Computation

EigenCompute is the engine that brings scalable, trust-minimized computation to Ethereum without sacrificing cryptographic guarantees. At its core, it enables developers to outsource complex logic, such as large language model (LLM) inference or heavy data processing, to decentralized operators running within trusted execution environments (TEEs). These operators are required to stake ETH or liquid staking tokens via EigenLayer smart contracts, and can be penalized (slashed) if they provide incorrect or dishonest results.

This model transforms off-chain compute into a marketplace where reliability failures have real financial consequences. For DeFi projects or AI-driven dApps seeking to bridge on-chain and off-chain worlds, this means unprecedented confidence in both data integrity and execution fidelity. Deterministic inference, untampered prompts, and provable execution become baseline features rather than aspirational goals.

EigenAI: Bringing Verifiable AI into the Restaking Era

The integration of EigenAI marks a watershed moment for blockchain trust in artificial intelligence workflows. By anchoring AI processes to restaked ETH security pools, developers can build applications where every step, model selection, input prompt integrity, output generation, is subject to cryptoeconomic verification.

This approach is particularly crucial as mainstream adoption of generative AI intersects with Web3’s demand for transparency and auditability. Whether it’s verifiable LLM inference or tamper-resistant agent architectures, EigenAI ensures that both users and protocols have recourse if promises aren’t kept, enabling new insurance primitives and fostering innovation across DeFi, gaming, autonomous agents, and more.

Ethereum (ETH) Price Prediction 2026-2031

Forecast based on current market data, EigenCloud/EigenAI adoption, and macro crypto trends

| Year | Minimum Price | Average Price | Maximum Price | % Change (Avg) vs. Prev. Year | Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,950 | $5,100 | $6,200 | +13.8% | Potential post-EigenCloud consolidation; volatility as adoption grows |

| 2027 | $4,250 | $5,800 | $7,400 | +13.7% | Broader DeFi/AI integration; ETH demand rises, but regulatory headwinds possible |

| 2028 | $4,650 | $6,600 | $8,900 | +13.8% | Mainstream verifiable AI use; Layer-2 expansion; competition from modular blockchains |

| 2029 | $5,200 | $7,550 | $10,200 | +14.4% | Peak adoption of restaking and decentralized AI; macro bull cycle likely |

| 2030 | $5,900 | $8,600 | $12,000 | +13.9% | ETH as backbone for decentralized AI/compute; strong institutional inflows |

| 2031 | $6,400 | $9,400 | $13,500 | +9.3% | Market matures; ETH stabilizes as digital infrastructure with reduced volatility |

Price Prediction Summary

Ethereum is positioned for substantial growth over the next six years, driven by the adoption of EigenCloud’s EigenAI and EigenCompute, which amplify blockchain trust and verifiable AI. While the average price is projected to increase steadily each year, significant volatility remains due to evolving technology, market cycles, and regulatory factors. By 2031, ETH could average close to $9,400, representing over 2x growth from current levels, with potential for higher peaks in bullish scenarios.

Key Factors Affecting Ethereum Price

- Adoption and success of EigenCloud/EigenAI as trust layers for decentralized applications

- Expansion of restaking and Liquid Staking Token (LST) markets

- Macro crypto market cycles (bull/bear phases) and Bitcoin halving effects

- Global regulatory developments impacting DeFi, AI, and staking

- Competition from other smart contract and modular blockchain platforms

- Institutional adoption and integration into traditional finance

- Scalability improvements and Layer-2 ecosystem growth

- Broader mainstream acceptance and new Ethereum-based use cases

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Restaking Revolution: Security Beyond Consensus

The true genius behind EigenCloud’s design lies in its extension of Ethereum’s robust security model beyond mere consensus validation. By allowing restaked ETH to secure AVSs like EigenAI and EigenCompute, the protocol creates an economic moat around verifiable off-chain computation, one that is both scalable and adaptable as new use cases emerge.

This evolution positions restaking not just as a yield strategy but as an essential infrastructure layer for the decentralized internet, a vision that is rapidly materializing with each deployment on mainnet alpha.

Adoption of these mechanisms is already catalyzing a new wave of developer activity, with projects rapidly integrating verifiable AI and compute into their architectures. As more decentralized applications recognize the value in provable execution and cryptoeconomic accountability, EigenCloud’s platform is poised to become the default substrate for trust-minimized off-chain services.

Use Cases: From DeFi Security to Autonomous Agents

EigenAI and EigenCompute are not limited to theoretical frameworks; they are powering real-world innovations across multiple verticals:

Top Real-World Use Cases for EigenAI & EigenCompute

-

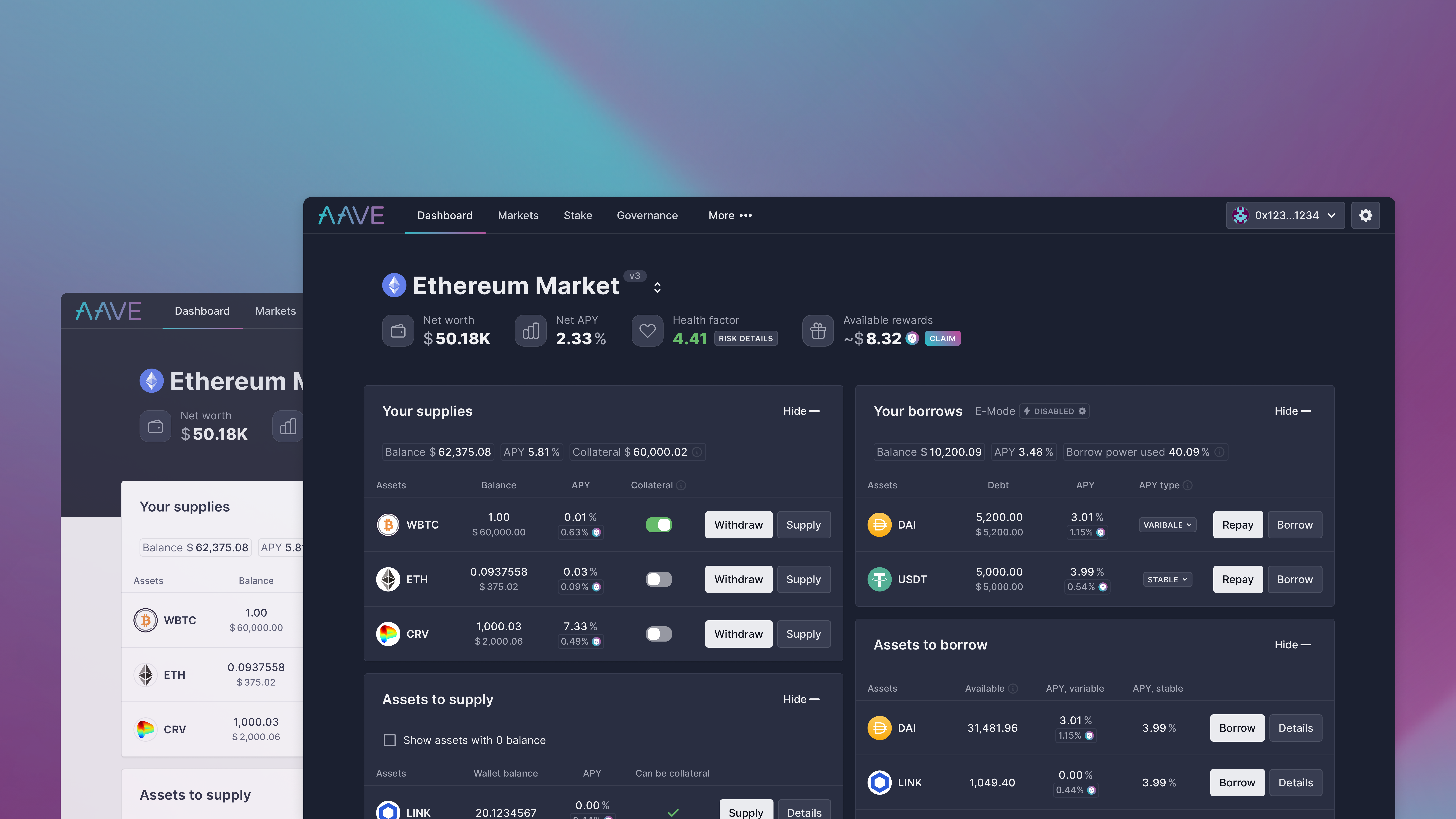

Decentralized Finance (DeFi): Verifiable On-Chain Risk AssessmentEigenAI enables DeFi protocols like Aave and Compound to integrate off-chain AI-driven risk models with on-chain verifiability. This allows for more accurate, tamper-proof credit scoring and dynamic collateral management, all secured by Ethereum restaking and EigenCompute’s trust-minimized execution.

-

Blockchain Gaming: Provably Fair AI-Powered NPCsUsing EigenCompute, blockchain games such as Immutable and Gala Games can deploy AI-driven non-player characters (NPCs) whose actions and decisions are verifiable on-chain. This ensures fair gameplay and transparent outcomes, enhancing trust in decentralized gaming ecosystems.

-

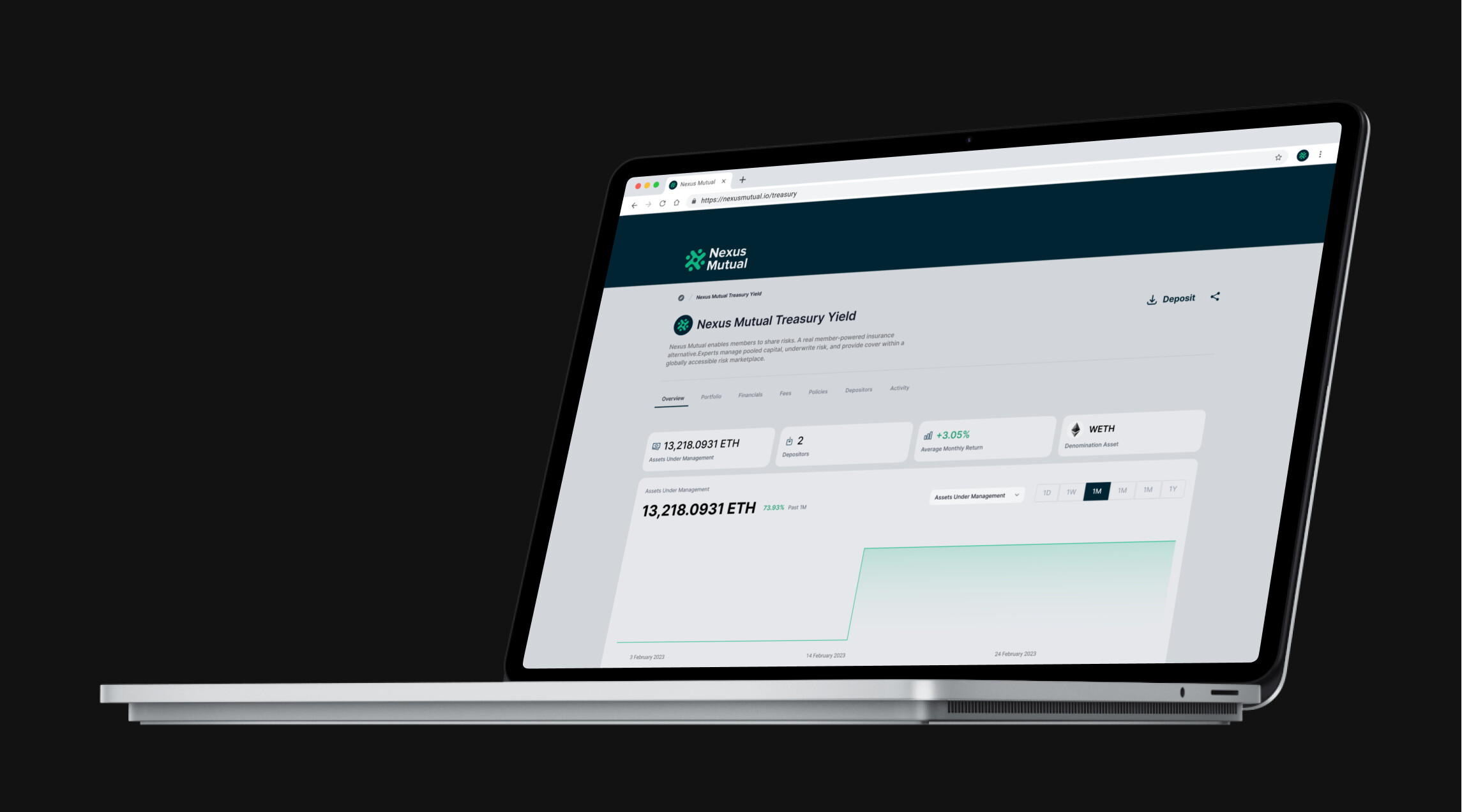

Insurance: Automated, Transparent Claim ProcessingPlatforms like Nexus Mutual can leverage EigenAI for automated claims assessment, using off-chain data and AI models whose execution is provably correct via EigenCompute. This reduces fraud and speeds up payouts, while maintaining transparency and accountability for all parties.

-

Autonomous AI Agents: Verifiable Agent Payment ProtocolsEigenCloud’s partnership with Google Cloud enables the creation of autonomous AI agents that can interact, transact, and verify outcomes on-chain. With EigenAI and EigenCompute, these agents can operate trustlessly, supporting use cases like decentralized marketplaces and automated negotiations.

-

Cross-Chain Data Oracles: Secure, AI-Enhanced Data FeedsOracles such as Chainlink can utilize EigenCompute to run AI models that aggregate and verify off-chain data before delivering it on-chain. This bolsters the reliability and security of DeFi, insurance, and gaming dApps that depend on accurate real-world data.

DeFi protocols can now outsource risk modeling or fraud detection to verifiable AI modules without relying on centralized oracles. In gaming, provable randomness and tamper-proof NPC logic create fairer, more transparent player experiences. Insurance platforms leverage EigenCompute for claims processing that users can independently verify on-chain. The rise of autonomous agents, such as decentralized trading bots or supply chain managers, benefits from both deterministic execution and recourse through slashing if operators misbehave.

Risks and Considerations: What Users Should Know

While the promise of verifiable AI is compelling, it introduces new operational complexities. Slashing mechanisms require robust monitoring infrastructure to avoid false positives. Trusted execution environments (TEEs) must be regularly audited for vulnerabilities. And as ETH’s price remains volatile at $4,482.46, stakers should remain vigilant about risk exposures when restaking assets into emerging AVSs.

It’s also important for developers to deeply understand the economic incentives underpinning their chosen modules, misaligned incentives or poorly designed slashing conditions could undermine security rather than enhance it.

The Road Ahead: A Verifiable Cloud for Web3

The introduction of EigenCloud’s verifiable AI stack signals a maturation point not just for Ethereum restaking but for the broader Web3 ecosystem. As on-chain and off-chain boundaries blur, cryptoeconomic trust becomes a prerequisite for any application demanding reliability at scale.

For those seeking deeper technical analysis or integration guides on how EigenAI and EigenCompute enable verifiable AI on Ethereum with EigenLayer Restaking, resources are rapidly expanding alongside community engagement.

The next twelve months will be pivotal as more protocols experiment with this architecture, potentially unlocking entirely new markets around decentralized insurance, sovereign AI agents, and scalable off-chain computation, all secured by the same cryptoeconomic primitives that underpin Ethereum itself.