With Ethereum (ETH) currently trading at $4,528.81 as of September 19,2025, and EigenLayer rolling out major upgrades to its restaking protocol, the landscape for maximizing staking yields has never been more dynamic. The recent enhancements to EigenLayer’s rewards system and the introduction of a programmatic incentives program, allocating roughly 4% of its native EIGEN token to restakers, signal a new era for both institutional and retail participants seeking robust returns. To help you navigate this evolving environment, we’ve curated the top five actionable strategies for maximizing yields and managing risks when restaking ETH on EigenLayer.

1. Diversify Across Multiple Actively Validated Services (AVSs)

Diversification remains a foundational principle in any yield-maximizing strategy, and restaking on EigenLayer is no exception. Actively Validated Services (AVSs) are decentralized applications or protocols that tap into EigenLayer’s pooled security, offering unique reward streams for validators who allocate their staked ETH across various services. By distributing your stake across several AVSs, such as oracle networks, sidechains, or new DeFi primitives, you can:

- Reduce exposure to underperformance or slashing events tied to a single AVS

- Capture layered rewards from multiple protocols simultaneously

- Adapt quickly to shifting market conditions or emerging AVS opportunities

This approach not only improves risk-adjusted returns but also positions you to benefit from future AVS launches as the ecosystem expands. For a deeper dive into maximizing rewards through diversification and protocol selection, see this comprehensive guide from Alexander Abramovich on Medium.

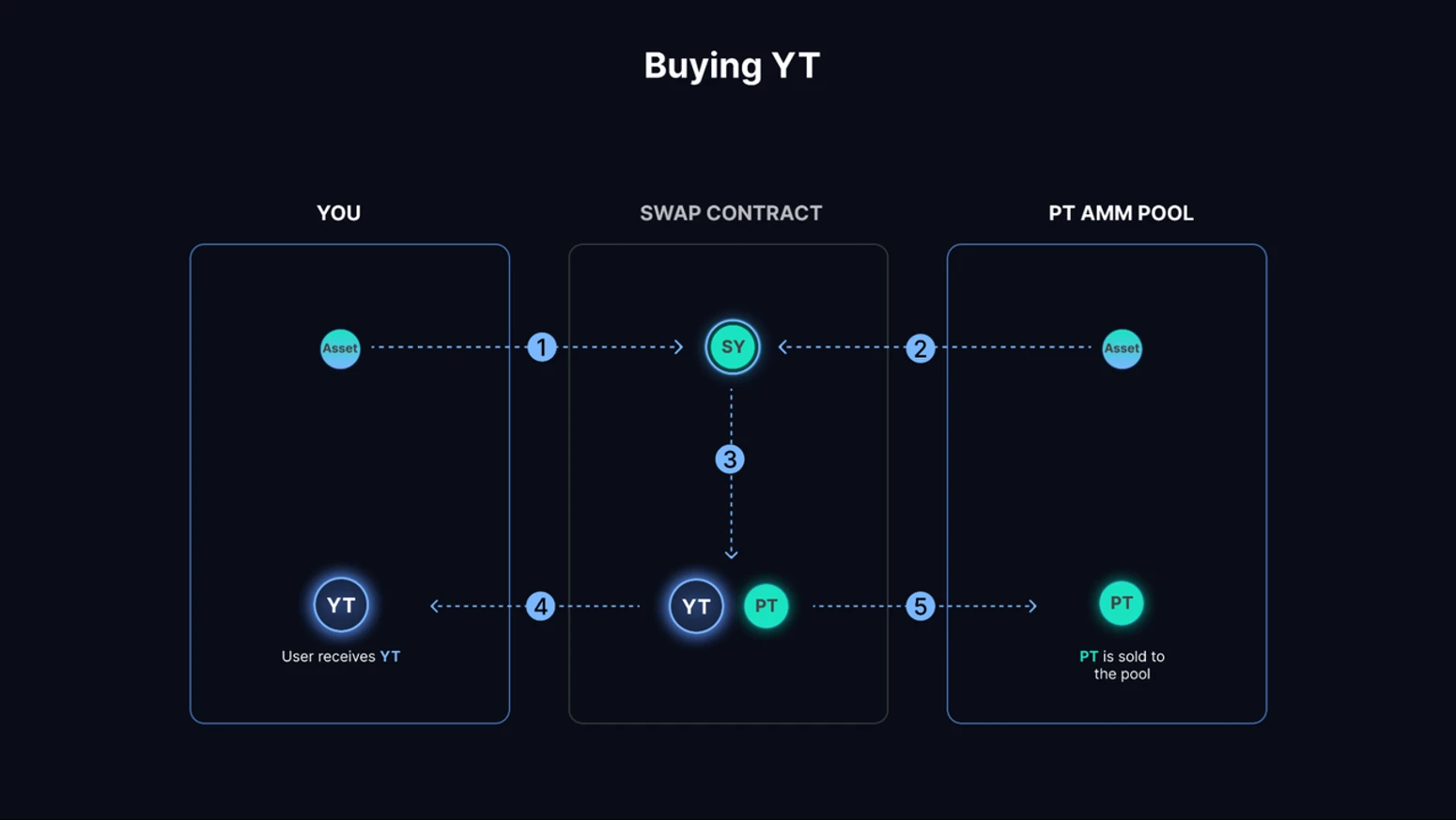

2. Leverage Liquid Restaking Tokens (LRTs) for Layered Yields

The rise of Liquid Restaking Tokens (LRTs) marks a significant innovation in Ethereum’s restaking arena. LRTs are issued by protocols that allow users to deposit staked ETH or liquid staking tokens (like stETH or eETH), then receive tradable tokens representing their underlying position plus accrued rewards. By leveraging LRTs:

- You maintain liquidity while participating in multiple DeFi activities, including lending, borrowing, and yield farming, without unbonding your assets.

- You can stack yields by using LRTs as collateral in other protocols or liquidity pools.

- You gain flexibility to respond rapidly to changing incentive structures or new AVS integrations.

This layered approach is fueling what many are calling the “restaking revolution”: a trend highlighted in recent coverage by QuickNode Blog, and is especially attractive for sophisticated users aiming to optimize capital efficiency.

3. Optimize Restaking Timing Around Major Airdrops and Incentives

The timing of your restaking actions can have an outsized impact on overall returns, particularly with EigenLayer’s ongoing programmatic incentives program and periodic airdrops of EIGEN tokens. By closely monitoring official announcements regarding reward distribution windows and upcoming AVS launches, you can:

- Maximize eligibility for bonus rewards by aligning deposits with snapshot dates

- Avoid missed opportunities due to late participation or unstaking during critical periods

- Enhance compounding effects by reinvesting earned tokens promptly into high-yield opportunities within the ecosystem

The current allocation of approximately 4% of EIGEN tokens directly incentivizes proactive engagement with the platform, a trend further explored in recent Cointelegraph coverage (source link here). Strategic timing is now more crucial than ever as competition among validators intensifies.

Ethereum (ETH) Price Prediction Table 2026-2031

Comprehensive Outlook Considering EigenLayer Restaking Strategies, Market Trends, and Technology Upgrades (Baseline: $4,528.81 as of Sep 19, 2025)

| Year | Minimum Price (Bearish) | Average Price (Base Case) | Maximum Price (Bullish) | Yearly % Change (Avg) | Key Market Scenario |

|---|---|---|---|---|---|

| 2026 | $3,900 | $5,200 | $7,100 | +15% | Post-EigenLayer upgrades spur institutional inflows; moderate volatility persists |

| 2027 | $4,200 | $6,250 | $8,900 | +20% | DeFi/L2 adoption grows; restaking yields drive demand |

| 2028 | $4,800 | $7,100 | $10,500 | +14% | Ethereum scalability improves; EIGEN incentives mature |

| 2029 | $5,200 | $8,200 | $13,100 | +16% | Ethereum becomes DeFi backbone; regulatory clarity improves |

| 2030 | $5,600 | $9,400 | $15,800 | +15% | Mainstream adoption accelerates; competition intensifies |

| 2031 | $6,200 | $10,700 | $18,200 | +14% | ETH solidifies as digital asset infrastructure; staking yields stabilize |

Price Prediction Summary

Ethereum is poised for steady long-term growth, supported by innovations like EigenLayer restaking and programmatic incentives. While short-term volatility remains, the trend points toward increased adoption, higher staking participation, and expanding DeFi use cases. The bullish scenario assumes rapid scaling and favorable regulation, while the bearish case reflects potential setbacks from market cycles or external shocks.

Key Factors Affecting Ethereum Price

- Adoption of restaking and L2 solutions (e.g., EigenLayer) driving yield and demand

- Continued growth in DeFi and Ethereum’s role as a foundational blockchain

- Regulatory clarity in major markets (US, EU, Asia) impacting investor confidence

- Technological upgrades (scalability, sharding, staking efficiency)

- Competition from alternative L1s and cross-chain protocols

- Macro market cycles and crypto-specific volatility

- Institutional participation and integration with traditional finance

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

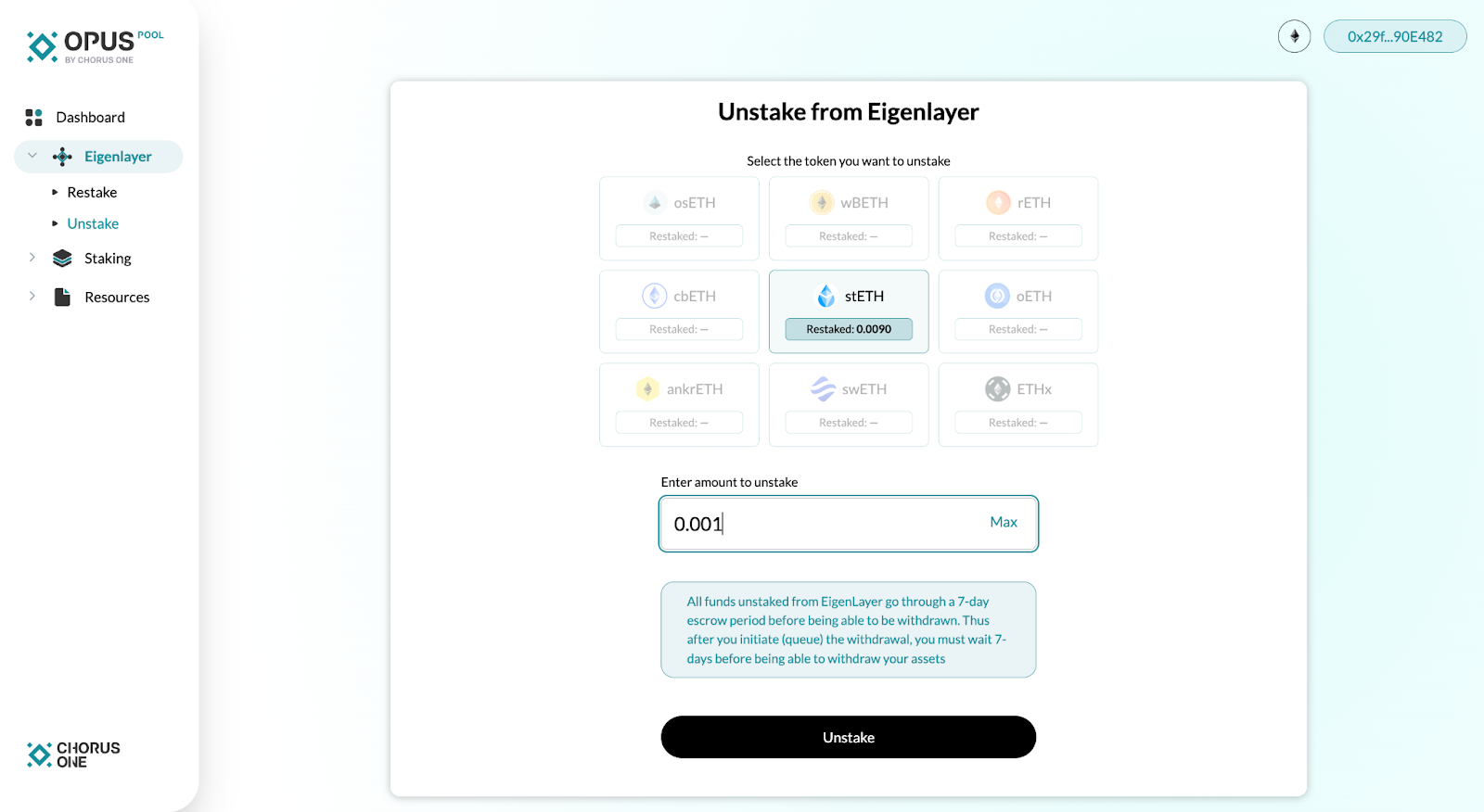

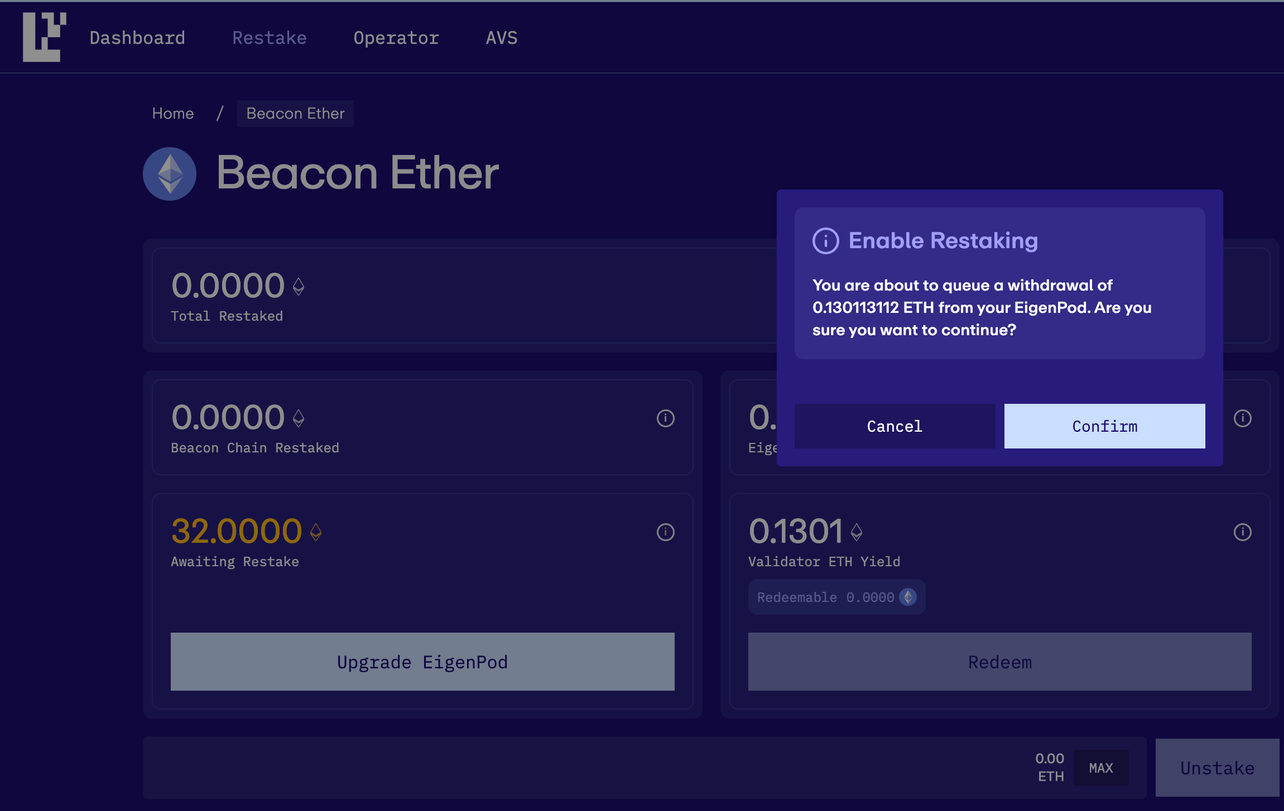

4. Utilize Risk Management Tools to Monitor Slashing and Protocol Health

As the EigenLayer ecosystem matures, so too does its risk landscape. Restaking introduces new slashing vectors and protocol dependencies that require vigilant oversight. Modern risk management tools now allow restakers to:

- Track AVS performance in real time and receive alerts for underperformance, downtime, or governance changes

- Monitor protocol health metrics, including total value locked (TVL), validator participation rates, and recent slashing events across integrated services

- Set custom thresholds for automated withdrawals or stake reallocations if risk parameters are breached

Platforms like Cobo and Simply Staking have begun integrating advanced dashboards for EigenLayer participants, enabling both institutional and retail stakers to safeguard their capital with greater transparency. This proactive approach is essential given the complex interplay between AVS security guarantees and the underlying Ethereum Beacon Chain.

5. Select High-Performance Operators with Transparent Track Records

Your choice of operator can make or break your restaking yields on EigenLayer. With recent upgrades, operators can now set independent fee rates and are incentivized to compete on both performance and transparency. When selecting an operator, prioritize those who:

- Publish detailed performance histories, including uptime statistics, past slashing incidents (if any), and AVS-specific expertise

- Clearly disclose fee structures so you can accurately estimate net yields after operator costs

- Engage actively in community governance and share regular updates regarding protocol changes or new AVS integrations

The most successful restakers often choose a diversified mix of reputable operators rather than concentrating all assets with a single entity. This not only reduces counterparty risk but also positions you to benefit from best-in-class execution across multiple AVSs as the platform evolves.

Top 5 EigenLayer Restaking Strategies

-

Diversify Across Multiple Actively Validated Services (AVSs): Spread your restaked ETH across several top-performing AVSs on EigenLayer—such as EigenDA and AltLayer—to balance risk and maximize reward potential. Diversification helps mitigate the impact of underperformance or downtime in any single AVS, especially as new AVSs with unique reward models launch post-upgrade.

-

Optimize Restaking Timing Around Major Airdrops and Incentives: Stay updated on EigenLayer’s programmatic incentives, such as the recent allocation of 4% of EIGEN tokens to restakers, and time your restaking to maximize eligibility for airdrops and bonus rewards. Monitoring announcements on EigenLayer’s official channels ensures you don’t miss high-value opportunities.

-

Utilize Risk Management Tools to Monitor Slashing and Protocol Health: Employ real-time monitoring platforms like Dune Analytics dashboards, DeFiSafety scores, and DeFiLlama risk trackers to keep track of slashing events, AVS performance, and protocol health. Proactive monitoring helps you react quickly to emerging risks and safeguard your staked assets.

-

Select High-Performance Operators with Transparent Track Records: Choose restaking operators with proven uptime, low slashing history, and transparent fee structures. Use EigenLayer’s Operator Directory and independent analytics to compare operator performance before delegating your stake.

Navigating the Road Ahead: Yield Optimization in a Dynamic Market

The convergence of Ethereum’s robust price action, currently holding at $4,528.81: with EigenLayer’s protocol upgrades has fundamentally shifted the calculus for maximizing staking yields. As more participants engage with programmatic EIGEN token incentives and as competition among AVSs intensifies, only those who combine diversification, liquidity layering, timing precision, robust risk management, and careful operator selection will consistently outperform.

Whether you’re an institutional validator managing thousands of ETH or a retail participant just beginning your restaking journey, these five strategies offer a research-driven framework for navigating 2025’s rapidly evolving Ethereum restaking landscape.