Ethereum’s security model has undergone a rapid evolution in the past two years, with restaking protocols like EigenLayer and EKOX at the center of this transformation. As of September 2025, Ethereum trades at $4,182.75, reflecting persistent institutional demand and surging on-chain activity. Yet, the real story is not just price – it’s how modular restaking is redefining both network security and yield generation for stakers, validators, and decentralized service providers.

Restaking: The Foundation of Next-Gen Ethereum Security

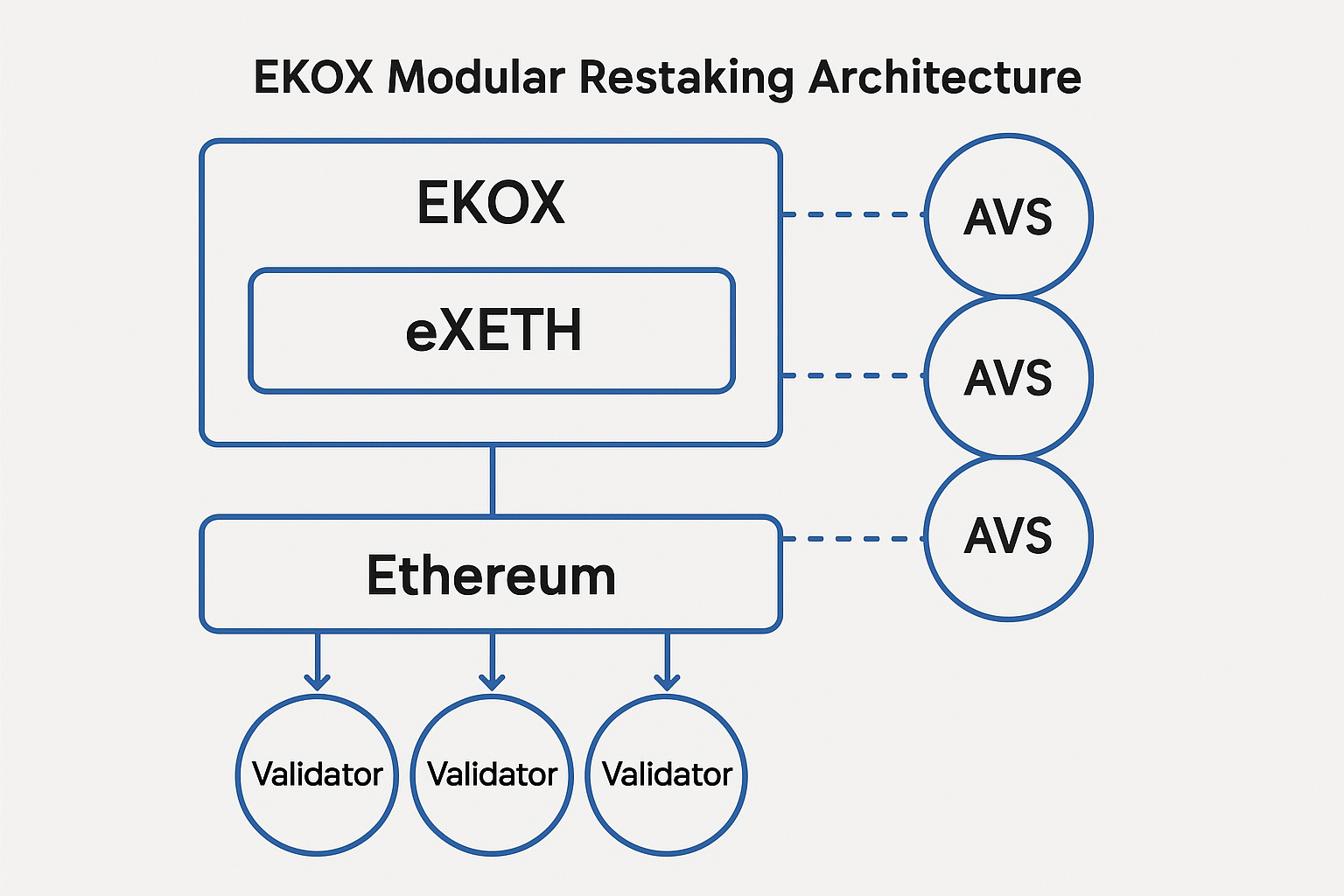

Traditional Ethereum staking locks up ETH to secure the consensus layer, rewarding validators with protocol emissions. But this approach leaves vast amounts of capital underutilized. Restaking protocols have emerged to solve this inefficiency by enabling staked ETH to be repurposed for additional security roles across Actively Validated Services (AVSs) such as data availability layers, middleware, and oracle networks.

EKOX exemplifies this new paradigm by offering a modular architecture that abstracts away technical hurdles for both retail and institutional users. Instead of managing complex validator infrastructure or manually selecting AVSs to support, users can simply deposit ETH into EKOX and receive eXETH: a liquid ERC-20 token representing their stake in both Ethereum validators and AVSs.

EKOX’s Modular Approach: Frictionless Restaking Meets Automated Delegation

The heart of EKOX’s innovation lies in its modularity and user-centric design. Unlike monolithic restaking systems that require hands-on management, EKOX automates AVS selection and delegation through smart contracts optimized for performance and transparency. This creates a frictionless experience where users can maximize yield without technical overhead or risk of misconfiguration.

When users mint eXETH by depositing ETH into EKOX, they gain exposure to two synergistic yield streams:

- Staking Rewards (SY): Earnings from securing the Ethereum consensus layer as a validator.

- Restaking Rewards (RY): Additional returns from providing shared security to AVSs via EigenLayer integration.

Both reward flows are auto-compounded into the eXETH token value – eliminating manual claims while optimizing capital efficiency for holders.

The Yield Revolution: Dual-Layer Rewards With Full Liquidity

This dual-yield structure is especially compelling in today’s market environment. With ETH holding steady at $4,182.75, stakers are hungry for ways to extract more value from their assets without locking up liquidity or taking on excessive risk. EKOX delivers here by allowing eXETH holders to:

- Earn staking rewards from Ethereum’s base layer

- Capture additional yield from securing AVSs through EigenLayer partnerships

- Retain full liquidity via eXETH ERC-20 tokens tradable across DeFi platforms

- Avoid technical complexity thanks to automated delegation logic built into the protocol

This model not only boosts individual returns but also strengthens the entire ecosystem by extending Ethereum’s robust security guarantees to a growing constellation of decentralized services.

Ethereum (ETH) Price Prediction 2026–2031: Impact of Modular Restaking Protocols like EKOX

Professional outlook based on the transformative effects of modular restaking, liquid staking tokens (eXETH), and evolving Ethereum security/yield mechanisms.

| Year | Minimum Price (Bearish) | Average Price | Maximum Price (Bullish) | % Change (Avg. YoY) | Market Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,950 | $4,750 | $6,100 | +13.6% | Restaking protocols see broad adoption; ETH yield appeal grows, offset by potential short-term regulatory hurdles. |

| 2027 | $4,400 | $5,600 | $7,900 | +17.9% | EKOX/eXETH and similar protocols mature; institutional participation increases, driving demand for liquid staking. |

| 2028 | $5,000 | $6,800 | $10,200 | +21.4% | Restaking becomes a standard for ETH holders; DeFi and AVS integrations boost ecosystem activity. |

| 2029 | $5,900 | $8,200 | $12,800 | +20.6% | Ethereum’s security market share grows; modular restaking yields attract capital from competing L1s. |

| 2030 | $6,800 | $9,900 | $15,600 | +20.7% | Mainstream adoption of liquid restaking; ETH seen as foundational security for Web3 infrastructure. |

| 2031 | $8,100 | $11,600 | $18,900 | +17.2% | ETH’s role as a security backbone is cemented; new AVS applications and global regulatory clarity propel further growth. |

Price Prediction Summary

Ethereum’s price outlook for 2026–2031 is robust, fueled by innovations in modular restaking protocols such as EKOX. These protocols drive higher yields, greater capital efficiency, and enhance Ethereum’s security, leading to increasing demand and price appreciation. While bullish scenarios could see ETH surpassing $18,000 by 2031, downside risks remain from regulatory actions and macroeconomic volatility. However, average price trends suggest strong, sustainable growth as restaking becomes integral to the Ethereum ecosystem.

Key Factors Affecting Ethereum Price

- Adoption of modular restaking protocols (EKOX, EigenLayer, Symbiotic) and their impact on yield and security.

- Growth and mainstreaming of liquid staking tokens (eXETH) improving capital efficiency and accessibility.

- Expansion of Actively Validated Services (AVSs) leveraging Ethereum security.

- Institutional adoption and integration of restaking into DeFi and TradFi products.

- Potential for increased regulatory scrutiny or favorable clarity.

- Competition from alternative L1s and cross-chain security solutions.

- Macro market cycles and global economic trends affecting risk appetite.

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

Security and yield are no longer a zero-sum game for Ethereum stakers. Modular restaking protocols like EKOX enable participants to extract more value from their assets while simultaneously enhancing the security infrastructure that underpins the broader DeFi landscape. By abstracting away validator operations and automating AVS selection, EKOX lowers the barrier to entry for both new and experienced users, democratizing access to dual-layer rewards.

Shared Security AVS: A New Layer of Trust for Decentralized Services

One of the most significant impacts of modular restaking is the emergence of shared security AVS. With EKOX and similar protocols, decentralized applications can tap into Ethereum’s validator set without bootstrapping their own security networks from scratch. This not only accelerates innovation but also reduces fragmentation in crypto-economic security models.

AVSs benefit from immediate access to a pool of economically aligned validators, while stakers enjoy increased rewards without additional complexity. The result is a more resilient ecosystem where new protocols can launch with robust trust assumptions, backed by the economic weight of existing staked ETH.

Performance, Openness, Usability: The EKOX Advantage

EKOX’s commitment to performance and openness is evident in its transparent smart contract architecture and community-driven governance model. The protocol’s automated delegation engine continuously optimizes validator assignments across both Ethereum consensus duties and AVS participation, ensuring that user capital is always working at peak efficiency.

This design also allows for seamless integration with other DeFi primitives. eXETH holders can use their tokens as collateral in lending markets or participate in liquidity pools – all while accruing dual-layer rewards in real time. Such composability further cements eXETH as a foundational asset within the next generation of DeFi applications.

Looking Ahead: The Roadmap for Modular Restaking Protocols

The trajectory for modular restaking protocols is clear: as more Actively Validated Services come online and institutional adoption accelerates, demand for frictionless restaking solutions will intensify. Protocols like EKOX are well-positioned to capture this growth by continuing to refine automated delegation logic, expand AVS integrations, and improve user experience through enhanced analytics dashboards.

With Ethereum’s price holding at $4,182.75, capital efficiency remains top-of-mind for both individual stakers and professional validators. Those who embrace next-gen restaking protocols today are not only maximizing their own returns but also playing a pivotal role in securing the future of decentralized finance.