Ethereum’s staking landscape has evolved dramatically in 2024, and EigenLayer restaking is at the forefront of this transformation. With Ethereum (ETH) holding steady at $4,473.94, validators are seeking new strategies to maximize their returns and capitalize on the growing ecosystem. EigenLayer’s innovative restaking protocol empowers validators to earn additional rewards by securing not just Ethereum, but also a diverse set of Actively Validated Services (AVSs), all while leveraging the same staked ETH.

Restaking: Unlocking Enhanced Rewards for Ethereum Validators

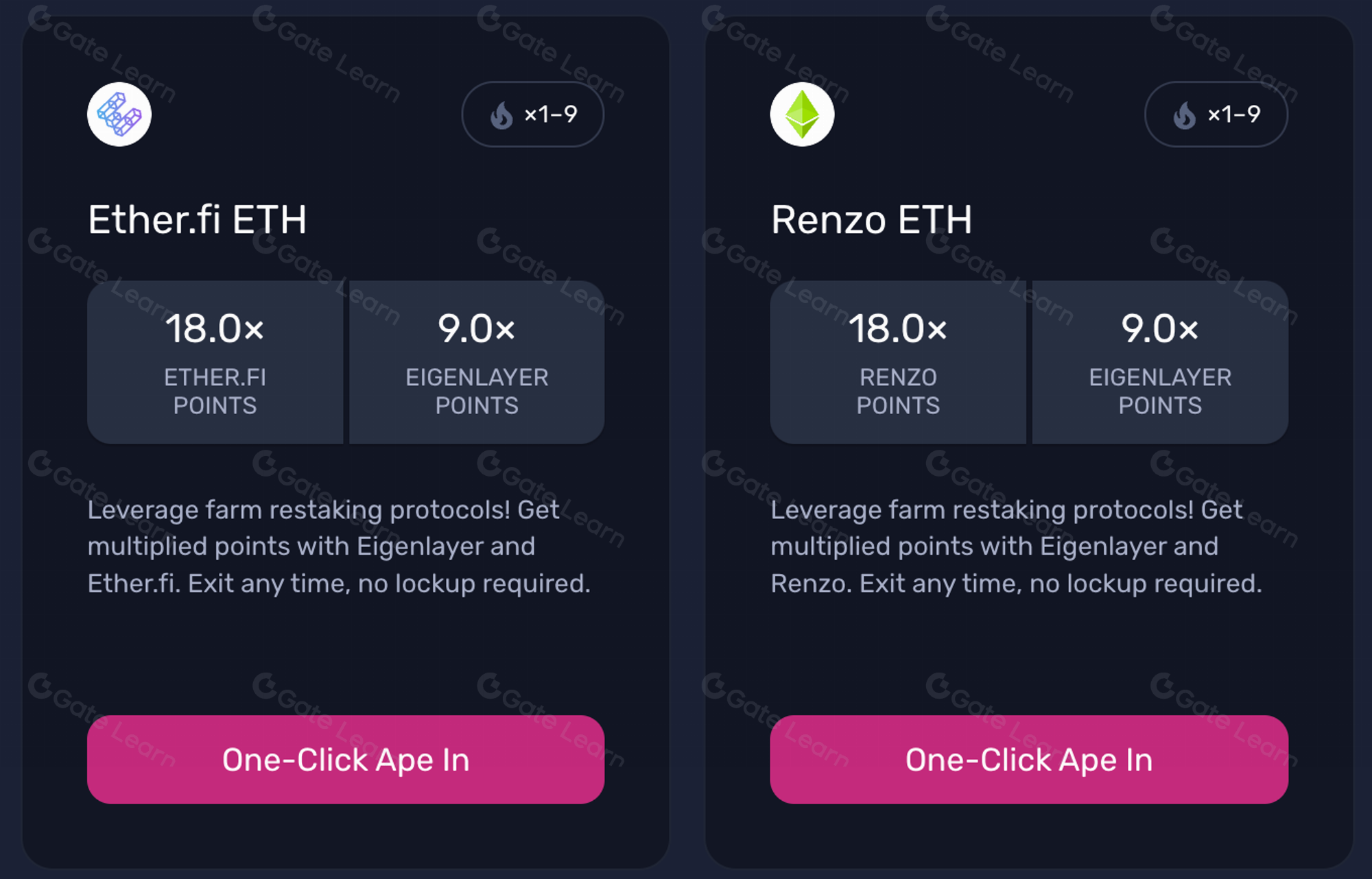

The core value proposition of EigenLayer is its ability to let validators “restake” their ETH. Instead of earning rewards solely from Ethereum’s consensus layer, restakers can now participate in validating multiple protocols simultaneously. This approach not only increases capital efficiency but also opens up new avenues for yield stacking – a major draw for both individual stakers and professional operators.

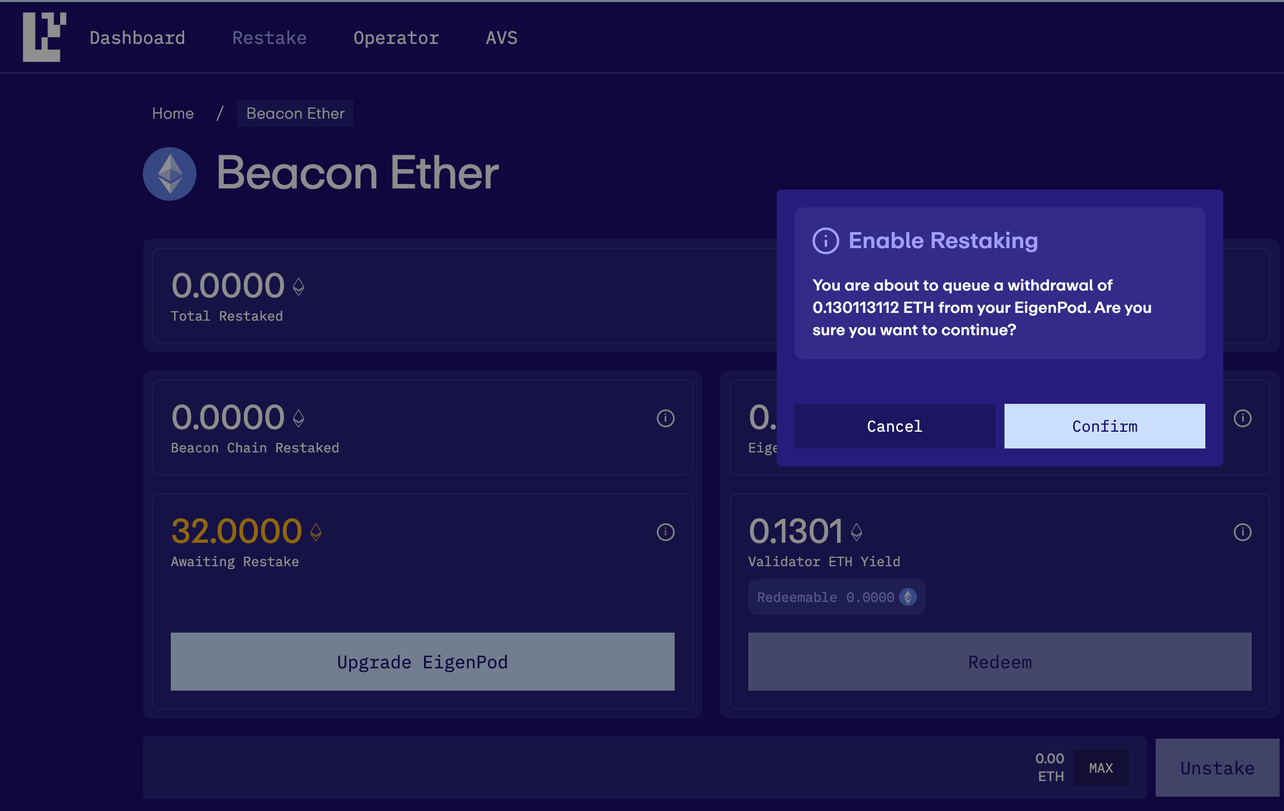

Recent upgrades in September 2024 have made native ETH restaking even more accessible. With the deployment of improved EigenPods (specialized smart contracts), users can automatically restake Beacon Chain ETH rewards, effectively compounding their earnings without manual intervention. This automation is a game-changer for those aiming to maximize staking returns on EigenLayer.

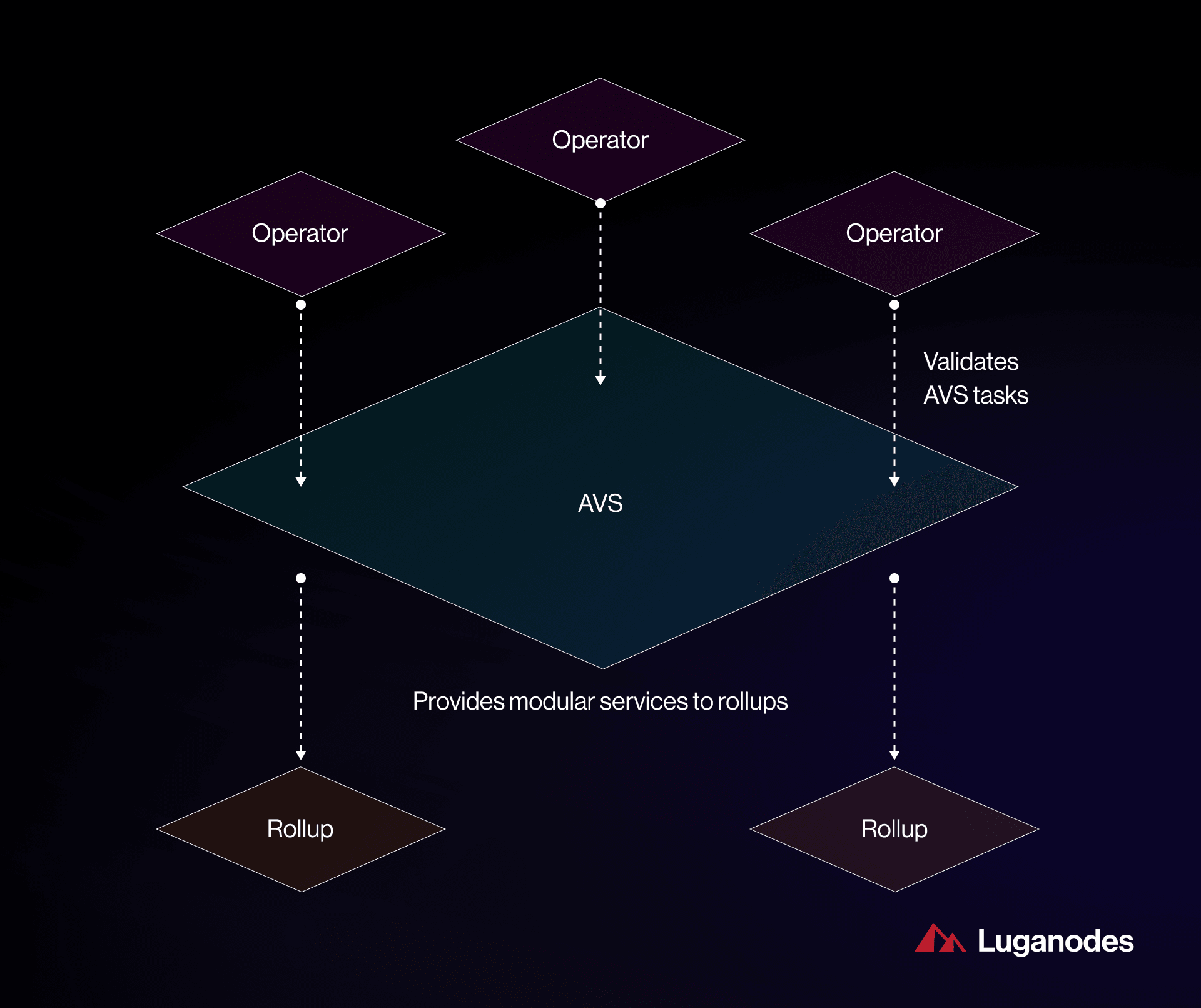

How AVSs and Operator Flexibility Drive Higher Earnings

The December 2024 protocol enhancements further accelerated validator earning potential. AVSs – decentralized services that require active validation – can now distribute rewards based on real-time performance metrics. This performance-based model incentivizes validators to optimize uptime and reliability, directly impacting their reward streams.

Additionally, operators gained the autonomy to set custom fee rates for their services, fostering healthy competition within the ecosystem. Stakers can now delegate assets to operators whose strategies align with their risk tolerance and yield goals – a feature that brings a new level of sophistication to Ethereum restaking strategies. For those less interested in hands-on management, delegation provides exposure to advanced operator tactics without sacrificing security or transparency.

Ethereum (ETH) Price Prediction 2026-2031: Impact of EigenLayer Restaking

Forecast considers enhanced validator rewards, staking innovations, and evolving market dynamics. Prices reflect both bullish and bearish scenarios given advancements in the Ethereum ecosystem and broader market conditions.

| Year | Minimum Price | Average Price | Maximum Price | Yearly % Change (Avg) | Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $4,100 | $5,250 | $6,800 | +17% | Sustained validator demand, increasing restaking adoption, but high volatility persists. |

| 2027 | $4,800 | $6,200 | $8,500 | +18% | EigenLayer restaking boosts DeFi integration; regulatory clarity improves institutional participation. |

| 2028 | $5,400 | $7,150 | $10,200 | +15% | Layer-2 and AVS expansion drive new use cases; ETH seen as DeFi backbone. |

| 2029 | $5,900 | $8,300 | $12,800 | +16% | EIP upgrades and mainstream staking adoption; ETH competes with alternative L1s. |

| 2030 | $6,250 | $9,500 | $15,600 | +14% | Global DeFi scaling, ETH ETF adoption, and network effects accelerate growth. |

| 2031 | $6,850 | $10,700 | $18,300 | +13% | Mature restaking ecosystem, cross-chain integrations, and broad institutional use. |

Price Prediction Summary

Ethereum’s price outlook from 2026 to 2031 is broadly bullish, underpinned by innovations like EigenLayer restaking that enhance validator rewards and capital efficiency. The average price is projected to rise steadily, with minimum and maximum ranges reflecting potential volatility from market cycles and macroeconomic shifts. As ETH solidifies its role in DeFi and staking ecosystems, its value proposition strengthens, though risks from regulation and competition remain.

Key Factors Affecting Ethereum Price

- EigenLayer restaking upgrades increasing validator returns and network security

- Wider adoption of staking and DeFi protocols on Ethereum

- Continued technical improvements (e.g., scalability, EIPs, Layer-2 solutions)

- Regulatory developments impacting institutional and retail participation

- Competition from other smart contract platforms (Solana, Avalanche, etc.)

- Market cycles, global macroeconomic trends, and crypto adoption rates

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

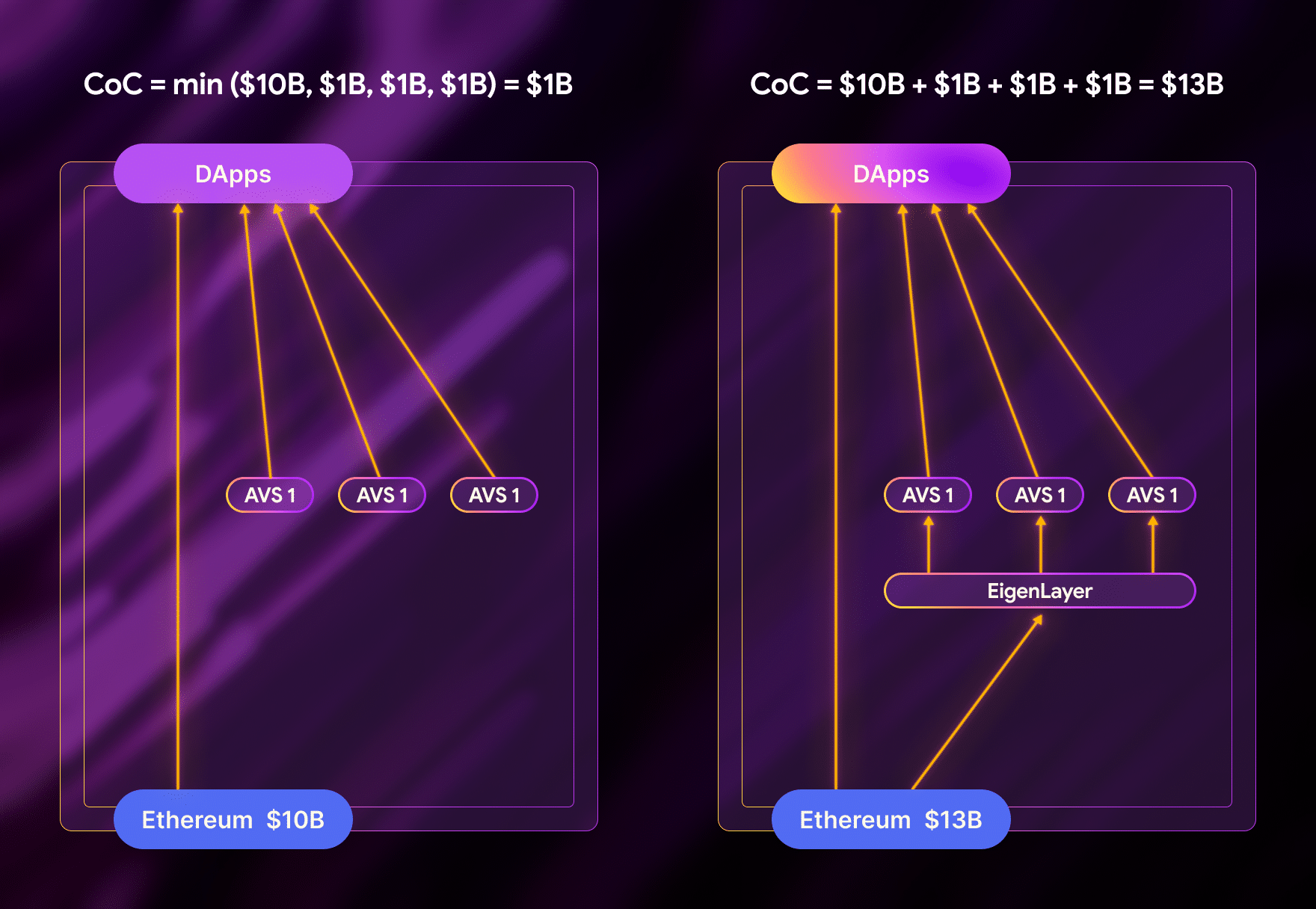

Capital Efficiency Meets Security Innovation

The dual benefits of higher yields and improved network security are central to why EigenLayer restaking continues to gain traction among validators. By allowing staked ETH to secure multiple protocols at once, capital is put to work more efficiently than ever before while simultaneously bolstering the resilience of emerging AVSs.

This synergy between enhanced rewards and robust security mechanisms marks a pivotal shift in how value is generated within the Ethereum ecosystem. As more protocols integrate with EigenLayer and offer compelling incentives for validators, the case for participating in restaking grows stronger by the day.

For validators and stakers alike, the practical impact of these innovations is clear: restaking no longer means sacrificing liquidity or overcomplicating risk management. Instead, it provides a streamlined path to earning multiple revenue streams from a single capital base. The automation enabled by EigenPods, combined with customizable operator fees and performance-based AVS rewards, has set a new standard for capital efficiency in Ethereum’s staking sector.

Top Advantages of EigenLayer Restaking for Validators

-

Increased Earning Potential: Validators can earn extra rewards by restaking their staked ETH on EigenLayer, securing multiple protocols and gaining incentives from both Ethereum and Actively Validated Services (AVSs) in addition to standard staking returns.

-

Enhanced Capital Efficiency: EigenLayer allows the same staked ETH to be used for multiple purposes, maximizing returns without requiring additional capital outlay.

-

Automated Compounding of Rewards: With the September 2024 EigenPods upgrade, Beacon Chain ETH rewards can be automatically restaked, enabling validators to efficiently compound their earnings.

-

Performance-Based Incentives: December 2024 upgrades introduced performance-based rewards from AVSs, allowing high-performing validators to earn more based on their contributions.

-

Customizable Fee Structures: Validators and operators can now set their own fee rates, fostering a dynamic and competitive environment that lets them optimize earnings and attract more delegations.

-

Broader Protocol Support: Recent upgrades expanded restaking options to support more tokens and protocols, giving validators greater flexibility and more opportunities to earn.

Security is also top of mind. By distributing validation responsibilities across a wider range of protocols and AVSs, EigenLayer reduces concentration risk and helps safeguard both the Ethereum mainnet and the rapidly expanding DeFi landscape. This distributed security model encourages innovation while maintaining rigorous standards for validator performance.

Navigating Risks and Optimizing Strategy

Of course, maximizing staking returns on EigenLayer requires a pragmatic approach. Validators must carefully assess the risk profiles of each AVS they choose to secure. Some protocols may offer higher yields but introduce novel risks or demand more active participation. The ability to delegate to skilled operators is especially valuable for those who prefer a hands-off approach or lack the resources to monitor multiple networks simultaneously.

Stakers should also pay attention to fee structures, as operator competition can lead to varying costs and reward splits. Staying informed about protocol upgrades, governance changes, and new AVS launches is essential for anyone seeking to optimize their EigenLayer restaking rewards.

The Road Ahead: What’s Next for Ethereum Validator Rewards?

With ETH currently priced at $4,473.94, the incentive to maximize yield through restaking has never been more compelling. As more AVSs come online and EigenLayer continues to enhance its protocol efficiency, the potential upside for early adopters remains significant. The protocol’s focus on automation, transparency, and performance-based incentives is likely to shape the future of Ethereum staking well into 2025.

If you’re considering joining this next wave of validator innovation or simply want to keep your portfolio competitive in a rapidly evolving market, now is an ideal time to explore EigenLayer’s latest upgrades. Whether you’re running your own node or delegating through trusted operators, restaking offers an unmatched blend of flexibility, security, and yield potential that sets it apart in today’s crypto landscape.