Ethereum’s validator ecosystem underwent a profound shift in 2024, with EigenLayer restaking emerging as a transformative force for both rewards and risk. As the price of Ethereum (ETH) hovers at $3,996.57, the impact of EigenLayer’s restaking protocol has become a central topic for validators strategizing to maximize their APY while navigating new complexities.

Restaking: Unlocking New Yield Streams for Ethereum Validators

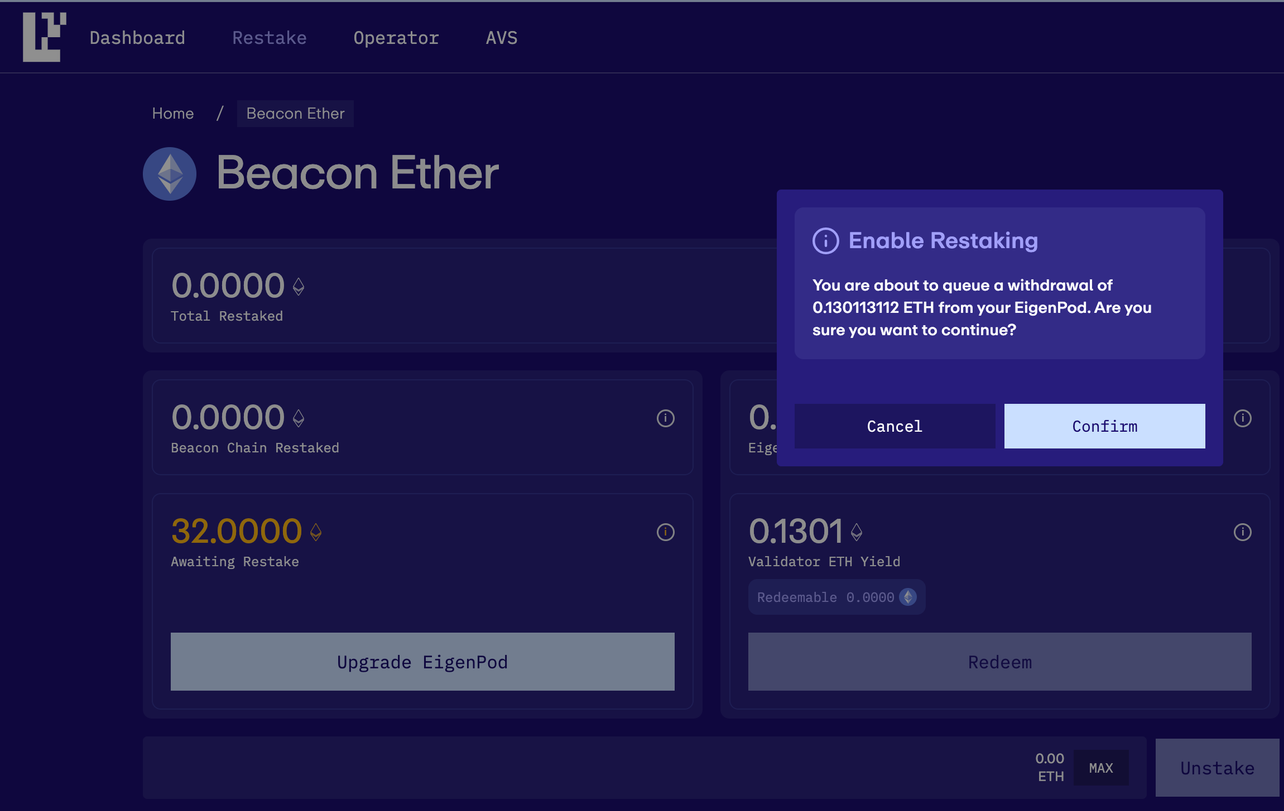

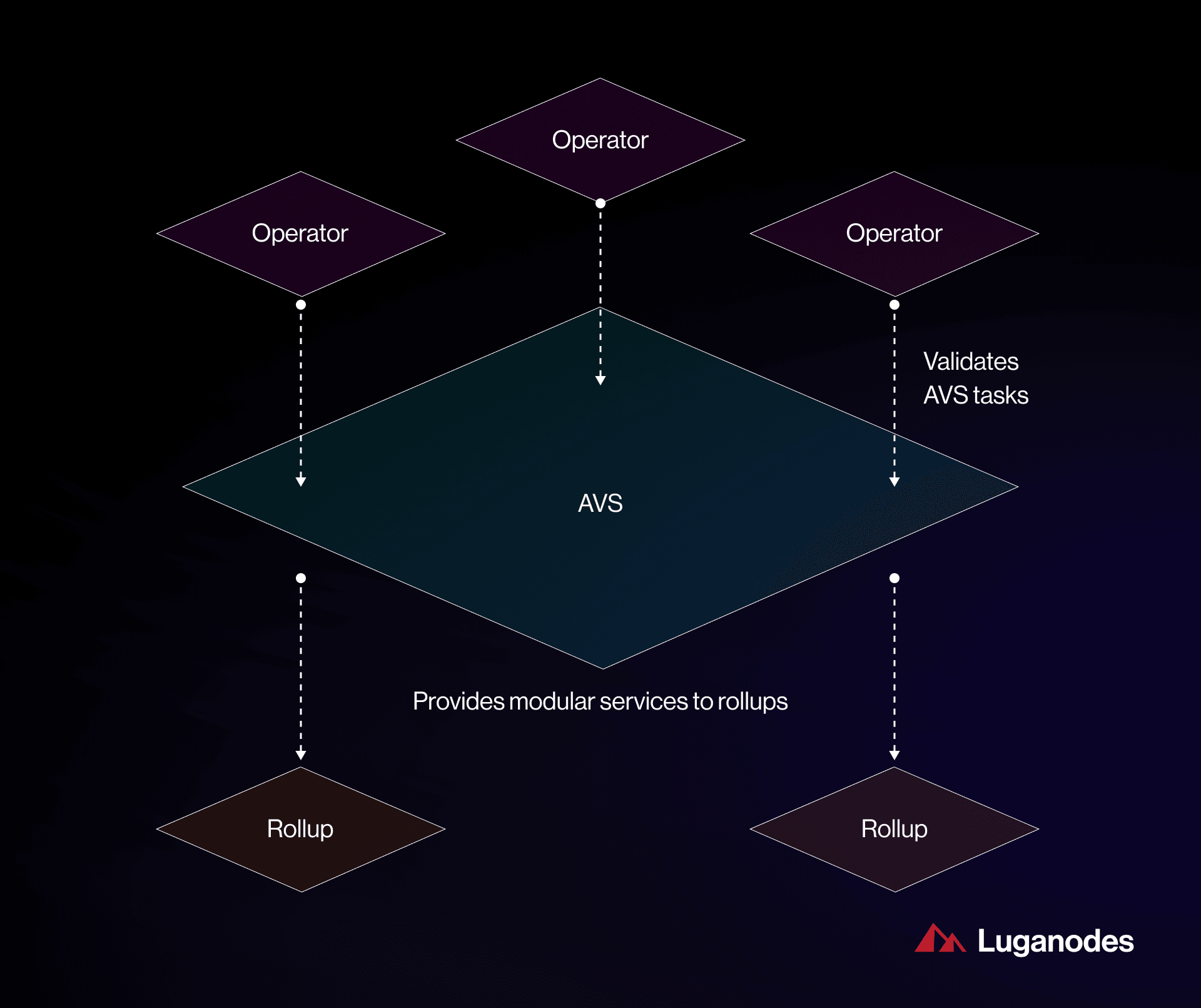

Traditionally, Ethereum validators earned rewards by securing the Beacon Chain, with APYs fluctuating based on network participation and fee dynamics. The introduction of EigenLayer restaking has upended this paradigm. By allowing validators to “restake” their already-staked ETH to secure Actively Validated Services (AVSs), EigenLayer opened the door to additional reward streams layered on top of the base staking yield.

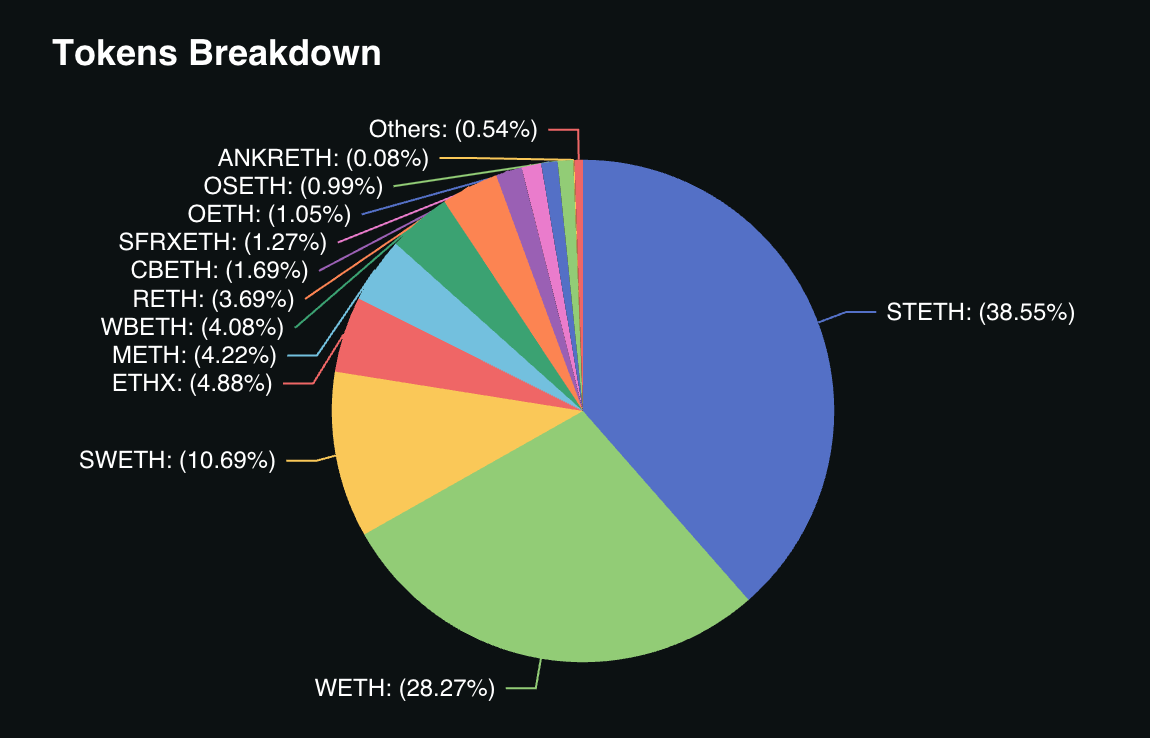

Recent data underscores this shift: as of late November 2024, over 6,250,000 ETH (about $19.3 billion) was locked in restaking protocols, with native ETH comprising 83.7% of these deposits (metalamp.io). According to Kiln.fi, total APY on restaked ETH can reach around 5%, combining approximately 3.18% from traditional staking and an additional boost from AVS participation.

This dynamic is often described as the “restaking flywheel”: higher rewards attract more stakers, which in turn enhances security and utility for AVSs, further increasing demand for restaked capital.

The Mechanics Behind EigenLayer Restaking Rewards in 2024

The core innovation lies in capital efficiency. Instead of locking up new assets or unstaking existing deposits, validators can leverage their staked ETH across multiple networks simultaneously. This mechanism not only amplifies potential earnings but also aligns incentives between Ethereum’s base layer and emerging decentralized services built atop it.

However, this opportunity comes with trade-offs. Validators must meet stringent performance requirements set by each AVS they support; failure can trigger slashing penalties that threaten both principal and accrued rewards (coingecko.com). The risk profile is fundamentally altered: while yields are higher, so too is the operational complexity and exposure to cascading slashing events.

Centralization Pressures and Market Dynamics at $3,996.57 ETH

The rapid growth in restaked assets has sparked debate about market structure and fairness within the validator community. As of June 25,2024, about 17% of all ETH staked on the Beacon Chain was being restaked – with a staggering 98.26% of that captured by EigenLayer (galaxy.com). This concentration raises concerns that larger operators may crowd out smaller participants by dominating AVS selection and governance processes.

The centralization question is not merely academic: it directly impacts reward distribution and long-term network resilience. While some see EigenLayer’s marketplace as a catalyst for innovation and security improvements across DeFi protocols (QuillAudits), others warn that unchecked growth could undermine decentralization – one of Ethereum’s foundational values.

Ethereum (ETH) Price Prediction 2026-2031: Impact of EigenLayer Restaking

Professional outlook on ETH price and validator rewards under continued EigenLayer adoption

| Year | Minimum Price | Average Price | Maximum Price | Year-on-Year Change (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $3,200 | $4,350 | $5,800 | +9% | Consolidation phase; restaking adoption stabilizes; regulatory clarity improves |

| 2027 | $3,700 | $5,100 | $7,000 | +17% | Bullish momentum as AVS ecosystem matures; increased institutional participation |

| 2028 | $4,200 | $5,900 | $8,600 | +16% | DeFi and AVS integration accelerates; ETH demand surges for staking/restaking |

| 2029 | $4,800 | $6,800 | $10,000 | +15% | Broader crypto market uptrend; ETH as backbone of modular blockchain economy |

| 2030 | $5,300 | $7,800 | $12,500 | +15% | Mainstream adoption of EigenLayer and Layer-2s; ETH scarcity narrative strengthens |

| 2031 | $5,900 | $8,700 | $15,000 | +12% | ETH matures as digital asset; validator rewards stabilize at sustainable APY |

Price Prediction Summary

Ethereum’s price outlook from 2026 to 2031 remains broadly positive, with EigenLayer’s restaking model driving enhanced validator rewards and increasing demand for ETH. While risks such as slashing and centralization exist, continued protocol innovation and mainstream adoption are expected to support price growth and validator APY. Price volatility will persist, but ETH could see average annual growth of 12-17% as the restaking ecosystem expands.

Key Factors Affecting Ethereum Price

- EigenLayer and restaking adoption rates influencing ETH demand and APY.

- Regulatory clarity and global crypto policy impacting institutional flows.

- Technological improvements (Layer-2s, AVSs, modular blockchains) enhancing use cases.

- Market cycles: macroeconomic factors, Bitcoin halving effects, and risk appetite.

- Potential risks from slashing, AVS failures, or smart contract exploits.

- Competition from other smart contract platforms and restaking protocols.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Navigating Uncertainty: Validator Strategies in an Evolving Restaking Landscape

The calculus for Ethereum validators in 2024 is more nuanced than ever before. With $3,996.57 as the current price point for ETH, even modest percentage increases in APY translate into significant dollar gains over time – but only if risks are managed effectively.

This evolving landscape demands rigorous due diligence when selecting AVSs to support via EigenLayer restaking. Payout procedures remain opaque across some protocols; counterparty risk is real; borrowing loops threaten capital stability if left unchecked (EarnBIT on Medium). The most successful validators are those who blend technical vigilance with strategic diversification – optimizing reward profiles while minimizing exposure to systemic shocks.

To help validators identify the most promising opportunities, leading research desks and staking analytics platforms have begun tracking AVS metrics, slashing histories, and real-time reward rates. This data-driven approach enables a more granular assessment of restaking risk versus reward, empowering smaller operators to compete more effectively with institutional-scale players. As EigenLayer’s governance matures, proposals for more transparent AVS onboarding and equitable fee structures are gaining traction among community stakeholders.

For those considering entry or expansion into EigenLayer restaking, it’s critical to understand that not all AVSs are created equal. Some offer higher headline rewards but carry greater technical risk or less robust economic guarantees. Others may provide lower incremental APY but with more predictable payout schedules and stronger reputational backing. Validators must weigh these variables against their own operational capabilities and risk tolerance.

Key Considerations for Maximizing EigenLayer Restaking Rewards

- Diversification: Avoid overexposure to any single AVS or protocol. Spread restaked ETH across multiple services to mitigate slashing contagion.

- Due Diligence: Scrutinize AVS performance histories, governance transparency, and technical documentation before committing capital.

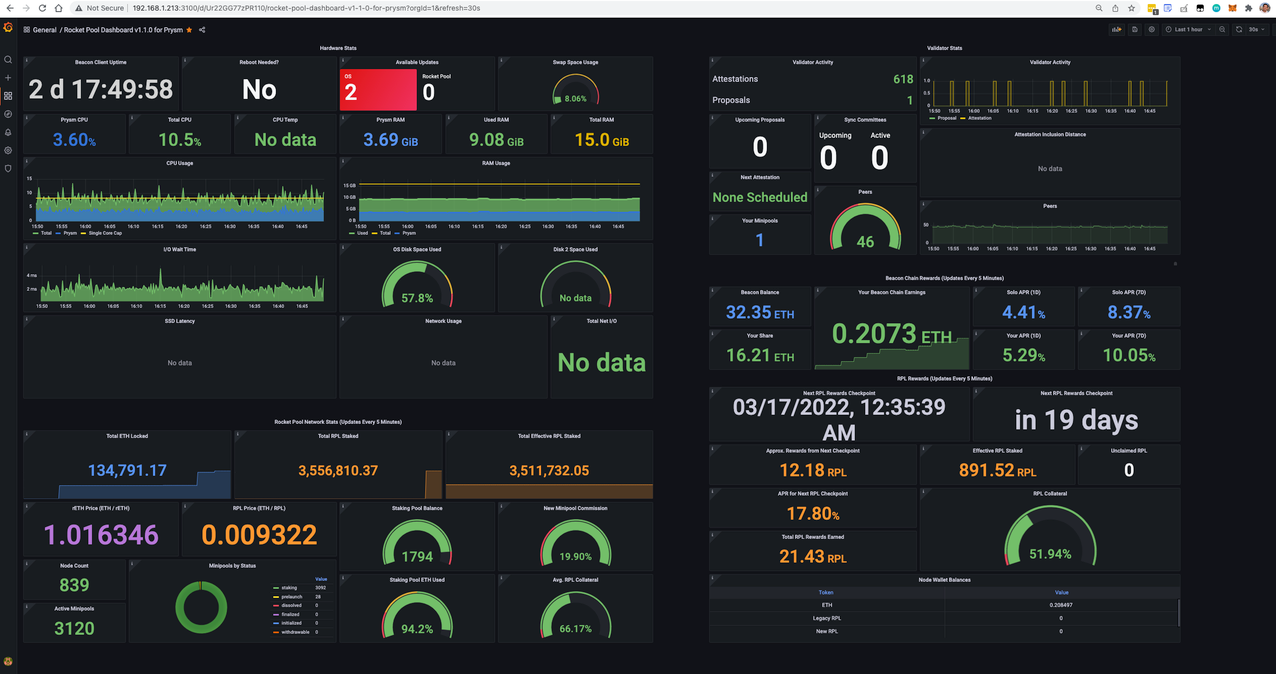

- Monitoring: Leverage monitoring tools for real-time alerts on slashing events, reward fluctuations, and network health indicators.

- Community Engagement: Participate in EigenLayer governance forums to stay informed about protocol upgrades, fee changes, and emerging risks.

Top Validator Strategies for EigenLayer Restaking in 2024

-

1. Diversify Across Multiple AVSs: Validators can maximize reward potential by restaking ETH across a range of Actively Validated Services (AVSs) on EigenLayer, balancing yields while mitigating the risk of slashing from any single service.

-

2. Monitor and Optimize Validator Performance: Consistently tracking validator uptime and responsiveness is crucial, as AVS-specific slashing conditions can impact rewards. Tools like Beaconcha.in help ensure optimal performance.

-

4. Stay Updated on AVS Risk Profiles: Regularly review the risk and slashing policies of each AVS via EigenLayer’s official documentation and community forums. This helps validators avoid high-risk services that could jeopardize staked ETH.

-

5. Participate in Governance and Community Discussions: Engaging with EigenLayer governance and the broader Ethereum staking community (e.g., on EigenLayer Discord) provides early insights into protocol upgrades and AVS launches, enabling proactive strategy adjustments.

The broader implication of this new paradigm is an increasingly sophisticated Ethereum validator ecosystem, one where technical acumen and strategic agility determine success. As the network’s security model evolves to accommodate multi-layered staking incentives, the interplay between capital efficiency and systemic risk will remain at the forefront of industry debate.

Looking ahead to 2025, many analysts expect continued growth in restaked assets as more DeFi protocols integrate with EigenLayer’s middleware. However, future reward trajectories will depend on several factors: ETH price stability (currently at $3,996.57), the emergence of new AVSs with sustainable economics, regulatory developments impacting staking-as-a-service providers, and ongoing innovations in slashing mitigation technology.

The next wave of Ethereum validator rewards will belong not just to those who chase yield, but to those who master risk management in a rapidly evolving marketplace.

For a deeper dive into how these dynamics play out at the protocol level, and what they mean for your validator strategy, explore additional resources from experts tracking EigenLayer’s evolving reward mechanisms.