As Ethereum continues its transition into a modular, trust-minimized infrastructure for decentralized applications, the demand for verifiable and tamper-resistant AI solutions has reached a critical inflection point. The launch of EigenAI and EigenCompute on the EigenCloud platform marks a watershed moment for both the Ethereum and artificial intelligence ecosystems. By leveraging EigenLayer’s innovative restaking mechanism, these services introduce cryptoeconomic guarantees to offchain AI computation, solving a persistent trust bottleneck that has limited the adoption of decentralized AI agents and applications.

Restaking: The Security Backbone of Verifiable AI

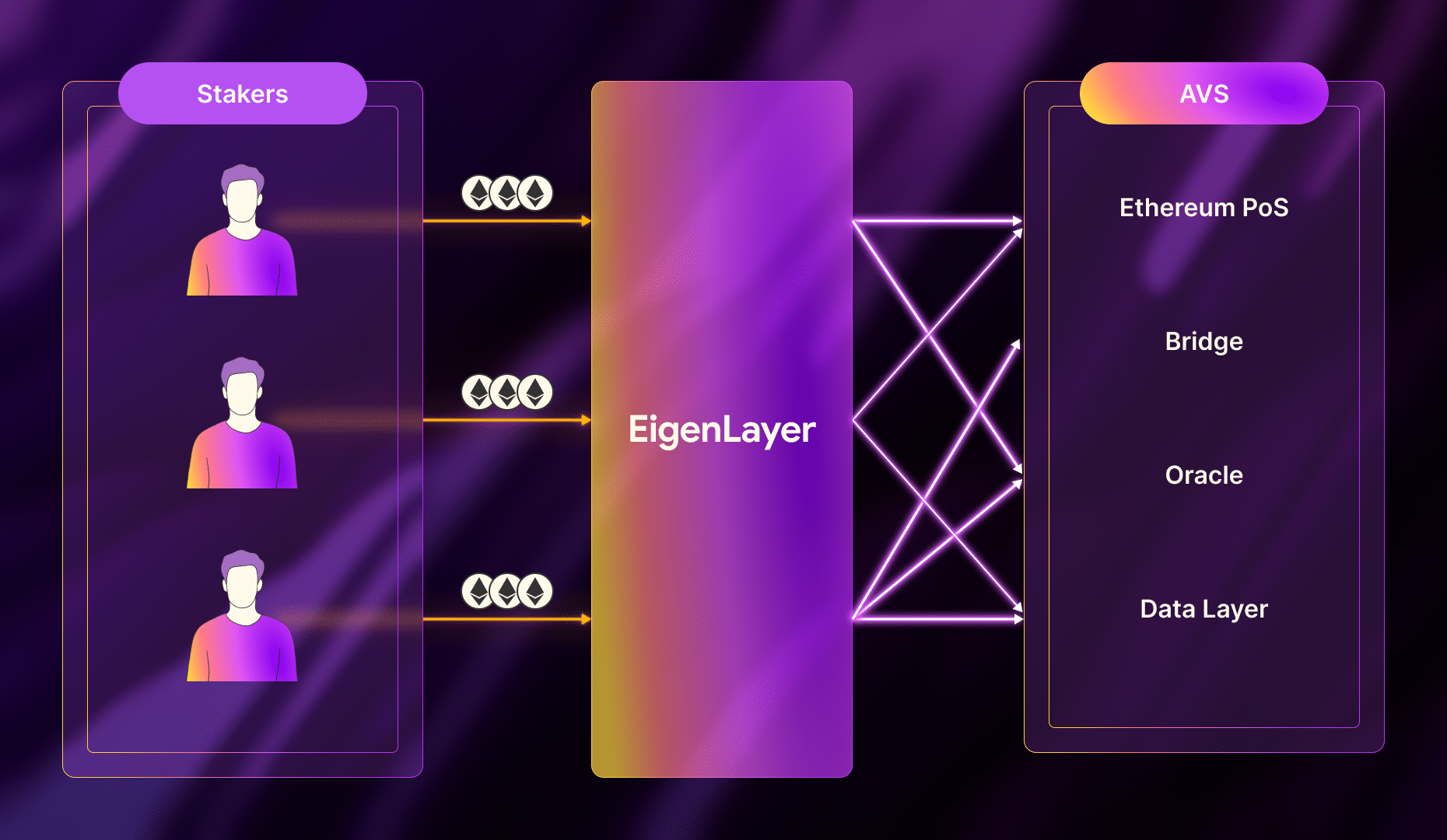

At its core, EigenLayer is an Ethereum-based protocol that enables validators to “restake” their staked ETH or liquid staking tokens. This means that ETH already securing the Ethereum mainnet can be reused to validate new services, without fragmenting security or requiring nascent protocols to bootstrap their own validator sets. The result: a shared security model where emerging decentralized services inherit the robust cryptoeconomic guarantees of Ethereum itself.

This architecture is especially powerful for AI workloads, which are notoriously difficult to verify due to their probabilistic and data-intensive nature. By anchoring verification in restaked ETH, currently trading at $4,474.36, with a 24-hour change of and $78.69 ( and 0.0179%): EigenLayer ensures that validators have significant economic skin in the game when attesting to AI inference results or data listings.

How EigenAI and EigenCompute Deliver Verifiable AI Infrastructure

EigenAI and EigenCompute, announced as part of EigenCloud’s mainnet alpha release in September 2025, are designed from the ground up to address two fundamental pain points:

- The need for transparent, verifiable computation in offchain AI workflows

- The challenge of establishing tamper-resistance without relying on centralized gatekeepers

EigenCloud’s developer platform integrates these components alongside EigenDA (for high-throughput data availability) and EigenVerify (for dispute resolution). Together, they offer a modular toolkit for building verifiable apps in familiar languages like Rust and Python, enabling developers to focus on logic rather than reinventing security primitives.

Kite AI Integration: Real-World Proof of Decentralized Validation

The integration between EigenLayer’s Active Validation Service (AVS) and Kite AI’s on-chain asset marketplace is a prime example of this technology stack in action. In April 2025, Kite AI incorporated AVS into its platform, empowering restaked validators to independently verify both AI inference operations and asset listings.

This move not only enhances transparency but also introduces an additional layer of economic accountability, validators risk losing their staked ETH if they collude or submit fraudulent attestations. As detailed by Chainwire’s coverage, this partnership demonstrates how decentralized validation can bring cryptoeconomic trust to previously opaque domains like machine learning marketplaces.

The Economics Behind Restaking Secured AVSs

The financial incentives underpinning restaking are central to its success as a backbone for verifiable AI infrastructure. Validators who participate in securing Active Validation Services (AVSs) such as EigenAI earn rewards for their work, creating a vibrant market dynamic where economic interests align with honest validation.

This model not only increases capital efficiency by reusing staked assets but also strengthens network resilience against attacks or manipulation attempts, a crucial requirement as autonomous agents proliferate across DeFi, prediction markets, and enterprise compliance workflows.

Developers and enterprises are already exploring how EigenAI and EigenCompute can power decentralized AI infrastructure with cryptoeconomic guarantees. By leveraging restaked ETH, every inference, model update, or dataset listing validated through EigenLayer is subject to the same tamper-resistance and auditability that underpins Ethereum’s core security. As a result, protocols can deploy AI agents that are not only scalable but also verifiable in a way that offchain or centralized solutions simply cannot match.

This paradigm shift is especially meaningful for sectors where trust and transparency are paramount. For example, prediction markets can use verifiable AI to settle outcomes based on independently validated data feeds. Enterprise compliance tools can automate regulatory checks using on-chain proofs of correct computation. Even decentralized autonomous organizations (DAOs) now have the ability to deploy tamper-resistant AI agents that execute governance logic with cryptoeconomic accountability.

Key Benefits: Why Verifiable AI Matters for Ethereum

Top 5 Advantages of EigenAI & EigenCompute for Verifiable AI

-

1. Enhanced Trust via Ethereum RestakingEigenAI and EigenCompute leverage EigenLayer’s restaking mechanism, allowing Ethereum validators to secure AI computations using their staked ETH. This extends Ethereum’s robust cryptoeconomic security to AI services, eliminating the need for new trust networks and ensuring a high level of verifiability.

-

2. Verifiable AI Computations On-ChainWith EigenCompute, off-chain AI computations receive on-chain guarantees. This means results from AI models and agents can be independently validated by restaked validators, providing transparent and tamper-proof verification for critical AI-driven applications.

-

3. Decentralized Validation of AI ServicesBy utilizing Active Validation Services (AVS) through EigenLayer, EigenAI ensures that AI inference and asset listing processes are validated by a decentralized network of stakers. This reduces reliance on centralized authorities and increases the reliability of AI outcomes.

-

4. Seamless Integration for DevelopersThe EigenCloud platform supports familiar programming languages like Rust and Python, enabling developers to build verifiable AI applications efficiently. This lowers barriers to entry and accelerates innovation in the Ethereum ecosystem.

-

5. Incentivized Security and ParticipationThrough EigenLayer, validators who restake ETH can earn additional rewards by securing AI services. This incentivizes broad participation, further strengthening the security and decentralization of verifiable AI infrastructure on Ethereum.Current Ethereum (ETH) Price: $4,474.36

The launch of EigenCloud mainnet alpha, featuring these services, is accelerating the adoption curve for both developers and stakers. The ability to build, stake, and run AVS infrastructure, while earning rewards, creates a positive feedback loop that strengthens the entire ecosystem. As highlighted in recent coverage from Blockworks and CoinMarketCap, the capacity to reuse staked ETH for multiple layers of security without fragmenting validator sets is setting a new standard for capital efficiency in crypto networks.

For investors tracking the evolution of Ethereum’s security landscape, it’s notable that ETH remains robustly priced at $4,474.36, reflecting growing confidence in its expanding utility as a base layer for decentralized trust, not just settlement. As more protocols migrate critical workloads like AI inference to restaking-secured AVSs, we can expect further demand-side pressure on ETH staking markets.

The Road Ahead: Decentralized Trust at Scale

The emergence of EigenLayer’s modular platform, with its suite of services like EigenAI and EigenCompute, signals a broader trend toward modularity and composability in blockchain infrastructure. By abstracting away complex security primitives through restaking, developers are free to innovate at the application layer, ushering in an era where trust-minimized AI services become the norm rather than the exception.

As adoption accelerates following the mainnet alpha release, and with integrations like Kite AI providing real-world validation, the promise of tamper-resistant, transparent AI is rapidly moving from concept to reality. The next wave of decentralized applications will not only be programmable but also provable, anchored by Ethereum’s cryptoeconomic security via restaking.