Ethereum’s staking landscape is rapidly evolving, and nowhere is this more evident than in the rise of EigenLayer restaking. As of today, Ethereum (ETH) trades at $4,528.81, a price point that underscores the high stakes and dynamic opportunities in the current staking ecosystem. For investors, validators, and DeFi professionals, understanding the technical differences between Eigenlayer vs Ethereum staking is critical for capitalizing on emerging yield strategies while managing risk.

How Traditional Ethereum Staking Works

Traditional Ethereum staking is straightforward: validators lock up ETH to secure the network, validate transactions, and earn rewards. The process is governed by Ethereum’s Proof-of-Stake (PoS) consensus mechanism. The staked ETH is dedicated solely to maintaining network security and consensus integrity. In return for their service and risk exposure, validators typically earn around 2.5% annual rewards in ETH, relatively stable but with limited upside beyond network participation.

This model has proven robust since Ethereum’s transition to PoS, but it comes with trade-offs:

- Single-purpose security: Staked ETH can only secure the Ethereum network.

- Limited capital efficiency: Once staked, those assets are locked for a set period and cannot be reused elsewhere.

- Simpler slashing risks: Validators face penalties mainly for protocol-level misbehavior or downtime related to Ethereum itself.

The EigenLayer Restaking Paradigm

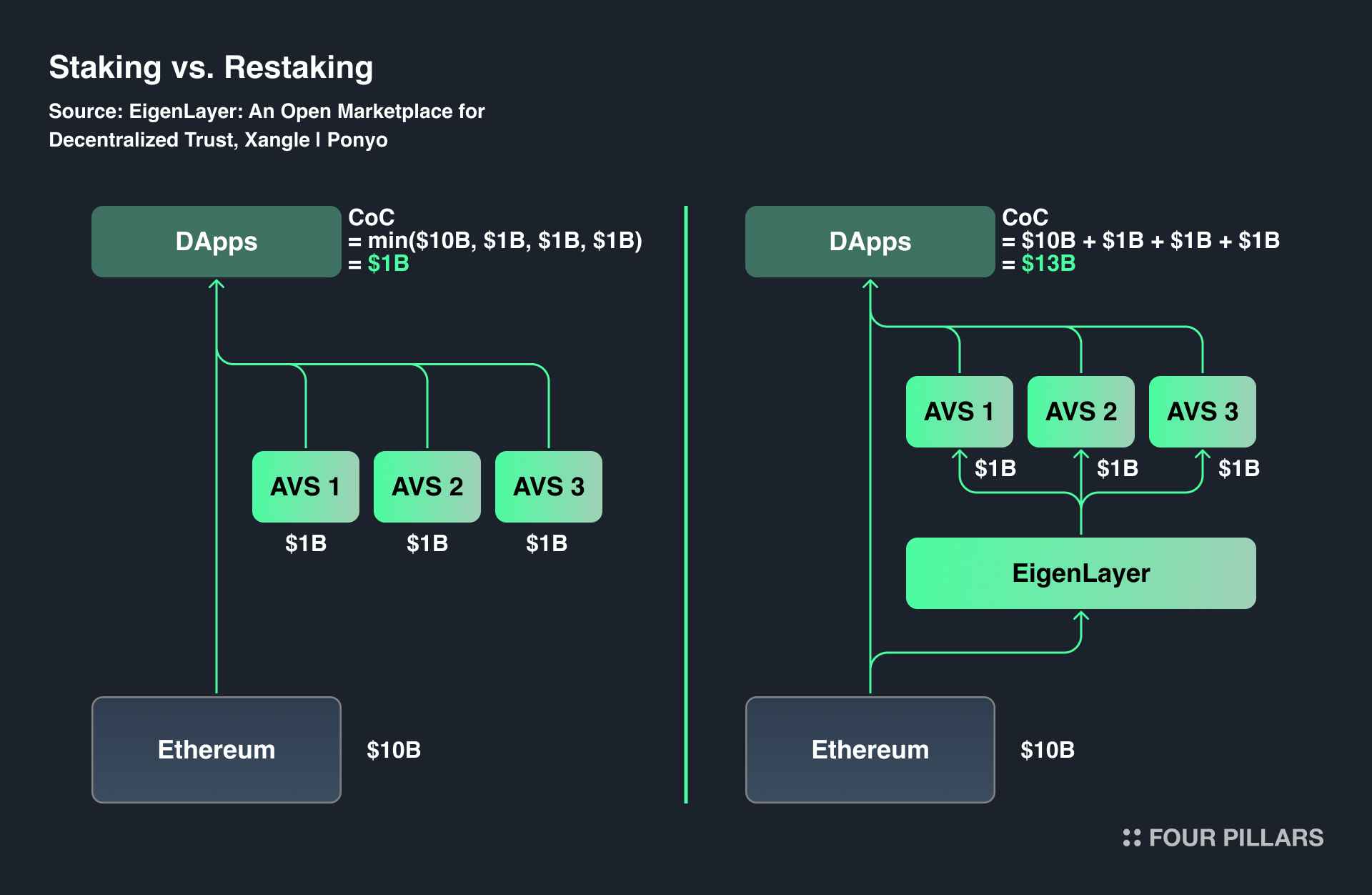

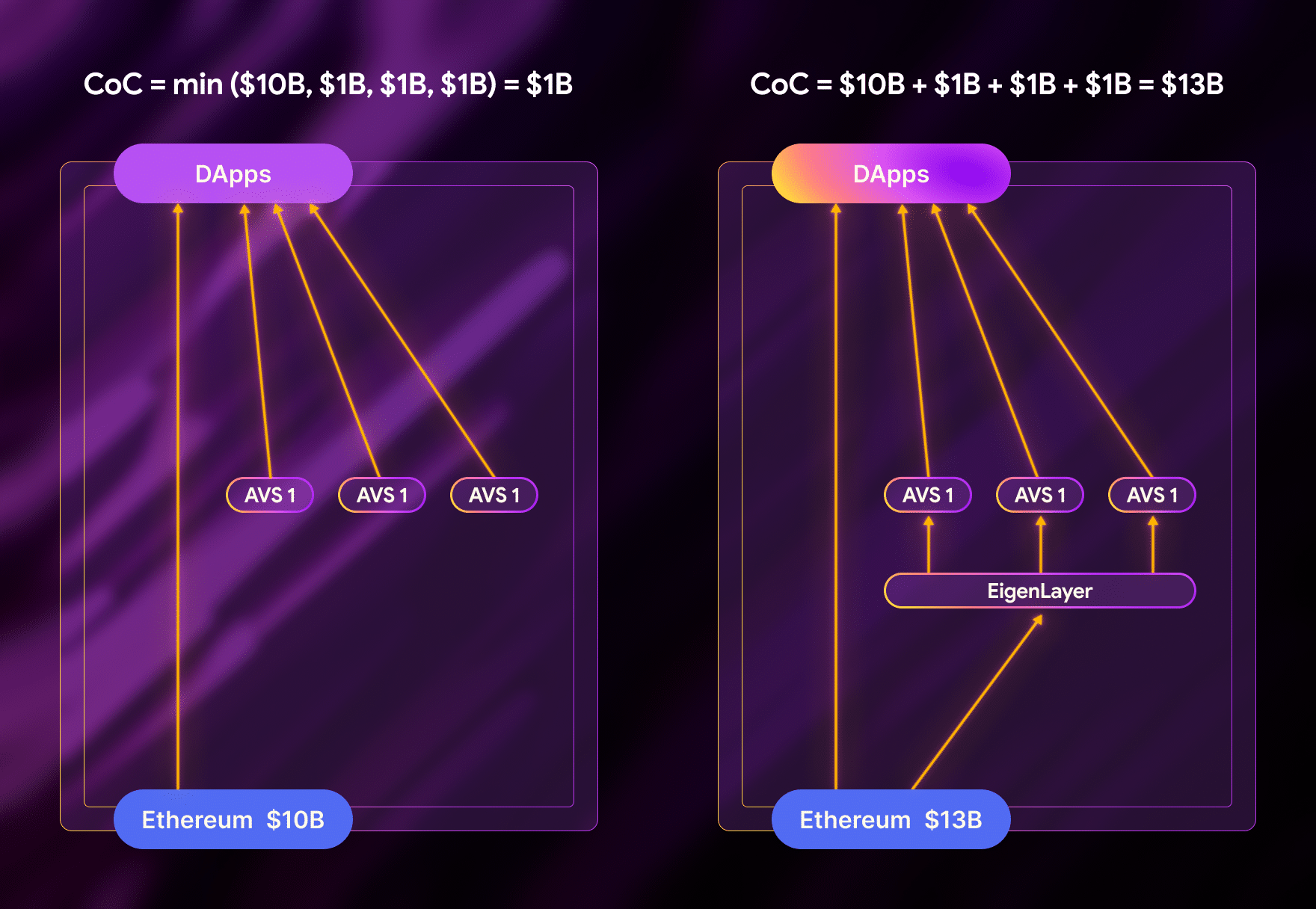

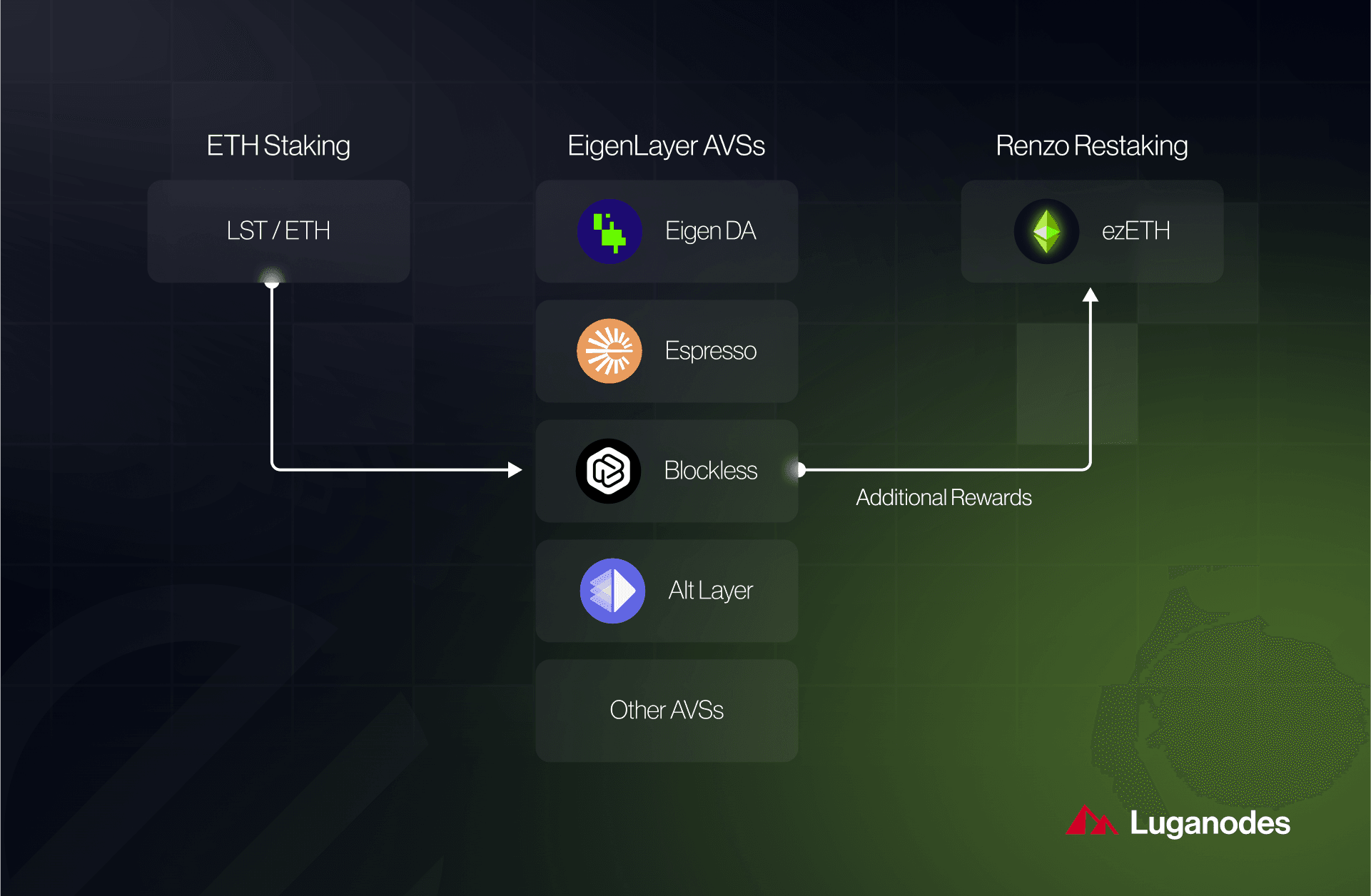

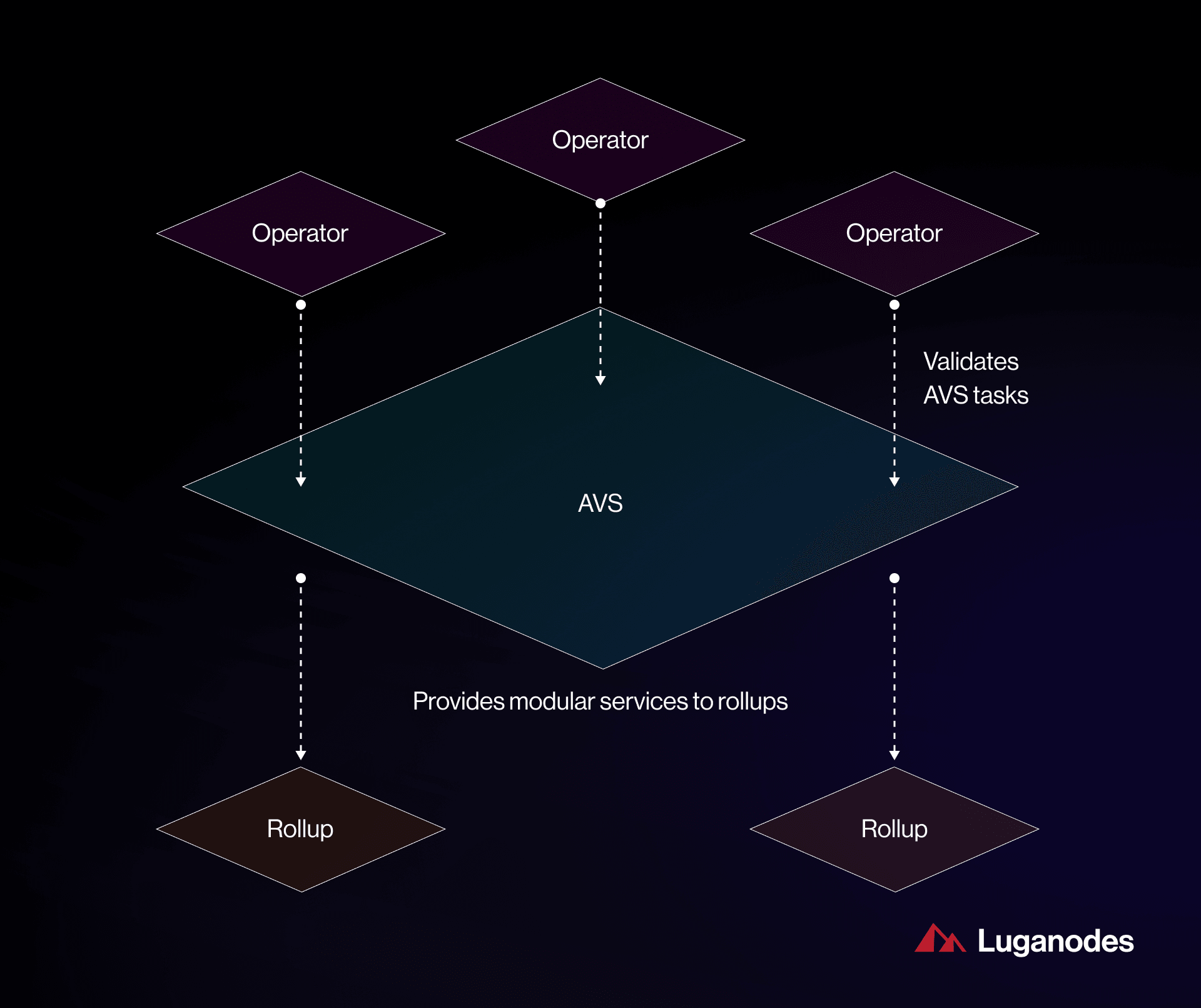

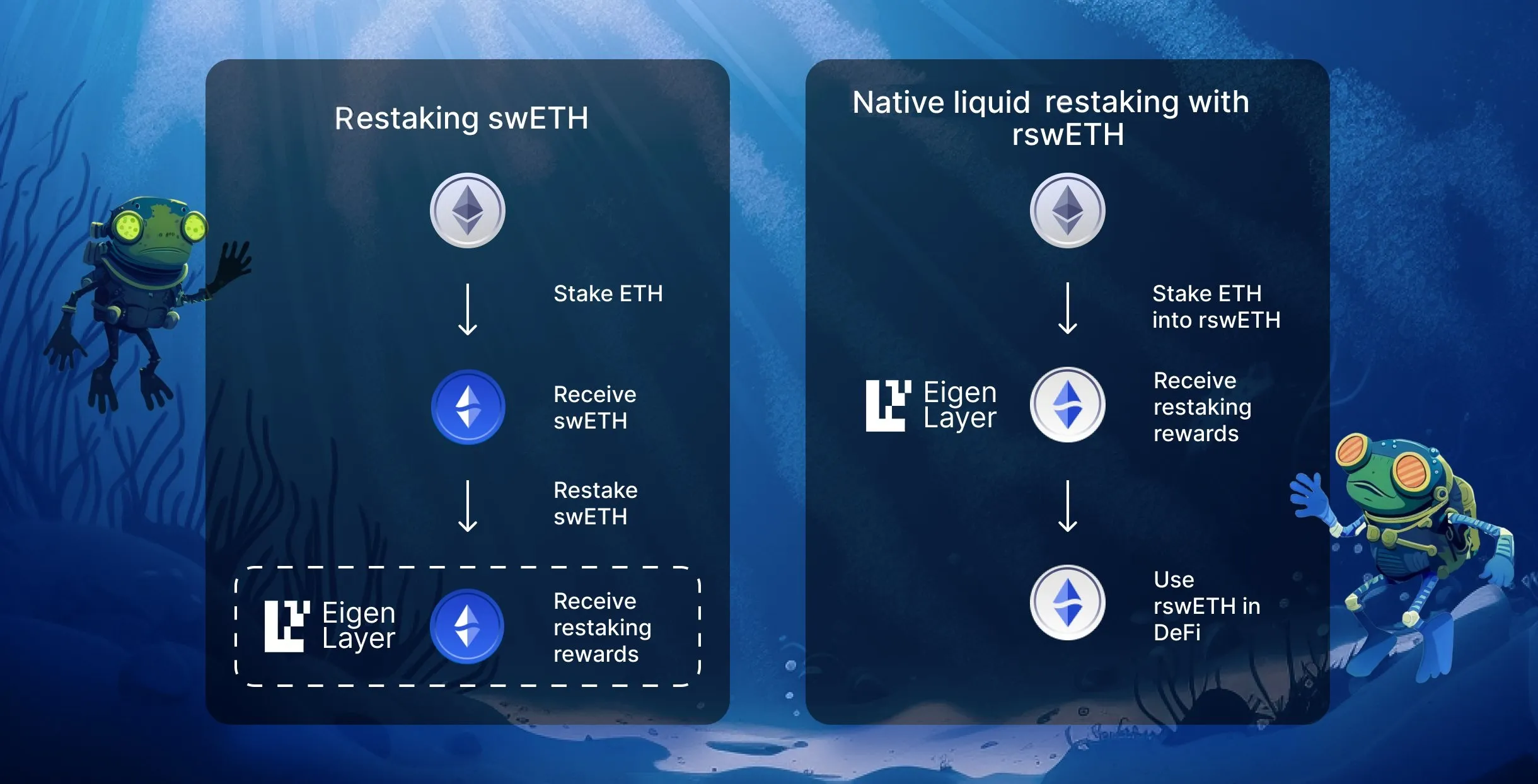

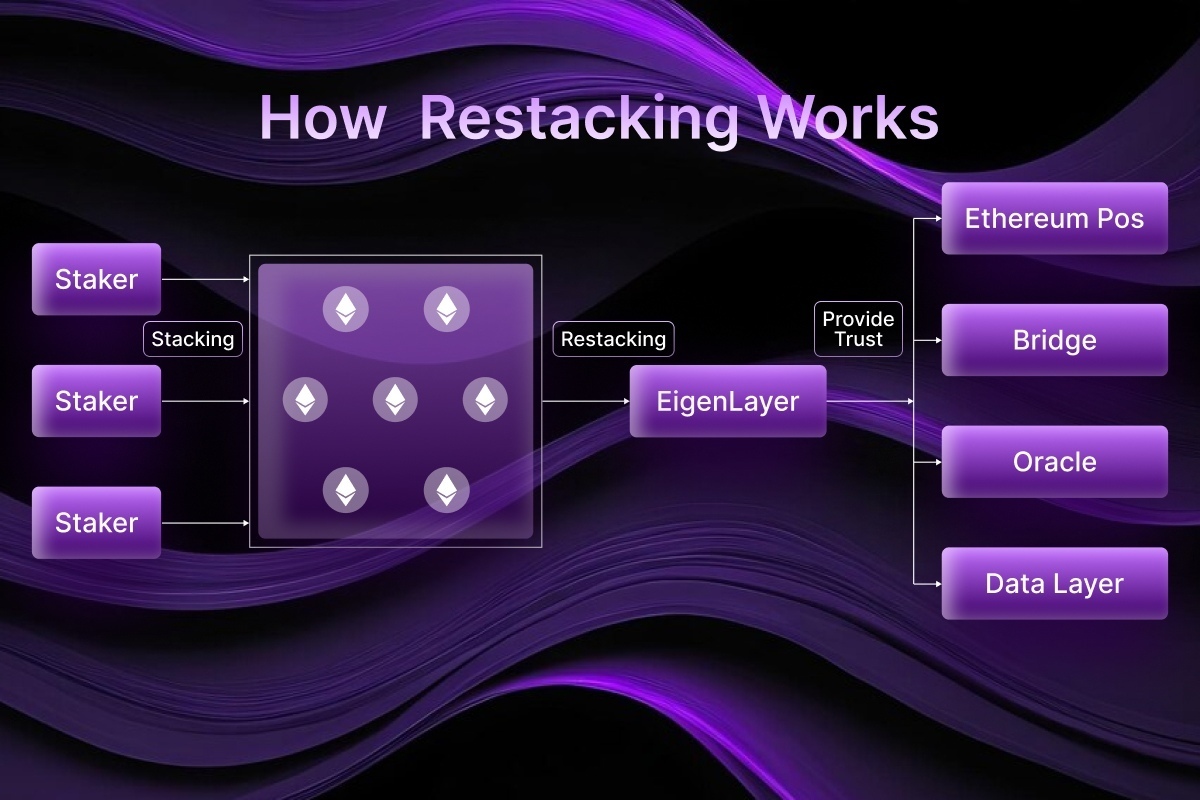

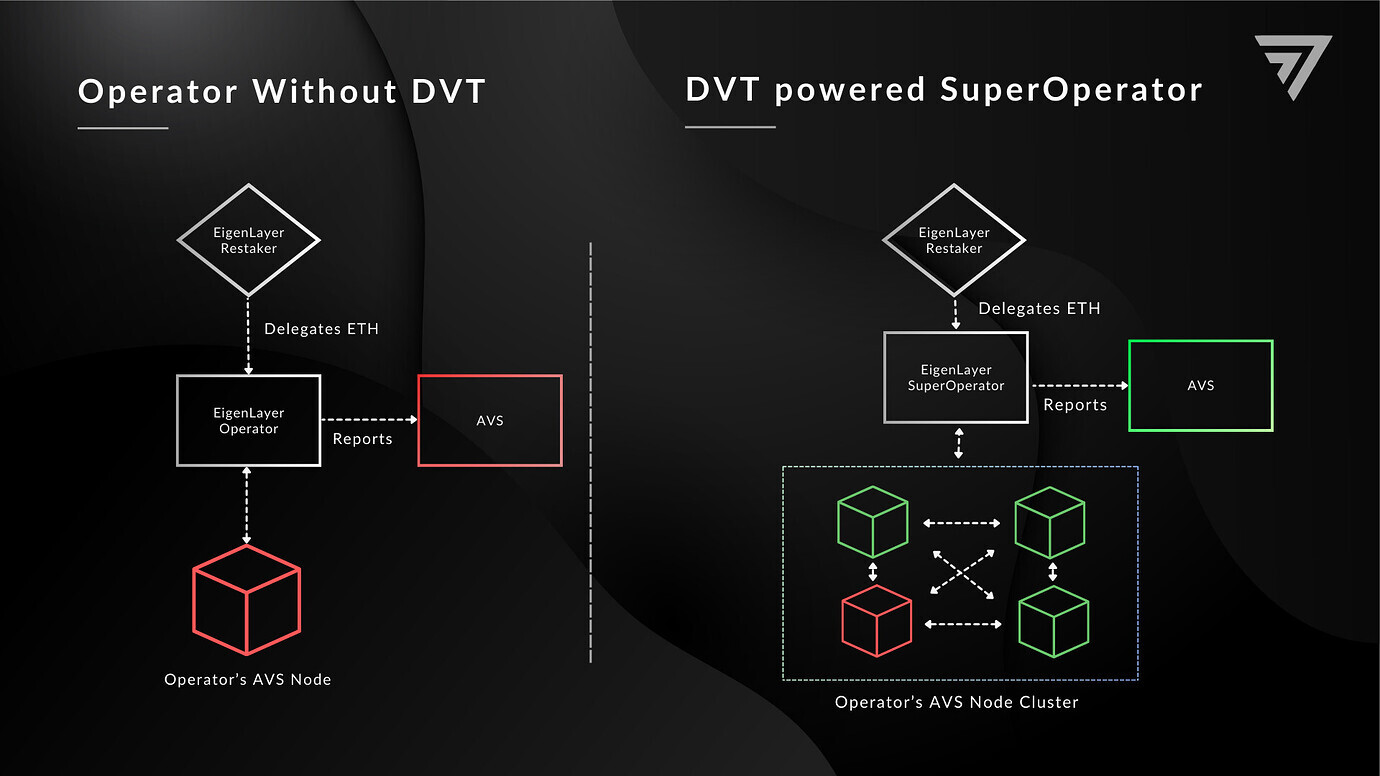

EigenLayer introduces a radical shift by allowing users to “restake” their already-staked ETH or liquid staking tokens (LSTs) to secure additional protocols, referred to as Actively Validated Services (AVSs). This means your same staked assets can provide economic security not just for Ethereum but also for new decentralized applications and middleware layers building on top of it.

The technical innovation here is profound:

- Multi-protocol security: Restaked ETH can simultaneously secure multiple networks or services.

- Increased capital efficiency: Users can unlock extra yield streams without deploying additional capital.

- Diverse reward sources: Besides standard ETH rewards, restakers may receive protocol-specific incentives from AVSs they support.

- Differentiated risk profile: Slashing conditions are now multi-faceted; restakers expose themselves to risks from both Ethereum and any supported AVS, potentially increasing downside if one fails or is attacked.

The primary appeal of restaking lies in its ability to generate additional income beyond the standard 2.5% annual reward in ETH, but this comes with layered complexities and risks that demand careful consideration from every participant.

Main Differences: Restaking vs Staking

The table below summarizes key distinctions between traditional staking and EigenLayer restaking, vital knowledge for anyone considering shifting strategies as new protocols emerge across the ecosystem.

Comparison of Traditional Ethereum Staking vs. EigenLayer Restaking

| Feature | Traditional Ethereum Staking | EigenLayer Restaking |

|---|---|---|

| Purpose | Secure the Ethereum network by validating transactions and participating in consensus. | Secure Ethereum and additional decentralized protocols (AVSs) using the same staked ETH. |

| Rewards | Earn standard Ethereum staking rewards (currently around 2.5% annually, paid in ETH). | Earn standard Ethereum staking rewards plus additional rewards from securing other protocols. |

| Asset Utility | Staked ETH is locked and dedicated solely to Ethereum network security. | Staked ETH (or LSTs) can be used to secure multiple protocols simultaneously, increasing capital efficiency. |

| Risk Exposure | Subject only to Ethereum’s slashing conditions (risk of losing some ETH if misbehaving). | Subject to slashing from both Ethereum and additional protocols, increasing risk of asset loss. |

| Flexibility | Limited: Only native ETH staking supported, with longer unbonding periods. | Flexible: Supports both native ETH and liquid staking tokens (LSTs), with potentially shorter unbonding periods. |

| Complexity | Simple: Only need to understand Ethereum’s staking mechanism and risks. | More complex: Must understand slashing and risks for each protocol supported via restaking. |

| Security Scope | Secures only the Ethereum network. | Expands security to multiple protocols, but also increases interconnected risk. |

| Centralization Risk | Lower, as rewards are limited to Ethereum staking. | Potentially higher, as increased yields may attract large validators, risking centralization. |

| Current ETH Price (as of 2025-09-19) | $4,528.81 | $4,528.81 |

Ethereum (ETH) Price Prediction 2026-2031

Comprehensive 6-Year Outlook Considering EigenLayer Restaking, Market Trends, and Adoption (Baseline: $4,528.81 as of Sep 2025)

| Year | Minimum Price | Average Price | Maximum Price | Year-over-Year Change (Avg) | Key Scenario Insights |

|---|---|---|---|---|---|

| 2026 | $3,850 | $5,100 | $7,450 | +12.6% | Continued adoption of EigenLayer bolsters ETH utility, but increased slashing risks and regulatory scrutiny keep volatility elevated. |

| 2027 | $4,100 | $5,850 | $8,900 | +14.7% | DeFi and restaking growth drive demand; ETH 2.0 upgrades improve scalability. Regulatory clarity in US/EU supports institutional entry. |

| 2028 | $3,900 | $6,700 | $10,200 | +14.5% | Market consolidation; possible bear phase mid-year, followed by recovery as L2s and EigenLayer services mature. |

| 2029 | $4,800 | $7,600 | $12,500 | +13.4% | Macro bull cycle; ETH becomes further entrenched as DeFi backbone, but competition from alternative L1s/L2s increases. |

| 2030 | $5,200 | $8,750 | $14,600 | +15.1% | Mainstream adoption of restaking and institutional DeFi. Regulatory frameworks are clearer, but periodic volatility persists. |

| 2031 | $6,100 | $10,200 | $17,800 | +16.6% | ETH cements position as foundational asset for multi-protocol security. Potential for new all-time highs if global adoption accelerates. |

Price Prediction Summary

Ethereum is poised for steady long-term growth, driven by innovations like EigenLayer restaking, increasing DeFi adoption, and ongoing protocol upgrades. While minimum prices reflect persistent market risks and cyclical corrections, the average and maximum projections capture the potential upside from enhanced capital efficiency and broader institutional participation. The outlook remains bullish overall, but investors should be mindful of increased complexity and risk introduced by restaking, as well as evolving regulatory landscapes.

Key Factors Affecting Ethereum Price

- Adoption and success of EigenLayer and restaking protocols

- Ethereum network upgrades (scalability, sharding, L2 integration)

- Regulatory developments in key markets (US, EU, Asia)

- Competition from other smart contract platforms (e.g., Solana, Avalanche, emerging L1s)

- Macro market cycles and institutional capital flows

- Security incidents or slashing events in multi-protocol restaking

- General crypto market sentiment and global economic trends

Disclaimer: Cryptocurrency price predictions are speculative and based on current market analysis.

Actual prices may vary significantly due to market volatility, regulatory changes, and other factors.

Always do your own research before making investment decisions.

The Expanding Risk and Reward Landscape

The potential for higher returns through EigenLayer comes at a cost: increased complexity and risk exposure. While traditional stakers only worry about slashing tied to their performance on the mainnet, restakers must monitor multiple protocols’ governance updates and slashing rules, a daunting challenge even for seasoned crypto operators. As noted in recent analysis by Crypto. com, “The slashing risk for EigenLayer ETH Restaking may be higher than that for normal ETH staking. ” In practice, this means you could possibly lose all your staked ETH if an AVS you’re supporting fails catastrophically or enacts harsh penalties.

This expanded risk landscape makes it essential to stay informed about each protocol you support via restaking, and highlights why due diligence matters more than ever as yields climb higher across DeFi’s frontier protocols.

With Ethereum trading at $4,528.81, the calculus for capital deployment is shifting. Restaking unlocks new layers of capital efficiency and yield, but it also introduces a multidimensional risk matrix. Validators and investors must now weigh not only the technical merits of each AVS but also the interconnectedness of risks across protocols. A single exploit or governance failure in one AVS could cascade, threatening the integrity of all assets restaked to that protocol.

The allure of EigenLayer is clear: maximize rewards by leveraging the same ETH collateral across multiple networks. However, this model relies on participants’ ability to actively manage their positions and remain vigilant against evolving threats. For example, slashing conditions are no longer limited to Ethereum’s consensus rules; they now include a diverse set of protocol-specific penalties that can vary widely in severity and transparency.

Restaking vs Staking: Capital Efficiency in Action

Capital efficiency is where EigenLayer truly shines. In traditional staking, your ETH sits idle after being locked to secure the network, it cannot be used elsewhere until it is unstaked and passes through a potentially lengthy unbonding period. With restaking, that same ETH can simultaneously secure multiple protocols, compounding its utility without additional upfront investment.

Key Benefits and Drawbacks: EigenLayer Restaking vs. Traditional Ethereum Staking

-

Enhanced Capital Efficiency: EigenLayer restaking allows staked ETH to secure multiple protocols simultaneously, maximizing the utility of your assets compared to traditional staking, where ETH secures only the Ethereum network.

-

Potential for Increased Rewards: By participating in restaking, users can earn additional rewards from Actively Validated Services (AVSs) on top of standard Ethereum staking rewards, whereas traditional staking offers only Ethereum network rewards.

-

Higher Slashing Risk: Restakers face increased slashing risk due to exposure to both Ethereum and additional protocols’ slashing conditions, potentially leading to greater asset loss than with traditional staking.

-

Greater Flexibility: EigenLayer supports both native restaking (with staked ETH) and liquid restaking (with liquid staking tokens), offering more participation options than the single-path approach of traditional staking.

-

Added Complexity and Security Considerations: Restaking introduces additional layers of complexity, requiring users to understand multiple protocols’ risks and slashing conditions. Traditional staking is simpler, with risks confined to the Ethereum network.

-

Centralization Risks: The pursuit of higher yields through restaking could lead to validator centralization, as large operators may dominate, potentially reducing network decentralization compared to traditional staking.

-

Current Market Context: As of now, Ethereum (ETH) is priced at $4,528.81. Both staking methods are influenced by ETH’s market value, but restaking’s additional reward potential comes with proportionally higher risk.

This flexibility has led to a surge in DeFi protocols integrating with EigenLayer as AVSs, seeking to bootstrap security from Ethereum’s robust validator set. For users willing to navigate the added complexity, this means access to higher aggregate rewards, though always balanced by heightened risk.

Centralization Pressure and Governance Challenges

One emergent concern with restaking is centralization pressure. As yields increase for validators with large amounts of staked ETH or LSTs, there’s a risk that network power consolidates among a handful of dominant actors. This could undermine both decentralization and security if not addressed through careful protocol design and governance mechanisms.

Furthermore, governance becomes more intricate as restakers must track proposals and updates from every AVS they support. Missing a critical vote or misunderstanding an upgrade can have direct financial consequences due to slashing or missed rewards.

The Future: Navigating Complexity for Enhanced Yield

The next evolution in Ethereum staking isn’t just about maximizing returns; it’s about building resilient strategies that adapt to an increasingly modular DeFi landscape. Tools for automated risk monitoring, dynamic allocation between AVSs, and real-time analytics are becoming essential for serious participants.

For those considering the leap from traditional staking to EigenLayer restaking, preparation is key:

- Research each AVS: Understand their security model, slashing conditions, and historical performance.

- Diversify exposure: Spread risk across multiple AVSs rather than concentrating on a single protocol.

- Monitor governance: Stay engaged with protocol updates, your yield depends on it.

- Utilize analytics tools: Leverage dashboards tracking both reward rates and risk metrics in real time.

The future belongs to those who can synthesize data from multiple sources and act swiftly as market conditions change, let the charts tell the story, but don’t ignore the fundamentals behind each protocol you support.